Inflation is falling faster than the RBNZ expected and downwardly-revised GDP data are now consistent with labour market data showing an easing in capacity constraints.

Our measures of quarterly core inflation have declined to be only a little above the RBNZ’s 1-3% target on an annualised basis.

The RBNZ is done hiking and we expect a modest shift away from the relative hawkish comments made in late November. Chief Economist Conway’s speech on Tuesday, where he will comment on domestic data developments since the November MPS, provides an opportunity to start to change the tone.

Short-end kiwi yield spreads are at risk of narrowing and the AUD looks a bit low relative to the NZD.

The MPC meeting on 22 May is the first opportunity in our view to start lowering the OCR from the current restrictive setting.

A few months is a long time

The RBNZ Monetary Policy Committee (MPC) doesn’t meet for another month (28 February) and then it will be three months since they last deliberated.

The communication from the MPC and Governor Orr in late November was on the hawkish side.

“…ongoing excess demand and inflationary pressures are of concern, given the elevated level of core inflation. If inflationary pressures were to be stronger than anticipated, the OCR would likely need to increase further. The Monetary Policy Committee agreed that interest rates will need to remain at a restrictive level for a sustained period of time.”

Our view is that this hawkishness was at least partly driven by the fact that market (swap) interest rates had declined meaningfully at the time and the MPC was wary of this flowing through to an easing of financial conditions via lower fixed mortgage interest rates. That has not eventuated. Banks have so far heeded the RBNZ’s implicit warning.

And it remains the case that there will be further pass-through of higher interest rates to actual mortgage rates paid by households. The lags of monetary policy!

The MPC’s comments in late November haven’t aged that well.

Data received since the last MPC meeting on GDP and inflation have been weaker than the Bank’s expectations. We discuss this below.

“Excess demand” arguments are weakening

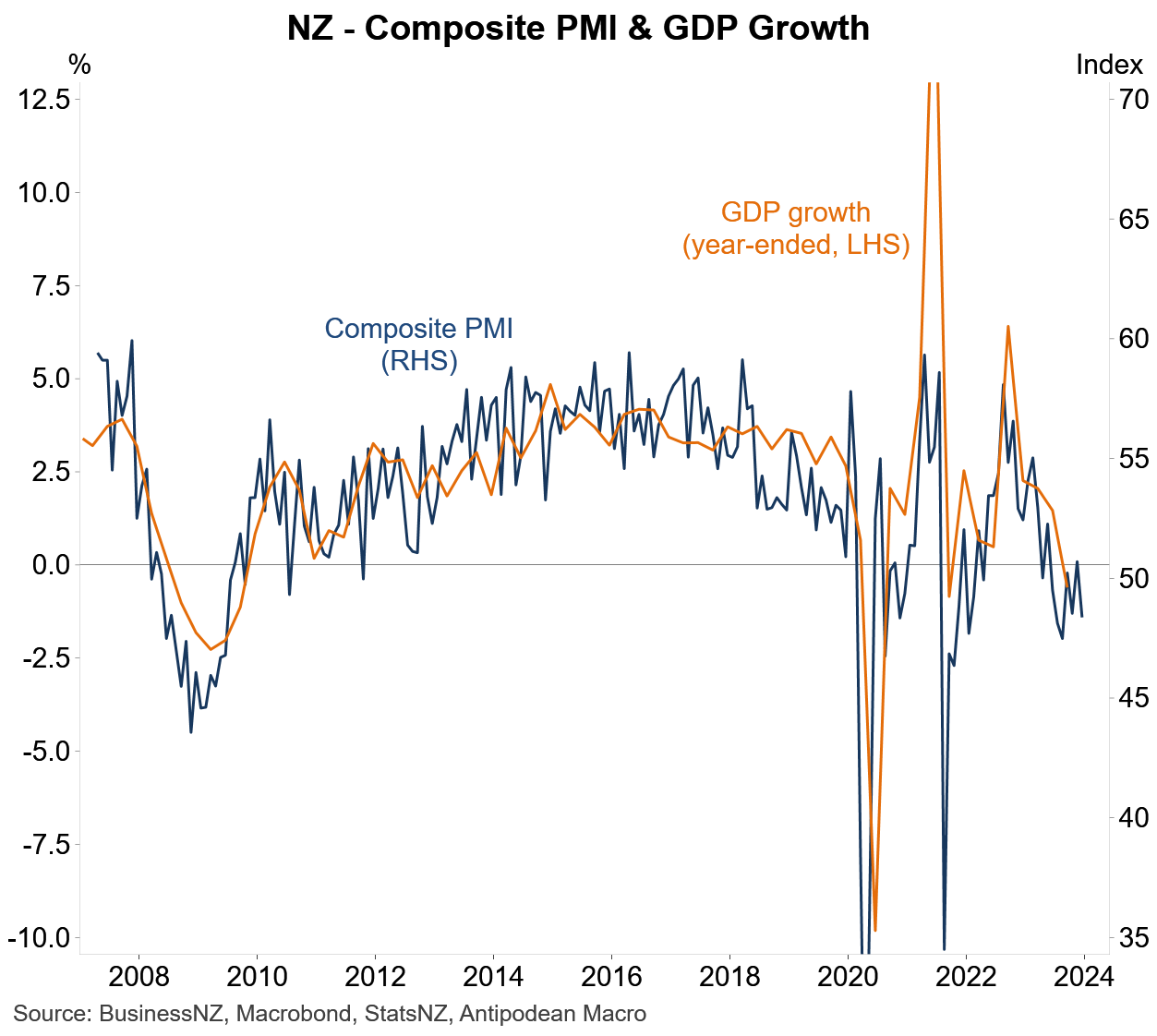

First, downward revisions to GDP and weaker-than-expected Q3 GDP (-0.3% q/q) weaken the MPC’s “ongoing excess demand” argument (see chart). The composite PMI suggests that growth remained weak in Q4 2023. (While firms reported a bounce in “own activity” in the Q4 QSBO, we suspect the election outcome may have had some influence on firms’ responses.)

The revised GDP profile is now more consistent with the easing in labour market conditions. While New Zealand’s unemployment rate was a still-low 3.9% in Q3 last year, a range of indicators suggest that it will have increased further since then.

Signs that net immigration to New Zealand is slowing - even discounting the latest figure - should also allay MPC fears that very strong immigration has been “increasing the risk of inflation remaining above target”.

Inflation is falling faster than the RBNZ expected

The MPC’s November comments on inflation noted that Q3 CPI inflation was below their expectations, but the surprise was driven by lower tradables inflation.

“Annual headline inflation was lower than expected in the September 2023 quarter. This was accounted for by lower inflation for tradable goods and services. Members noted that tradable inflation can be volatile and cannot be relied upon to achieve their inflation target. Non-tradable inflation is easing only gradually and, while all measures of core inflation have declined, they are still elevated.”

The recent Q4 CPI report again showed that headline inflation was below the RBNZ’s forecast (+0.5% q/q vs +0.8% q/q expected).

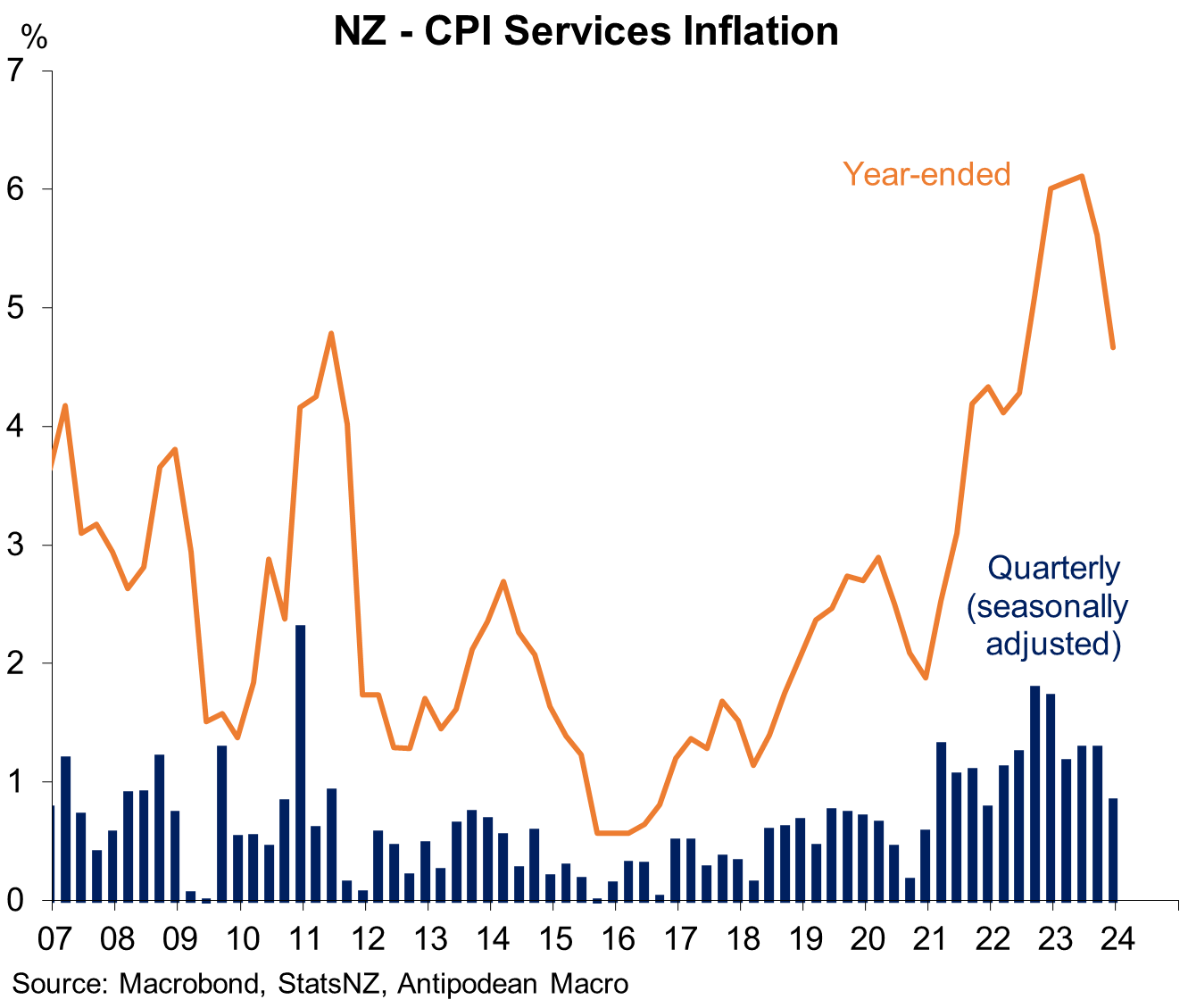

As we pointed out at the time, however, Q4 non-tradables inflation was stronger than the RBNZ expected and continued to decline only slowly (see chart). Encouragingly, however, quarterly services inflation declined noticeably in Q4.

But what about measures of core inflation which the RBNZ previously noted had remained “elevated”?

Published year-ended measures of core inflation can still be characterised as “elevated” (see chart).

But year-ended inflation measures are less useful for gauging, in a timely sense, the rate of change in inflation around turning points.

It’s best to focus on the trend in quarterly core inflation. A problem, however, is that New Zealand publishes limited quarterly core measures. And the ones that are published - the trimmed mean and weighted median - are calculated using non-seasonally adjusted data and, hence, are very volatile (and not very useful).

For that reason we calculate our own using seasonally adjusted CPI sub-group data.

These measures show a noticeable decline in quarterly core inflation to +0.8% q/q in Q4 (see chart). This is still above the RBNZ’s 1-3% target on an annualised basis, but not by much.

Measures of the breadth of inflation across the 108 CPI sub-groups tell a similar story.

Pulling all that together, it would be brave for the RBNZ to continue characterising the risks to inflation as being to the upside.

Our view is that the discussion should now turn to when some modest policy easing can be delivered given the restrictive stance of monetary policy, encouraging disinflation trend (including globally) and easing in labour market conditions.

It’s too early for the RBNZ to be talking about rate cuts. By the MPC meeting on 22 May, however, the Committee will have Q1 labour market, wages and inflation data, plus readings on net immigration to March. We think this will be the first opportunity to start lowering the OCR.

While the MPC’s focus is on the 2% mid-point of the target, it need not wait to reach it before starting to wind back how restrictive monetary policy is.

Market implications

Short-end kiwi yield spreads are at risk of falling if the RBNZ changes its tune as we expect.

The 2-year NZ-US government bond yield spread is currently a touch above where it was after the late-November MPC meeting. This looks ripe for a narrowing.

The NZD appreciated solidly against the AUD in the days after the November MPC meeting and AUD/NZD is currently a bit below where it was at the time of that meeting. Again, if we are right, the AUD could be due to appreciate against the NZD as the RBNZ softens its stance before the RBA.