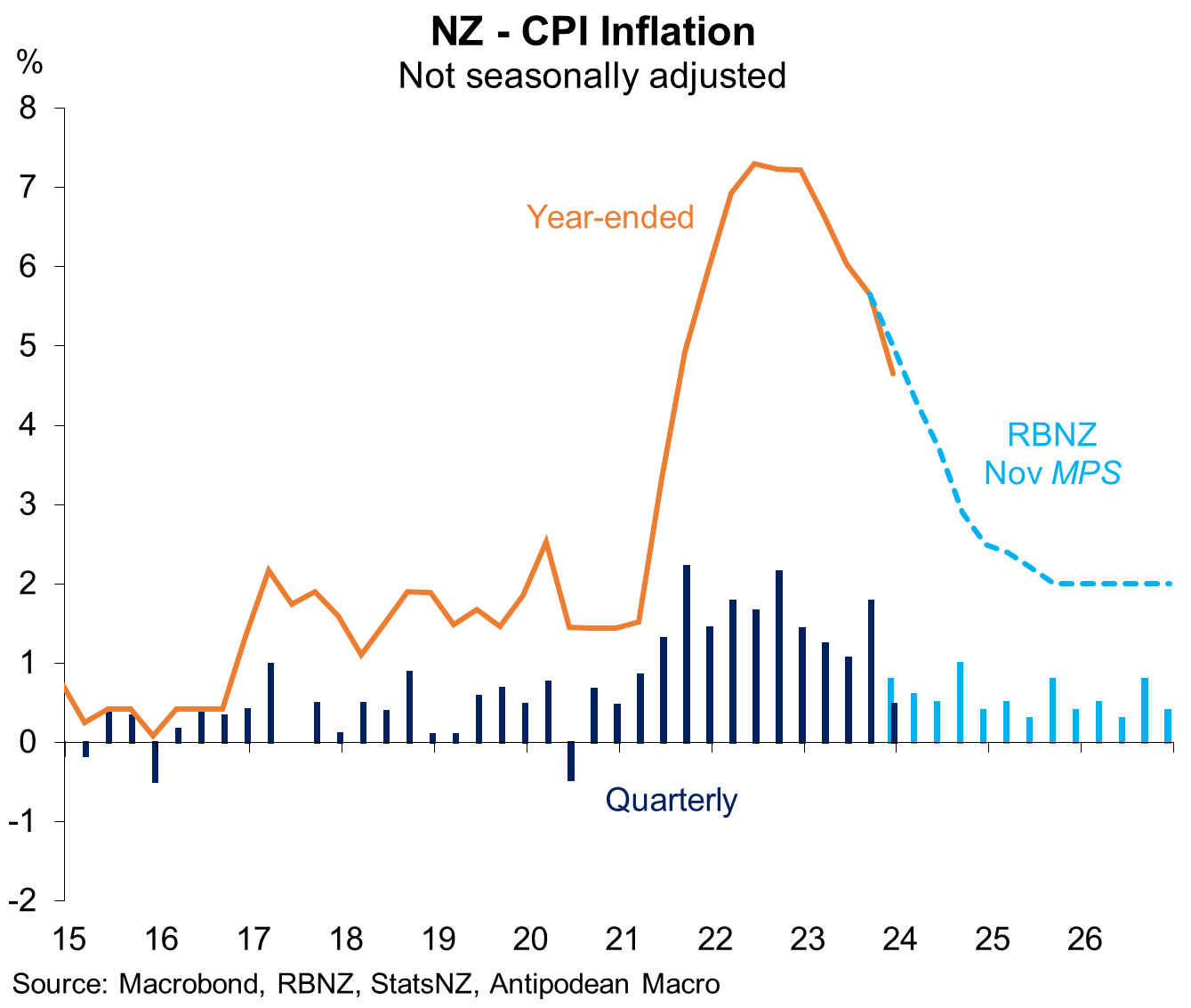

1. New Zealand’s CPI rose +0.5% q/q and 4.7% y/y in Q4 (as expected). On a seasonally adjusted basis the CPI rose 0.7% q/q - this is the smallest increase in 3 years

2. Measures of ‘core’ inflation slowed further on a year-ended basis. This should be replicated in the RBNZ’s statistical ‘core’ measures released this afternoon

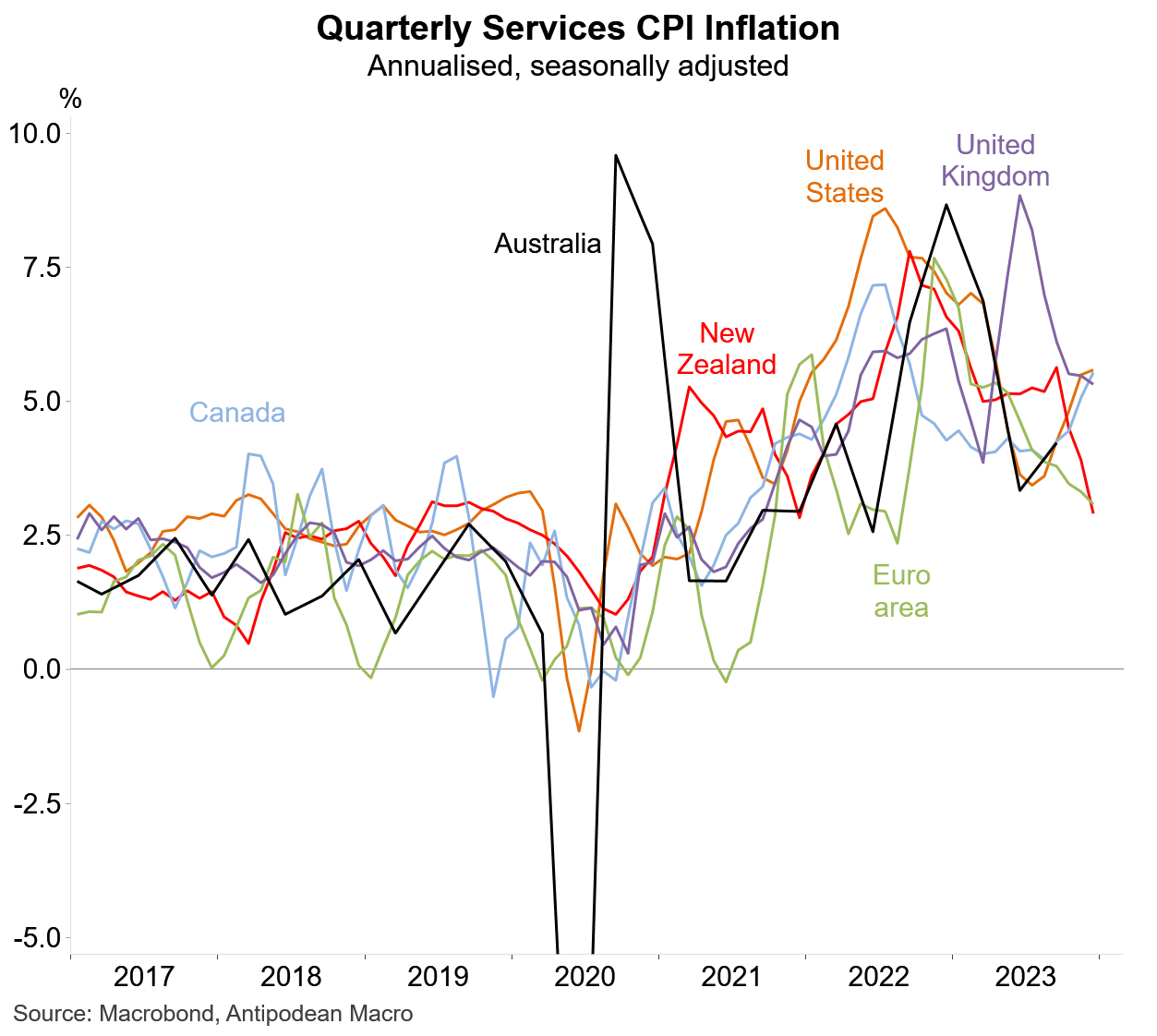

3. Excluding food and energy, disinflation in NZ is looking fairly similar to elsewhere

4. Kiwi inflation in Q4 was below the RBNZ’s forecast in the November Monetary Policy Statement (MPS)…

5. …but all of that downside surprise was because of weaker-than-expected tradables inflation which was just +0.2% q/q (and -0.3% q/q excluding fuel)

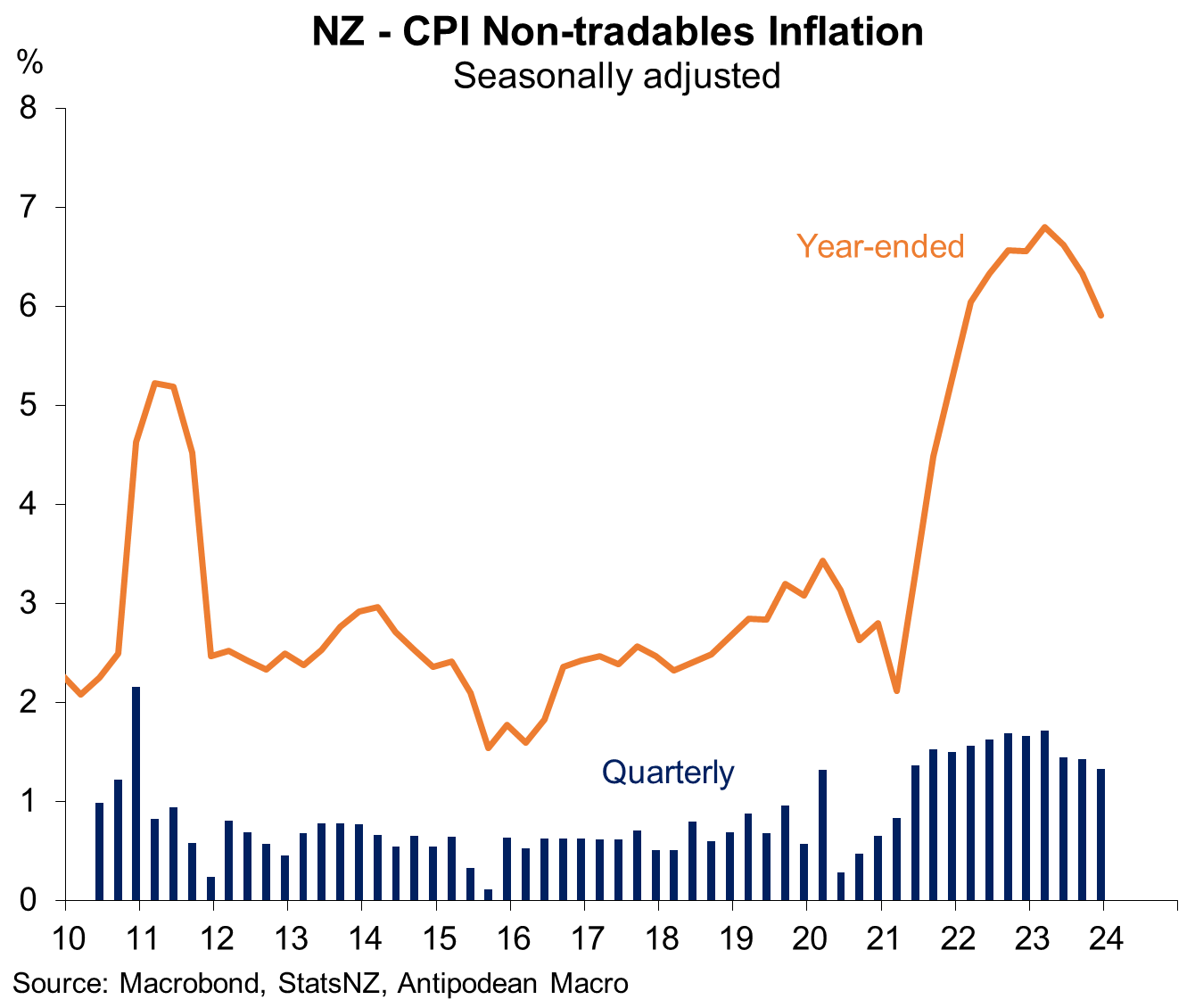

6. Non-tradables inflation in New Zealand in Q4 was a bit above the RBNZ’s expectation (+1.1% q/q vs +0.9% q/q). On a seasonally adjusted basis, non-tradables inflation edged slightly lower to +1.3% q/q

7. Encouragingly, however, services inflation in New Zealand has slowed in recent quarters

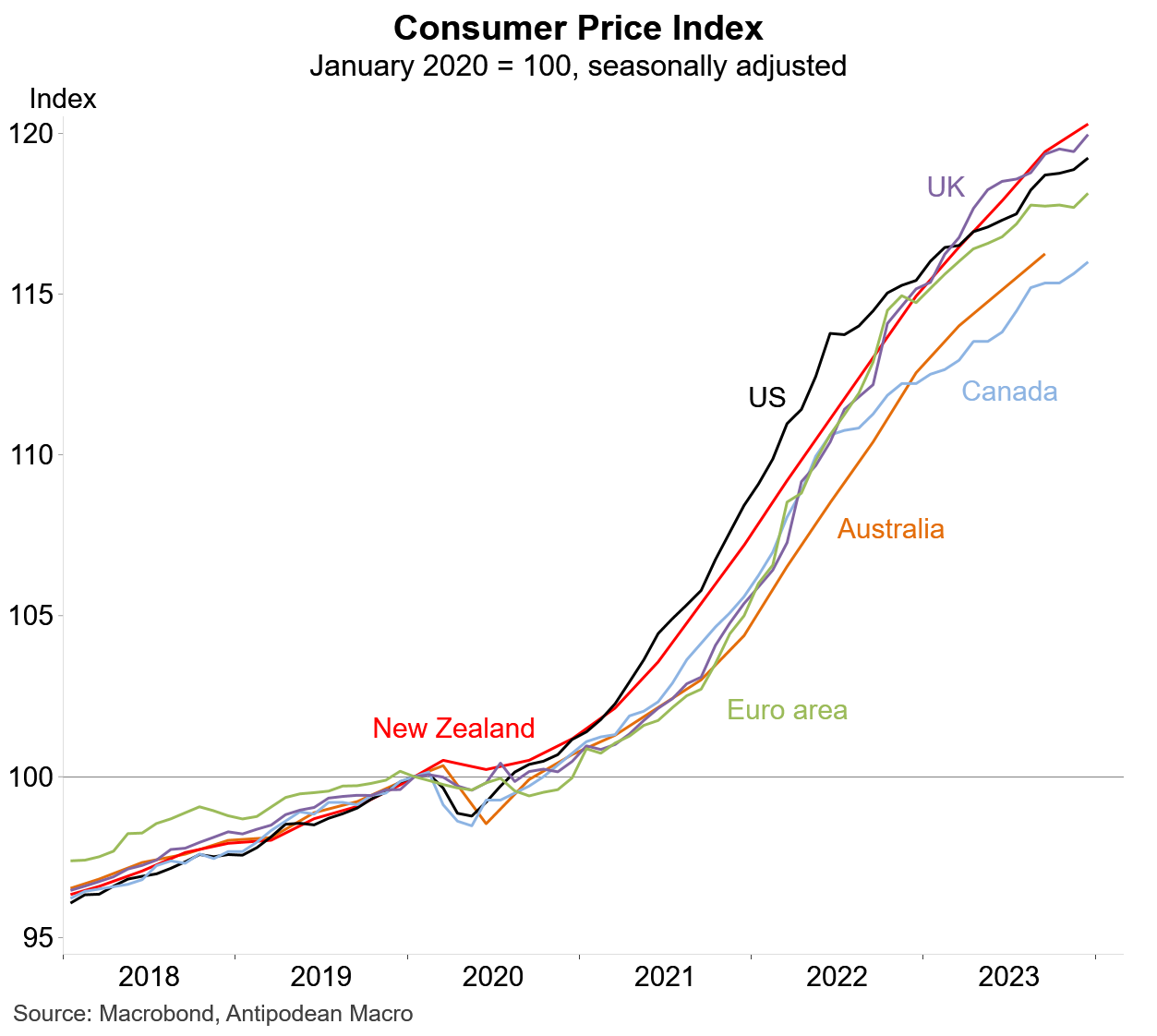

8. Pick the economy that went early on monetary policy tightening (hint: NZ)

9. Australia’s composite PMI picked up again in January but at 48.1 remained weak

Discussion about this post

No posts