1. Australia’s headline CPI rose 0.6% q/q and 4.1% y/y in Q4 2023. This was a touch below our expectation (+0.7% q/q) and well below consensus (+0.8% q/q)

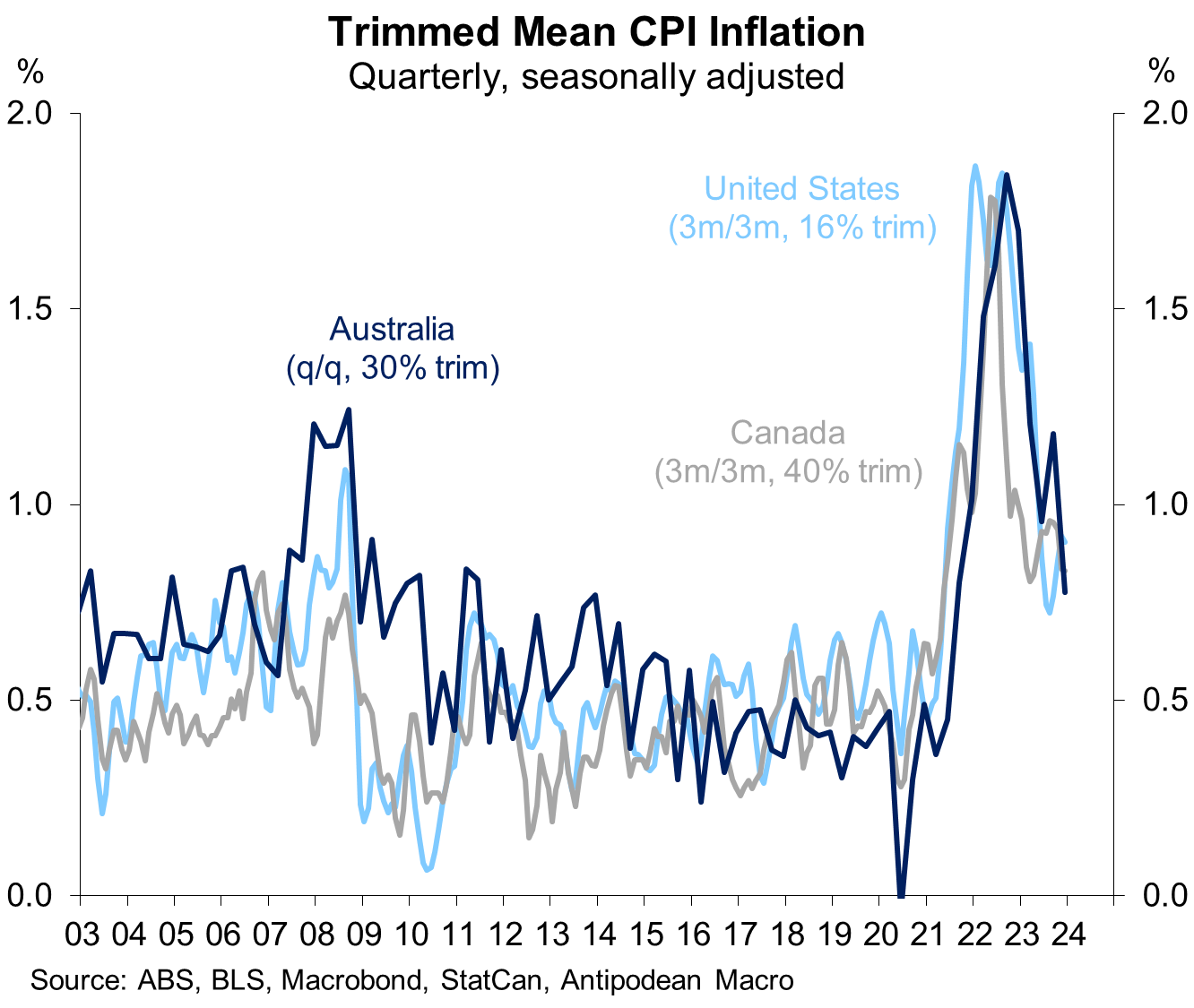

2. The RBA’s preferred trimmed mean measures of inflation rose 0.8% q/q and 4.2% y/y. Again, this was a bit below consensus (+0.9% q/q) but in line with our forecast

Australia now doesn’t look too different to the US and Canada on this metric

3. Measures of the ‘breadth’ of inflation in Australia also declined noticeably in Q4

4. ‘Core’ non-tradables inflation (excluding tobacco) slowed to +1.0% q/q and +5.2% y/y, which was the same as our forecast

5. Domestic market services inflation printed bang in line with our expectation at +1.1% q/q and 5.6% y/y. This remains elevated, in part due to very strong increases in insurance premiums

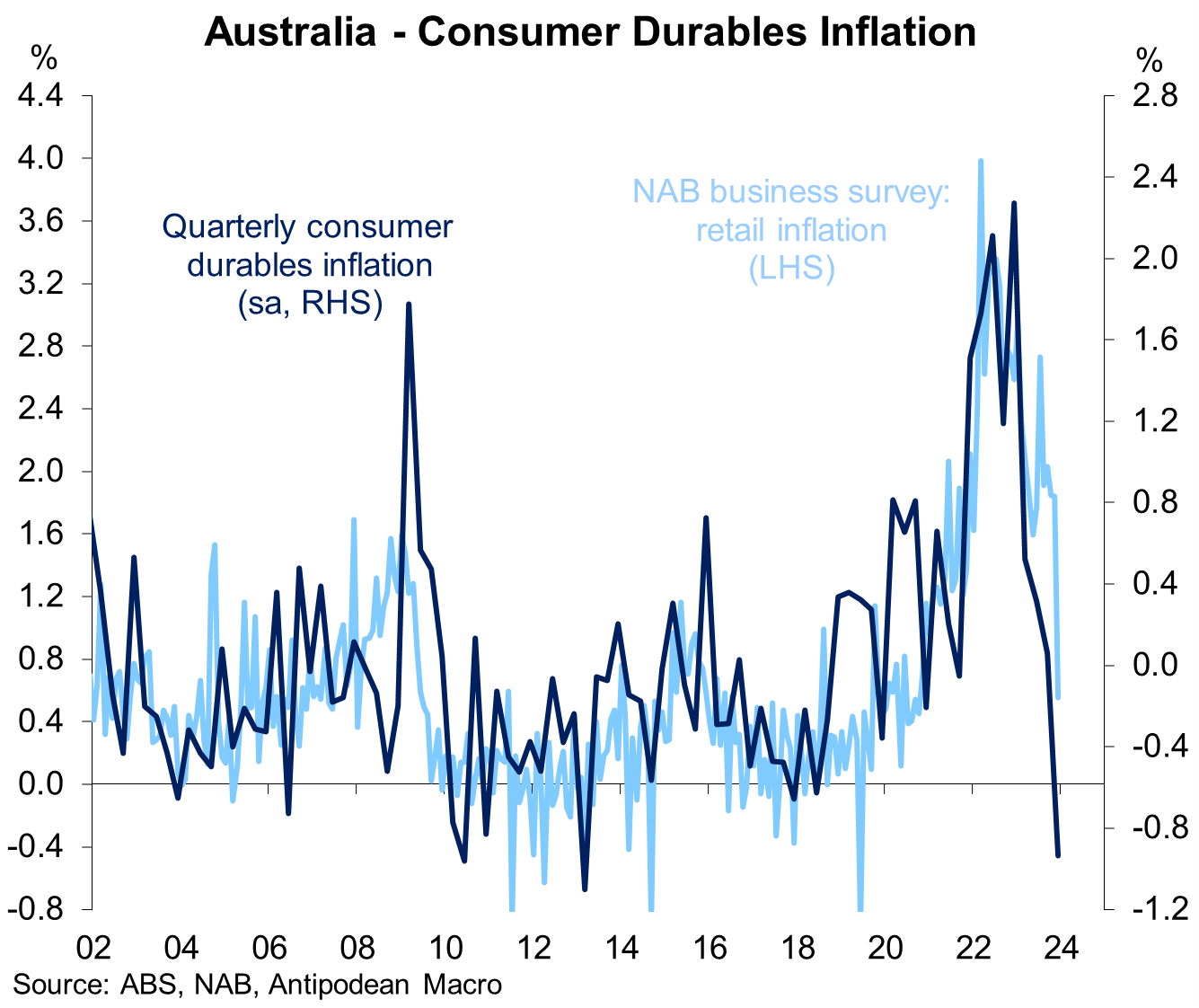

6. Like elsewhere, ‘core’ tradables prices fell in Q4 in Australia…

7. …with consumer durables prices falling sharply

8. Government-administered price inflation picked up in Q4 (on a seasonally adjusted basis) and combined with tobacco contributed HALF (0.36ppts) of total quarterly CPI inflation

Discussion about this post

No posts