1. CBA’s internal data suggest that growth in nominal household spending in Australia remained weak in the 3 months to April. This is a useful way to look at these data because the early timing of Easter is likely to have boosted the March monthly outcome and weighed on the April outturn.

2. Roy Morgan’s unemployment rate measure for Australia rose in April after falling for several months. This survey classifies respondents aged 14+ as unemployed if they are looking for work, no matter when (so it’s a much less strict definition of unemployment than used by the ABS).

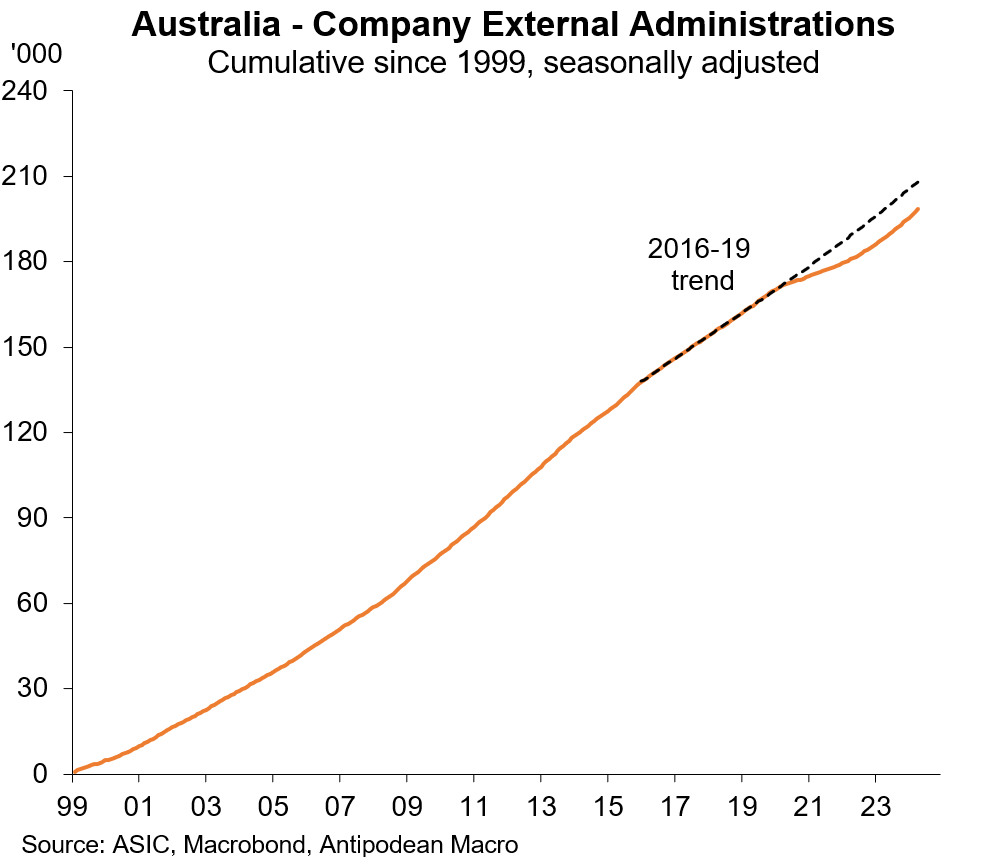

3. Data to 28 April reveal that the number of companies entering external administration in Australia remained at a high level…

4. …but the cumulative number of external administrations remains well below the counterfactual had the 2016-19 trend continued in recent years.

5. While company administrations are up, so are new company registrations.

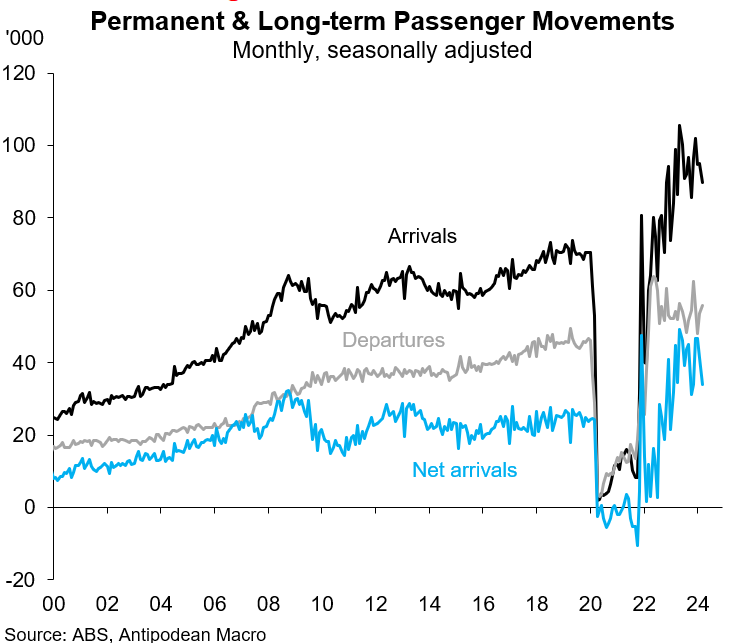

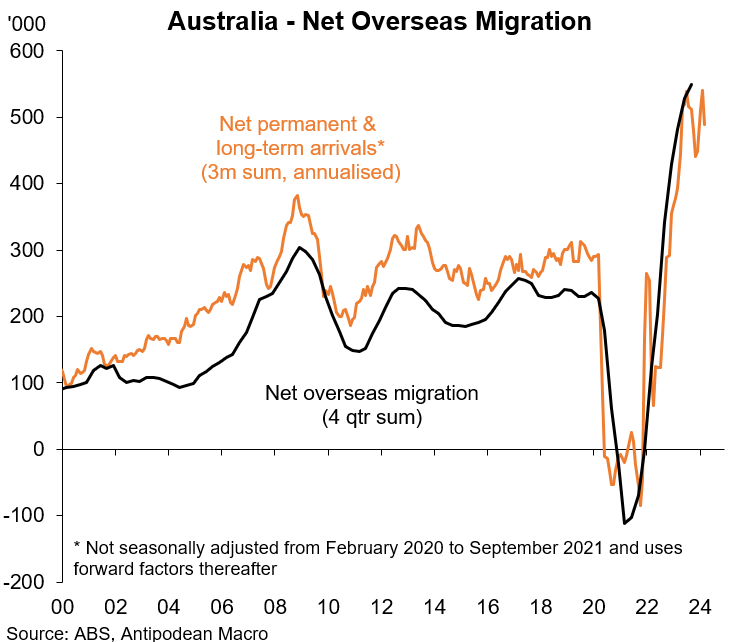

6. The monthly proxy for Australian’s net immigration, based on net permanent and long-term arrivals, slowed in March.

Monthly movements data are volatile. On a 3-month average basis, Australia’s net immigration appears to have remained very high in the March quarter.

7. Data for April show that arrivals of student visa holders to Australia were broadly in line with what occurred in that month in 2018 and 2019 (i.e. prior the pandemic) after being well below ‘normal’ in March.

Departures of student visa holders from Australia have returned to more ‘normal’ levels, reflecting a lag from the earlier surge in arrivals.

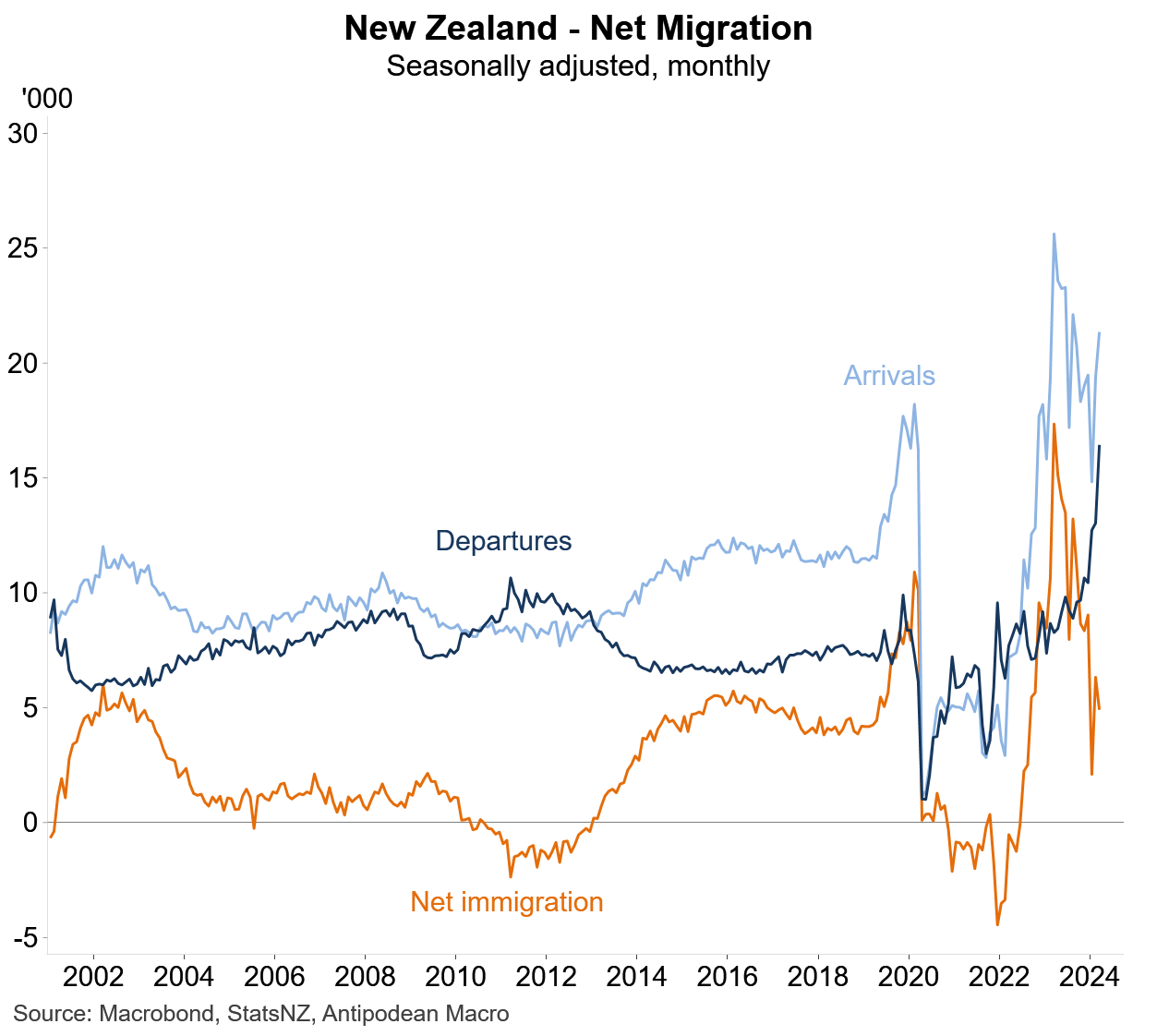

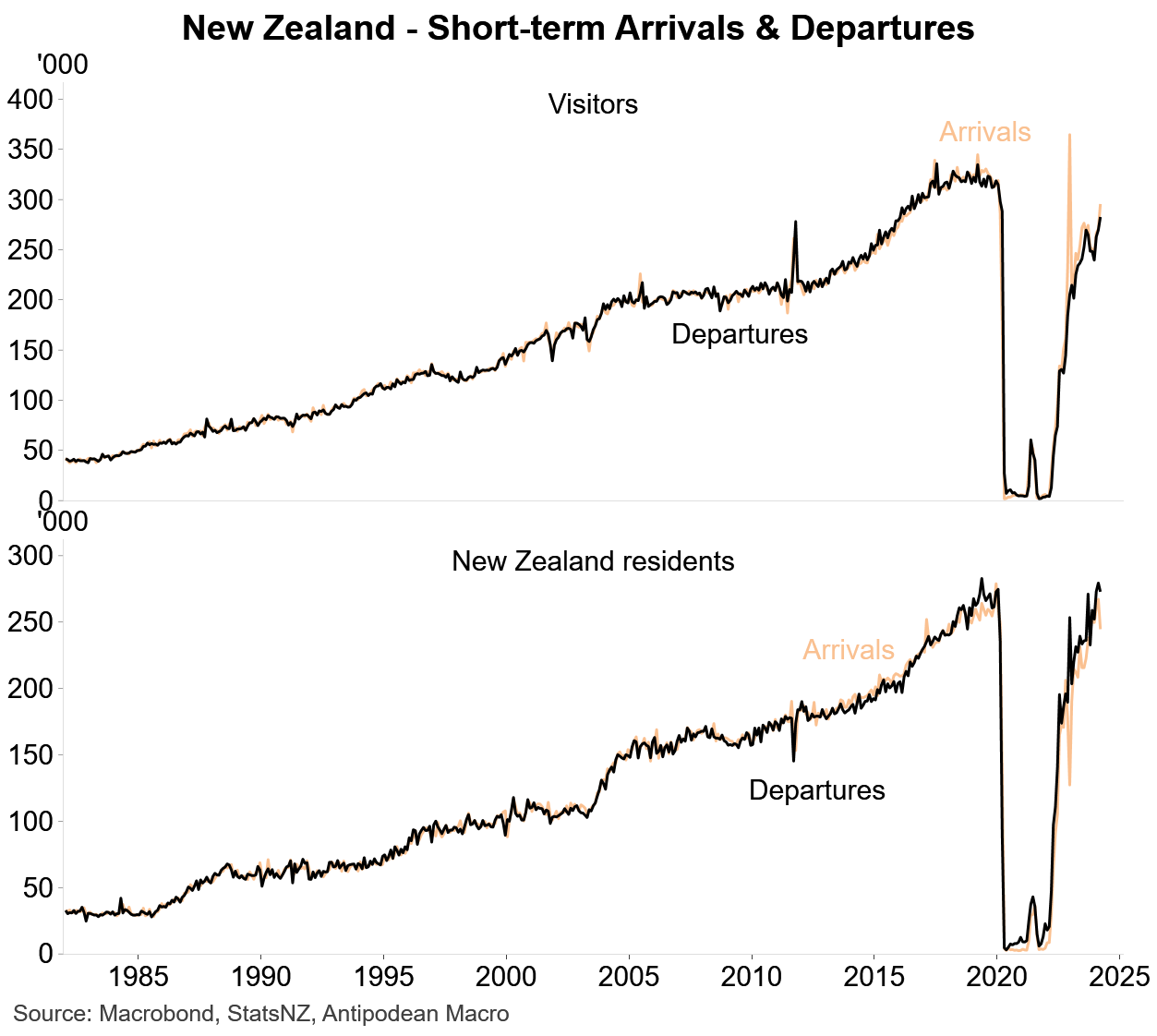

8. Net immigration to New Zealand dipped in March and remained much lower than the peak as departures have surged higher.

Net immigration has returned to adding ~1ppt to annualised population growth.

9. Both New Zealand and non-NZ citizens have been driving the number of departures higher.

10. Short-term visitor numbers to New Zealand continued to recover in March but remained well below pre-pandemic levels.

11. New Zealand housing prices rose slightly in April according to REINZ (and post our seasonal adjustment).

Kiwi housing prices have been little changed in recent months after gradually picking up from early 2023.

More kiwi housing charts can be found in the updated version of our Antipodean Housing Deep Dive below.

Discussion about this post

No posts