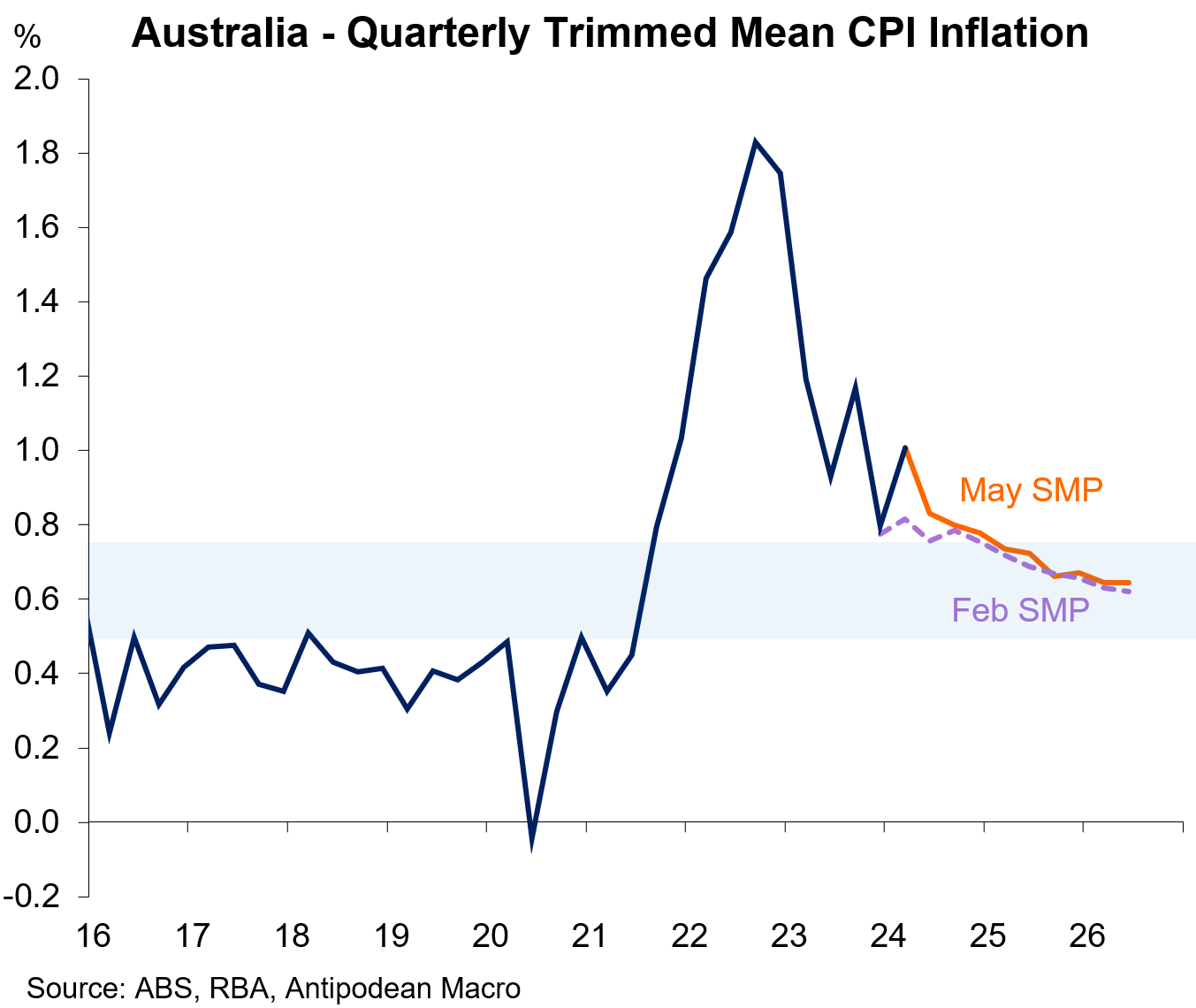

1. The RBA has slightly revised up its trimmed mean inflation forecasts across the forecast horizon. The Bank is still forecasting annualised underlying inflation around the mid-point of the 2-3% target by mid-2026 (it’d be a surprise if it wasn’t!!).

2. The year-ended inflation forecasts look like this…

3. The Bank has not only aligned its near-term unemployment rate forecasts with the recent lower-than-expected outcomes but has shifted the whole forecast profile back to where it was in November.

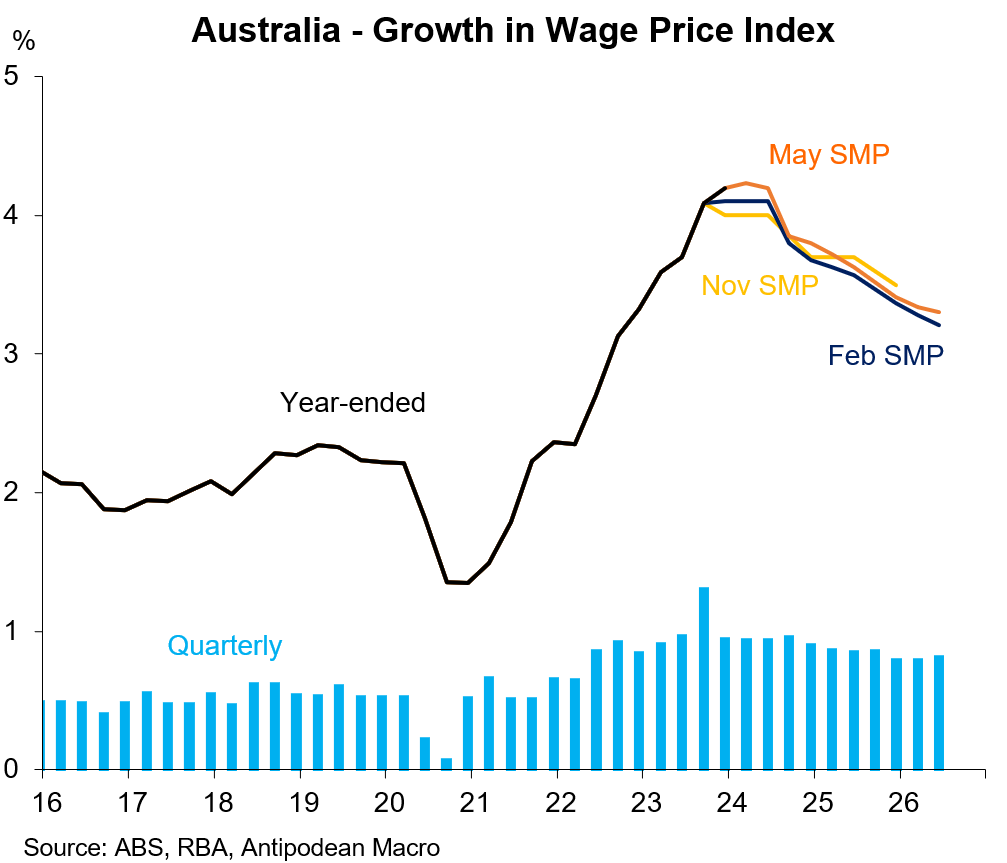

4. The RBA expects wages growth to ease more gradually than previously expected, reflecting both the strength in recent wage outcomes and the slightly stronger outlook for the labour market.

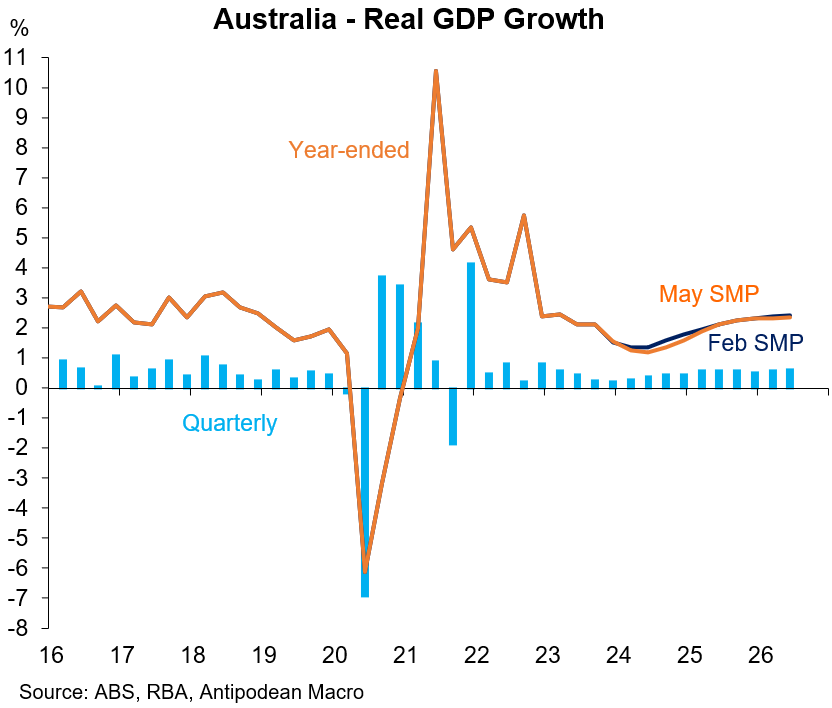

5. The RBA’s GDP growth forecasts - of lesser importance in our view - have been revised a bit lower in the near-term, reflecting a softer near-term outlook for household consumption and dwelling investment and a higher expected cash rate profile than three months ago.

6. The Bank outlined how it measures and thinks about “potential” output. It chose to use the chart below, noting that it’s from one of the models in the RBA’s suite. But it chose this one, and it shows that output is forecast to remain above potential over the entire forecast horizon.

Discussion about this post

No posts