1. New Zealand’s Q1 CPI was in line with our/market expectations at +0.6% q/q and +4% y/y (this was above the RBNZ’s February MPS forecast but they flagged that risk last week).

On a seasonally adjusted basis, CPI inflation moderated a little further to +0.7% q/q.

2. Excluding food and energy, kiwi CPI inflation has picked up in recent quarters (post our seasonal adjustment).

3. Our own underlying measures of kiwi inflation were mixed for Q1. Quarterly trimmed mean inflation moderated further to +0.7% q/q, but simple measures of the breadth of inflation remained elevated.

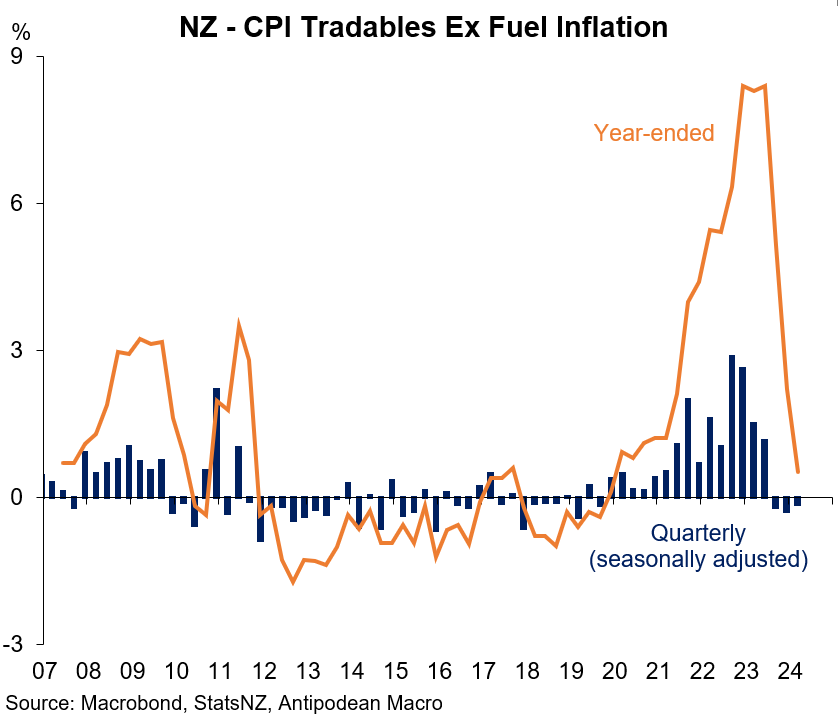

4. Tradables prices (ex fuel) continued to decline in New Zealand in Q1, but non-tradables inflation remained too high.

5. Likewise, NZ services inflation bounced back in Q1.

6. Focusing just on domestic market services inflation doesn’t change the story - it remained strong in Q1 and way too high.

7. CPI rents inflation also remained elevated at more than +1% q/q and +4.7% y/y.

8. Like in Australia, new dwelling purchase inflation in New Zealand has moderated significantly but has increased a little in recent quarters.

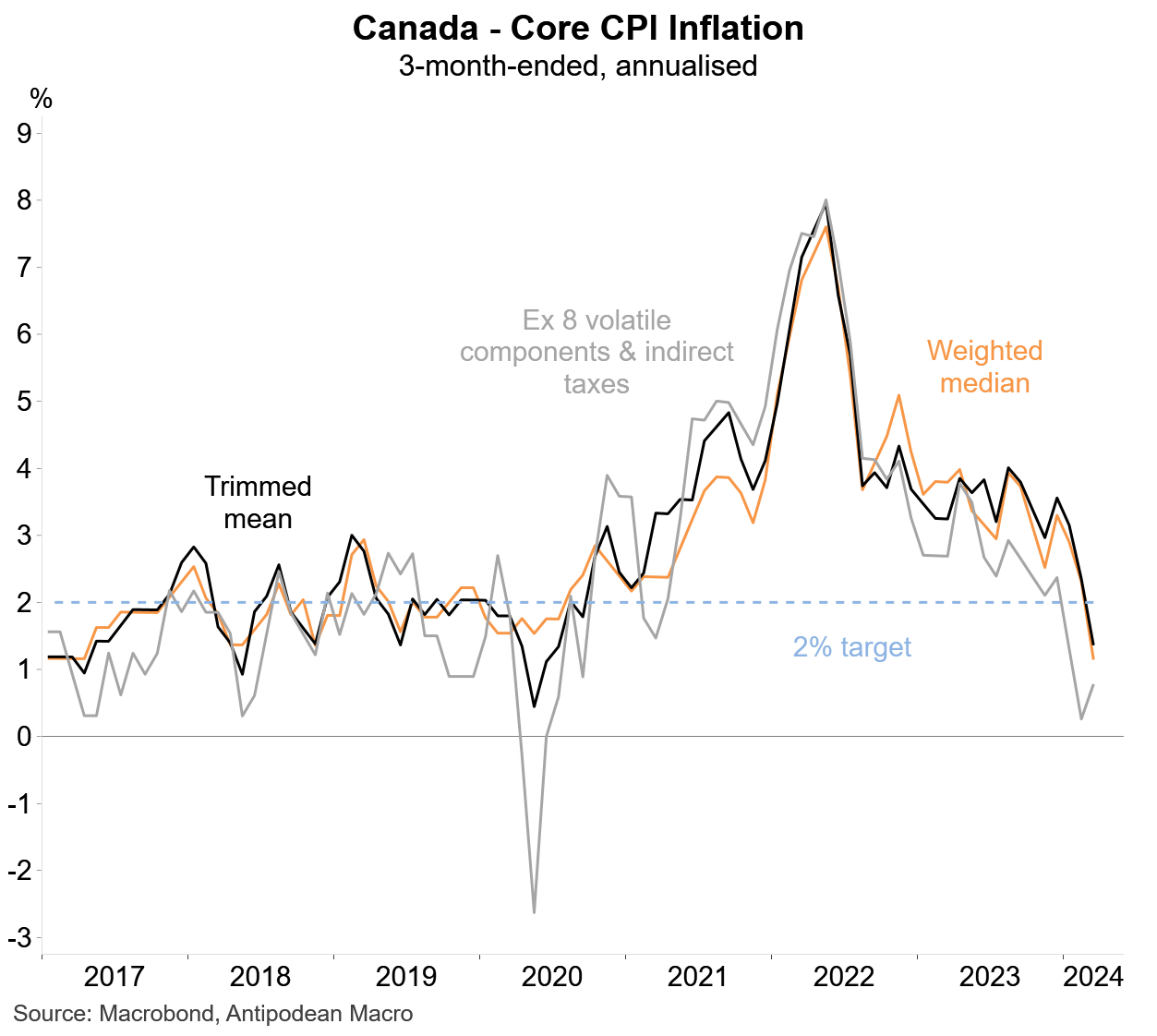

9. Meanwhile, Canada’s underlying inflation remained well-behaved in March…

10. …and much lower than equivalent measures for the United States.

Discussion about this post

No posts