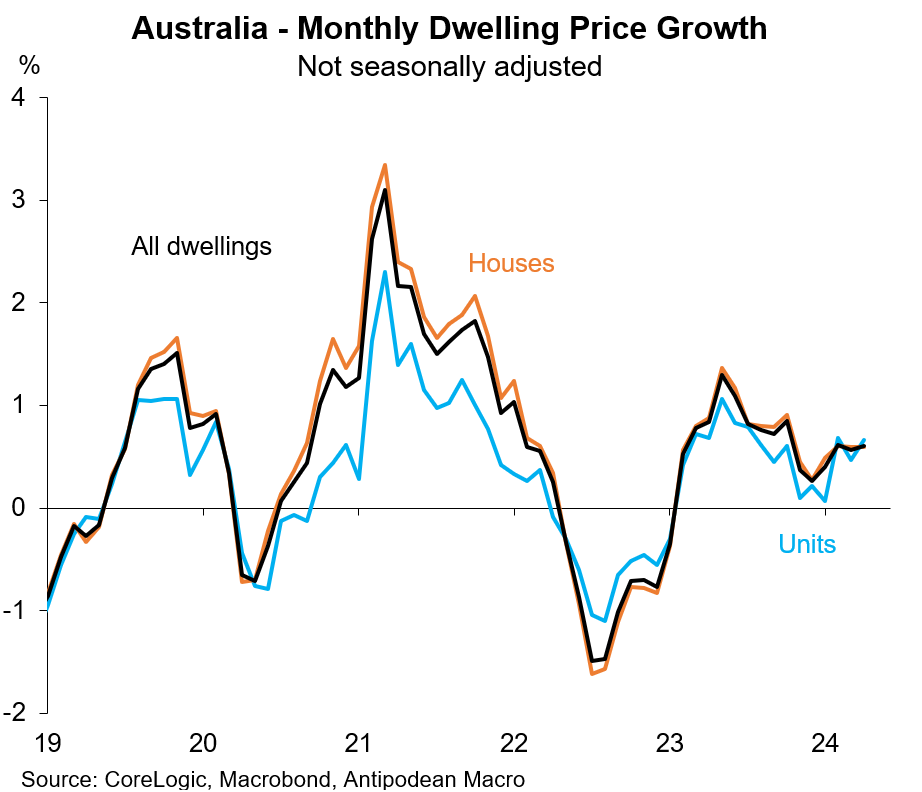

1. Australian dwelling prices rose +0.6% m/m over April and +8.7% y/y according to CoreLogic.

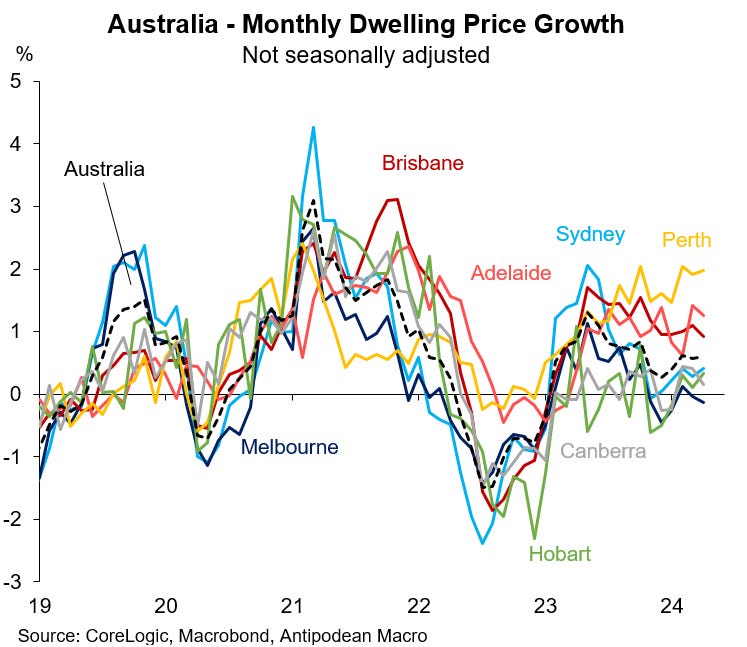

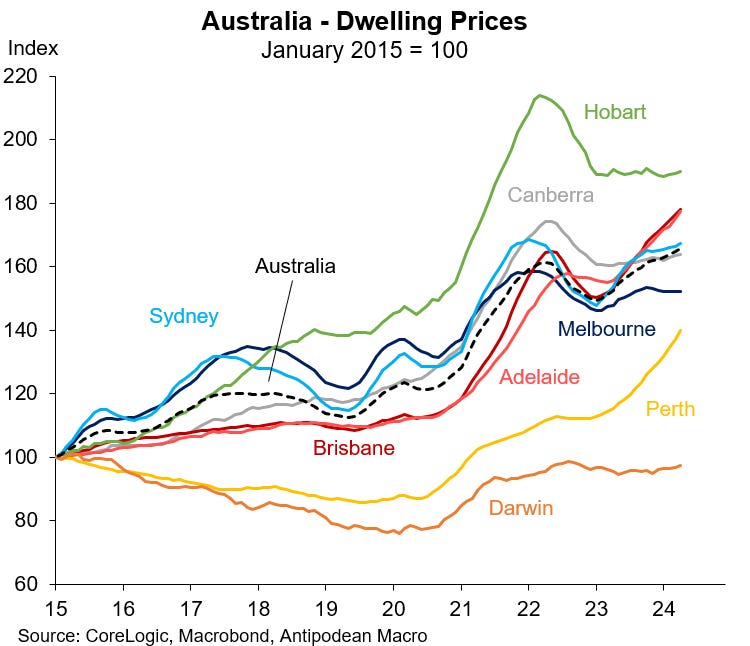

2. Monthly dwelling price growth remained strongest in Perth, Adelaide and Brisbane. Housing prices declined in Melbourne and remained below the peak.

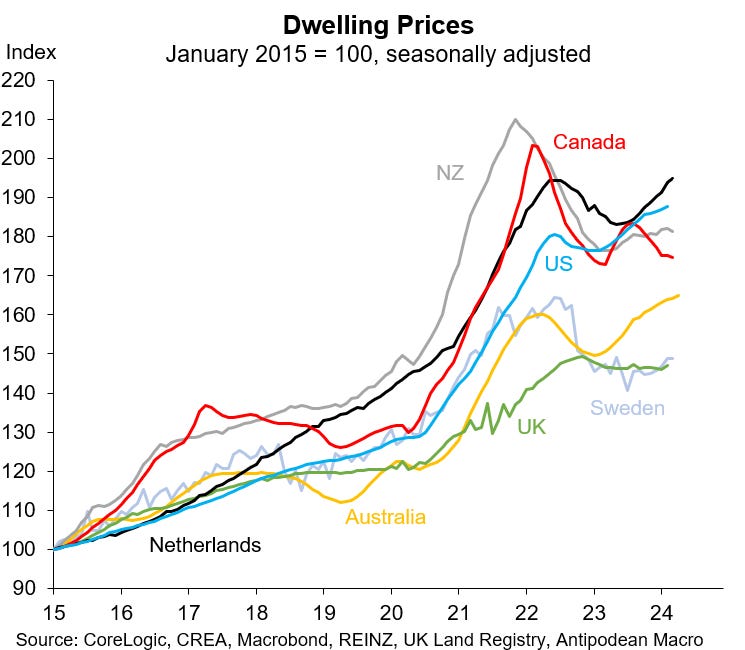

3. The recent performance of housing prices across countries has been mixed.

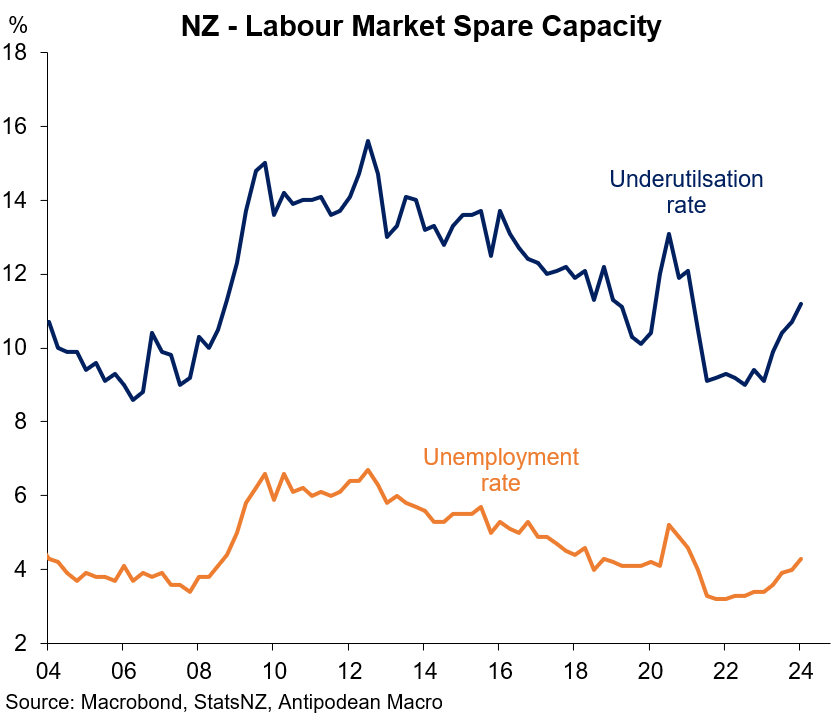

4. New Zealand’s unemployment rate rose by a bit more than consensus and the RBNZ expected in Q1 to 4.3% (+1.1ppts from the trough). Overall labour underutilisation also jumped higher.

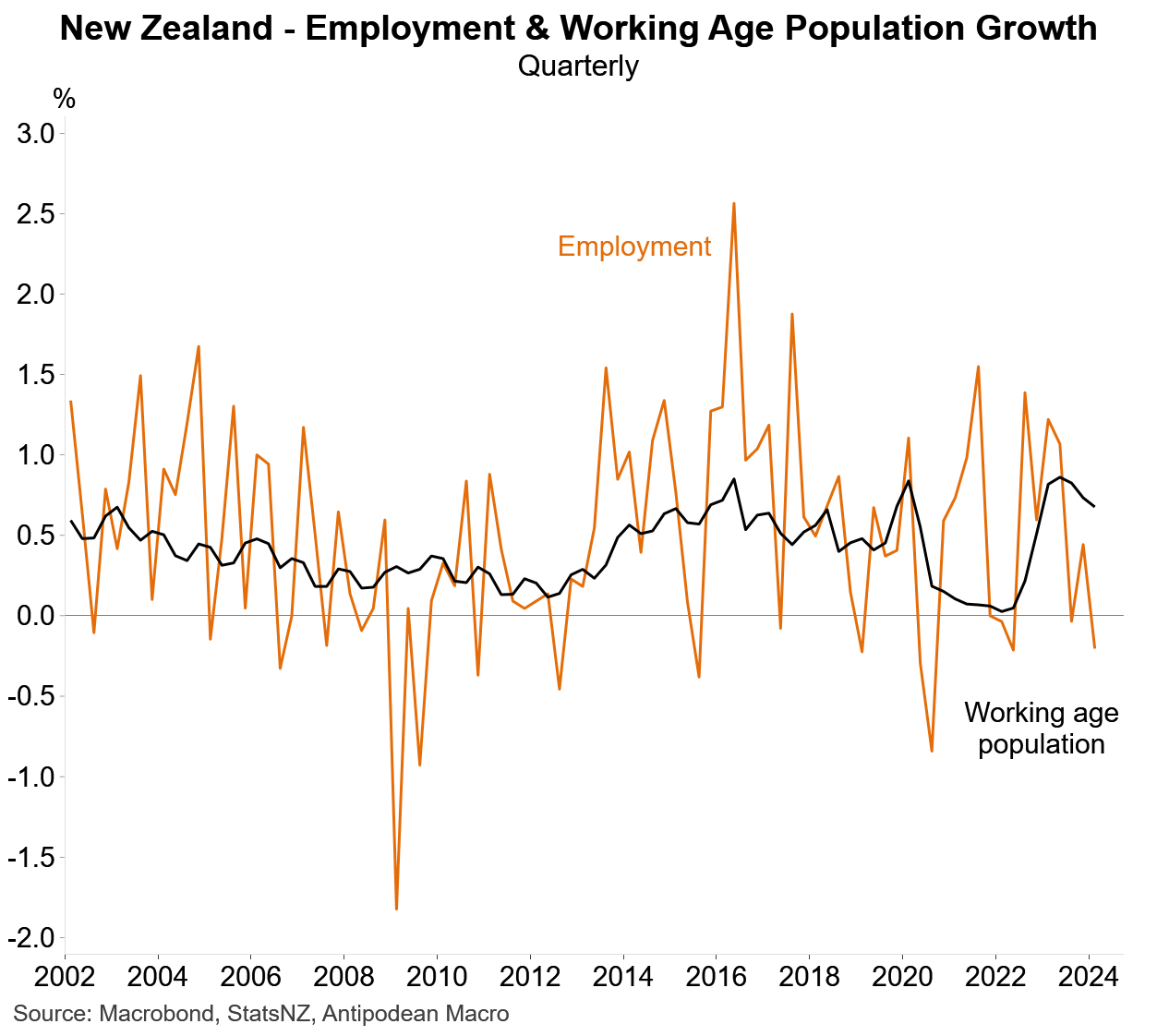

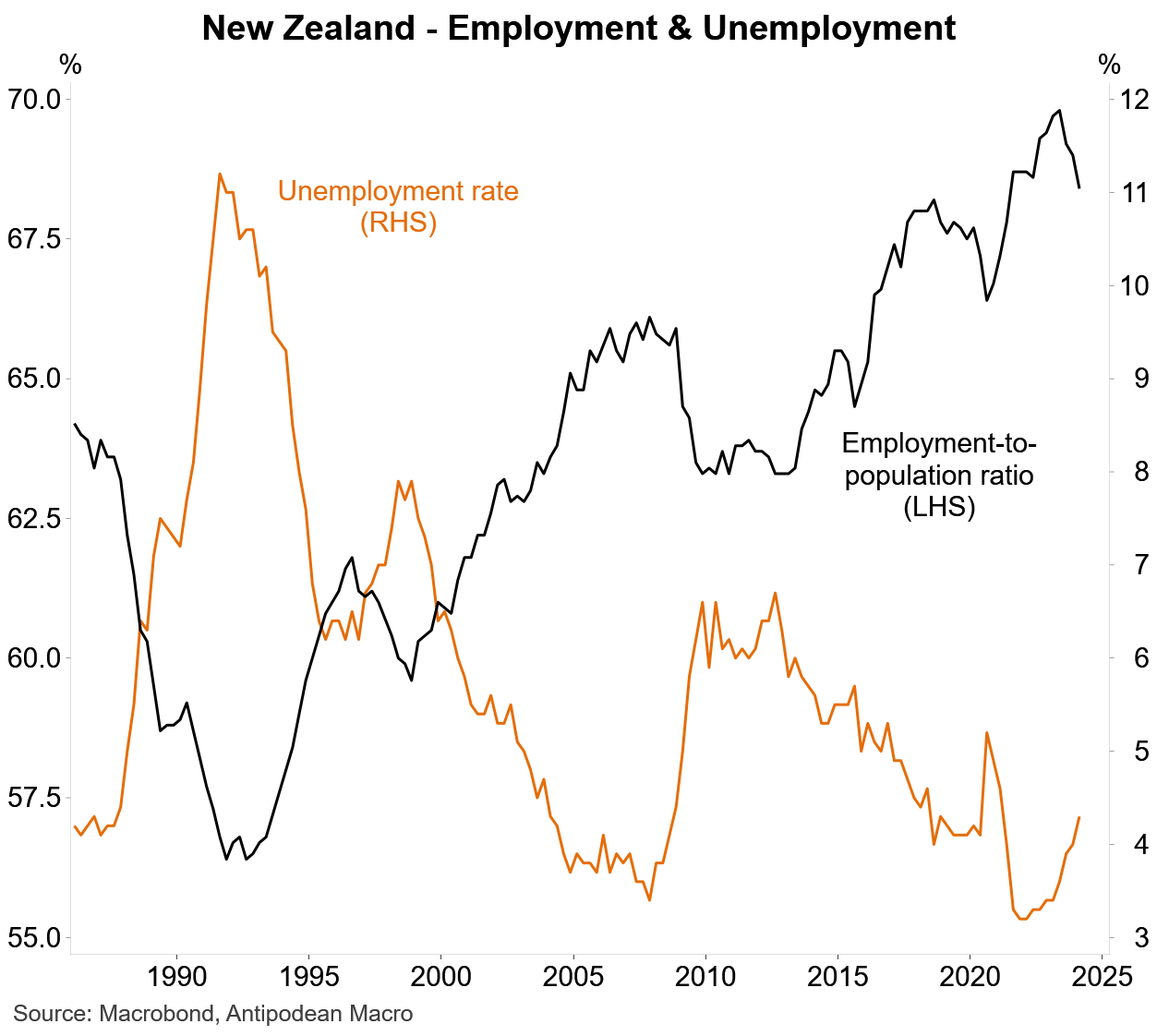

5. The rise in kiwi unemployment occurred alongside a 0.2% q/q decline in employment and a large 0.6ppt fall in the employment-to-population ratio.

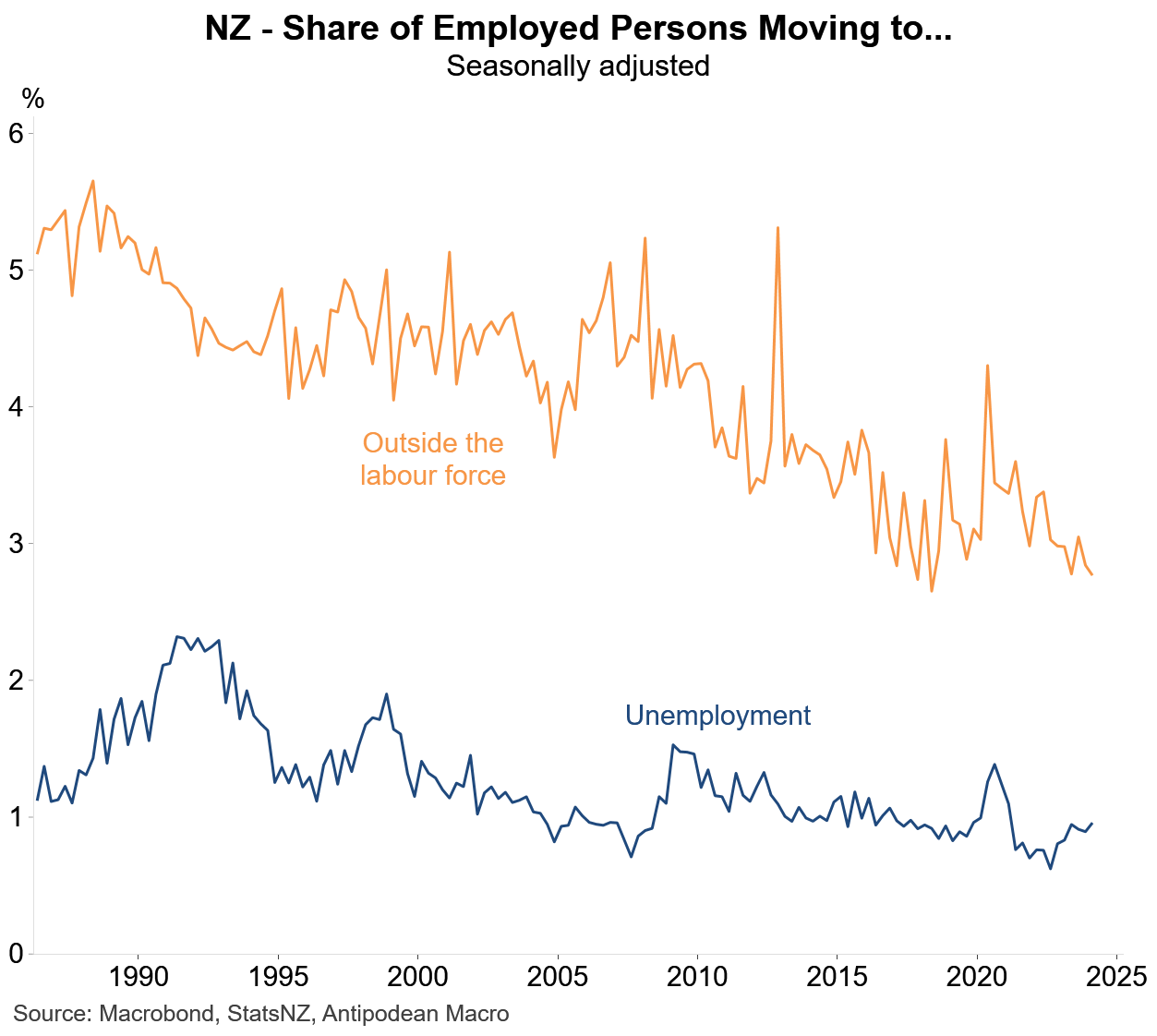

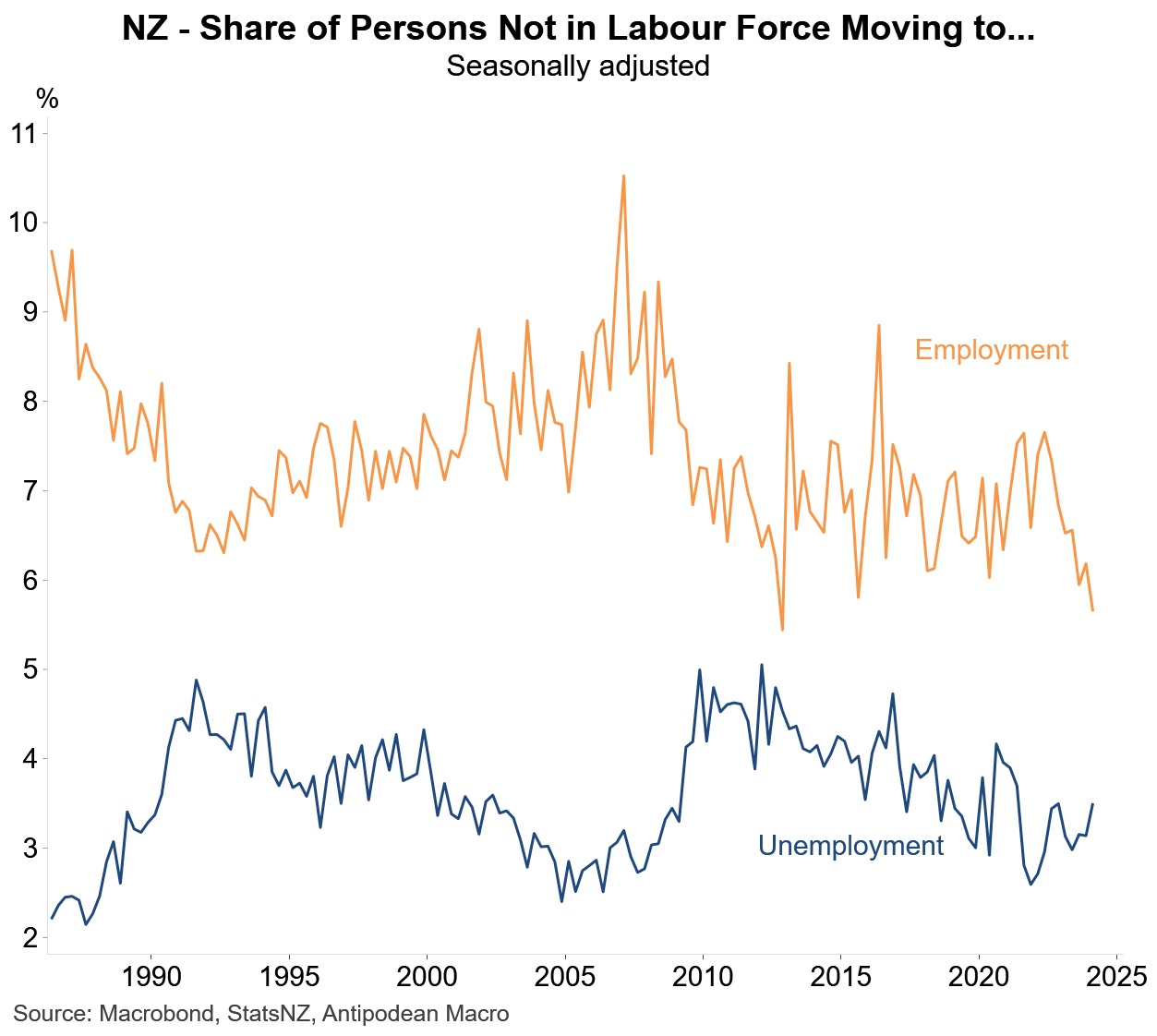

6. The share of employed kiwis moving to unemployment has been rising…

…but there have been more noticeable shifts in the share of kiwis outside the labour force to employment (much lower) and unemployment (higher). In part this is likely to reflect the effects of very strong net immigration and rising difficulties for some new arrivals to New Zealand to find work.

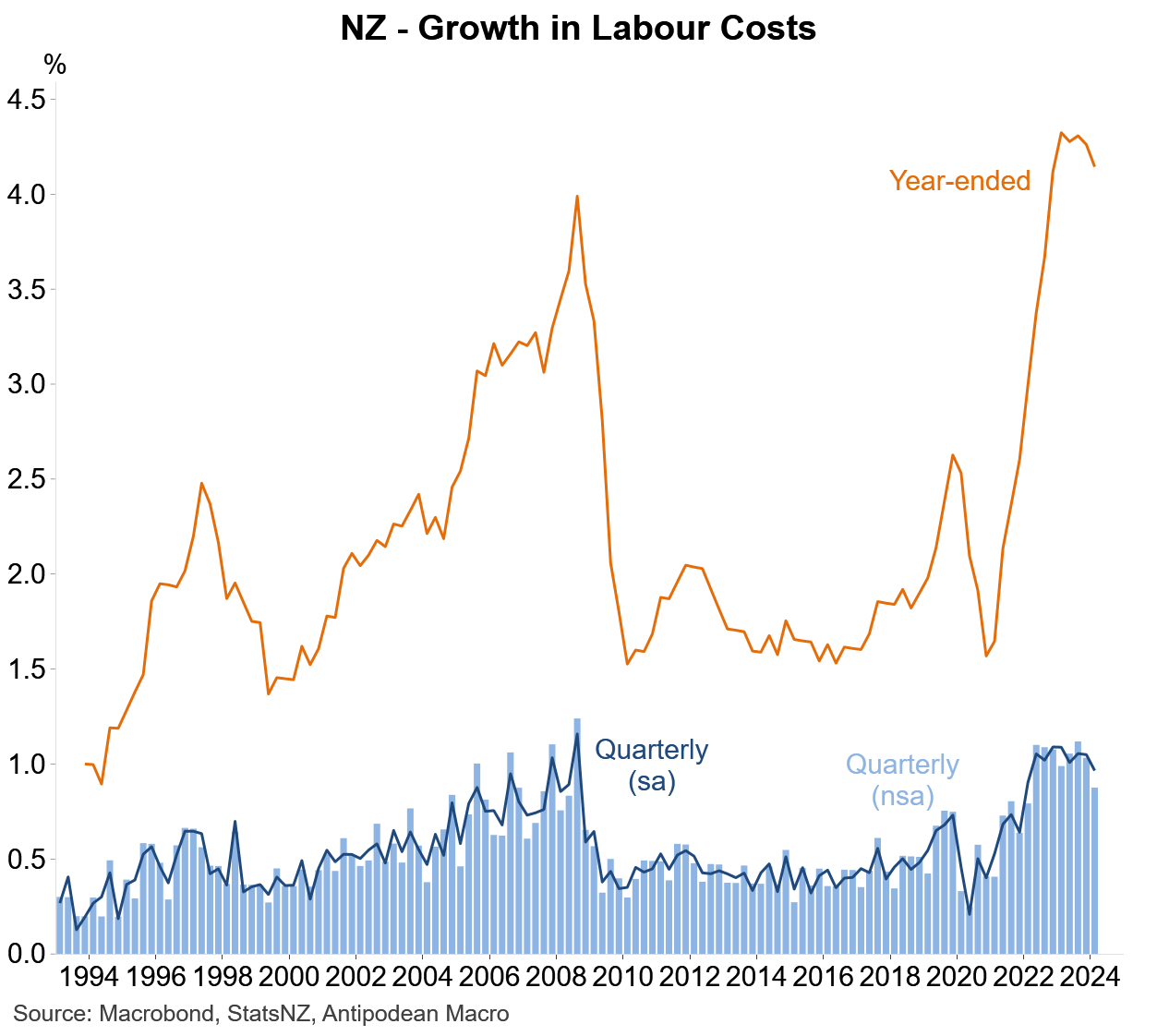

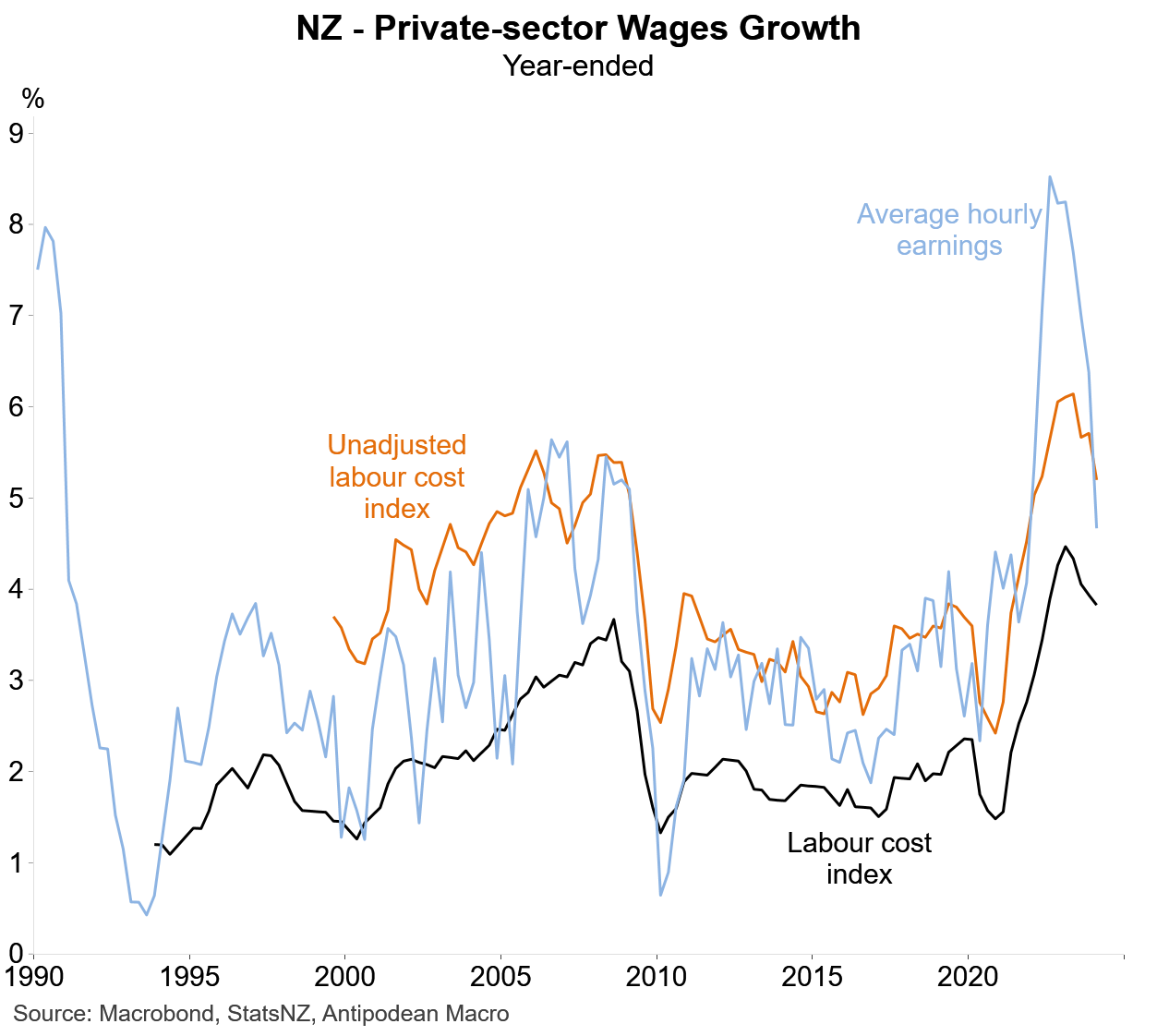

7. Early signs of an easing in wages growth are emerging in New Zealand amid less-tight labour market conditions. The labour cost index for all employees moderated a little in Q1…

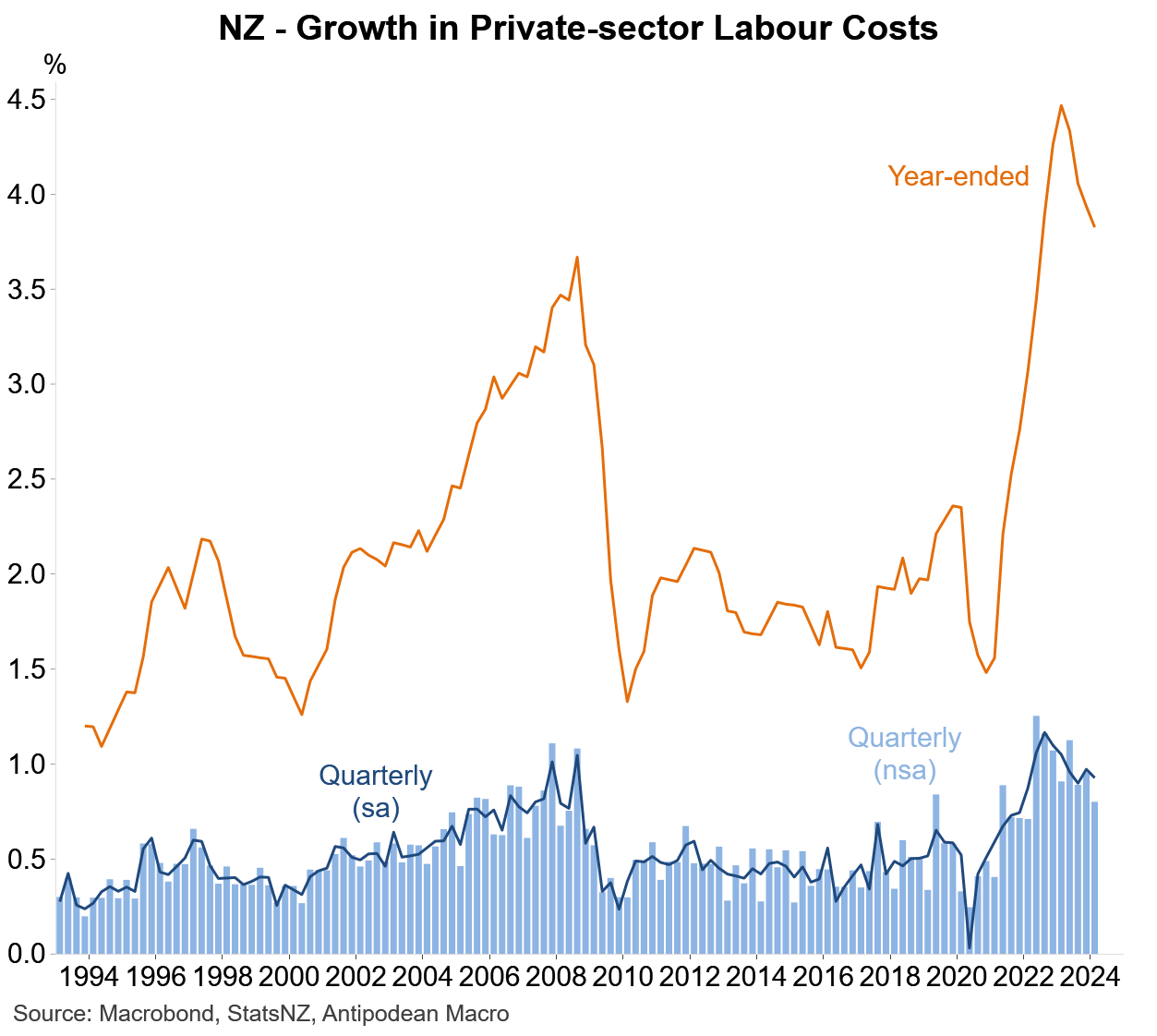

…and has been slowing for several quarters for private-sector workers. (Public-sector wages growth has been boosted by the Public Sector Pay Adjustment.)

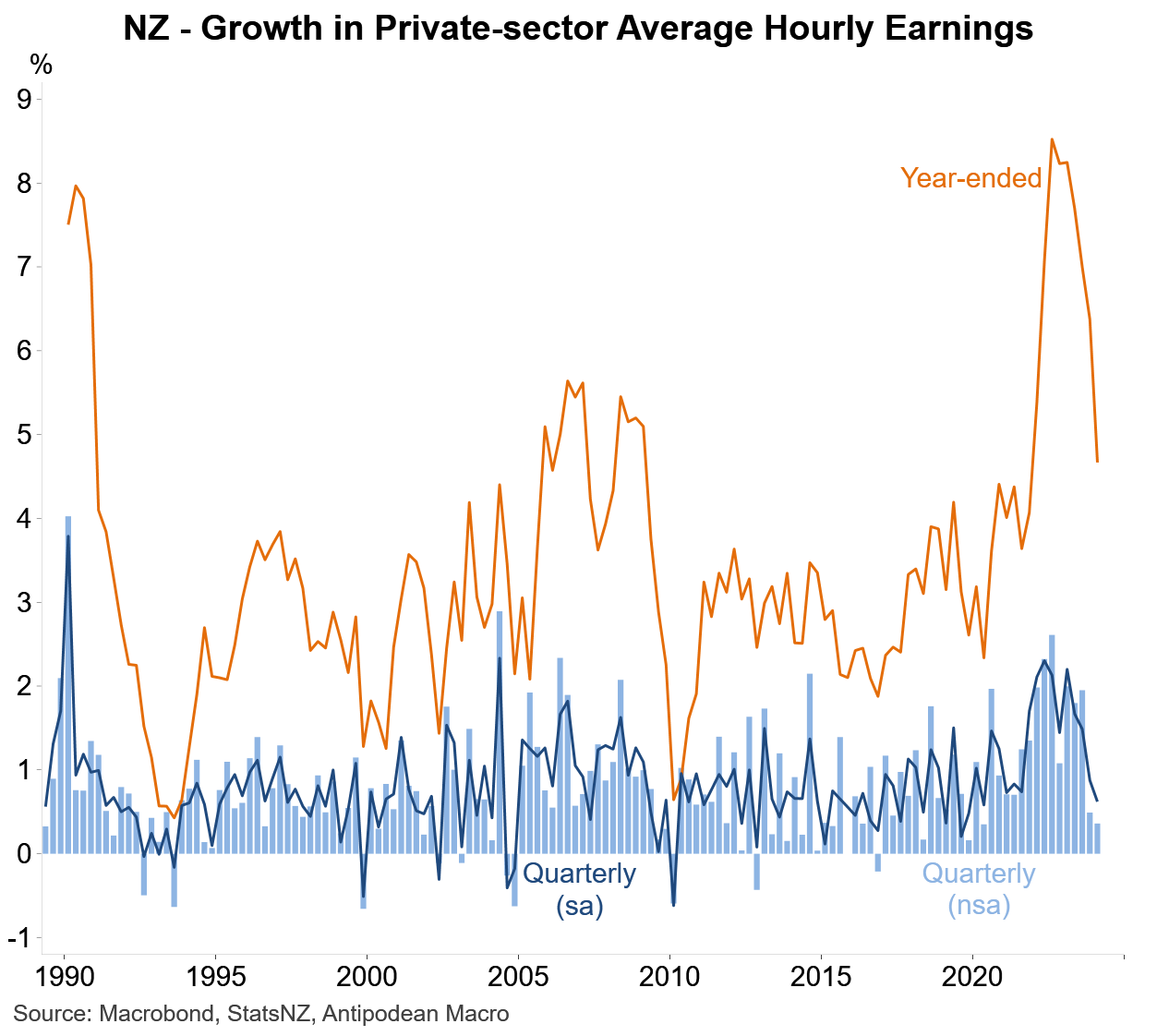

8. Measures of kiwi private-sector wages growth that do not adjust for compositional change in employment - and are arguably more important for thinking about unit labour costs growth - have slowed more noticeably.

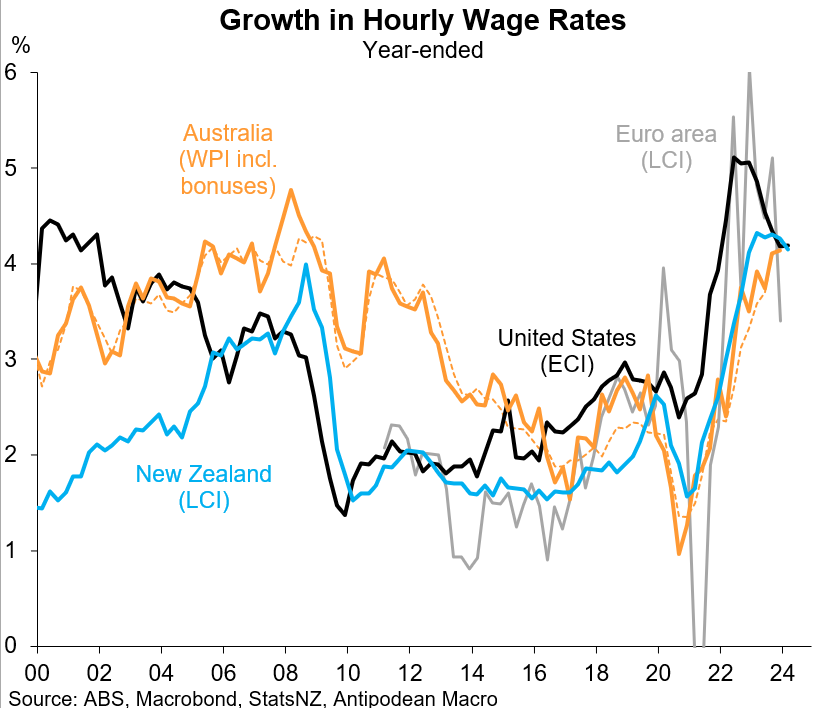

9. Year-ended growth in hourly wage rates is now similar across the US (which printed stronger than expected overnight), New Zealand and Australia.

Discussion about this post

No posts