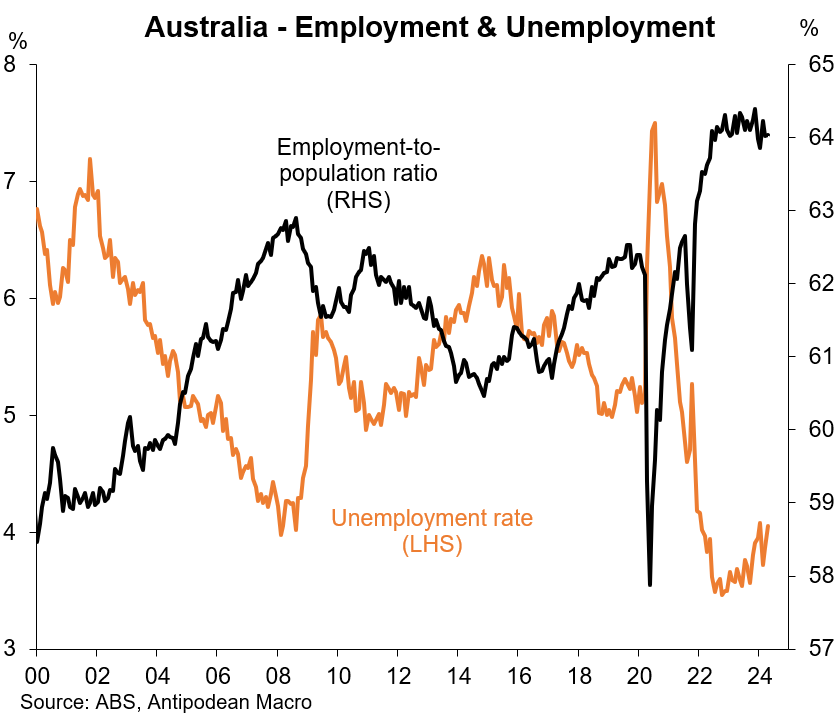

1. Australia’s unemployment rate rose nearly 0.2ppts to 4.05% in April (rounded to 4.1%). Employment rose +38.5k m/m (mkt: +22k) which kept the employment-to-population ratio stable at 64.0%.

The ABS noted that the rise in unemployment in April reflected both that more people without jobs were available and looking for work, and also more people than usual indicated that they had a job that they were waiting to start in. (Those people will show up as employed in the May release.)

The latter reason is likely to be because the survey reference period started on 31 March (Easter Sunday). This casts a cloud over the April labour force data.

2. While some of the rise in the unemployment rate in April could be noise, the rising trend is consistent with falling job ads and rising reported spare capacity.

3. Solid employment growth in Australia in April was at odds with the weaker signal from the NAB business survey.

4. On the ABS’ point that “more people without jobs were available and looking for work“, we can see from the gross flows data that the share of Aussies not in the labour force (NILF) moving to unemployment has risen for several months.

The share of unemployed Australians moving into a job has also been falling (but isn’t exactly at a low level).

5. Youth labour market conditions in Australia continue to show more weakness than those for 25+ year olds. Nonetheless, there are now clearer signs of a small rise in the unemployment rate for 25+ year olds.

6. It’s likely that Aussie labour market conditions are going to have to ease up by considerably more for wages growth to slow to a rate consistent with 2.5% inflation.

7. Australia’s labour market conditions continue to hold up better than in many other economies.

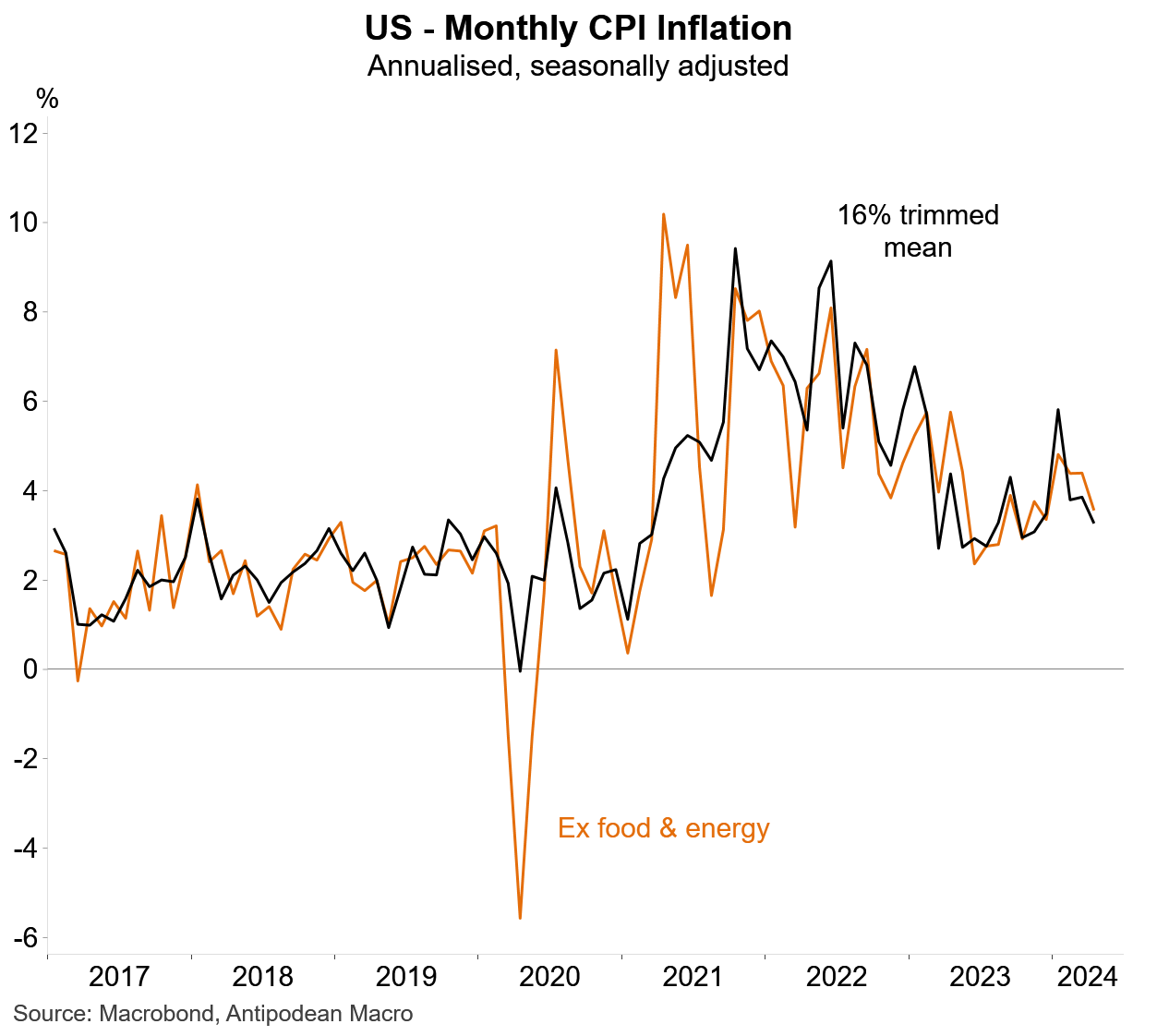

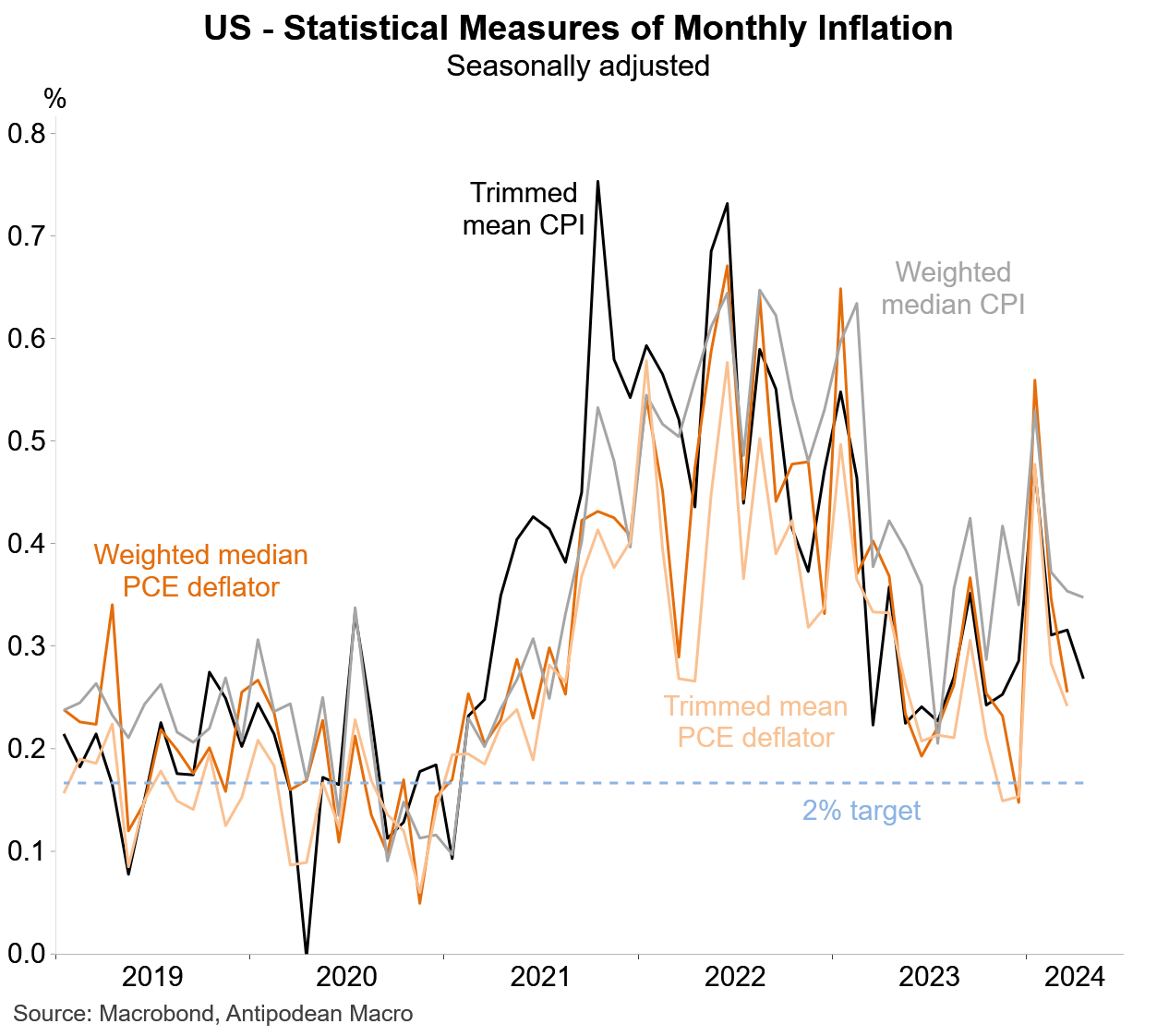

8. US CPI inflation may have been a ‘relief’ to financial markets overnight, but underlying measures remained well above the Fed’s 2% target in April.

9. Simple measures of the breadth of US CPI inflation, however, are around the average since 2000…

…but there is a skew, with a higher-than-average share of US CPI items rising at an annualised monthly rate of >5%.

10. Services inflation in the US remains way too high.

11. Motor vehicle registrations in New Zealand have weakened.

Discussion about this post

No posts