1. Could small businesses in Australia be telling us something about the near-term direction of wages growth? Xero’s data shows (much) slower growth in small business wages compared with the private-sector wage price index measure.

Also note that the WPI has not included businesses with 0-4 employees in its coverage since Q4 2009. At the time, the ABS noted evidence that the size and frequency of pay changes for jobs in micro businesses was the same as for larger businesses.

Maybe that’s not the case at the moment.

2. We expect Australia’s Q4 GDP growth to have been around +0.3% q/q.

Underlying public demand rose +0.5% q/q in Australia in Q4 and contributed a bit over 0.1ppts to quarterly GDP growth. Q3 growth was revised up from +1.3% q/q to an even stronger +1.9% q/q.

BUT the big number was public inventories which contributed more than 0.4ppts to Q4 GDP growth (after subtracting a similar amount in Q3).

These were both in line with our expectations.

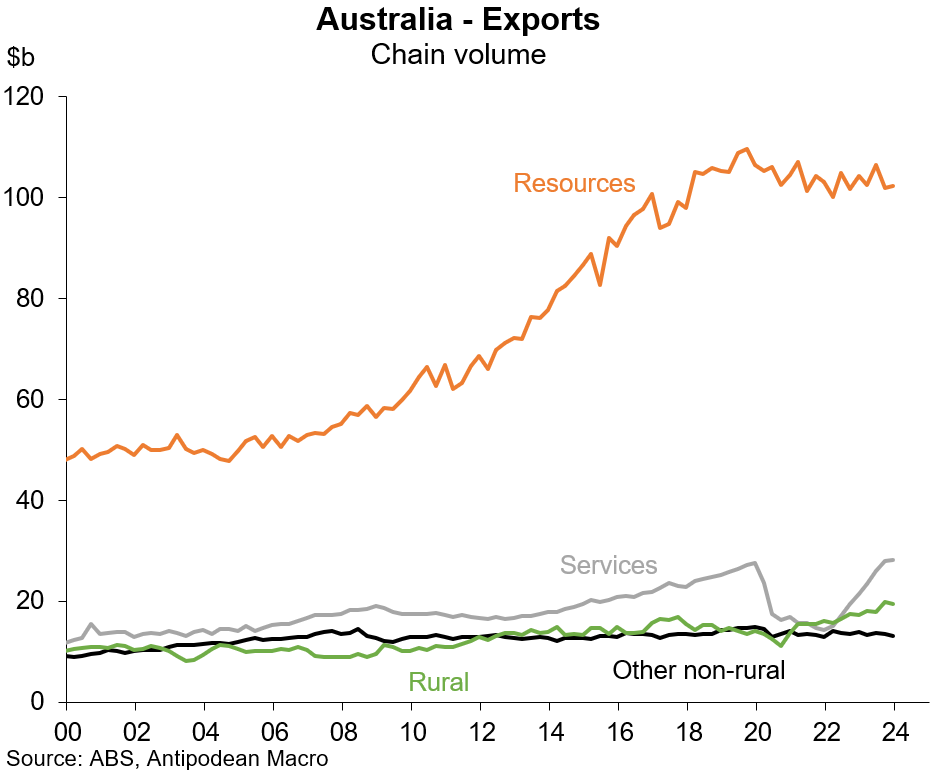

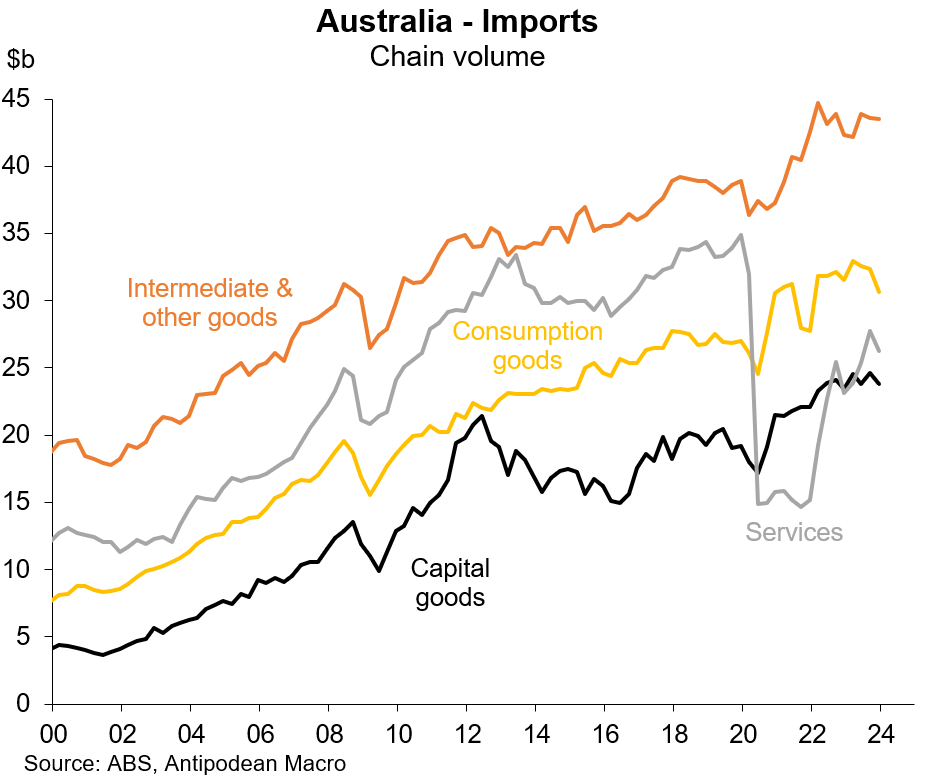

3. Net exports contributed 0.65ppts to Australia’s Q4 GDP growth, entirely because of weaker import volumes. This was well above market expectations (+0.2ppts) but closer to our estimate (+0.5ppts).

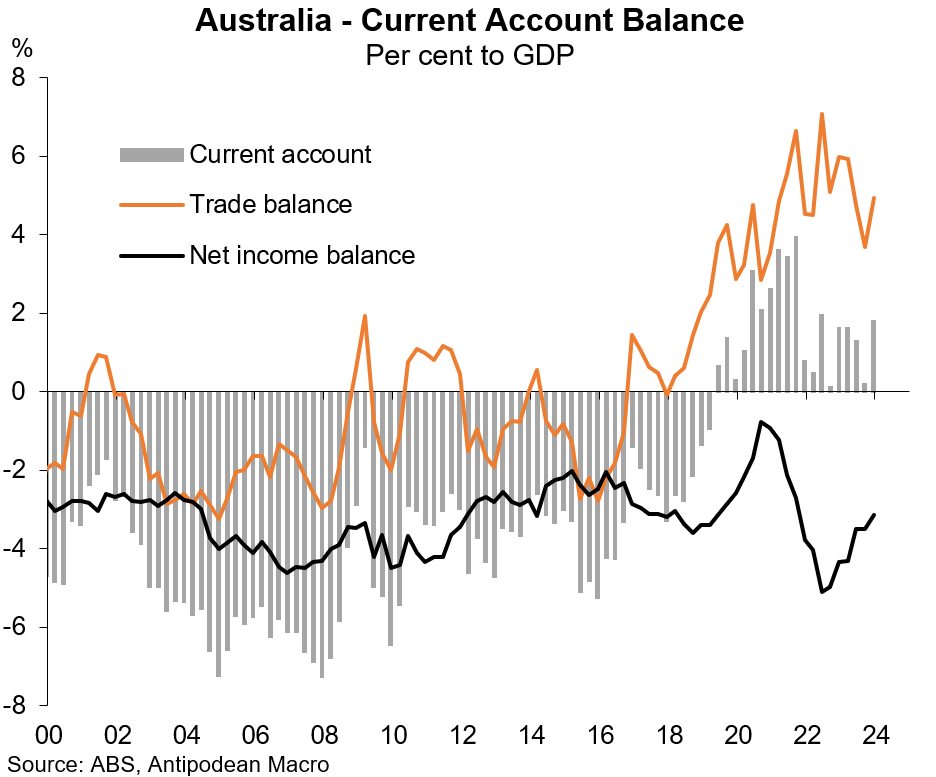

4. Australia’s current account surplus widened in Q4 2023, supported by higher commodity prices, weaker imports and a shrinking net income deficit.

5. Australia’s real exports declined 0.3% q/q in Q4, which was a bit softer than we expected. Resource exports have moved broadly sideways - in real terms - for several years now.

6. Australia’s real imports declined 3.4% q/q in Q4, which was in line with our estimates and consistent with the decline in non-mining inventories in the quarter.

7. The decline in Australia’s (real) services imports in Q4, however, was a surprise. The fall was driven by lower spending on outbound travel which will also show up as a drag on household consumption.

This was surprising given further growth in the number of Australians travelling overseas. This could reflect the changing composition of outbound travel (e.g. more Bali), but it could also partly reflect seasonal adjustment issues given a similar fall occurred in Q4 2022.

8. Australia’s education exports continued to increase strongly in Q4 2023…

9. …and the ABS found nearly an extra $1b of education exports in Q3 last year

Discussion about this post

No posts