1. The bout of optimism that firms in New Zealand reported in Q4 last year following the election disappeared in Q1. A gauge of firms’ own activity sunk to a new low.

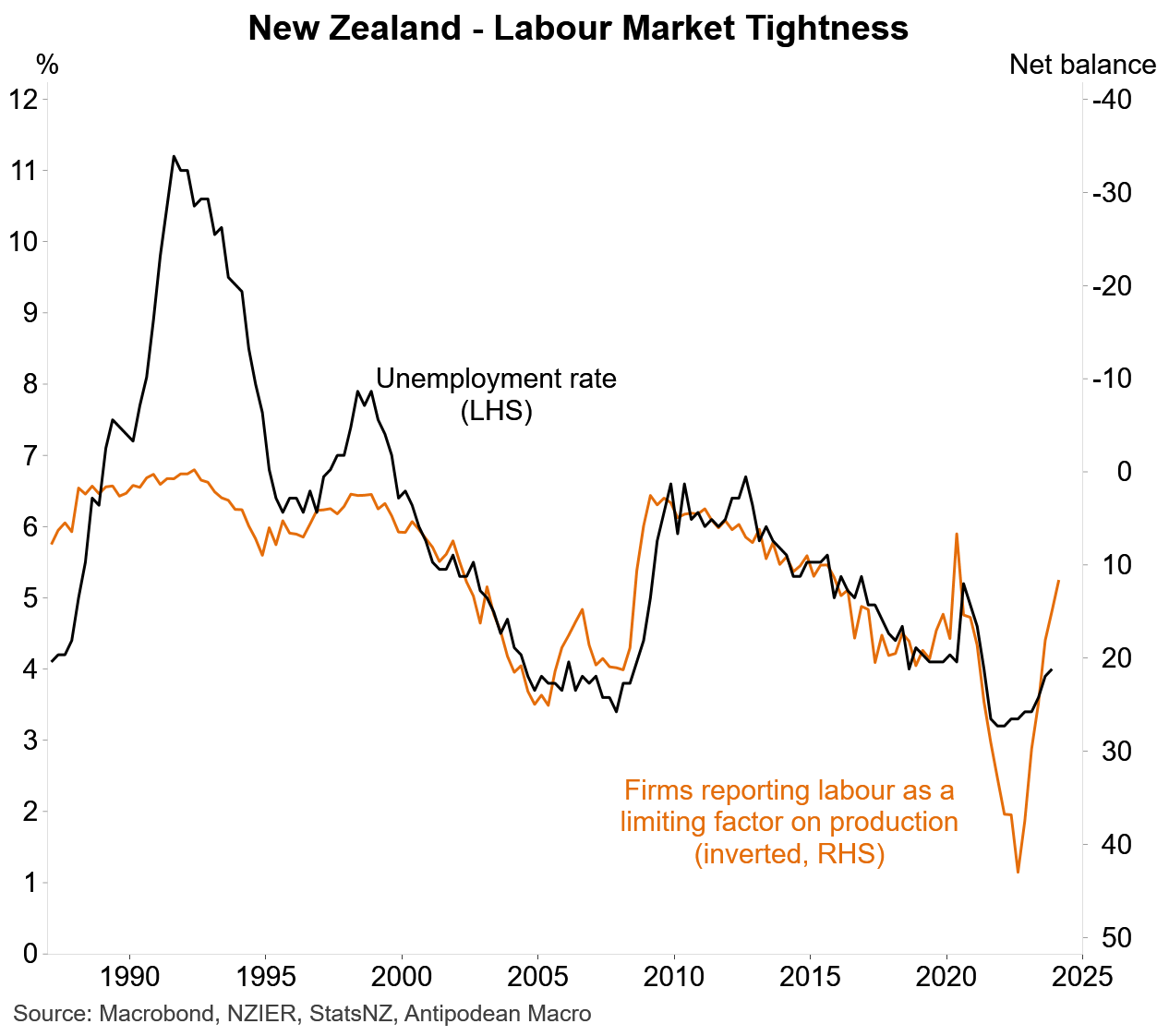

2. The share of Kiwi firms reporting that labour is a limiting factor on production declined further in the March quarter…

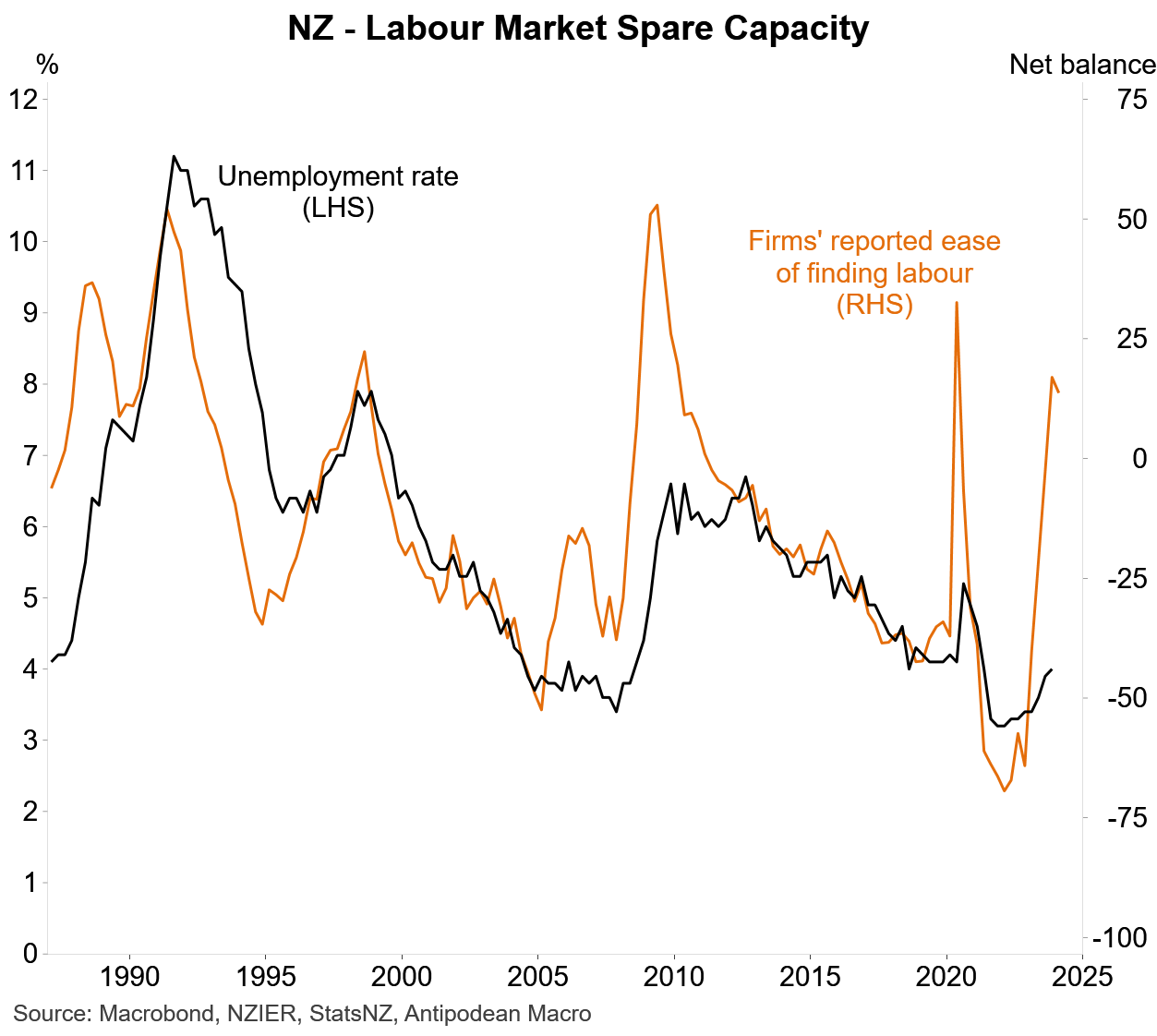

3. …and those firms continue to report that finding labour is significantly easier than 12-18 months ago.

4. Kiwi firms said that their hiring in Q1 slowed sharply…

5. …but selling price inflation remained elevated despite a modest decline in Q1.

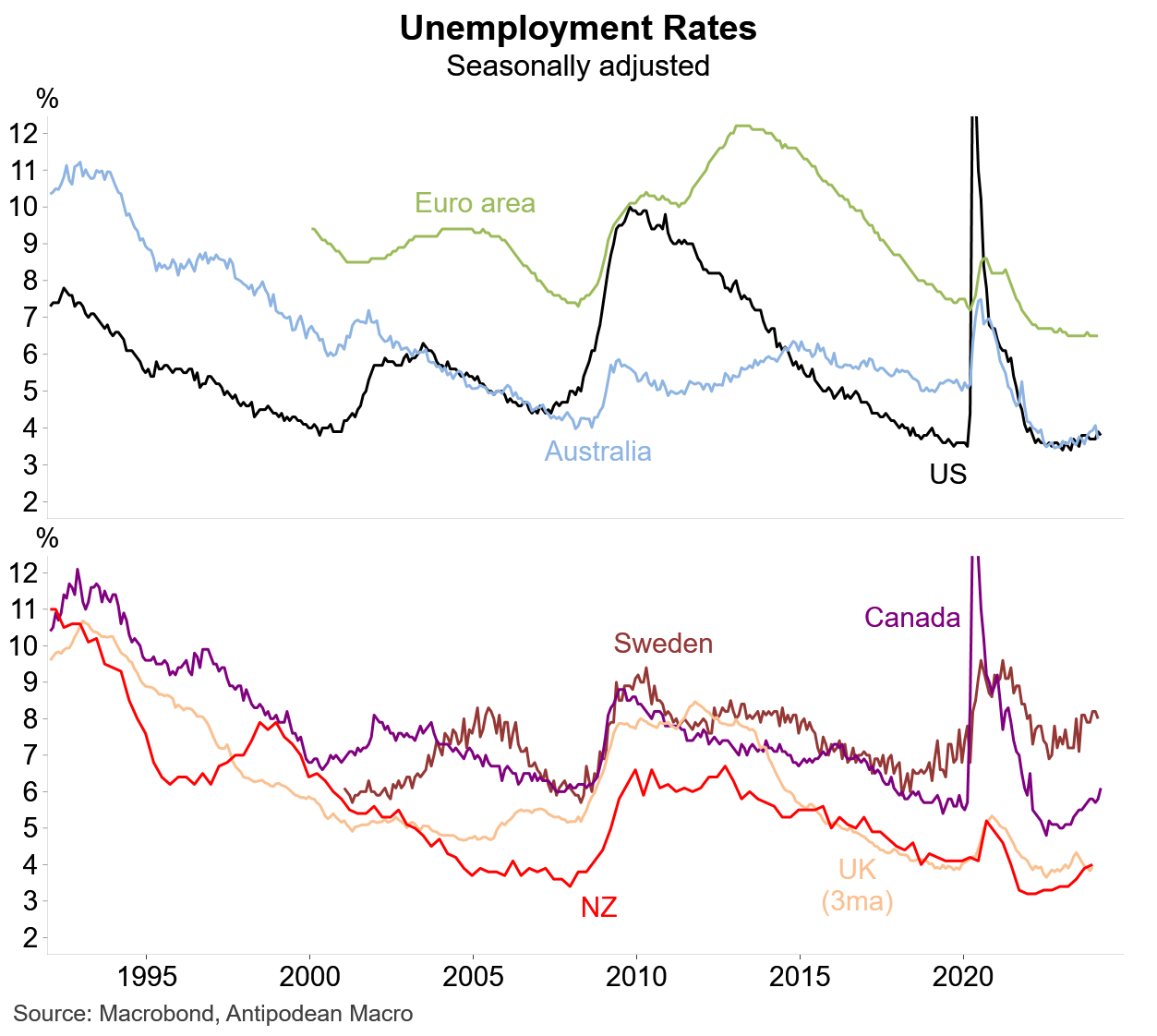

6. While most eyes were on the US employment reports late last week, developments in Canada - which has several similar traits to the Antipodean economies - were arguably just as important.

The share of the working age population in a job continued to decline, and the unemployment rate rose further to 6.1% (from a low of 4.8%).

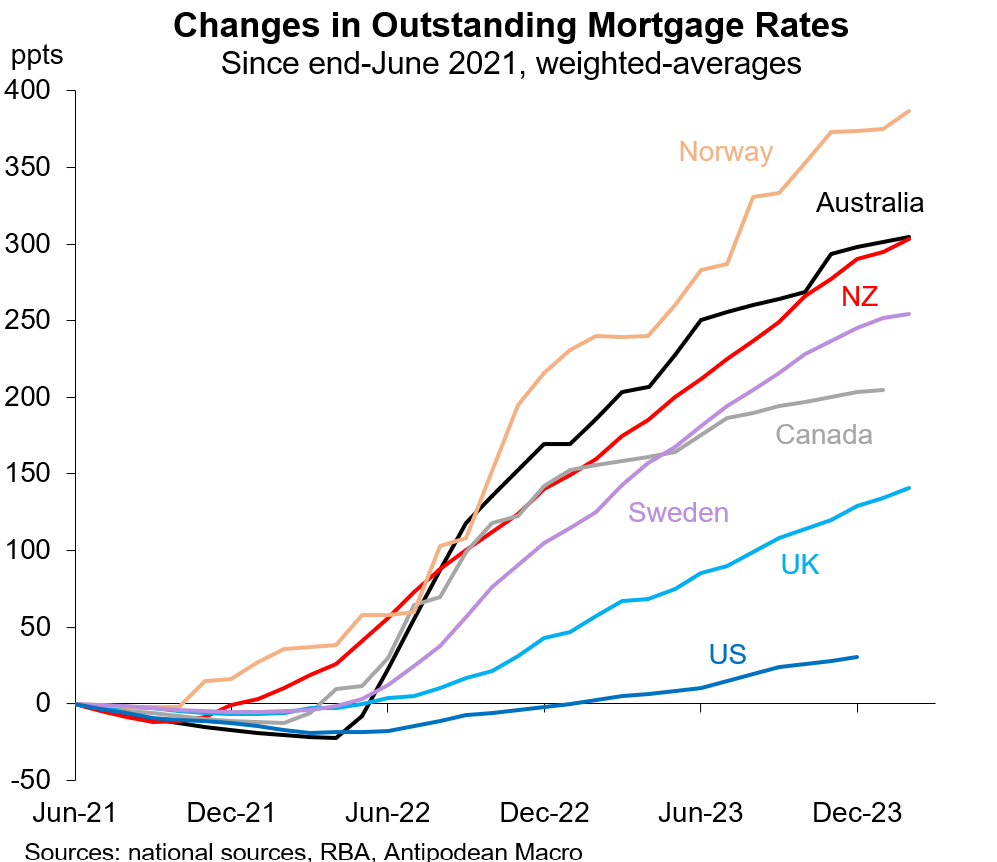

7. Interestingly, the drag on household disposable income in Canada from higher mortgage costs has been much lower than in the Antipodes.

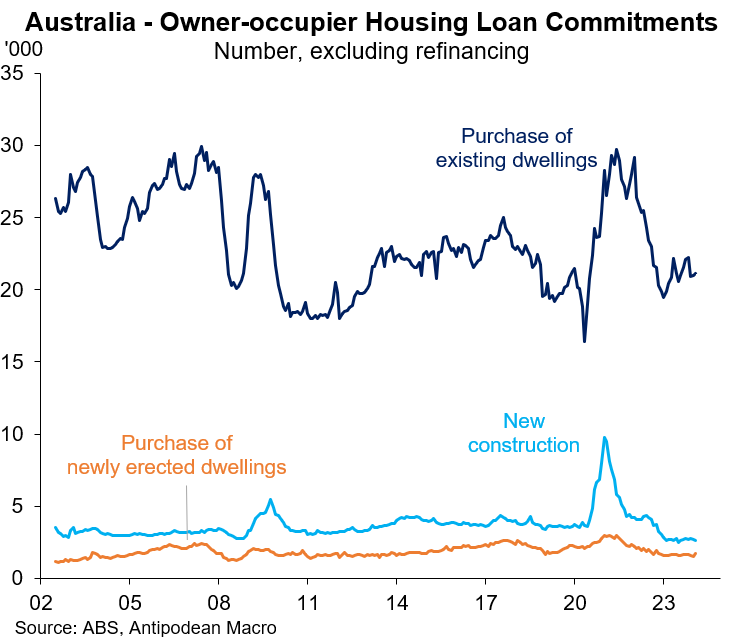

8. Borrowing by owner-occupiers in Australia remained fairly weak in February

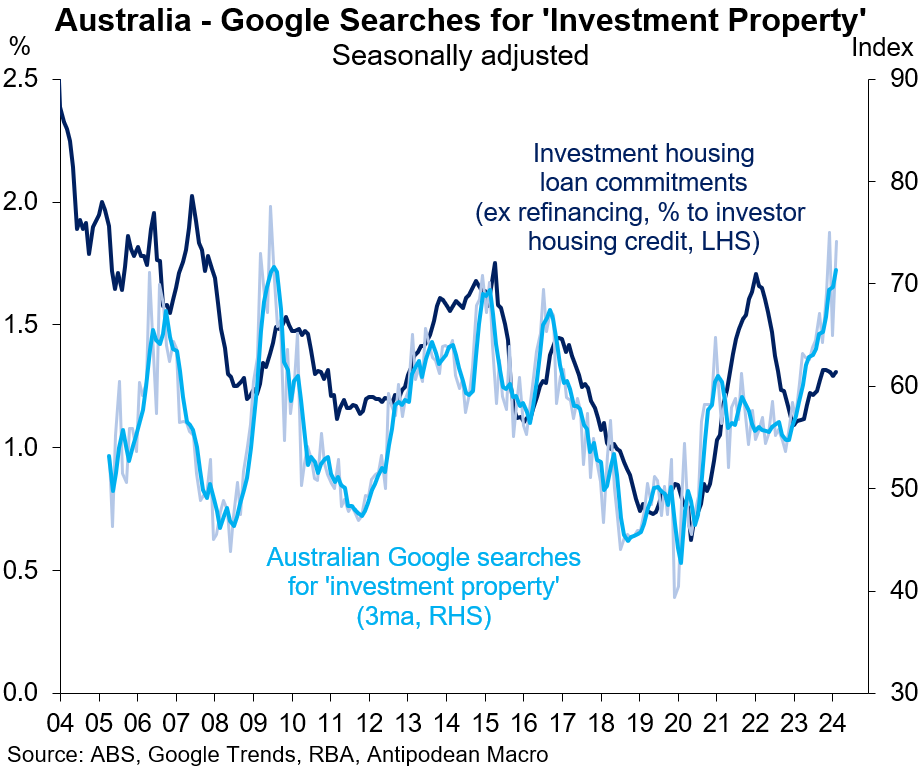

9. New borrowing by housing investors has picked up (even though investor housing credit growth has been weak).

10. Hardly anybody is going fixed in Australia…

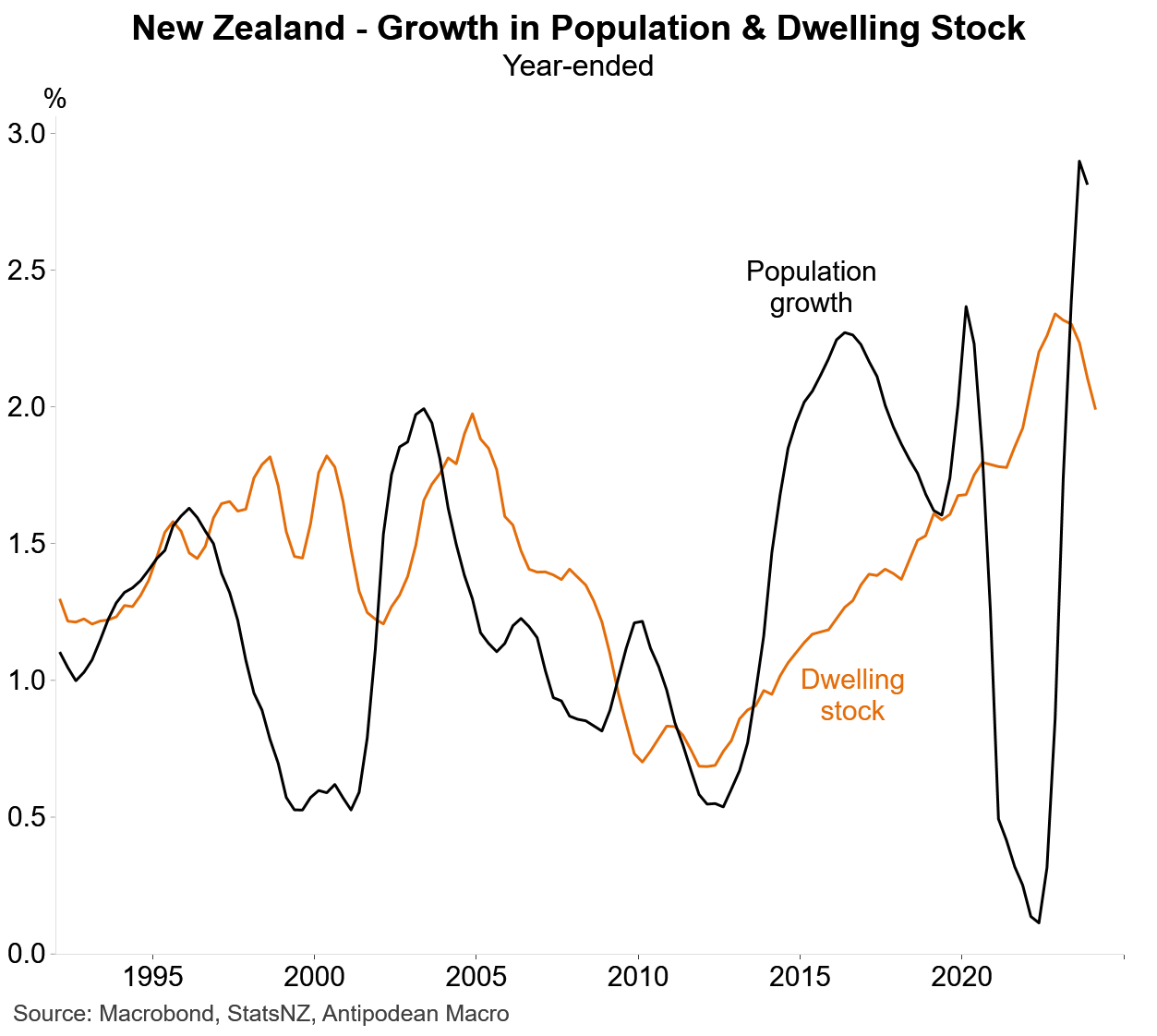

11. Growth in the number of dwellings in New Zealand is slowing but remained quite fast at ~2% y/y in Q1 (compared with ~1.5% in Australia).

Discussion about this post

No posts