Pretty quiet on the Antipodean front so we mainly look abroad.

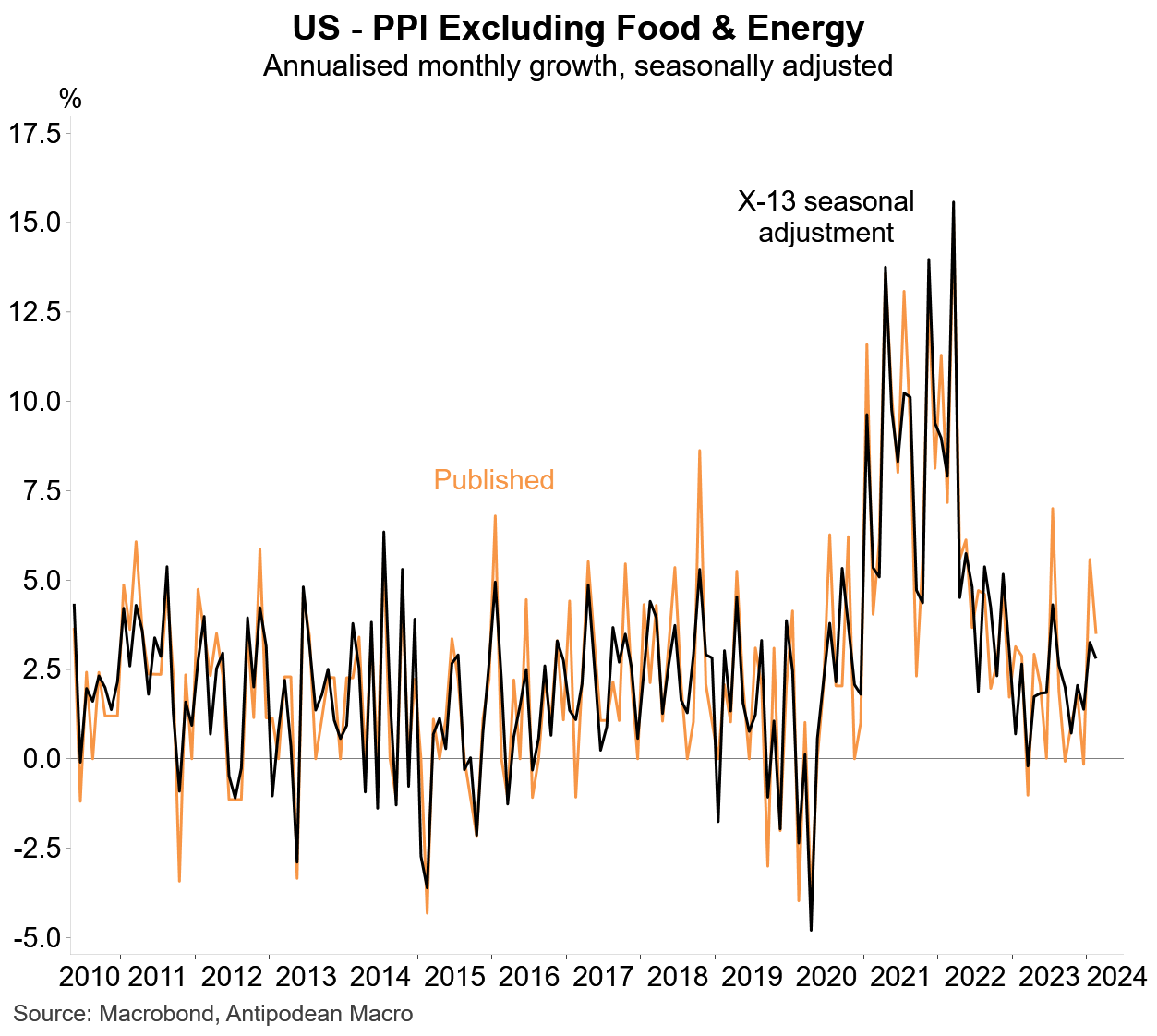

1. US PPI inflation in February was stronger than consensus expected BUT we highlight the pronounced volatility in published seasonally adjusted monthly PPI inflation. Running the Census Bureau’s X-13 seasonal adjustment through the data results in a (much) less volatile series over time.

The upshot is that published inflation figures for late 2023 may have been artificially low, while figures for early 2024 could be artificially high.

2. Similar results are calculated for the personal consumption services component of the US PPI. In this case, however, our estimates put recent annualised monthly growth at ~4%

3. Proposed annualised average wages growth in enterprise bargaining agreements (EBAs) lodged with Australia’s Fair Work Commission remains around the 3.5-4% mark.

4. Sales of new houses in Australia remained at a low level in February.

5. Existing home prices in China continued to decline in February at a reasonably rapid pace…

6. …and are now down ~10% since the peak in 2021.

7. Latest figures on containerised shipping costs show they remain elevated despite further moderation.

Discussion about this post

No posts