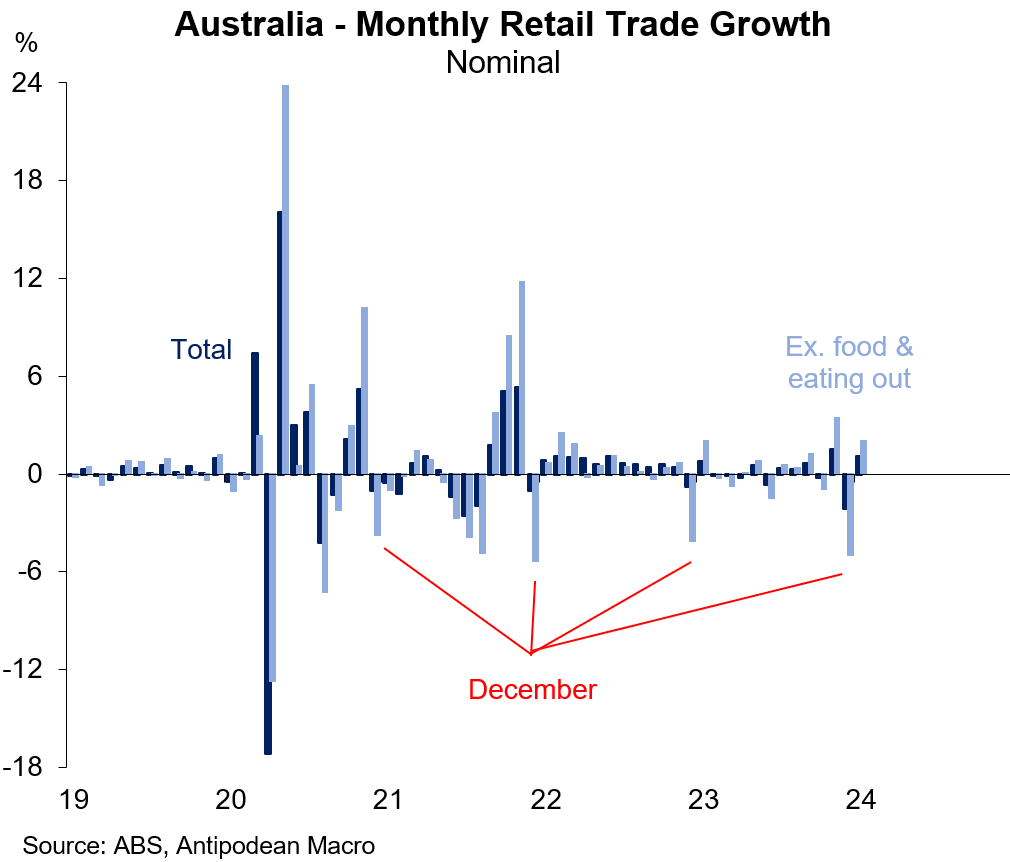

1. Australian nominal retail sales rose by a disappointing 1.1% m/m in January after declining 2.1% m/m in December.

2. Aussie retail sales in January were below the level in November and only just above the September level. Remember, these are nominal data.

3. Aussie’s spending on clothing and goods in January has tracked broadly sideways for many months.

Eating out & takeaway sales in Australia rose in January at the expense of softer at-home food & beverage sales, though the former remained below the recent peak

4. Housing credit growth in Australia remained at +0.4% m/m in January. The investor component has softened in recent months.

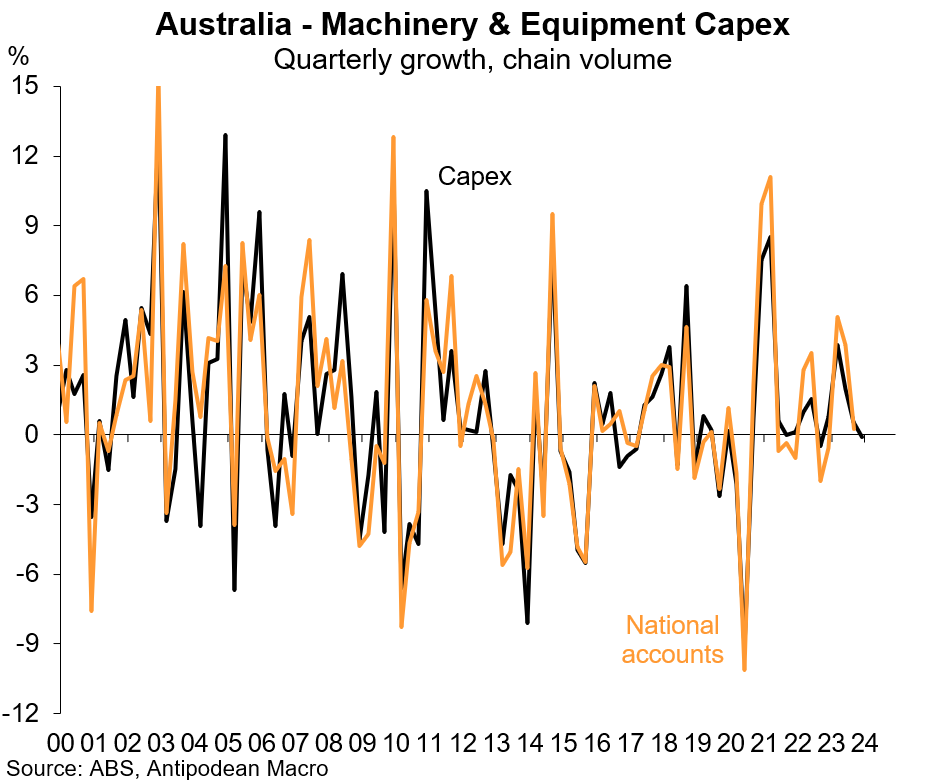

5. Real private capex rose +0.8% q/q in Q4 in Australia, led higher by spending on buildings and structures. Equipment spending declined modestly.

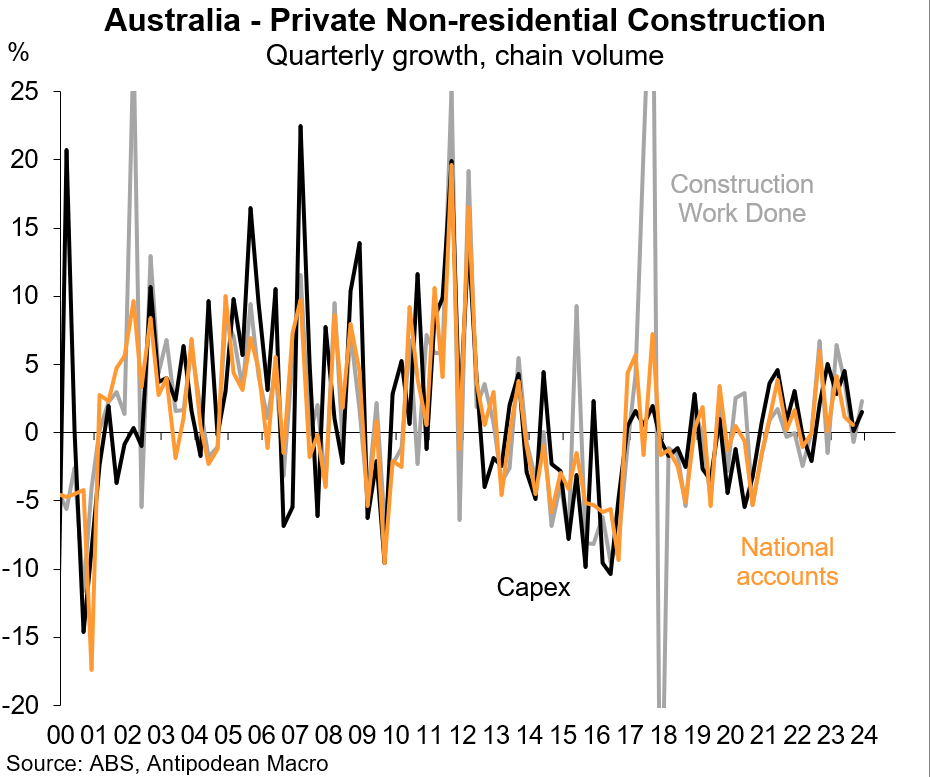

6. Aussie firms’ real spending on non-residential construction in Q4 2023 appears to have risen solidly based on both the CAPEX and Construction Work Done surveys

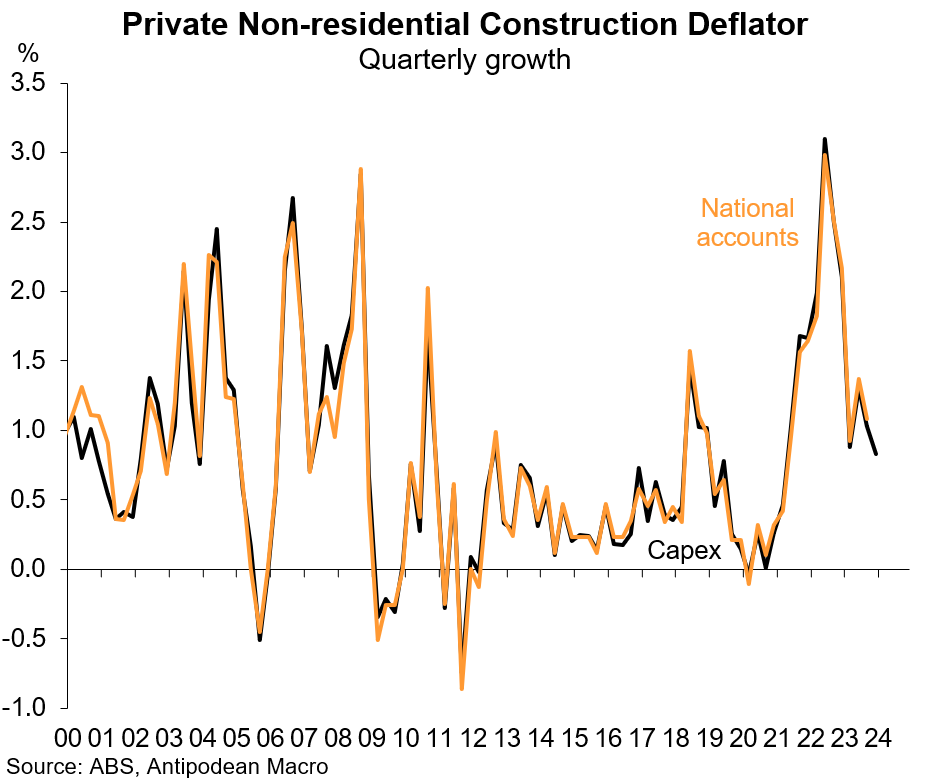

7. Inflation in private non-residential construction in Australia moderated further in Q4 2023

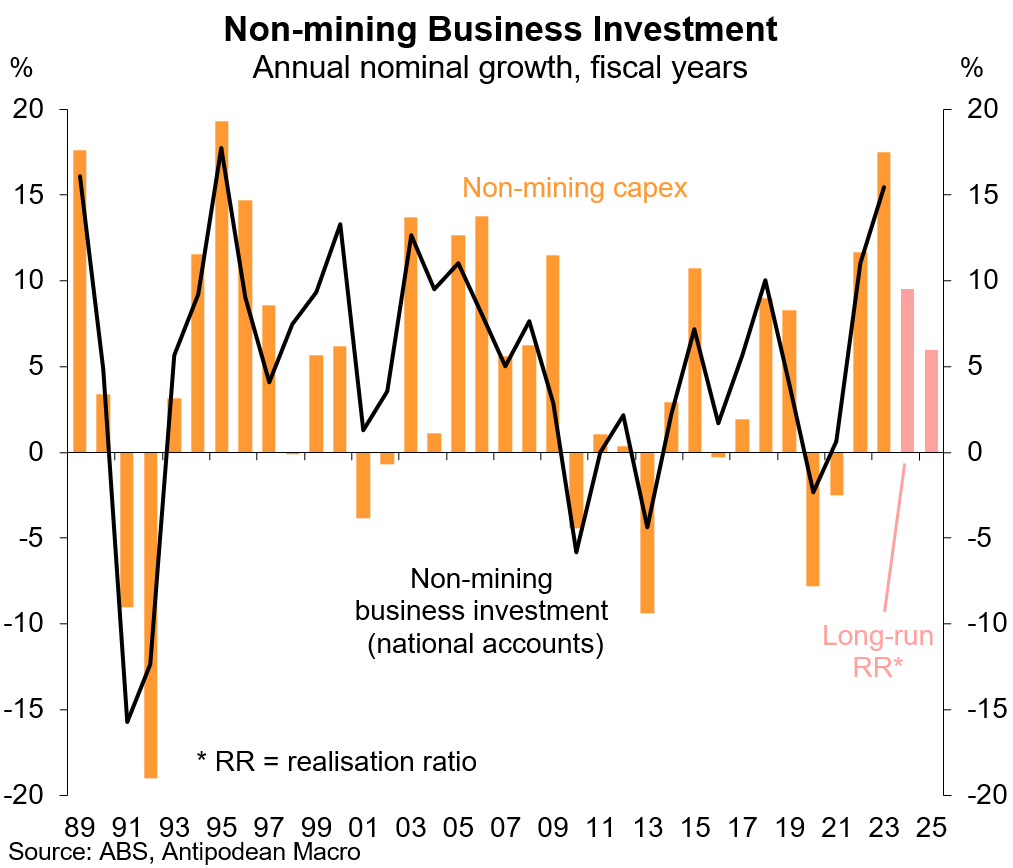

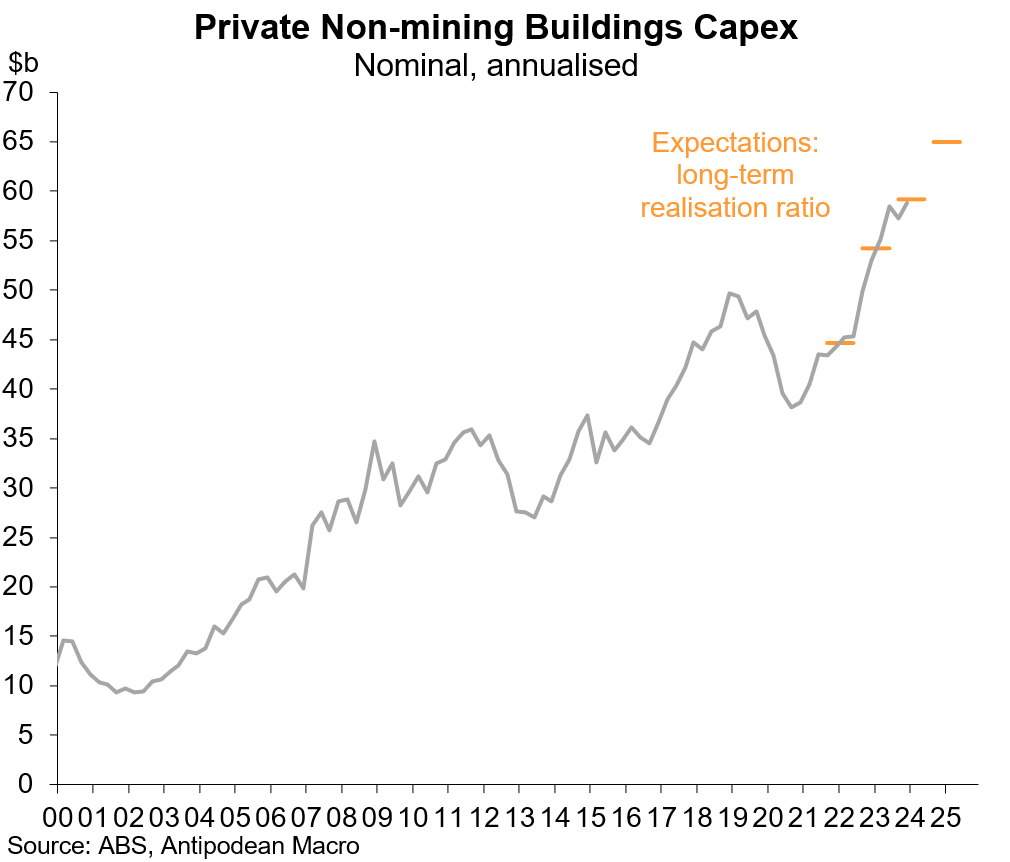

8. Non-mining firms in Australia expect fairly solid growth in nominal capex for the remainder of 2023-24 and into 2024-25.

Most of that anticipated growth is in buildings & structures capex as opposed to equipment capex.

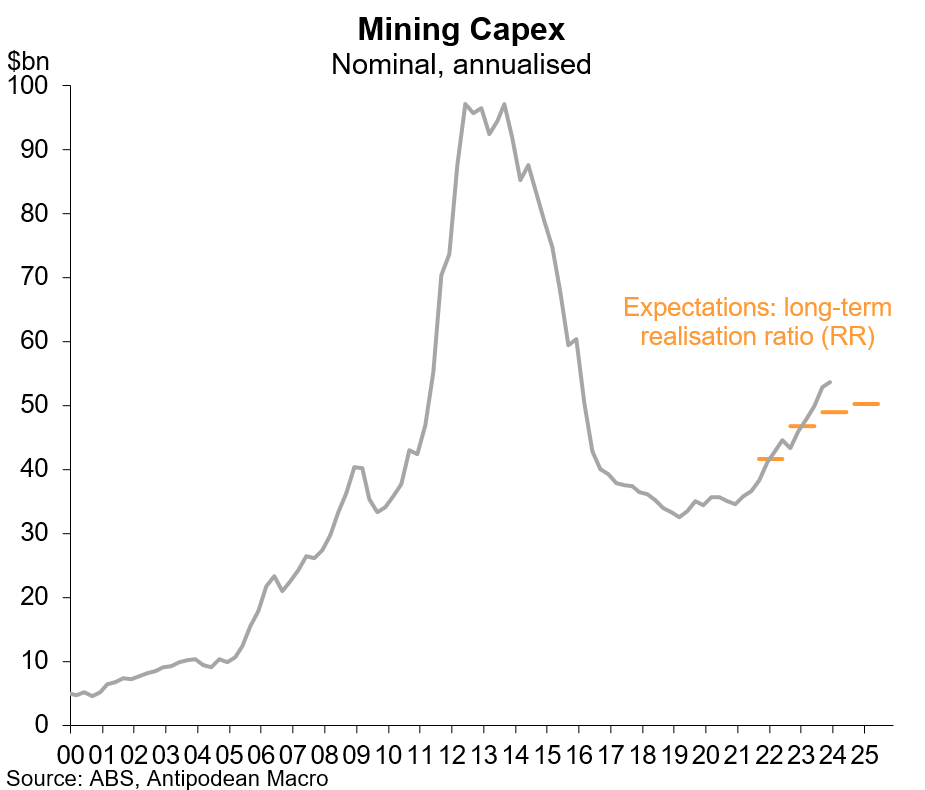

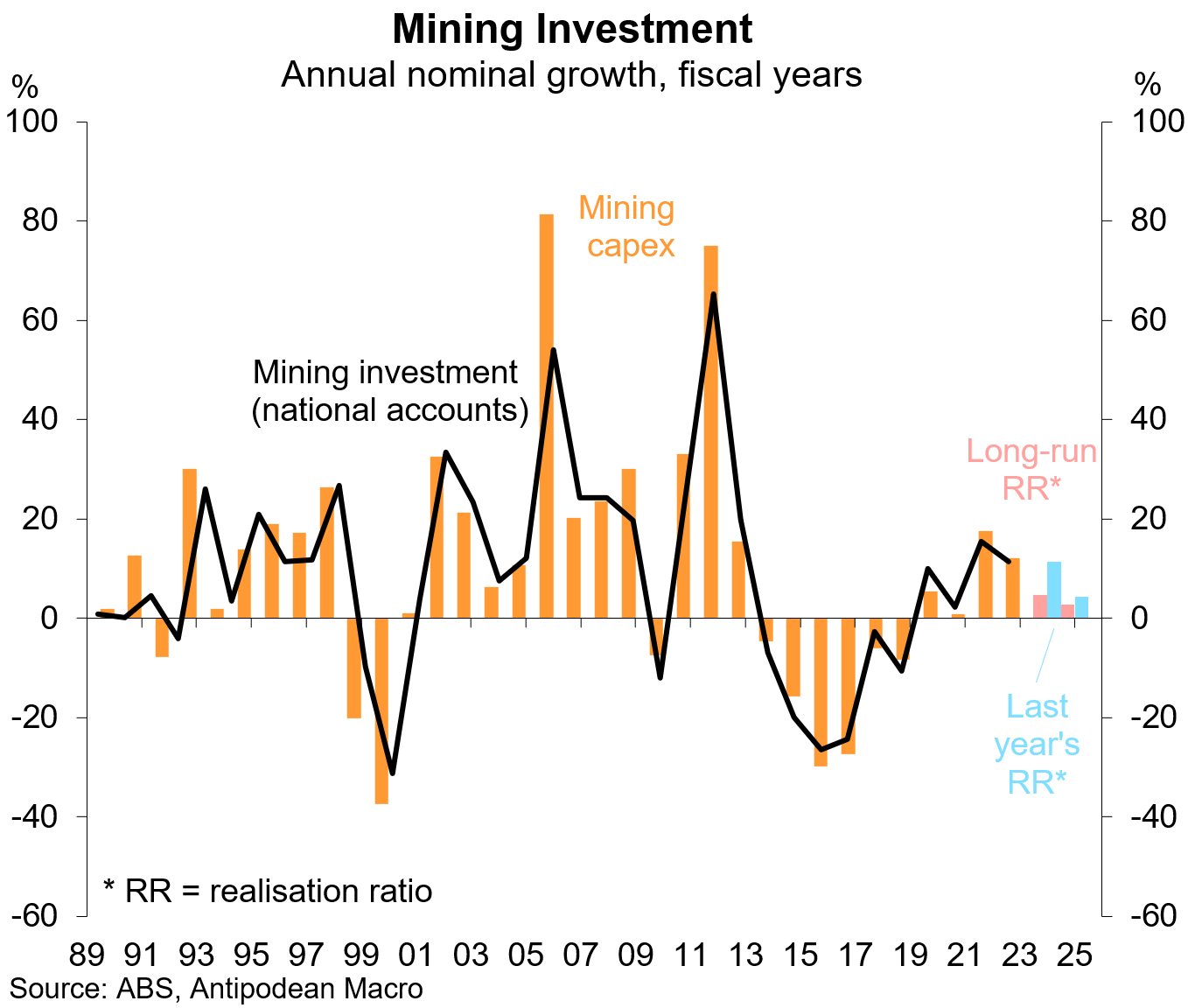

10. Gauging likely growth in Australian mining firms capex in the current financial year is tricky. Why? Because actual quarterly mining capex is already well above that implied by the whole year estimate.

But that estimate is based on the long-run average realisation ratio which is likely to be an inappropriate adjustment.

Adjusting mining firms’ capex expectations using the most recent (and higher) realisation ratio results in what we suspect are more plausible - and faster - estimates of capex growth for 2023-24 (blue bars in chart).

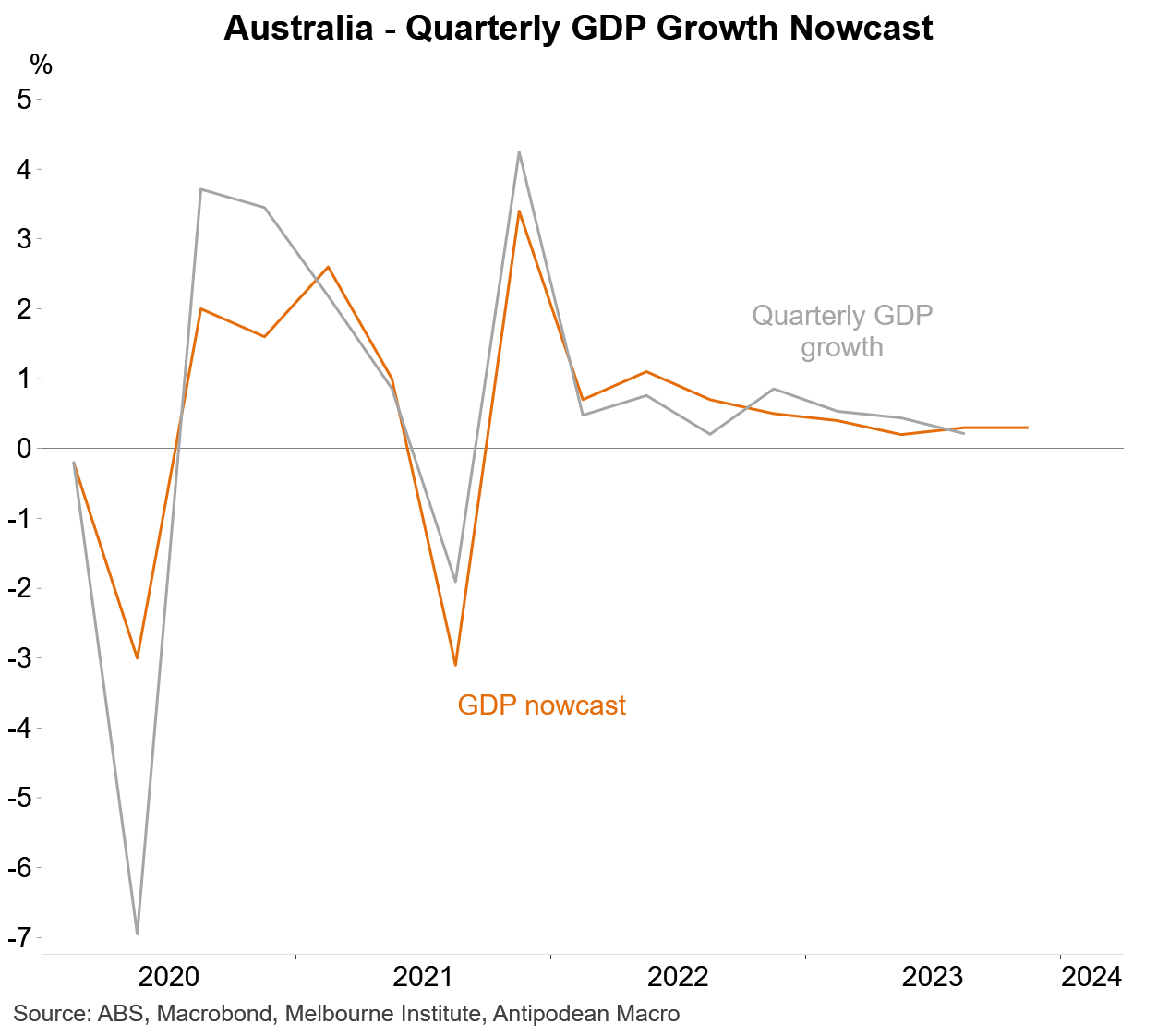

11. The Melbourne Institute’s latest nowcast of Q4 GDP growth remained at +0.3% q/q

12. ANZ’s survey of kiwi businesses revealed a further improvement in firms’ activity outlook in February. This survey has lost some predictive power in recent years but the magnitude of the rise is difficult to ignore

Discussion about this post

No posts