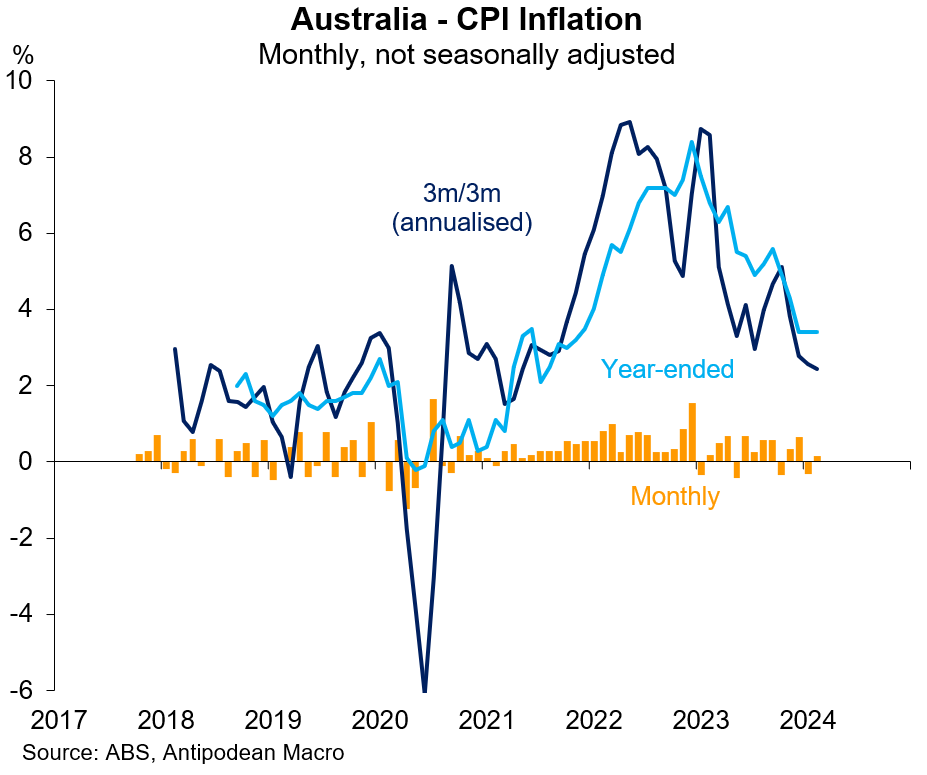

1. Australia’s monthly CPI rose 0.2% m/m and 3.4% y/y in February - bang in line with our forecast (see our preview) and a touch below consensus (+3.5% y/y).

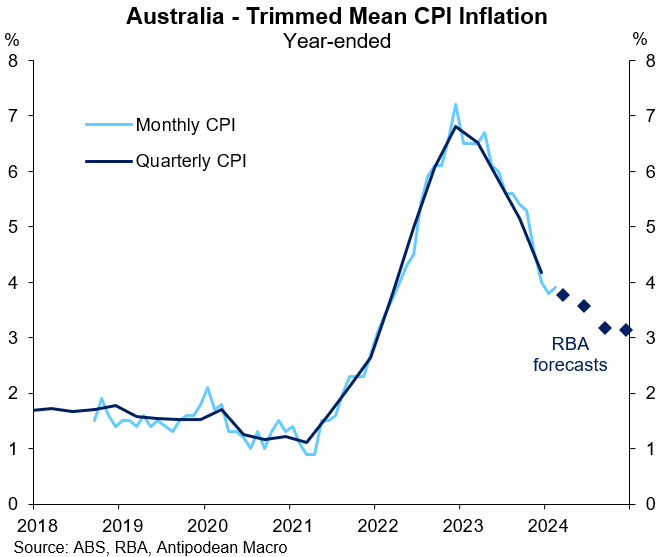

2. Year-ended trimmed mean inflation in Australia rose a little to 3.9% y/y but remained broadly on track to meet the RBA’s forecast.

3. Monthly ‘core’ CPI inflation - excluding fuel, fruit & veg and holiday travel - in Australia was +0.5% m/m and 3.9% y/y, and in line with our forecast.

While these data are seasonally adjusted, the past two Februarys also showed relatively strong outcomes, hinting at residual seasonality in the data.

4. The seasonal weakness in holiday travel & accommodation prices in Australia in February (-9.5% m/m) was as we expected.

5. Central banks are most focused on services inflation. Several services prices in Australia’s monthly CPI were updated in February. It was a mixed bag. For example, there were strong price rises for hairdressing & personal grooming (+2.1% q/q), other recreational sports & cultural services (+3% q/q), and insurance (+3.7% q/q). In contrast, meals out & takeaway prices rose just +0.5% q/q.

Pulling it all together, we estimate that domestic market services inflation was +0.9% q/q in the March quarter, and +1% q/q on a seasonally adjusted basis. That would be an improvement on the average of recent prior quarters. A wrinkle, however, is that the previous two March quarters appear to have been more seasonally soft than historically (see chart).

6. Non-tradables inflation in Australia might be a bit sticky but it is well below the peak.

7. As expected, rents inflation in Australia remained strong in February.

8. At-home food inflation (ex fruit & veg) in Australia has moderated significantly.

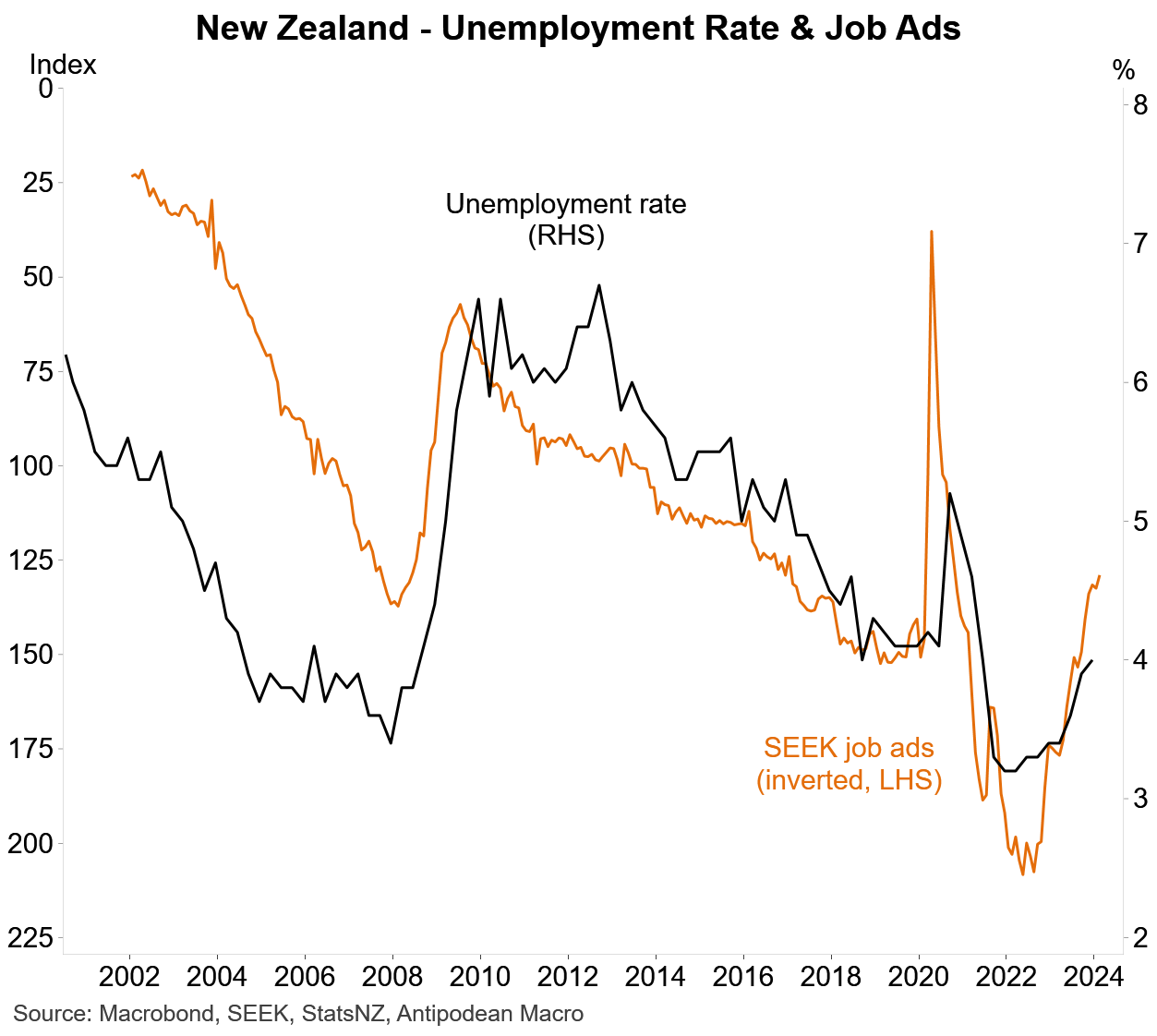

9. The number of jobs newly advertised on SEEK in New Zealand declined in February and applications per job ad continued to rise.

Discussion about this post

No posts