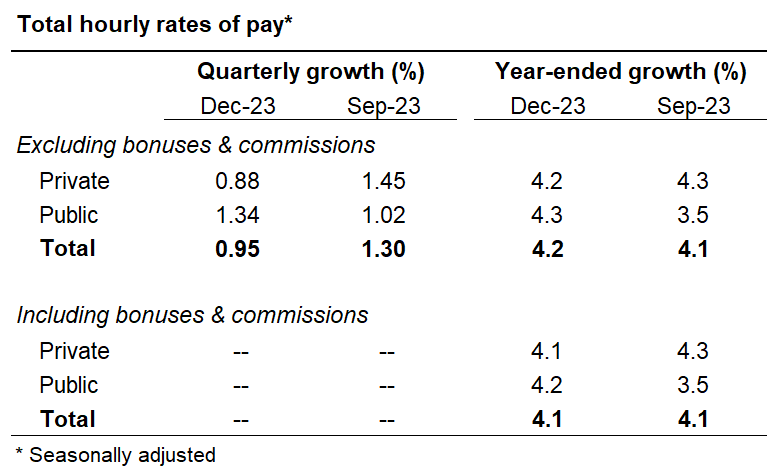

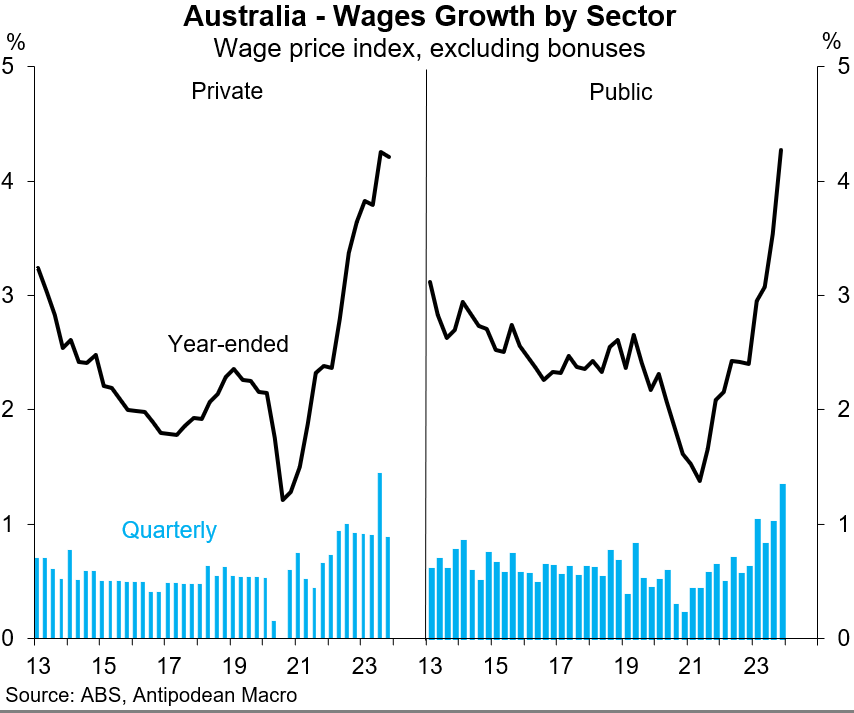

1. Australia’s wage price index - which measures hourly wage rates for a basket of jobs - rose 0.95% q/q and 4.2% y/y in Q4. This was a little above the RBA’s February SMP forecast and consensus

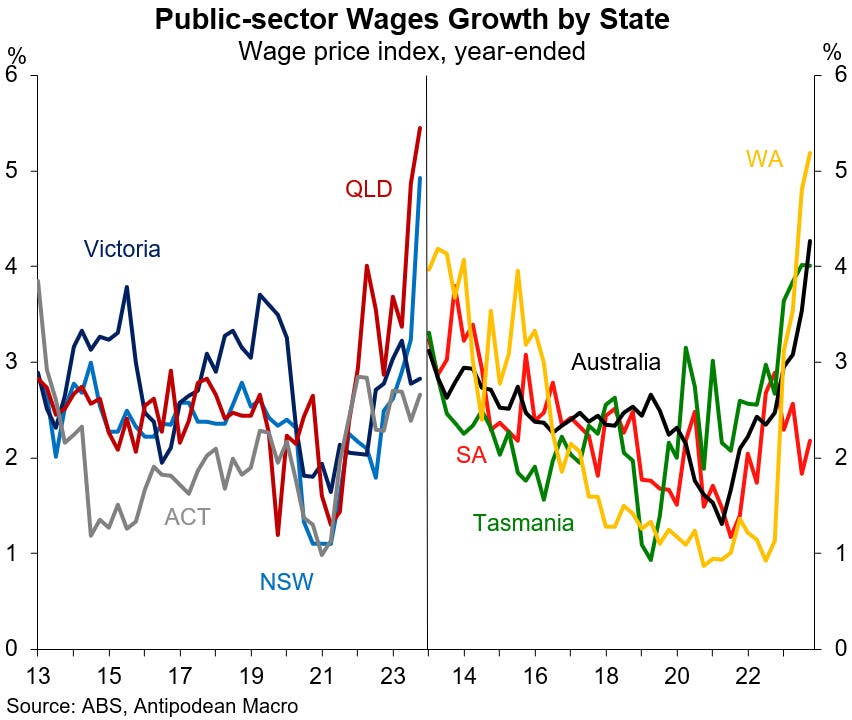

2. Private-sector wages growth was +0.9% q/q while public-sector wages growth of +1.3% q/q was boosted by pay outcomes for health workers and teachers. This included the NSW Government’s 8-12% pay increase for 95,000 teachers from 9 October…

3. …but public-sector wage rates also rose sharply in WA and Queensland over 2023

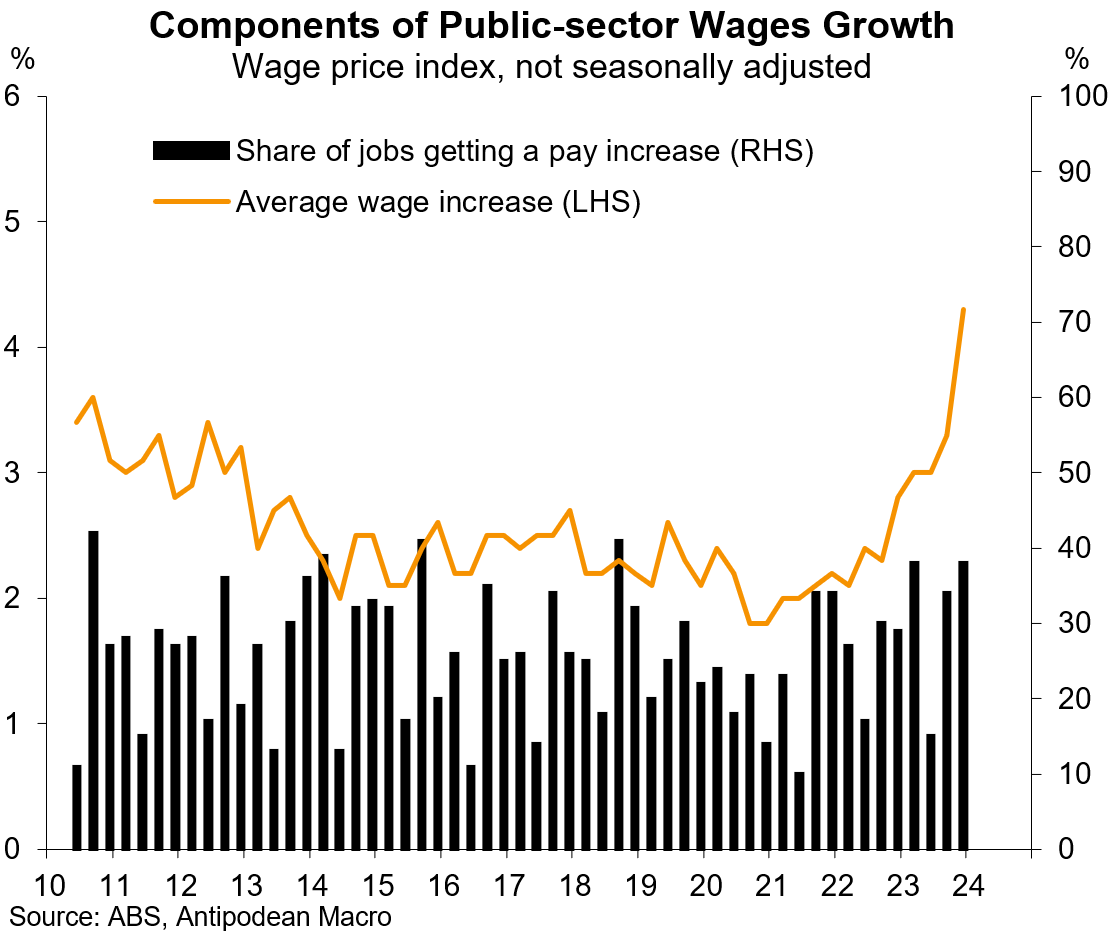

The share of public-sector jobs getting a pay increase in Q4 was the highest for a December quarter in at least 14 years

4. Jobs with pay set under enterprise agreements contributed the most to quarterly wages growth in Q4 2023. The ABS said this was driven by both the private- and public-sectors.

Additionally, “enterprise agreements linked to outcomes from state public-sector wage negotiations, the 2022-2023 Fair Wage Commission annual wage review rise, the Aged Care Work Value case decision or the CPI, contributed to higher hourly wage changes” than a year earlier.

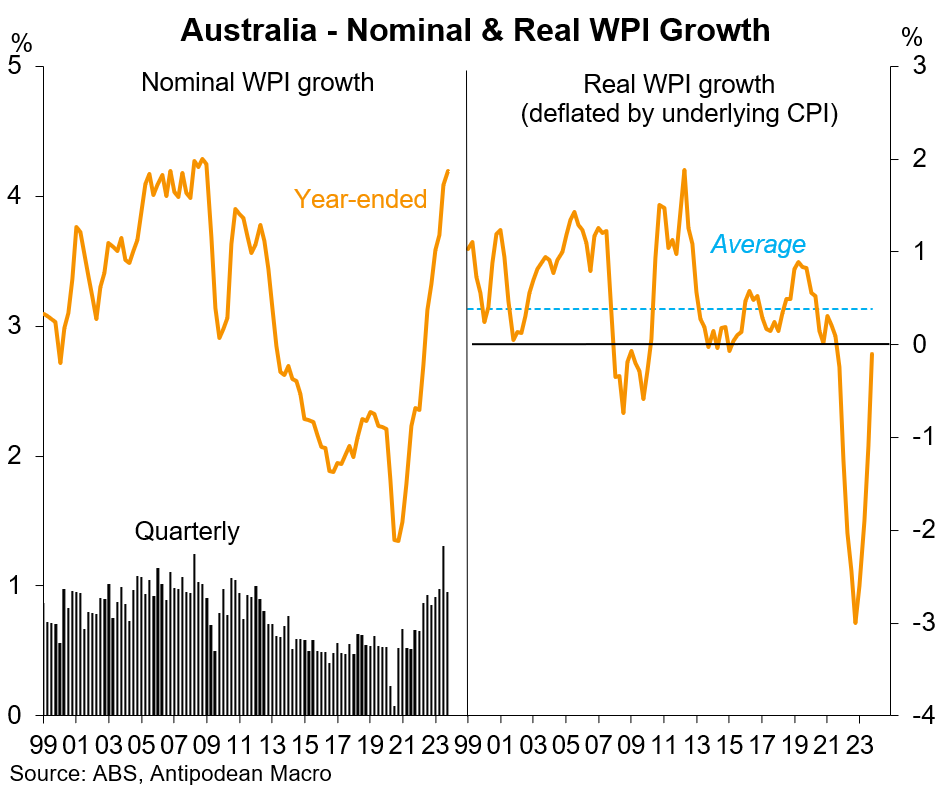

5. Growth in hourly wage rates in Australia over 2023 was close to underlying CPI inflation

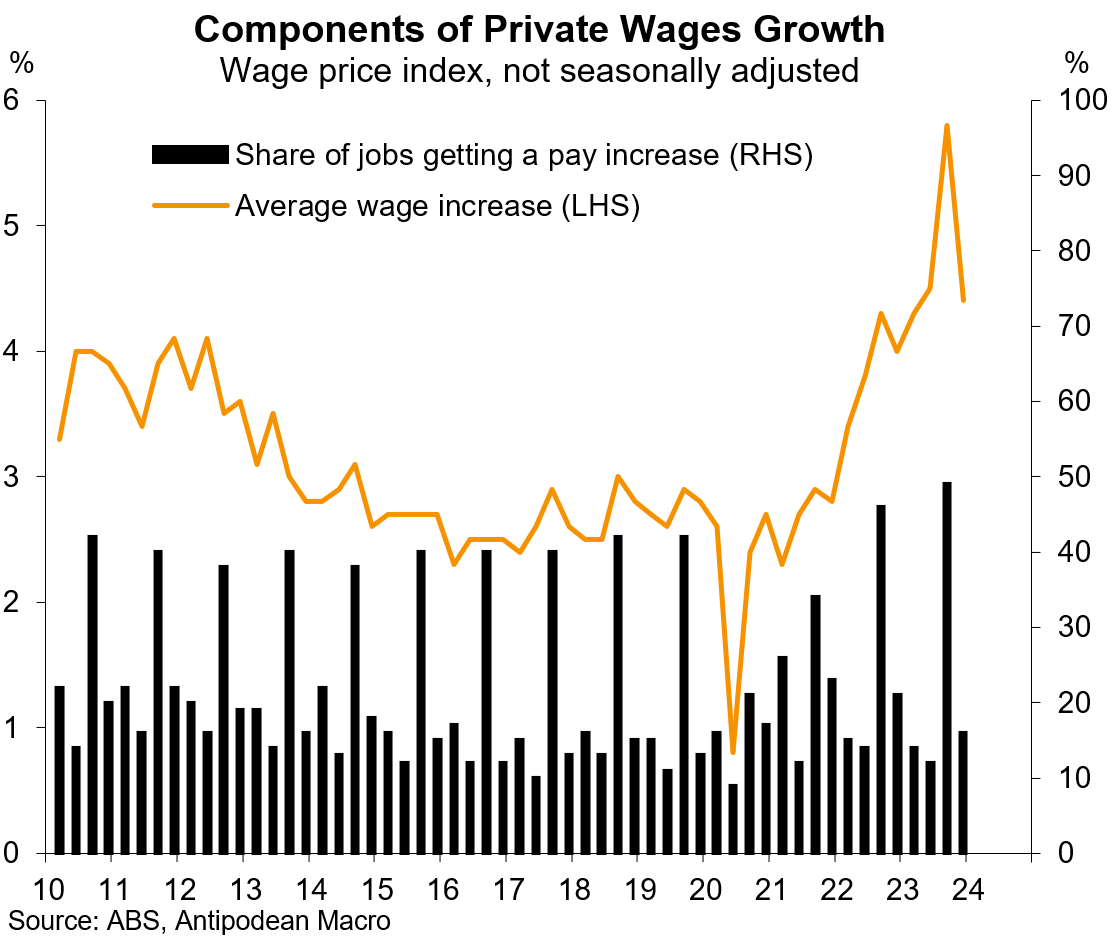

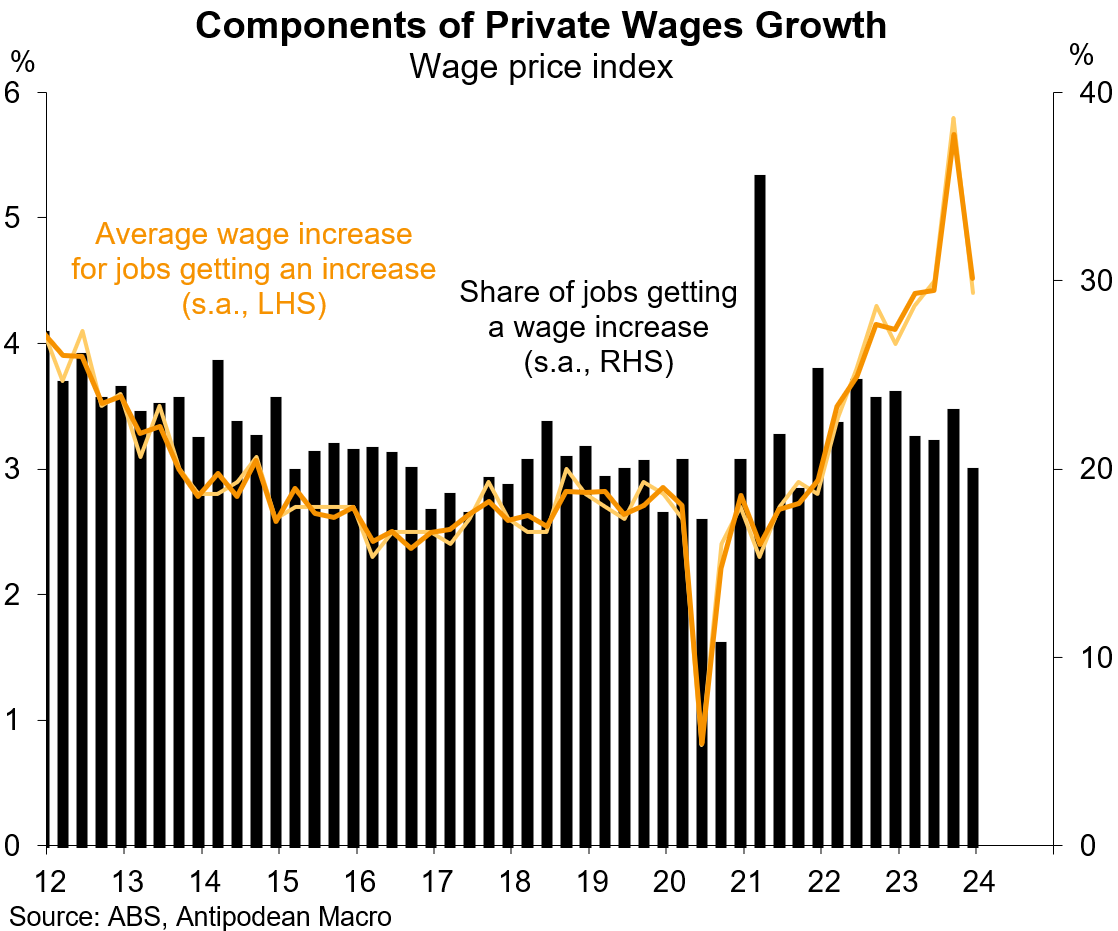

6. The easing in Australian labour market conditions, and lower inflation expectations, are starting to show up in slightly less robust private-sector wages growth

7. 16% of private-sector jobs in Australia received a pay increase in Q4 (of 4.4%), down from 21% a year earlier and the lowest share since Q4 2019

Seasonally adjusting those numbers reveals a decline in the share of private-sector jobs receiving a pay increase in Q4 after it jumped higher in Q3

8. By industry, the fastest wages growth over 2023 was in health care & social assistance and education & training

9. Canadian inflation in January was much lower than expected

10. On a 3m/3m annualised basis, the trimmed mean and weighted median measures of Canada’s core inflation sat at 3.2-3.3% in January

The latest trimmed mean inflation figures for Australia, Canada and the United States aren’t terribly different

Discussion about this post

No posts