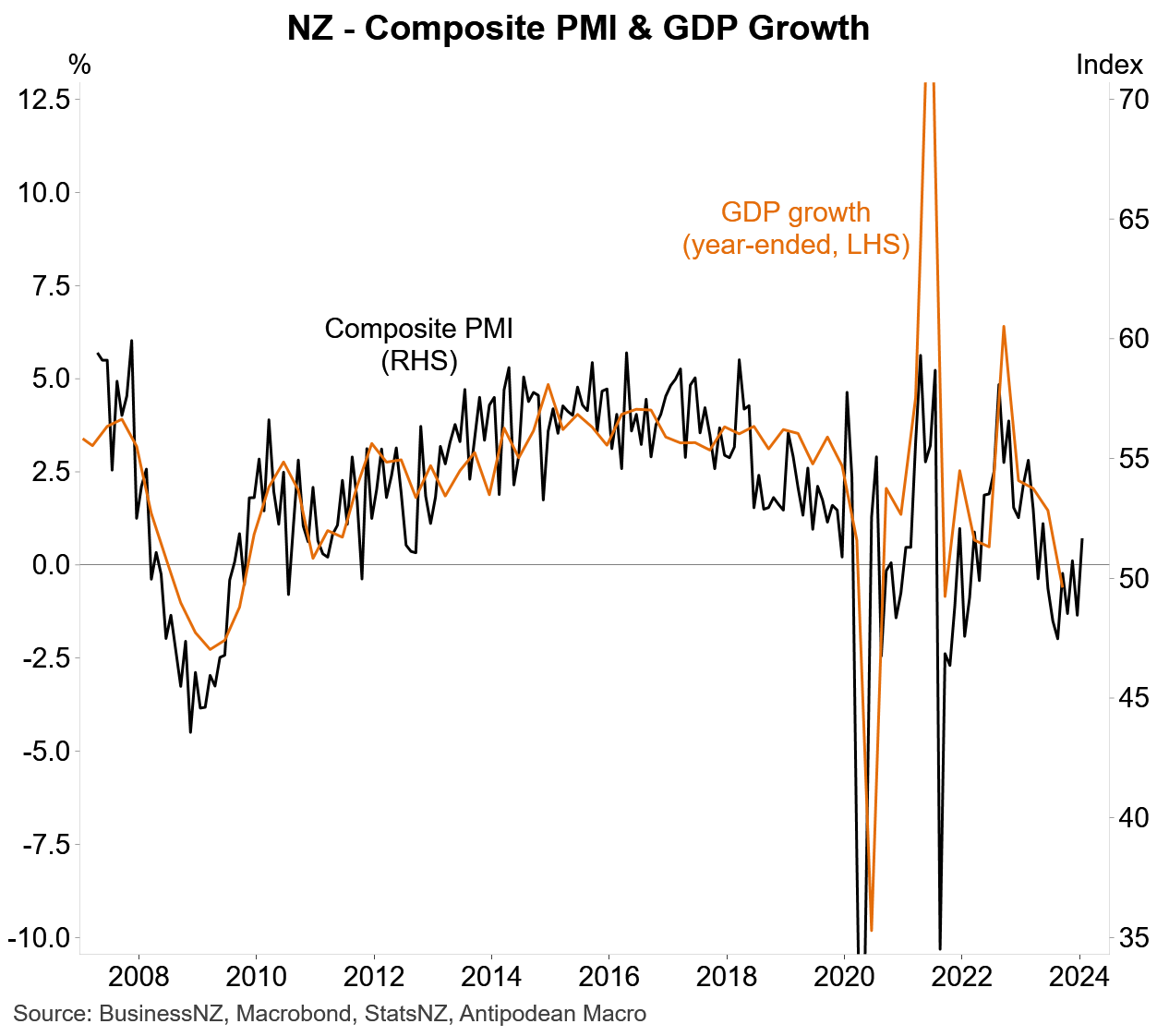

1. New Zealand’s composite PMI rose in January and has trended higher for several months.

2. Coupled with the QSBO survey showing a bounce higher in firms’ views towards their own trading conditions, the PMI may suggest that NZ economic activity is stabilising

3. Statisticians around the world are having difficulties appropriately seasonally adjusting data, including because of apparent changes in behaviour - particularly late in, and around the turn of, the year. Retail trade data (globally) and Australia’s labour force data are good examples.

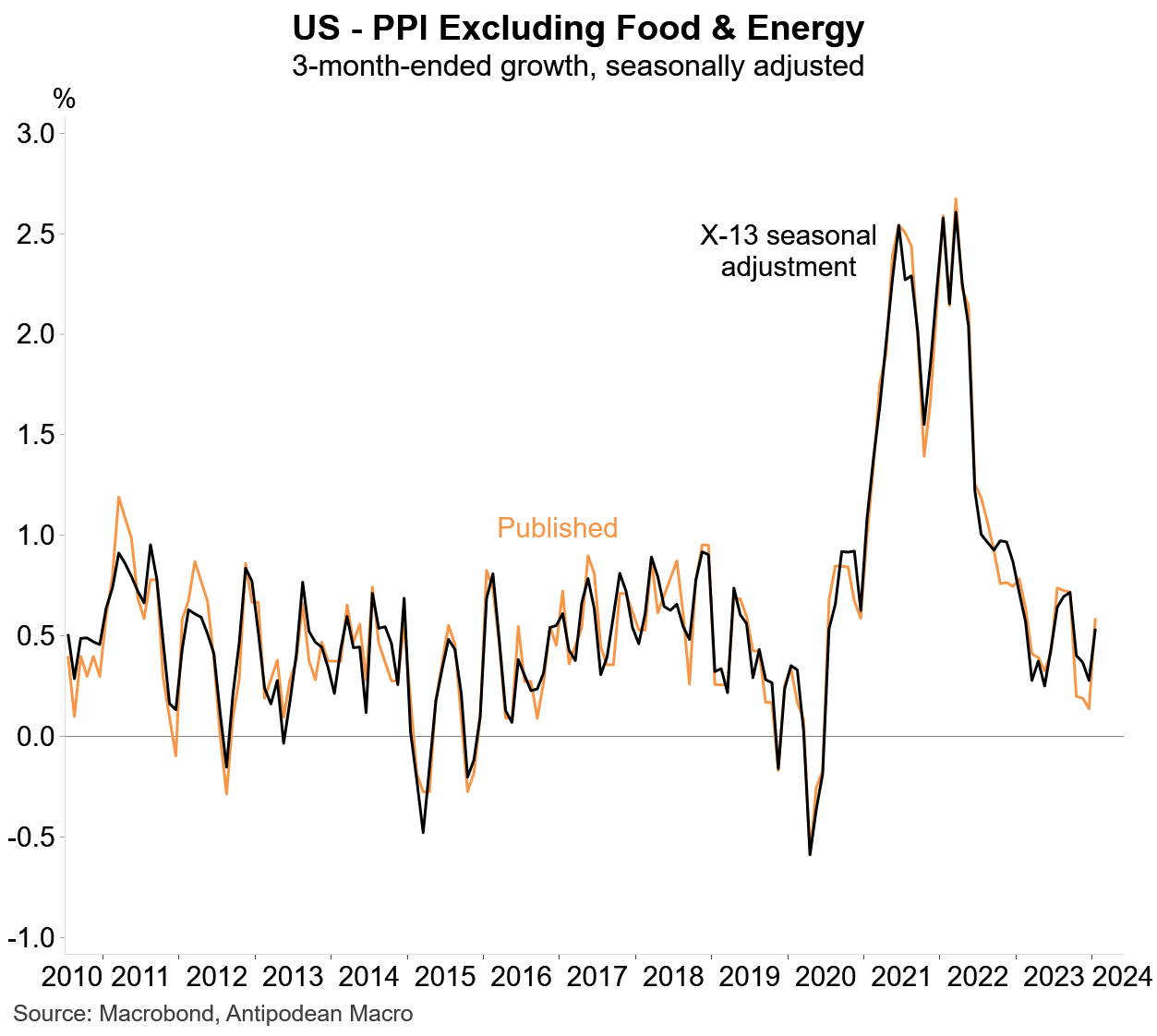

The latest example is the US PPI data. Simply running the US Census Bureau’s X-13 seasonal adjustment through the PPI ex food & energy data produces less volatile monthly growth than what is published.

Those data still showed a pick-up in January but by far less than what was published. Prior months also weren’t as weak as what was published.

Where’s the truth? Not sure. We’ll need a few more years of data.

But it’s a lesson for markets that another month of data can apparently change the story massively…or actually not very much at all.

4. Markets expect quite different policy rate paths over the rest of this year for the RBNZ, RBA, Fed and Bank of Canada

Discussion about this post

No posts