1. The number of Aussie companies entering external administration surged in March.

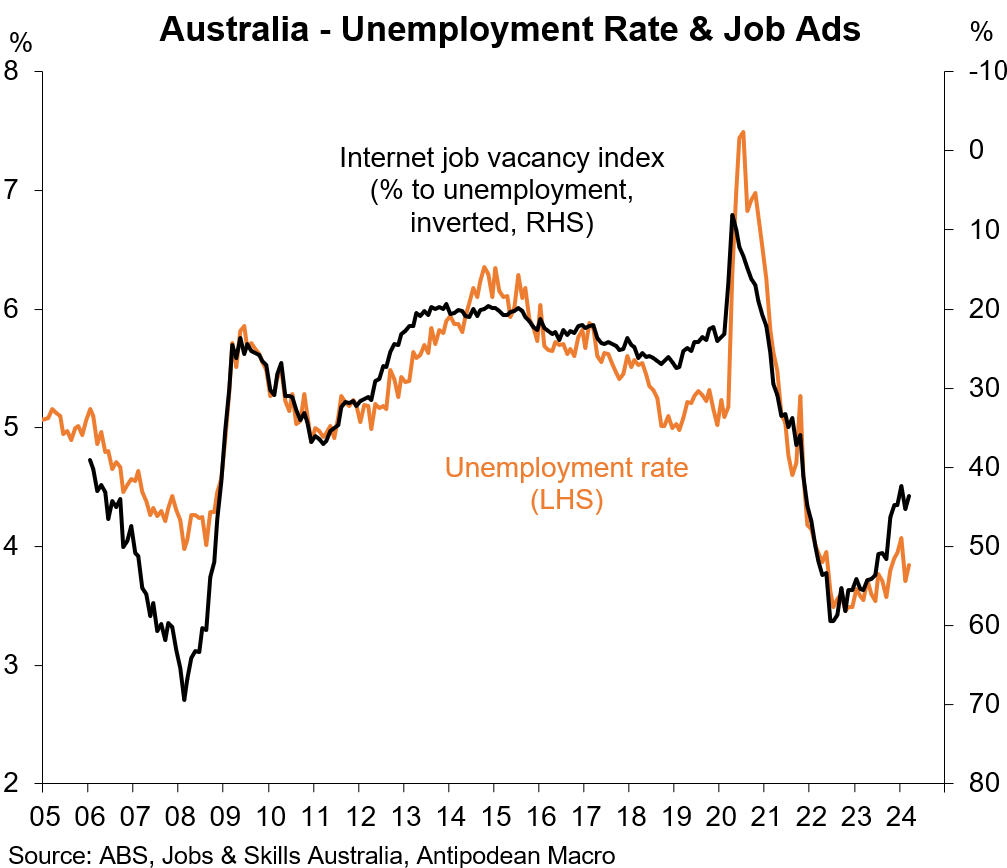

2. Australian labour market conditions are gradually easing. The unemployment rate rose 0.1ppts to 3.8% in March and the employment-to-population ratio dipped 0.2ppts to 64.0.

3. Looking through the monthly noise, employment grew +0.5% q/q in Q1 in Australia - solid, but slower than growth in the 15+ population.

4. Average hours worked in Australia dipped a little in Q1 as a whole. Total hours worked were little changed in Q1 (on a labour force basis).

5. Labour underutilisation - unemployment + underemployment - in the March quarter was only a little higher than in the prior quarter.

The increase in labour underutilisation rates has been most pronounced for 15-34 year olds in Australia.

6. Something we have highlighted for a while now is the resilience of labour market conditions in Australia for those aged 25 and over. The jobless rate for 25+ year olds was just 2.7% in March.

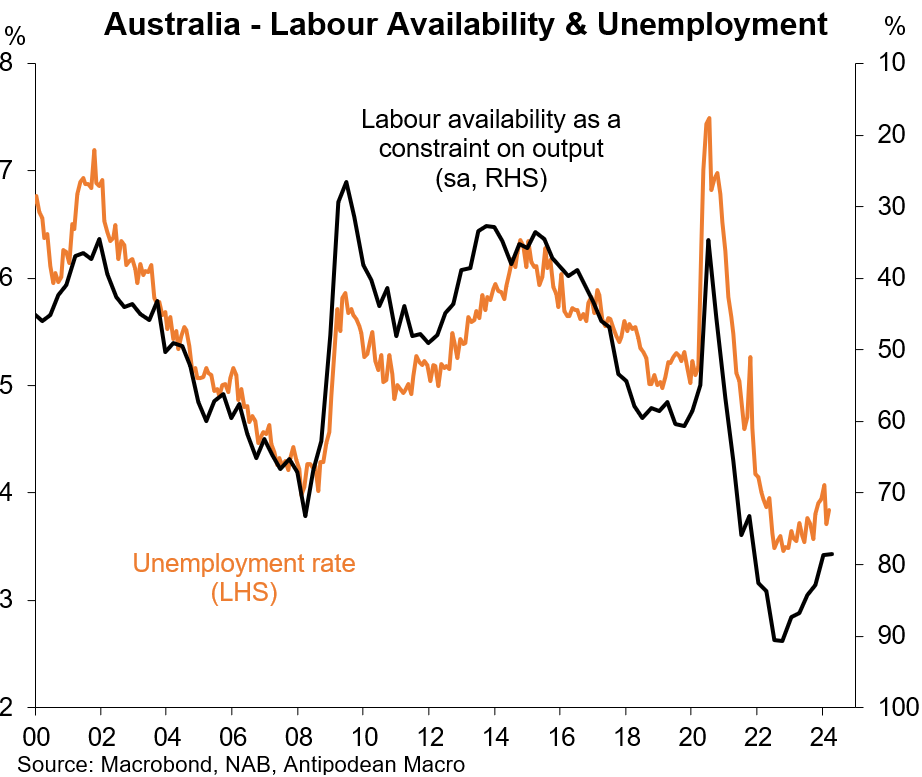

7. Australian firms reported little change in their perceptions of labour availability in Q1, though there was a small decline in the share of businesses saying the labour was a ‘significant’ constraint on output.

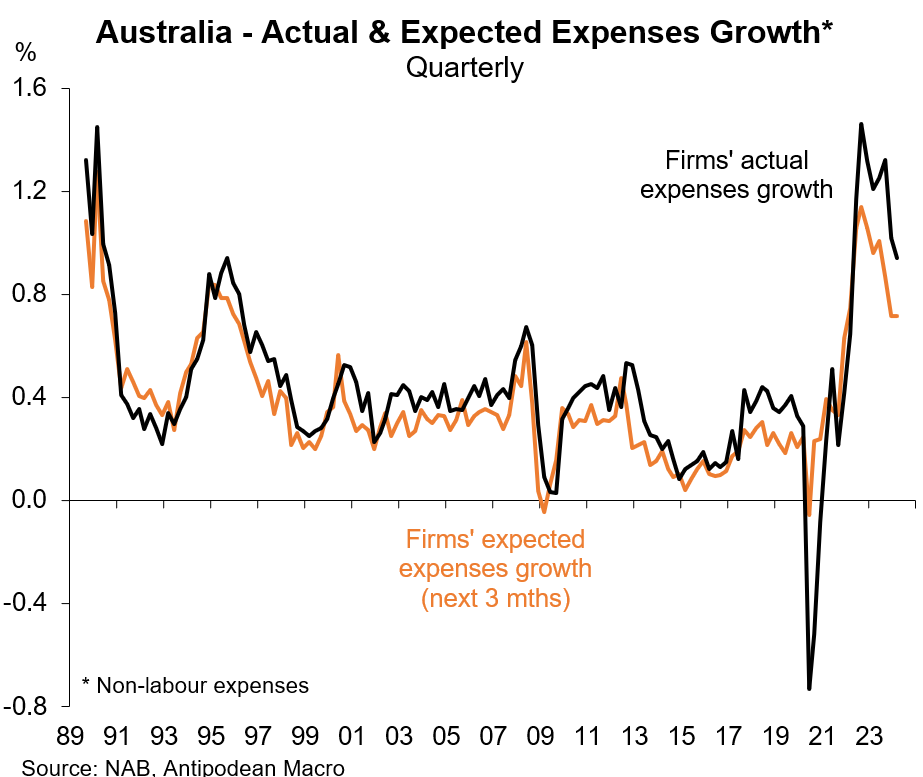

8. Aussie firms expect their output price inflation to moderate further in the June quarter but they are seeing some stickiness in expenses growth.

9. The number of passengers moving through Australia’s airports in January remained below pre-COVID levels, and well below the pre-COVID trend.

10. Weakness continued in China’s residential construction industry in March.

11. Existing home prices in China continued to fall at a solid clip in March.

Discussion about this post

No posts