ONLY CHARTS will be available to paid subscribers only from Monday. See here for details. You can upgrade now to paid in your Substack account or click on “Upgrade to paid” from Monday. Group discounts are available here.

A huge thank you to everyone that has already converted and provided awesome feedback - it is much appreciated.

1. The flash US composite PMI rose sharply in May and threw another cat amongst the pigeons.

2. Encouragingly, however, the US PMI output price index has remained relatively stable.

3. April goods trade data for New Zealand revealed another rise in import freight costs.

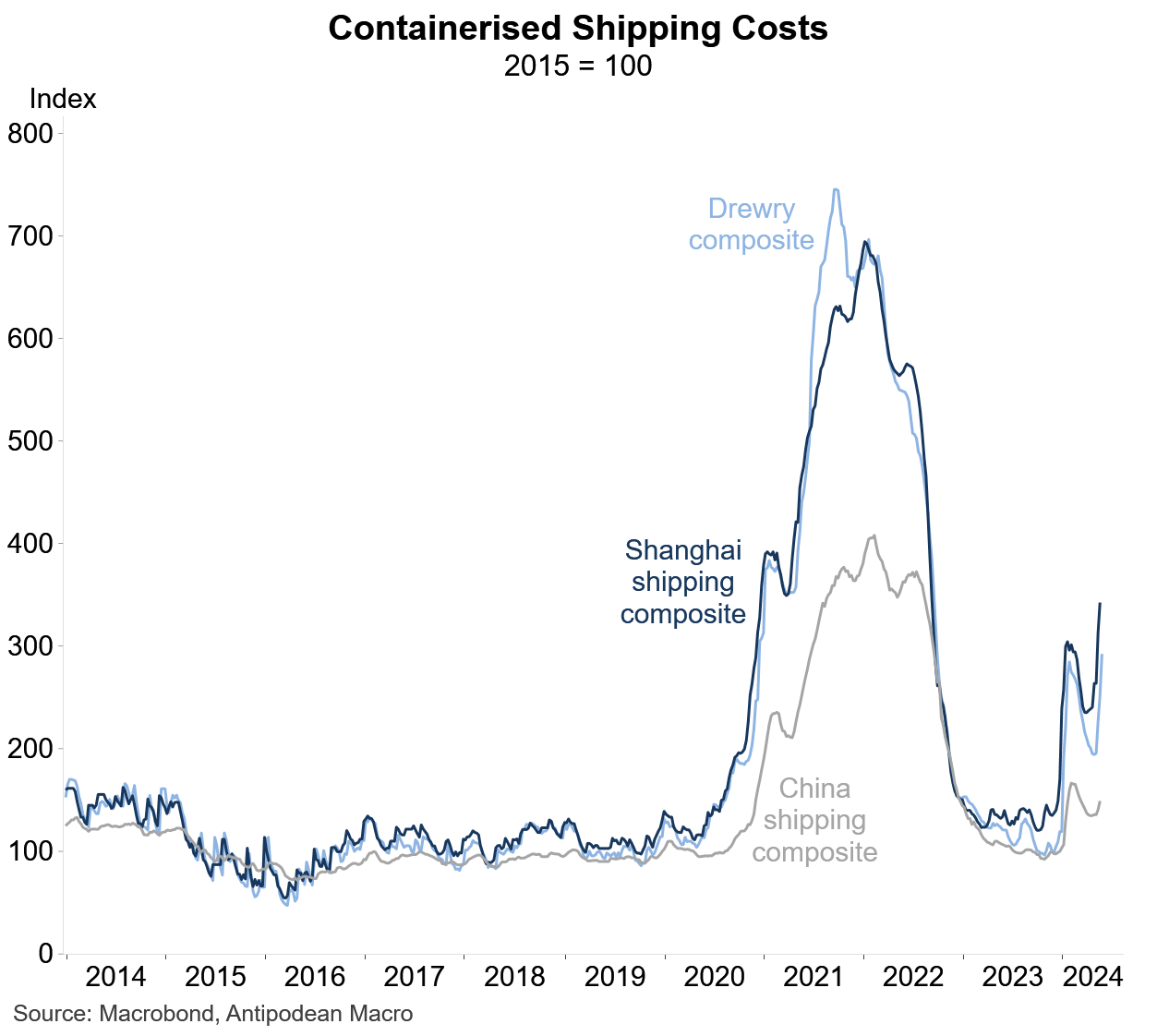

4. Spot global containerised shipping costs have been rising again.

5. Another example of US, and the rest.

6. The value of new housing loan commitments in New Zealand continued to pick up in April. Investor activity has picked up.

7. The number of new housing loan commitments (excluding refinancing and top ups) in NZ also rose in April

8. But the average size of new kiwi housing loan commitments has also been drifting higher alongside modest growth in housing prices.

9. Think about it. The (nominal) price of steel in China is lower now than in 2005.

Discussion about this post

No posts