1. New Zealand’s composite PMI (the PCI) remained subdued in December and is consistent with weak growth in Q4

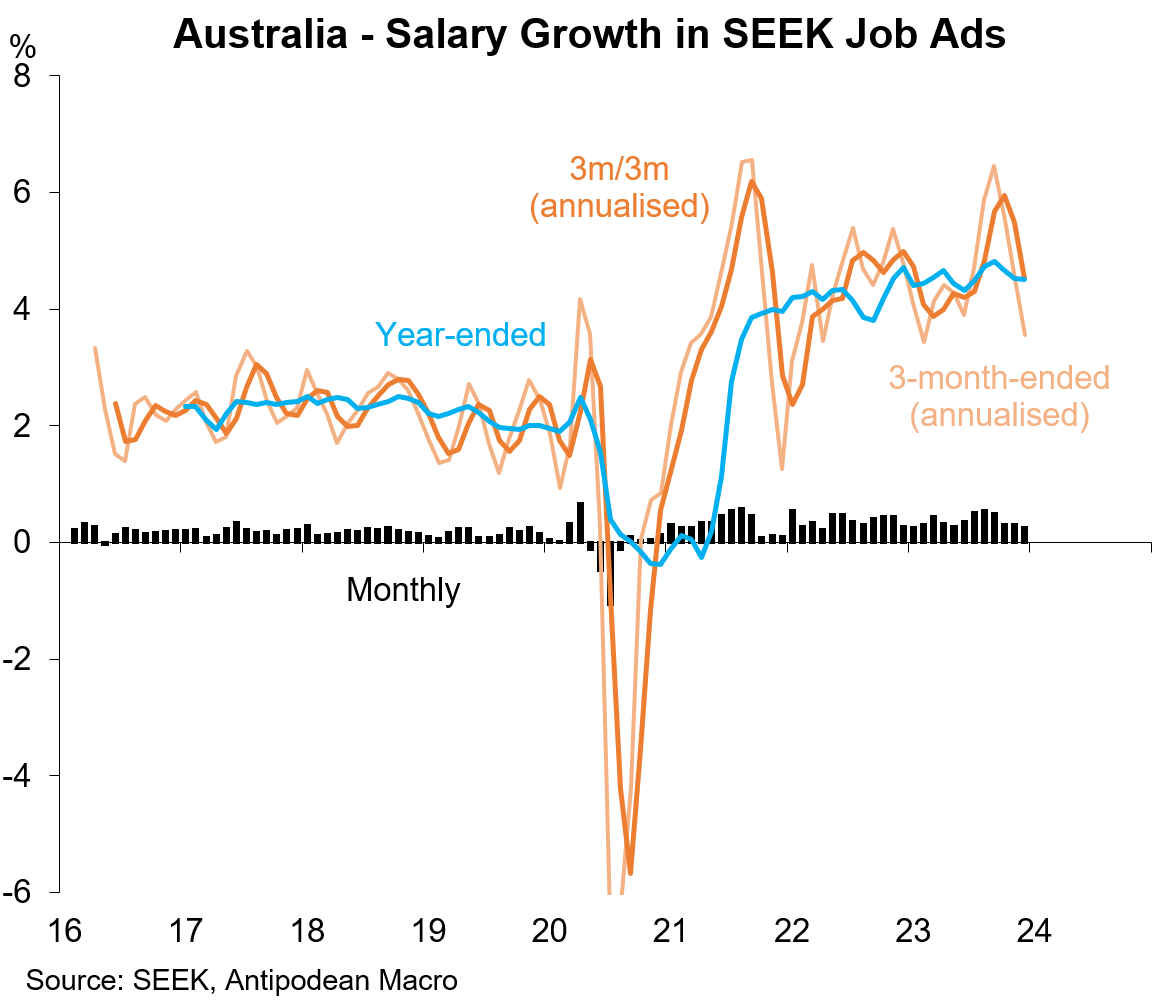

2. Growth in advertised salaries in job ads in Australia remained strong at the end of 2023, though slowed a bit in monthly terms

3. The two key activity indicators in NAB’s survey of Australian businesses are forward orders and capacity utilisation.

Firms reported slightly better, but still below average, forward orders in December. This is consistent with subdued domestic demand growth in Q4.

4. Firms reported that the level of spare capacity in their businesses continued to decline at the end of 2023. This measure is a good proxy for the ‘output gap’ (and doesn’t suffer from end-point problems).

5. Alongside the increase in reported spare capacity, Aussie firms reported another decline in recruitment difficulty in December

6. The RBA will be happy with further signs of capacity pressures easing as it will provide more confidence that domestic inflation pressures will follow

7. Aussie firms’ reported that output price inflation moderated a little further in December

8. While Australian businesses also reported a further slowing in labour cost growth, the latest reading is consistent with circa 2%q/q growth in private-sector employee compensation.

This should moderate further given the easing in capacity constraints.

Discussion about this post

No posts