1. Growth in nominal spending in Australia covered by the ABS Household Spending Indicator (HSI) - 64% of total consumption - slowed further in year-ended terms in December.

If replicated in the national accounts equivalent, quarterly nominal growth in spending would be just +0.3% q/q (then knock off inflation to get real growth)

2. Growth in discretionary consumption in Australia remained weak at the end of 2023

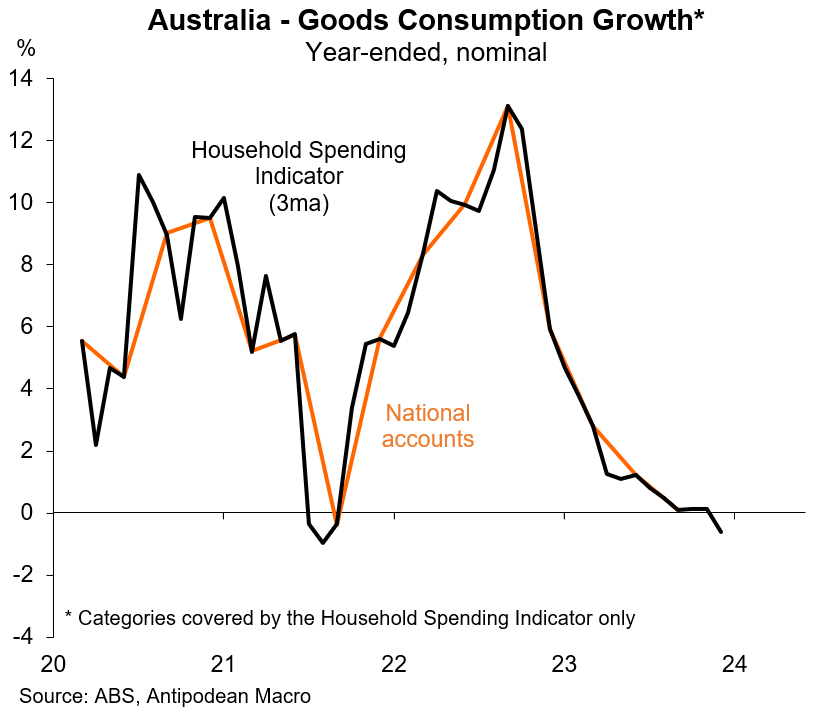

3. …with nominal goods consumption contracting over the year

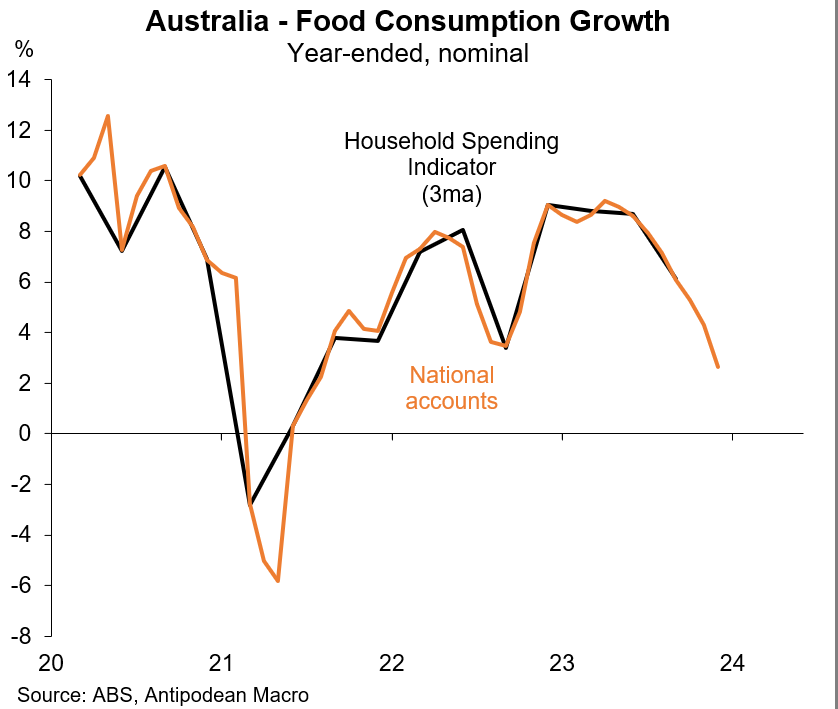

4. And that contraction in goods consumption in Australia includes positive, yet slowing, growth in food consumption

5. Growth in nominal services consumption in Australia also slowed further in Q4 2023.

If replicated in the national accounts this would imply quarterly nominal growth of +0.7% q/q and little, if any, real growth given services inflation remained solid in the quarter. Real spending on eating & drinking out appears to have fallen in Q4

6. Extrapolating daily housing price growth so far in February and applying seasonal adjustment points to further slowing in the largest capital cities

Discussion about this post

No posts