1. Australia’s wage price index (WPI) (ex bonuses) - which measures hourly wage rates - rose +0.8% q/q and +4.1% y/y in Q1. This was a bit below consensus. Year-ended growth including bonuses was a touch stronger.

Today’s WPI print was in line with Treasury’s profile published in last night’s Federal Budget but lower than the Bank’s latest forecast.

2. Quarterly WPI growth slowed for both the private- and public-sectors.

3. Our calculations suggest that wages growth for jobs under individual agreements continued to edge lower in Q1.

Wages growth in EBAs also slowed, which is consistent with the signal from slower wages growth in EBAs lodged with the Fair Work Commission.

4. Much slower growth in award wages is likely from 1 July given we expect the Fair Work Commission to hand down a significantly lower increase for award wages this year.

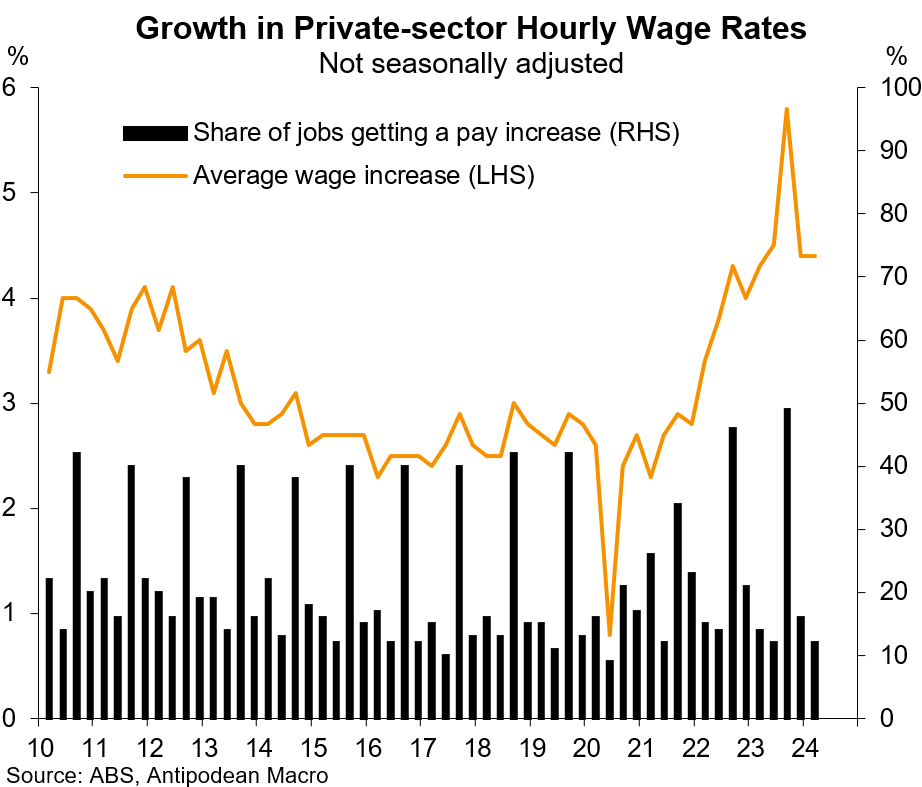

5. Just 12% of private-sector jobs in Australia received a pay increase in Q1 compared with 14-15% at the same time in the past 2 years. Nonetheless, the average size of the pay increase remained solid at 4.4%.

6. Soft public-sector WPI growth of just 0.5% q/q in Q1 reflected that a relatively low share of public-sector jobs received a pay increase following two quarters where an unusually high share of jobs gained pay rises.

7. In the year to Q1, 14.4% of jobs covered by the WPI received a pay rise of more than 6%.

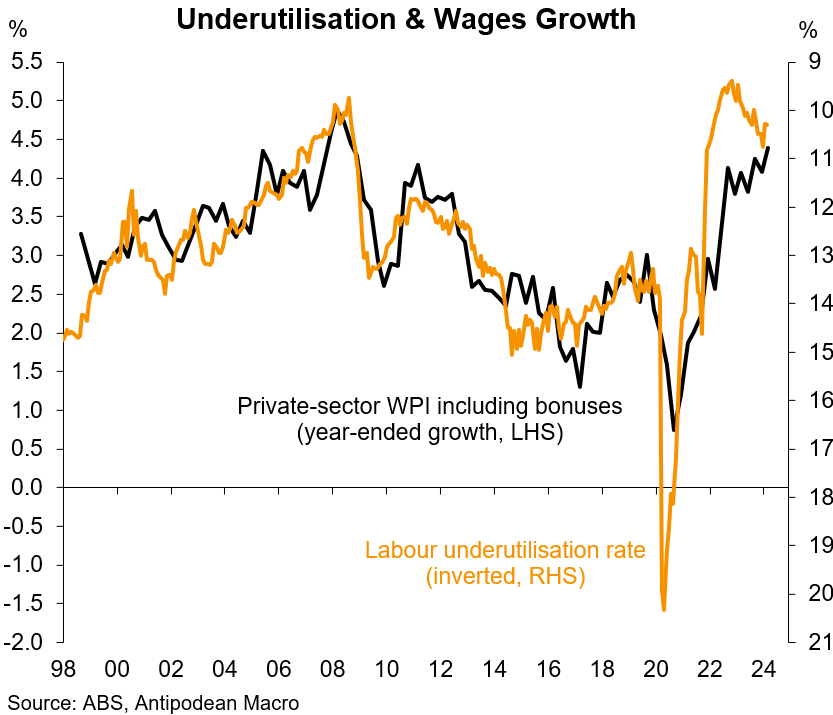

8. Labour market conditions are likely to have to ease much more for Australia’s wages growth to ease substantially…

9. ….but the fall in actual and expected inflation points to a further slowing in WPI growth this year.

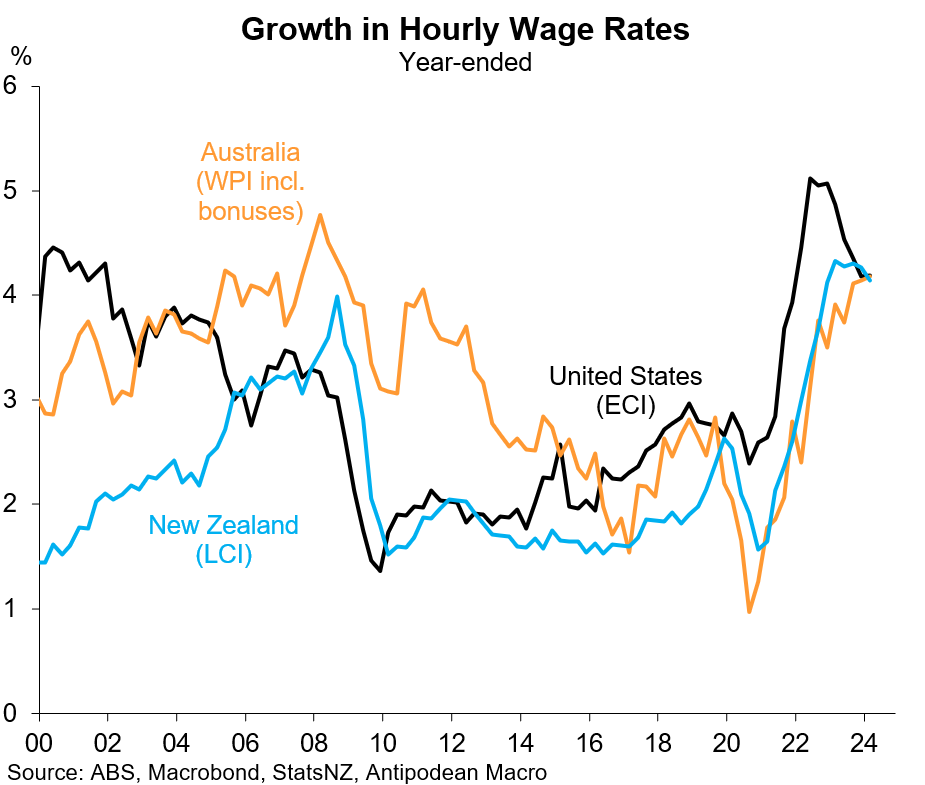

10. Year-ended growth in hourly wage rates is now very similar across the US, Australia and New Zealand.

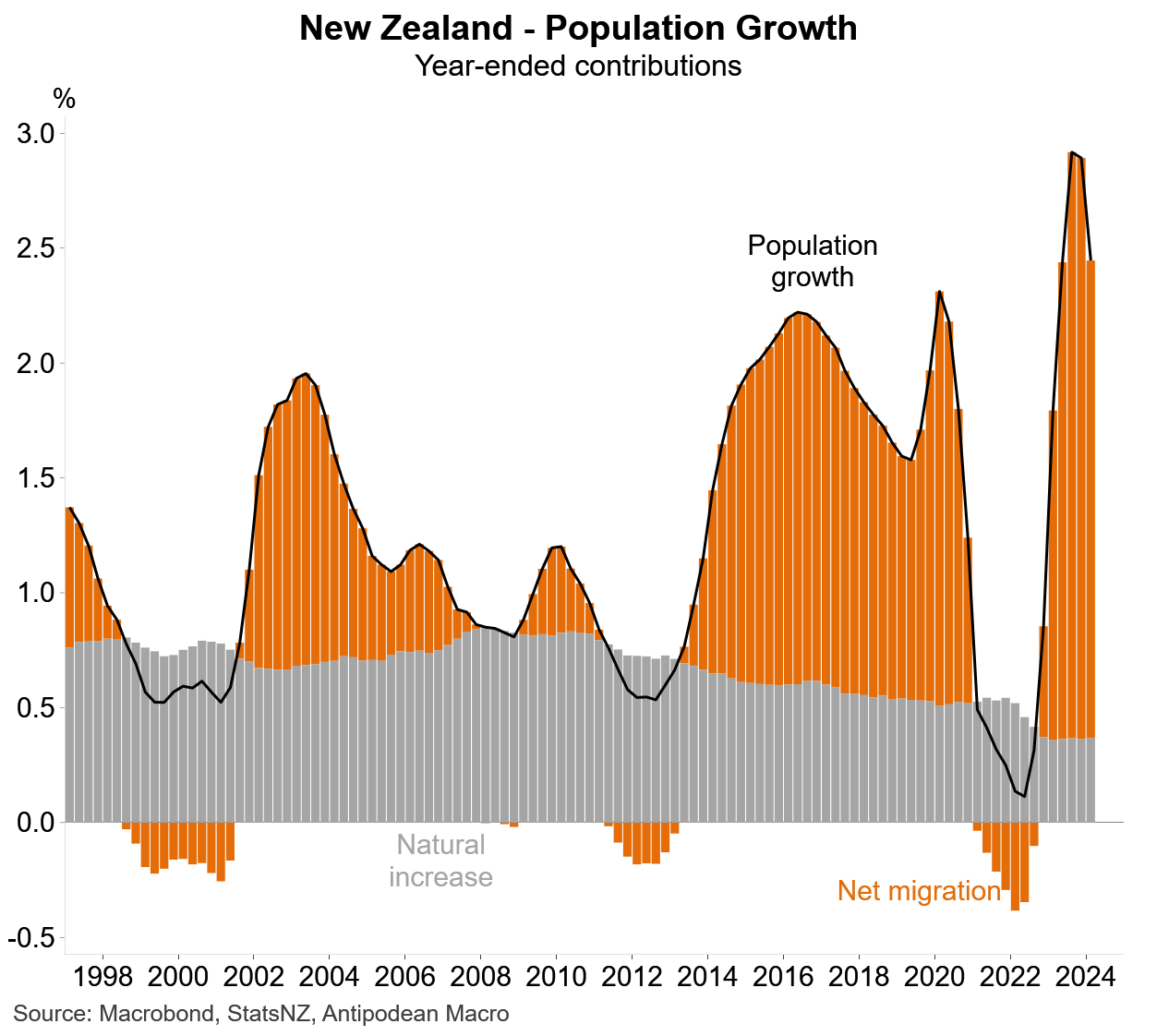

11. New Zealand’s population growth slowed to 2.5% y/y in Q1 as net immigration slowed somewhat.

12. New Zealand’s population was still growing faster than the dwelling stock but that followed the pandemic period where the reverse was true.

Discussion about this post

No posts