ONLY CHARTS will be available to paid subscribers only from Monday. See here for details. You can upgrade now to paid in your Substack account or click on “Upgrade to paid” from Monday. Group discounts are available here.

1. UK CPI inflation for April was stronger than expected. ‘Core’ inflation (ex food & energy) has picked up in quarterly terms in a range of economies - Canada a key exception - since the turn of the year.

2. World steel production declined in April and has been trending lower since peaking in late 2020.

3. Australia’s flash composite PMI for May dipped a little lower to a relatively solid 52.6.

4. The Aussie PMI is the first to be release. Recall that the global composite PMI had picked up through to April, signalling improving global GDP growth, but appeared to be losing momentum.

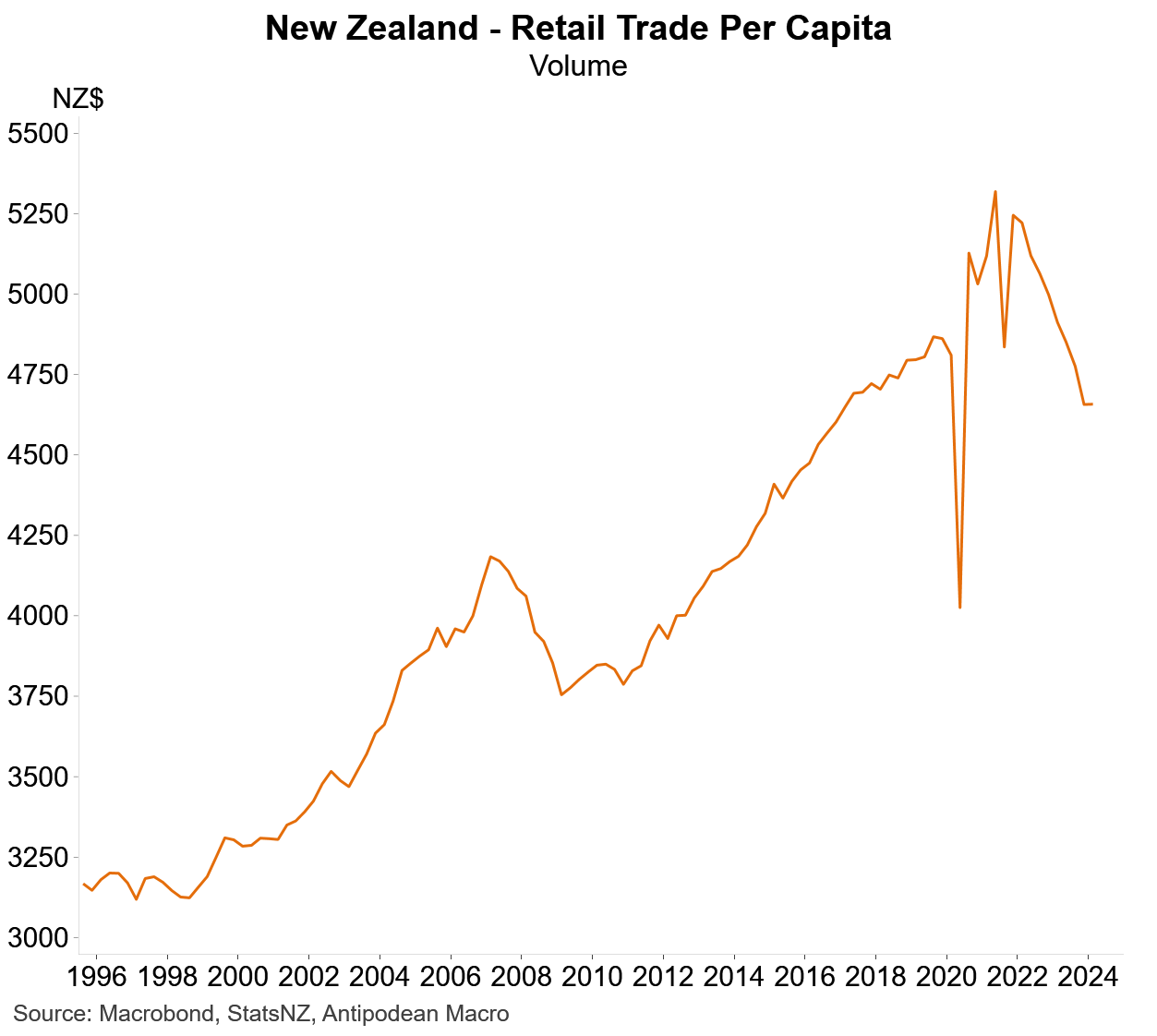

5. Retail trade volumes in New Zealand rose +0.5% q/q in Q1 following 8 consecutive quarterly declines. Real sales were 8.7% below the peak.

6. Per capita retail trade volumes in New Zealand were broadly unchanged in Q1 and 12.4% below the peak.

7. Retail trade inflation in New Zealand has slowed significantly.

8. Australians swallowed the Government’s rhetoric that ‘cost of living’ assistance in the Budget will lower inflation, with inflation expectations dipping in May.

9. It’s getting more difficult for the unemployed to find work in Australia.

Discussion about this post

No posts