1. Australian firms reported better business conditions in February…

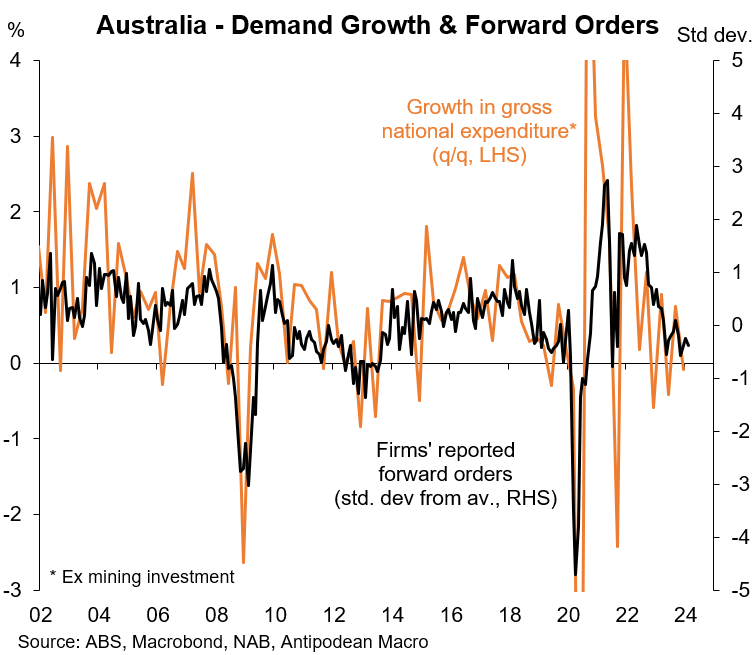

2. …though forward orders were said to be a bit softer and remained consistent with weak growth in domestic demand.

3. Hiring in February reported by Aussie businesses was still above average…

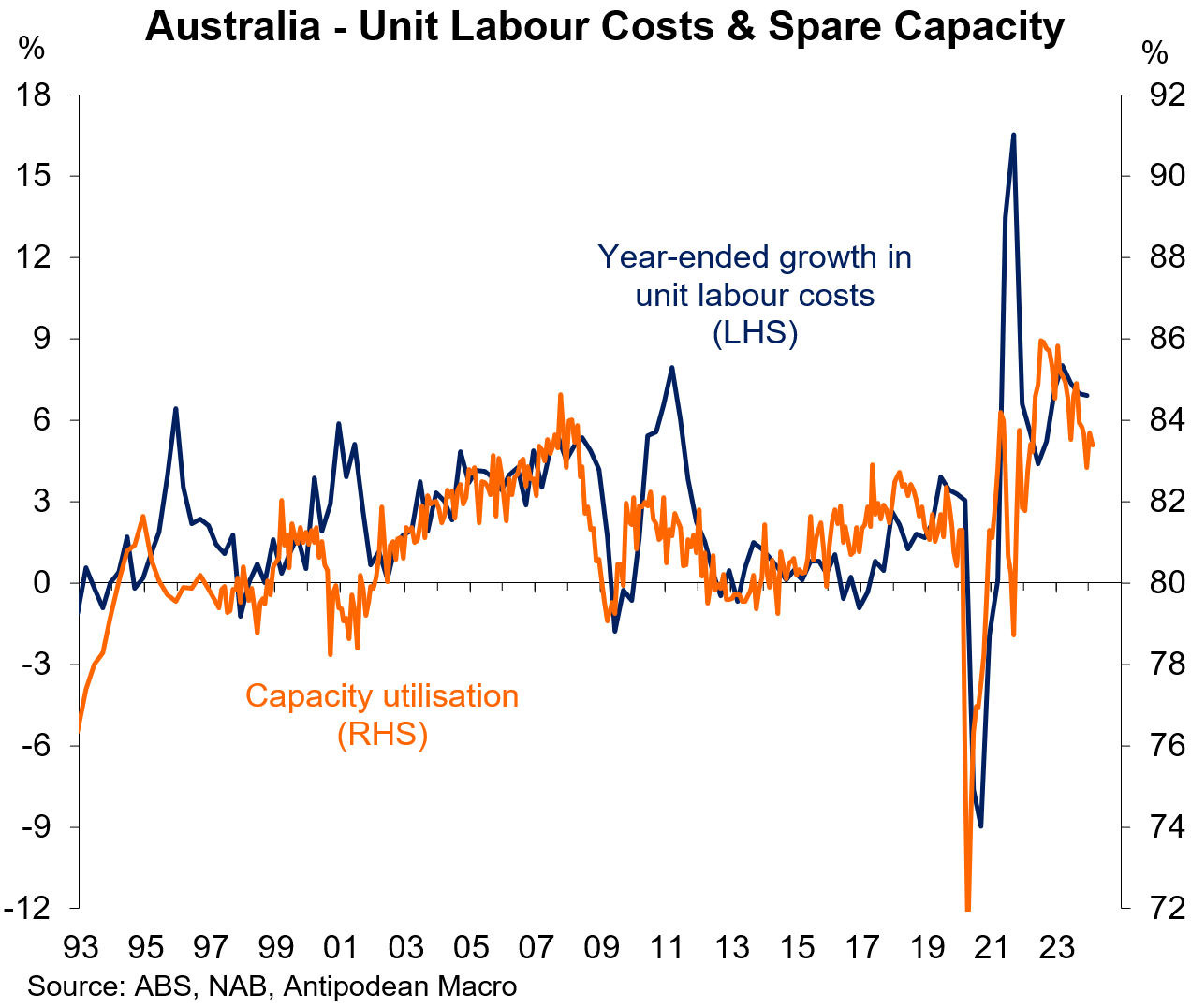

4. …yet the trend decline in firms’ capacity utilisation is consistent with easing labour market conditions.

5. The decline in reported capacity utilisation bodes well for further moderation in unit labour cost growth. But history suggests that a larger rise in spare capacity will be needed to take sufficient pressure off (unit) labour cost growth and services inflation.

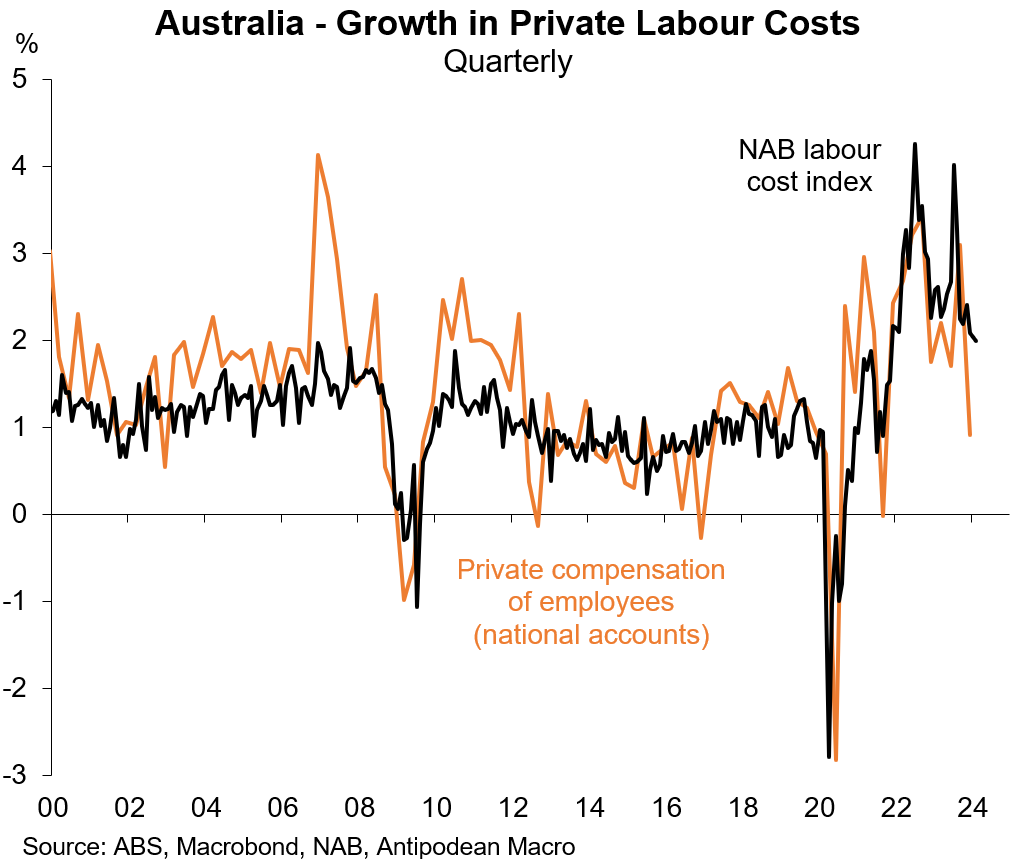

6. In that vein, Aussie firms continued to report robust labour cost growth despite a slightly softer reading in the month.

7. Inflation indicators reported in the NAB business survey rose again in February and remain well above levels consistent with inflation settling into the RBA’s 2-3% target.

8. The average interest rate to assess serviceability on new housing loans used by lenders in Australia reached 9.22% in Q4 2023.

9. High assessment rates have contributed to the low share of new housing loans in Australia being written for borrowers with a very high debt-to-income ratio of at least 6 times.

10. Nominal spending using debit and credit cards in New Zealand declined in February and unwound all of the increase in January.

Discussion about this post

No posts