Resending as this didn’t make it into inboxes earlier due to a glitch.

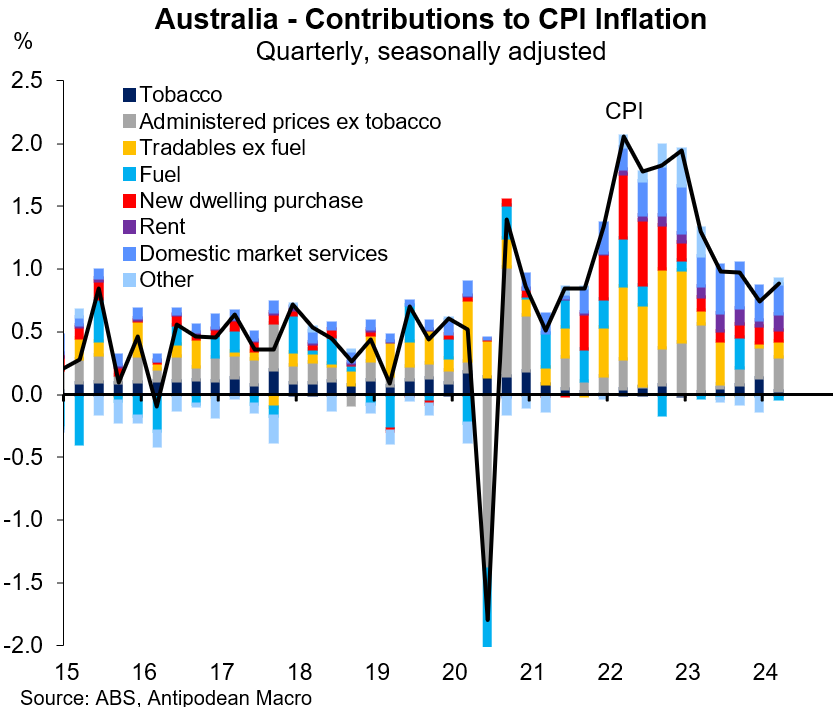

1. Australia’s Q1 CPI inflation was above market expectations. The headline CPI rose by nearly +1% q/q (mkt: +0.8% q/q) and trimmed mean inflation was +1% q/q (mkt: +0.8% q/q).

As outlined in our CPI preview (see link below), we expected trimmed mean inflation to be 0.9-1.0% q/q (point estimate of +0.95%) and noticeably above the RBA’s February SoMP forecast of +0.8% q/q.

We were close to the actual outcome.

The key CPI breakdowns are in this table:

2. The increase in trimmed mean inflation in Q1 occurred alongside a modest increase in the breadth of inflation.

Nearly half of Australia’s CPI basket rose at an annualised rate of more than 3% in the March quarter.

3. On any measure, underlying inflation in Australia remained well above the RBA’s target in Q1…

…and it’s following the US for now rather than what’s happening in Canada (which has had a weaker economy as shown by a more than 1ppt rise in the unemployment rate).

4. Services inflation in Australia picked up as expected in Q1 and, again, looks quite similar to developments in US services inflation (on a like-for-like basis).

5. The pick-up in services inflation in Australia has mostly been in non-discretionary CPI items.

6. Looking through a different lens, stronger services inflation has been most pronounced in government-administered CPI items (grey line).

Child care prices rose particularly strongly again (+3.9% q/q) in Q1.

Total administered price inflation contributed heavily to headline CPI inflation in both Q4 and Q1.

7. Within services inflation, domestic market services prices rose a solid +1.1% q/q (as we expected) and remained elevated despite coming off the highs. This strength continues to reflect the (lagged) effects of strong growth in unit labour costs.

8. The split between ‘core’ non-tradables and tradables inflation was as we expected. That is, ‘sticky’ non-tradables inflation and a small rebound in ‘core’ tradables inflation.

9. A rebound in consumer durables inflation in Q1 contributed to the pick-up in tradables inflation.

Tradable food inflation (ex fruit & veg), however, has moderated significantly.

10. As expected, CPI rents again rose strongly in Q1 amid very low rental vacancy rates and as strength in newly negotiated rents slowly passes through to the stock of rental properties.

Discussion about this post

No posts