1. New house sales in Australia jumped 22% m/m in April, boosted by buyers rushing to beat changes to the National Construction Code which came into effect in Victoria and Queensland on 1st May. According to the HIA, those changes are expected to add to the cost of house construction through, among other things, the Code’s new energy efficiency standards.

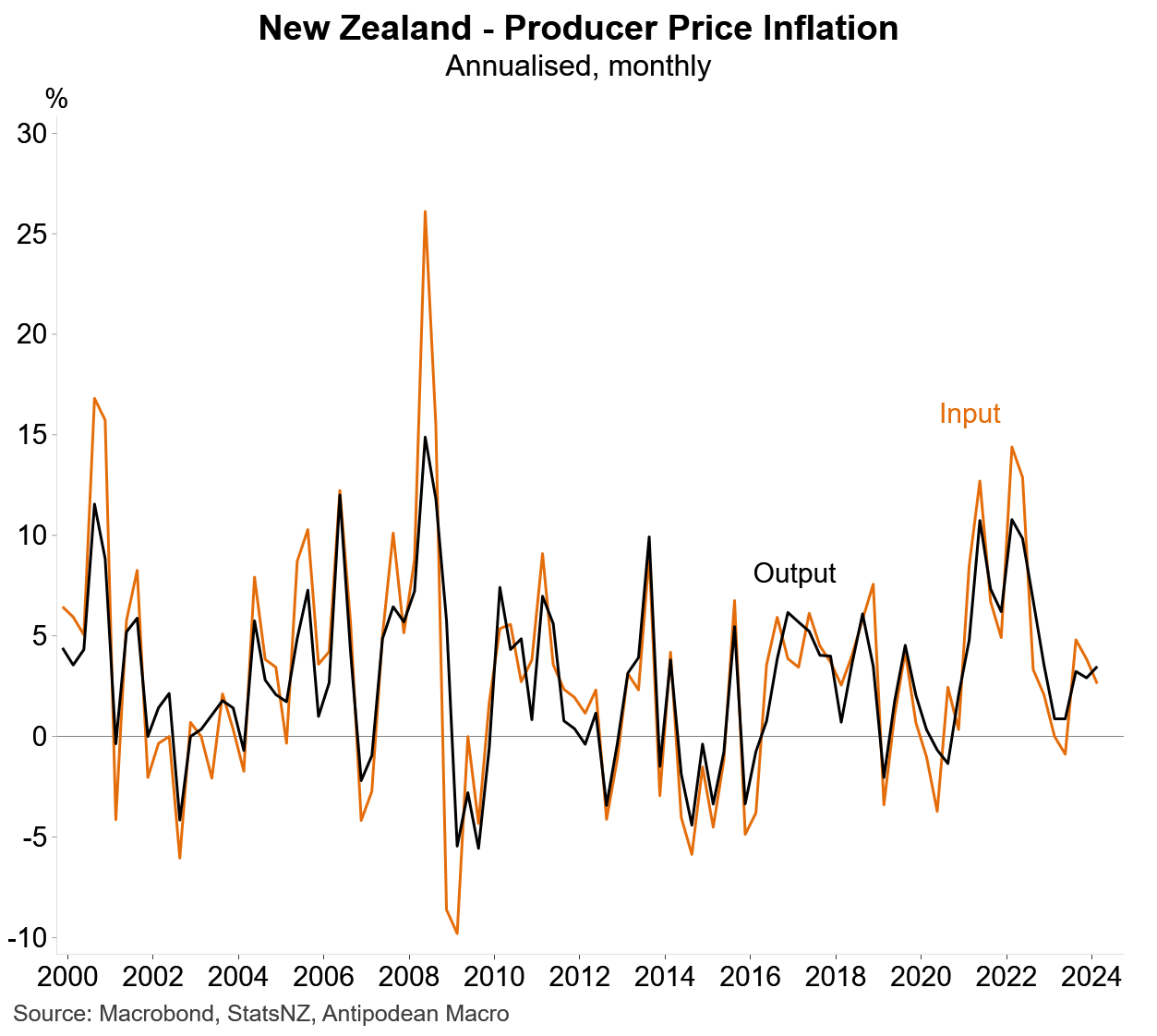

2. Producer price inflation in New Zealand in Q1 remained much lower than recent peaks.

3. The number of unemployment benefit recipients in Australia continued to gradually increase over April. Note that this typically lags changes in the ABS unemployment rate.

4. If we look at Australia's key labour market ratios for 15-64 year olds, like some other countries do, the unemployment rate and employment-to-population ratio have deteriorated a bit more noticeably than the headline series.

5. Total budget deficits of Australia's federal, state & territory governments are forecast to be circa 3% of GDP in 2024-25. Even if that is too conservative, is this really what the economy needs right now following a sizeable aggregate budget deficit in 2023-24?

6. China’s residential sales and construction starts remained very weak in April…

7. …and are unlikely to get better anytime soon with this existing housing price growth backdrop.

Discussion about this post

No posts