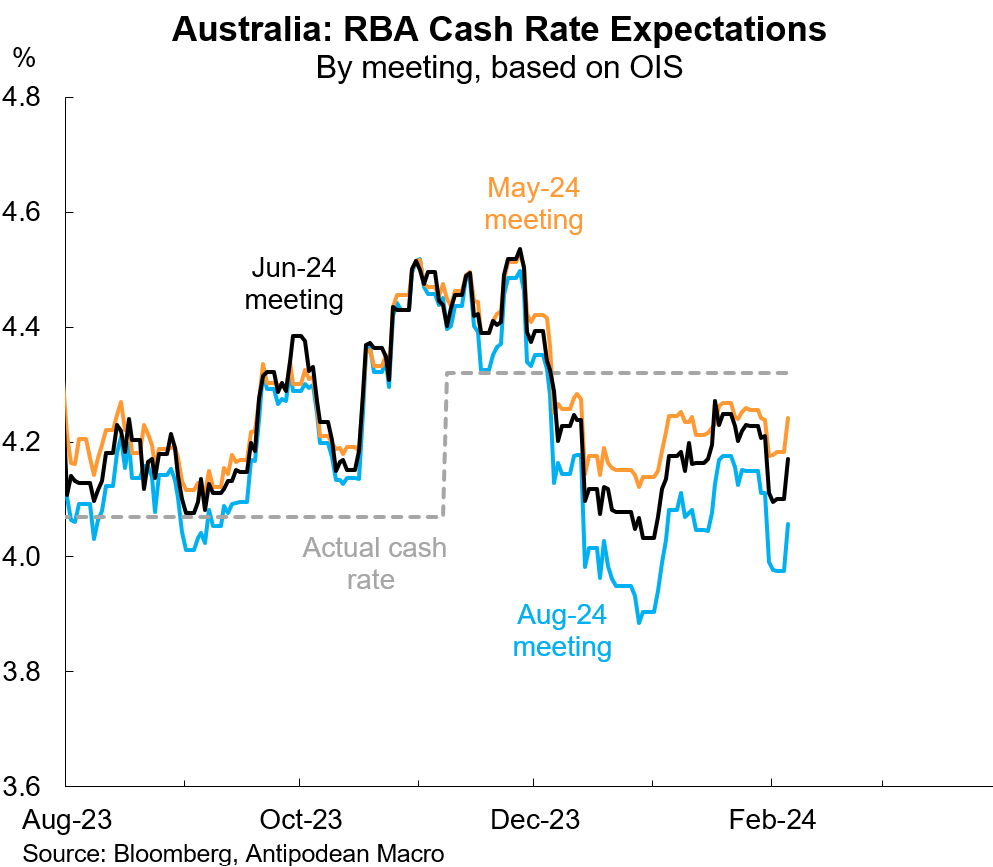

1. The blockbuster US labour market report on Friday contributed to markets winding back RBA rate cut expectations

2. While we expect the RBA Board and Governor to strike a less hawkish pose this week, they are likely to favour a “higher for longer” thematic for now. Market-implied rate cut expectations for Q2 and Q3 are at risk of being would in further

3. The ANZ-Indeed measure of job ads in Australia rose again in January

4. Australia’s goods trade surplus narrowed in December to just under $11b

5. The value of Australia’s resource exports partially recovered towards the end of 2023 as commodity prices rebounded somewhat

6. We estimate that the volume of consumer and capital goods imports to Australia fell sharply in Q4 2023. This reflects weak goods demand but could also show up as inventory de-stocking in the quarter

Discussion about this post

No posts