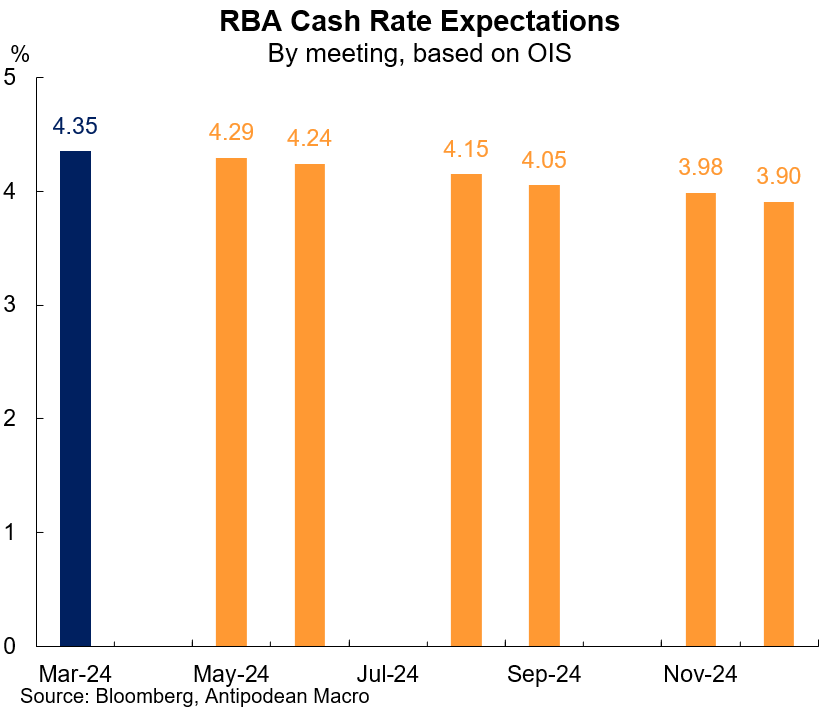

1. Market pricing for the RBA cash rate before 2:30pm AEDT…

2. …and after 2:30pm. The curve’s downward slope is now a bit steeper after the RBA Board’s words struck a slightly more ‘neutral’ tone. Why?

Gone is the reference to “a further increase in interest rates cannot be ruled out“ and the Board now simply says “the Board is not ruling anything in or out“.

Recall, however, that those are exactly the words Governor Bullock used in the press conference after last month’s Board meeting, so arguably little has changed.

3. Australian firms reported a slight dip in recruitment difficulty in February. The trend decline in hiring difficulty has been much more pronounced for low-skilled occupations, presumably related to the sharp bounce-back in net immigration.

4. The share of Australian firms reporting that they had reduced headcount dipped in February but remained higher than several months ago.

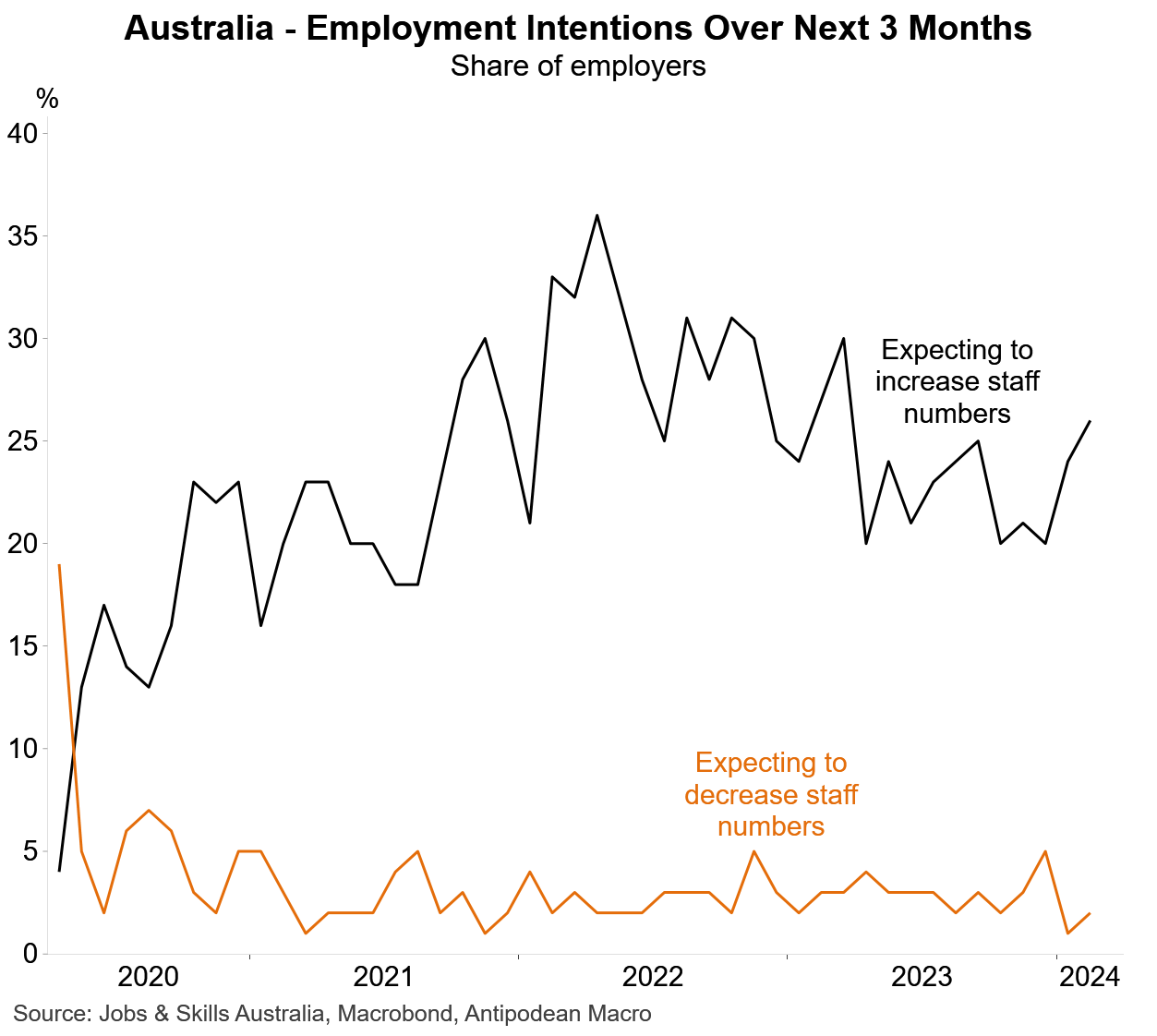

5. Nevertheless, the share of Aussie firms expecting to cut staff numbers in coming months remains low.

6. The capital city residential rental vacancy rate in Australia stabilised at a very low level at the end of 2023, suggesting that growth in real rents could be approaching a peak.

Discussion about this post

No posts