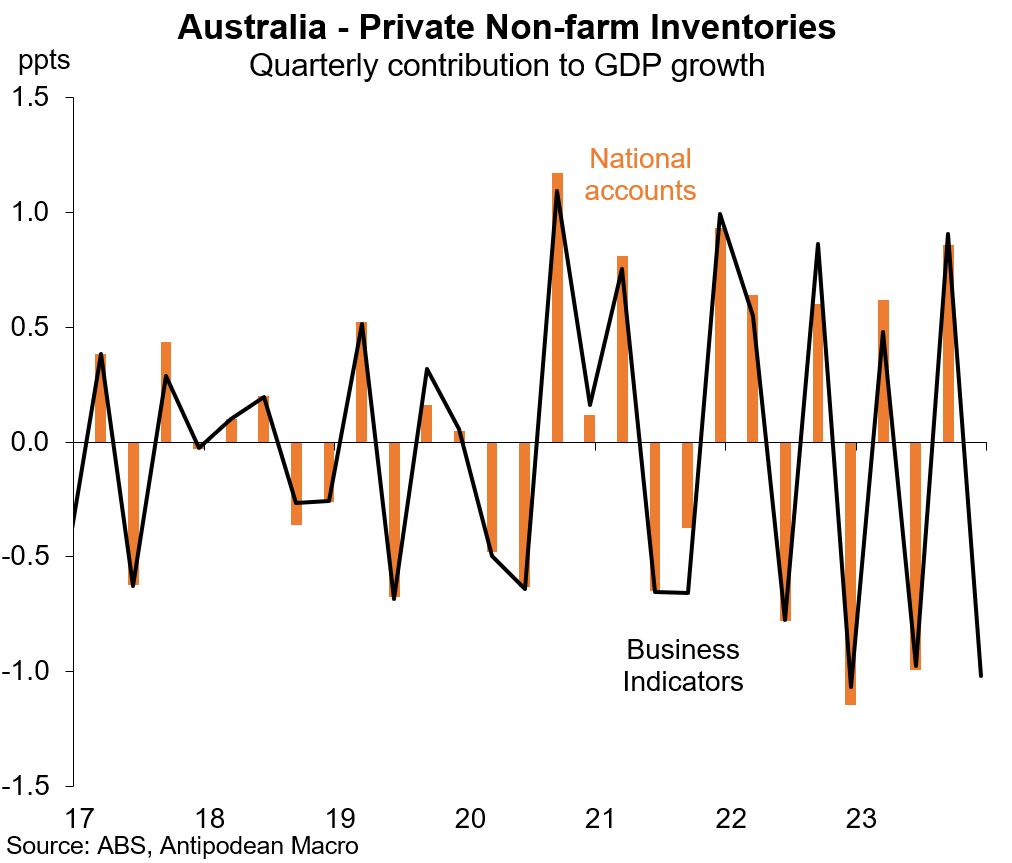

1. Private non-farm inventories subtracted 1ppt from Australia’s quarterly GDP growth in Q4 2023. The 1.7% q/q decline in inventories was much ‘worse’ than the flat outcome expected by consensus.

Our analysis, however, suggested that goods import volumes fell sharply in Q4 which is typically a good sign of a sharp turnaround in inventories’ contribution to GDP growth (see second chart). This will provide a significant offset from a GDP perspective.

2. Growth in the private-sector wage bill in Australia slowed sharply in Q4 2023. The overall wages bill measured in the national accounts is likely to get a boost from higher public-sector wages in the quarter.

3. Non-financial corporate profits in Australia rose quite solidly in Q4 2023 (+3.8% q/q after adjusting for inventory valuation changes). Mining profits led the way higher amid stronger commodity prices in the quarter. Non-mining profits growth appears to have been weak.

4. Unsurprisingly, growth in real sales volumes in Australia remained very weak in Q4 2023

5. The number of residential building approvals made in Australia in January declined 1% m/m. Detached house approvals fell nearly 10% m/m - with big falls in NSW and Victoria - but the volatile higher-density category rose nearly 20% m/m

6. The decline in detached house building approvals has been foreshadowed by the renewed weakness in new house sales

7. The value of non-residential building approvals in Australia rose in January after trending sharply lower for several months

8. Quarterly data reveal that the volume of approvals for total non-residential building again fell sharply in Q4 2023, but that followed a noticeable jump in Q2 last year.

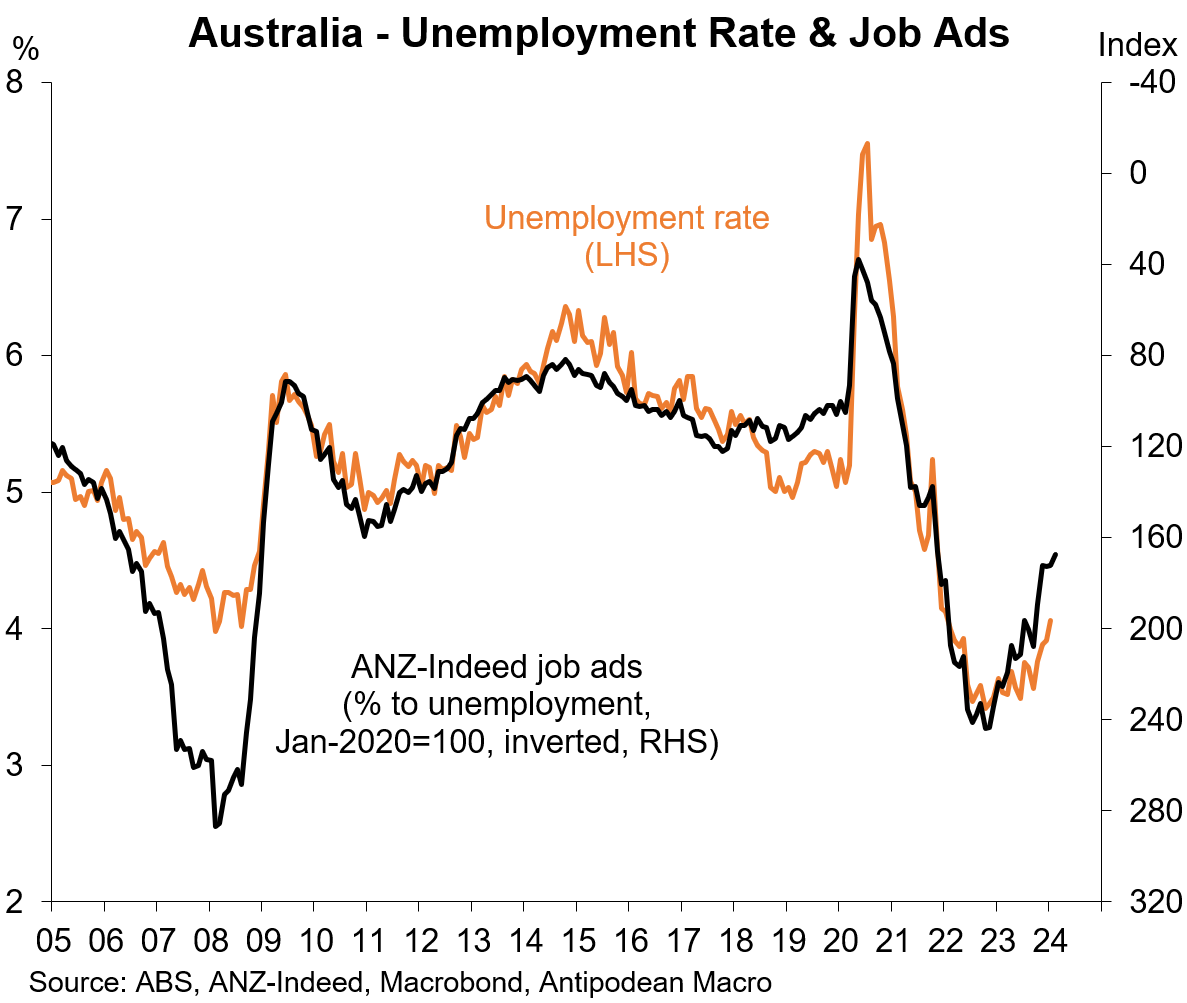

9. According to ANZ-Indeed, the number of job ads outstanding in Australia fell 2.8% m/m in February. The job vacancy rate edged lower.

10. New Zealand’s goods export volumes appear to have grown solidly in Q4 2023. In contrast, the partial indicator for the volume of goods imports fell sharply

11. New Zealand’s goods export prices fell further in Q4 while goods import prices rose (largely driven by higher fuel prices)

Discussion about this post

No posts