1. Total scheduled housing loan repayments (principal & interest) hit $41.8b - 10% of household disposable income - in the March quarter. Mortgagees pumped another $10.2b into offset and redraw accounts.

2. As the RBA showed in this week’s Statement on Monetary Policy, total household loan repayments - including those on personal loans - is currently equivalent to another ~2ppts of household disposable income. But this is much lower than in the past as interest-bearing consumed loans have declined.

3. One-third of the way through May and housing price growth in Australia continues to tick over at solid rates.

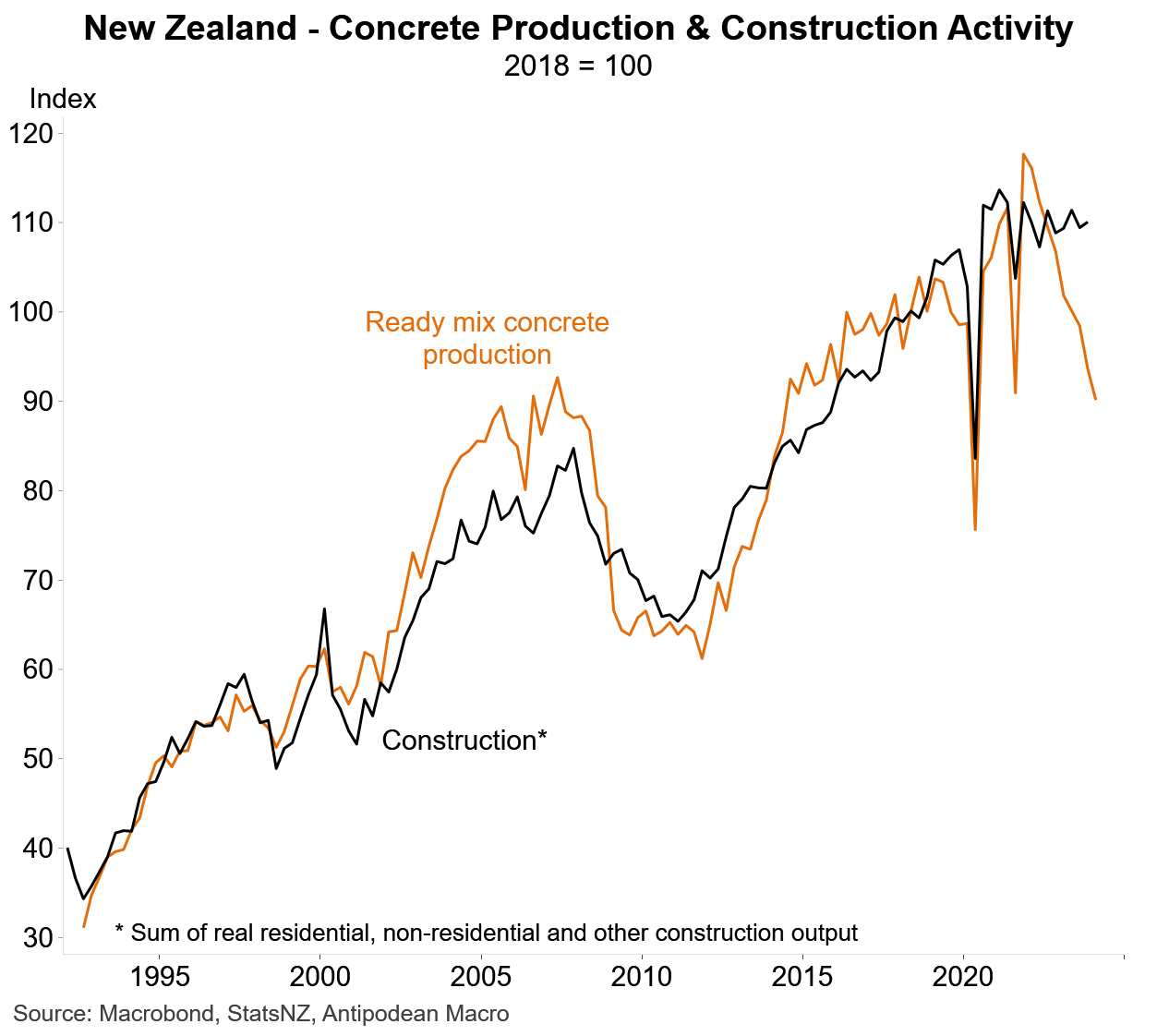

4. Falling concrete production in New Zealand doesn’t bode well for construction activity.

5. Australia and Chile have enjoyed the biggest of big terms of trade booms over the past 20 years.

6. The number of new job ads on SEEK in New Zealand continued to decline in April.

7. The ratio of job applications to job ads in New Zealand is rocketing higher.

8. The number of temporary visa holders in Australia - excluding visitors - has risen by ~480,000 since March quarter 2020. The top 30 countries of origin (by growth in number of visa holders) is shown below.

9. While there has been a big focus on the increase in the the number of student visa holders in Australia, there has been a larger rise in those on employment visas since early 2020.

Discussion about this post

No posts