1. China’s construction sector remained in the doldrums in April.

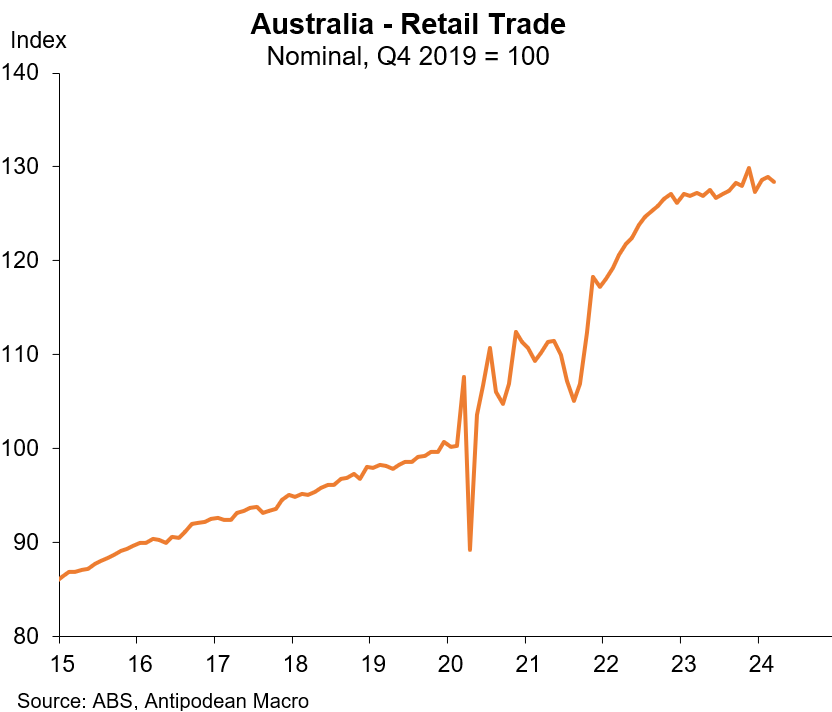

2. Nominal retail trade in Australia was much weaker than consensus expected in March, falling 0.4% m/m. Excluding food and eating out & takeaway, sales declined 1.6% m/m.

3. The Swifties-related spike in clothing & footwear sales in Australia in February was unwound in March. The value of household goods retailing also remained very weak.

4. Q1 nominal retail sales rose just +0.17% q/q in Australia. Combined with our retail trade deflator estimate of +0.5% q/q, we are looking at a small contraction in the volume of retail trade in Q1. Per capita retail volumes are looking particularly weak.

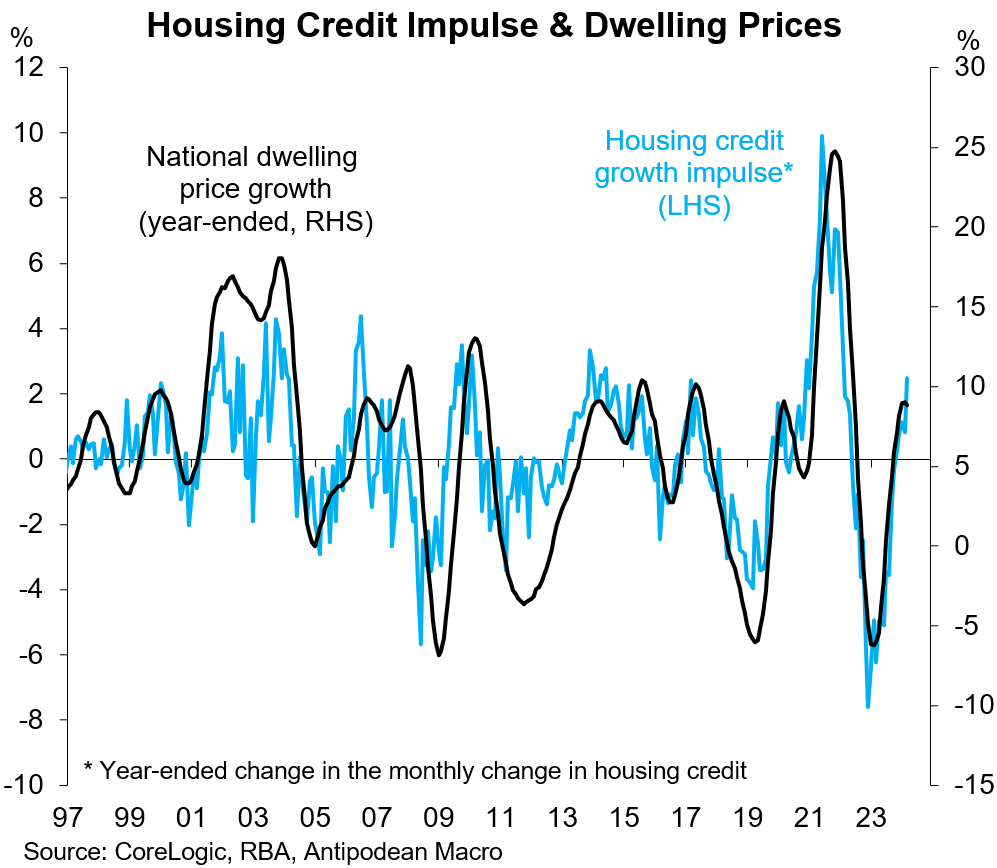

5. Housing credit growth in Australia continued to trend higher in March to a monthly annualised rate of nearly 5%.

6. Where dwelling prices go, housing credit growth goes.

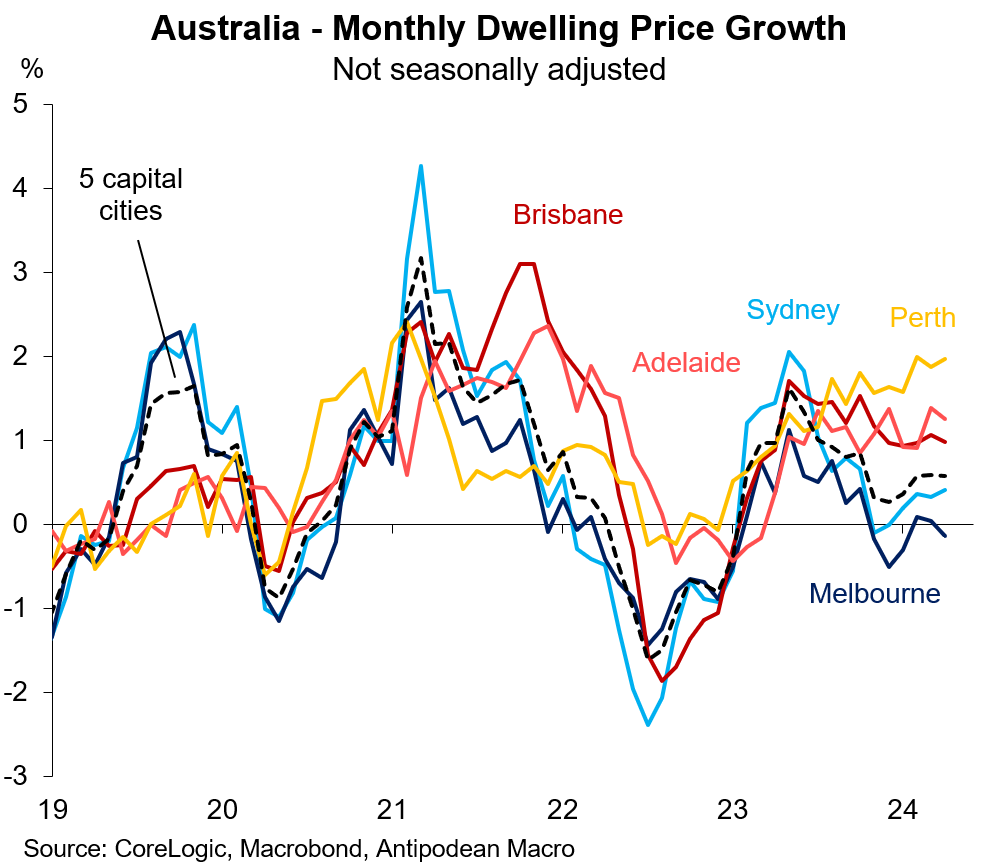

7. CoreLogic’s daily data suggest that housing prices in Australia’s major capital cities continued to rise solidly over April (though April is typically a seasonally strong month). Note that CoreLogic will put through revisions when the full suite of data are released (tomorrow).

8. Housing credit growth in New Zealand in March remained weaker than in Australia, though much stronger than in the UK and euro area.

9. New Zealand firms’ pricing intentions remain elevated in April.

10. The Antipodes, particularly Australia, has so far escaped the large increases in unemployment rates experienced in some other high-household-debt economies (Sweden, Canada and Finland).

Discussion about this post

No posts