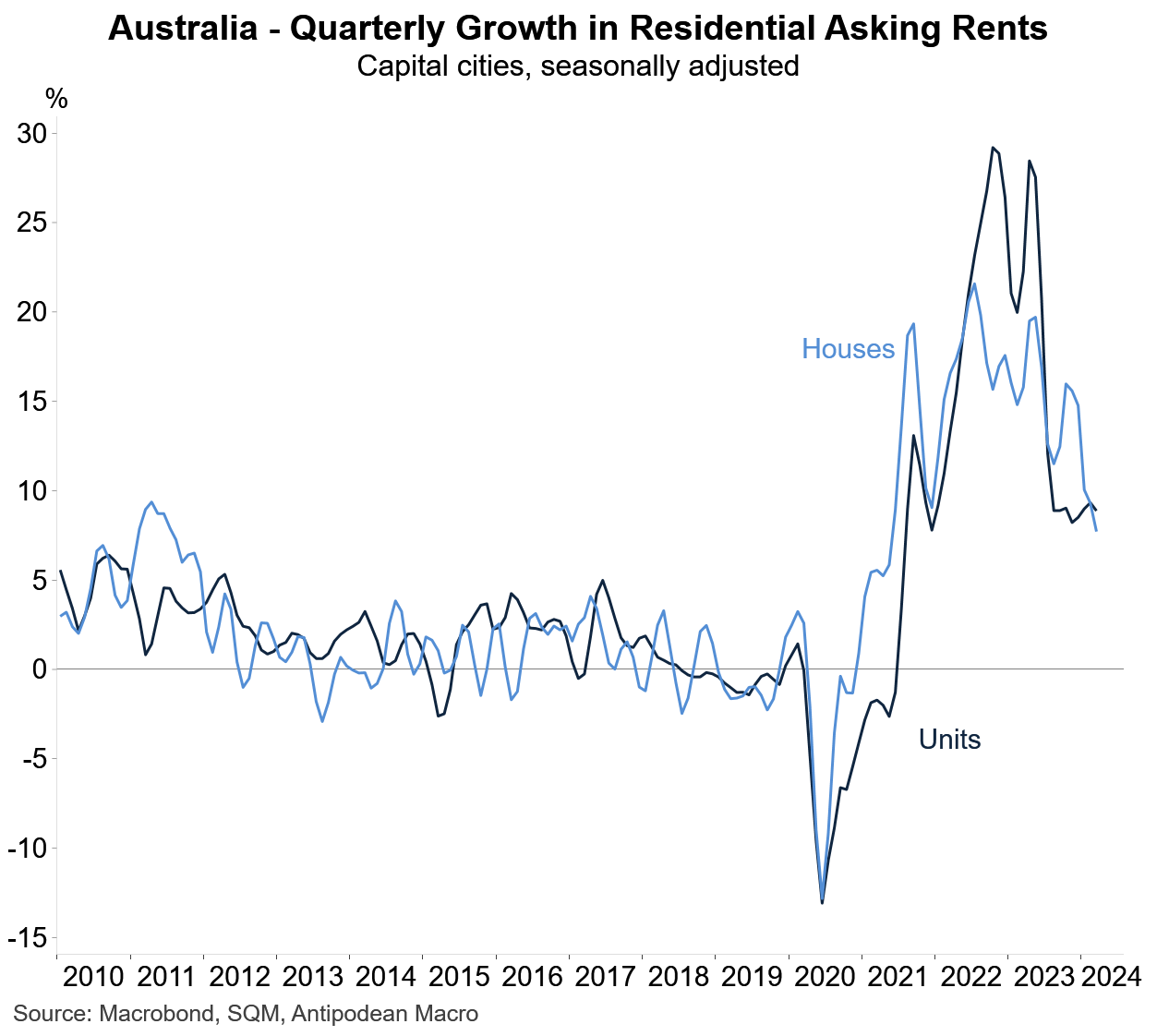

2. Growth in CPI rents in Australia has shot higher amid significant excess demand for housing (this chart was inspired by a similar CBA version).

3. Domestic spending using credit and debit cards in New Zealand has been broadly unchanged for a year in nominal terms.

4. Kiwi’s card spending on durables continues to trend lower.

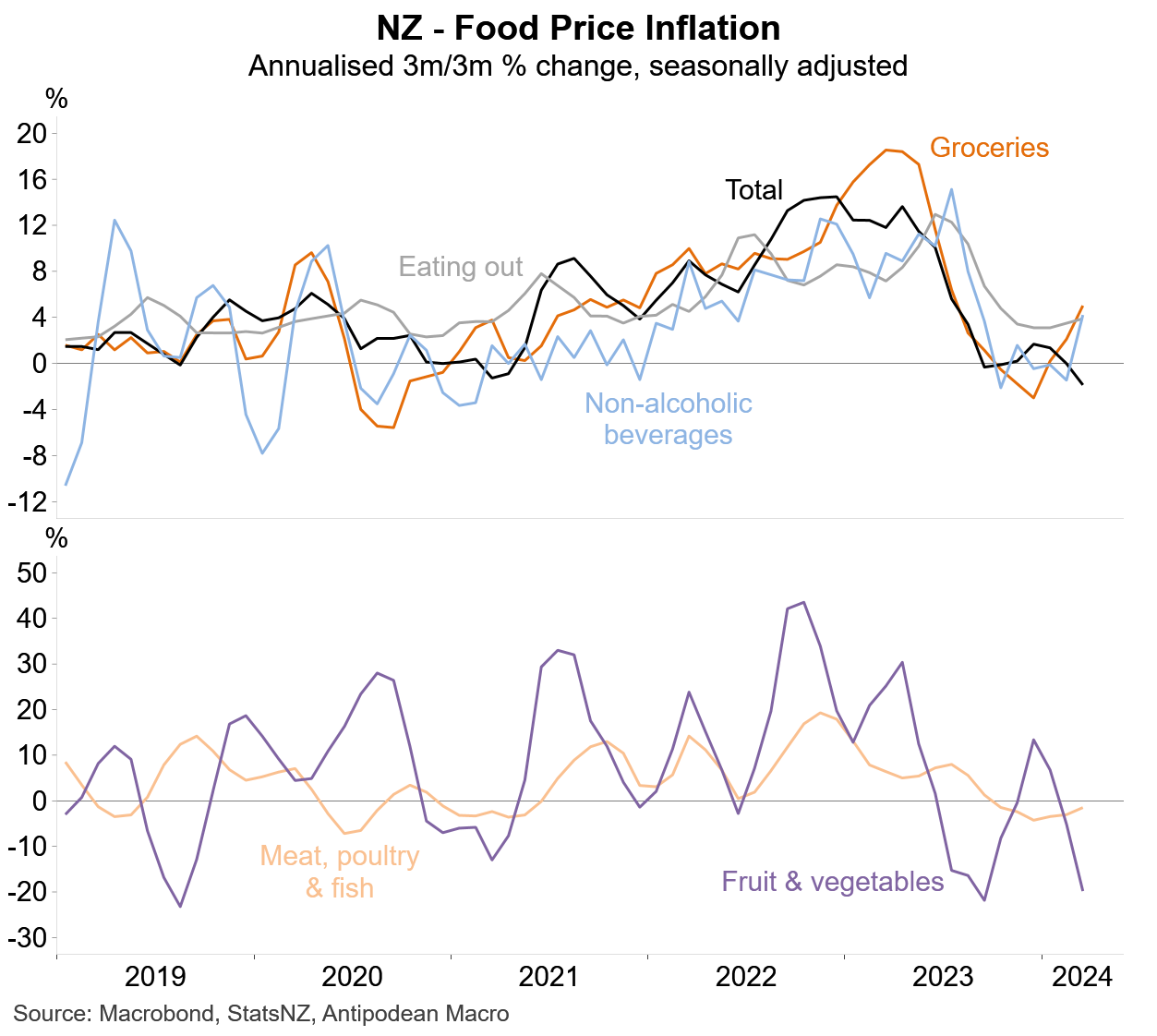

5. Food prices in New Zealand, which have an 18% CPI weight, rose +1.8% q/q in Q1.

After seasonal adjustment, however, food prices declined 1.9% q/q amid falling prices for fresh items. In contrast, prices for grocery items and non-alcoholic beverages strengthened in Q1, while eating out inflation remained close to 4% on an annualised basis.

6. Core US producer price inflation slowed in March, but our own seasonally adjusted measure - which has been much less volatile than the published equivalent - remained around where it was in February.

7. That is also true for the PPI personal consumption services measure…

8. …with both seasonally adjusted measures remaining above 4% in annualised 3-month-ended terms.

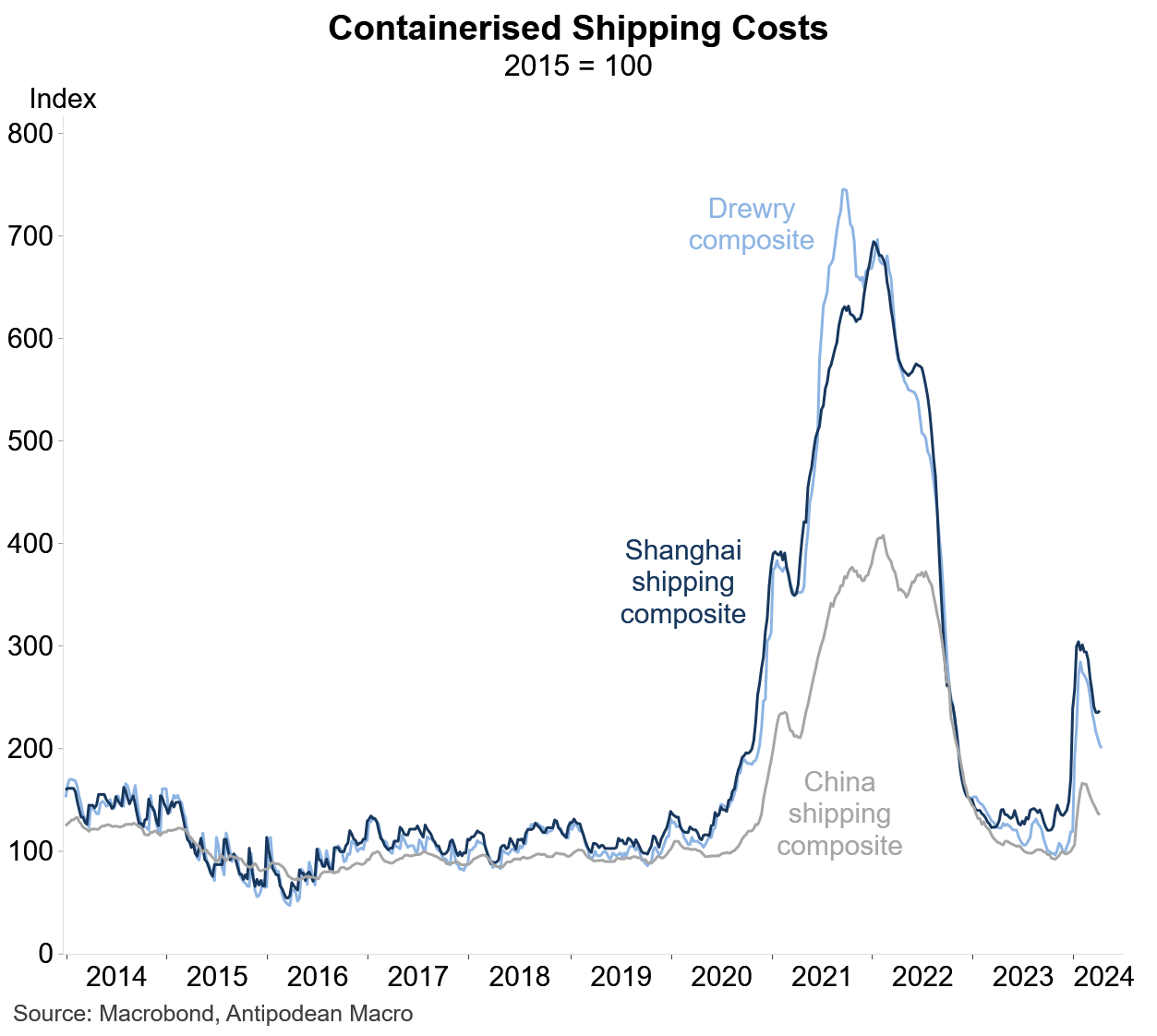

9. Global containerised shipping costs have continued to decline

Discussion about this post

No posts