1. The Australian Government’s underlying budget balance remained firmly in surplus in the March quarter, and $4b larger in fiscal year-to-date terms than assumed in the December MYEFO.

2. The Aussie Government’s net debt has stabilised at ~20% of GDP.

3. Income tax paid by Australian households appears to have declined again in the March quarter, supporting growth in disposable income.

4. Producer price data revealed that output price inflation for new higher-density homes continued to be faster than for new houses in Australia in Q1.

5. Output prices in house building in Australia have been rising faster than the cost of materials (partly because labour costs have been rising quickly).

6. The price of consumer goods imported into Australia fell in the March quarter, though some of this may be offset by higher freight costs (as we saw in kiwi imports data).

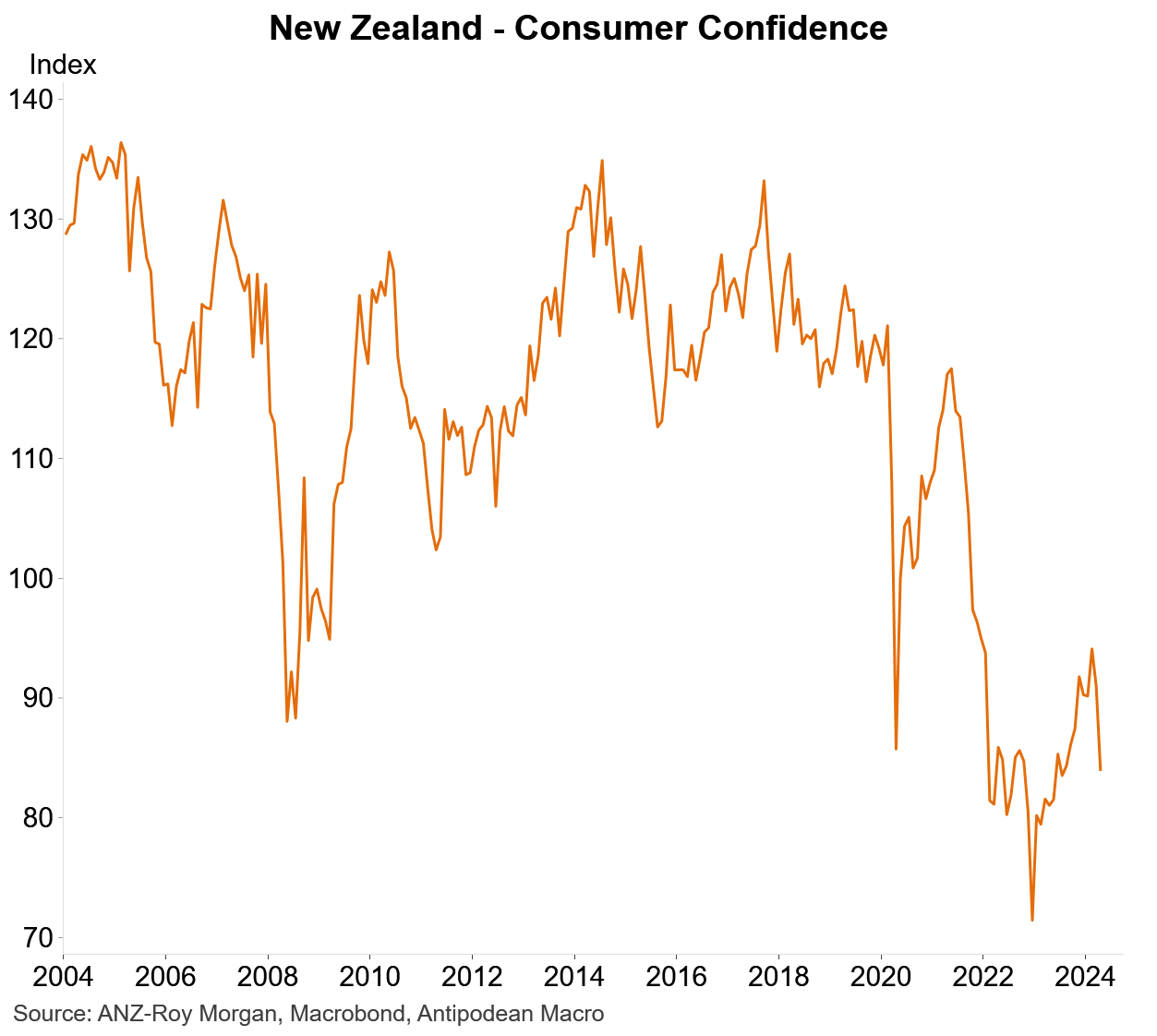

7. Consumer confidence in New Zealand declined again, and sharply, in April.

8. Housing loan repayments of kiwi households increased further in the March quarter.

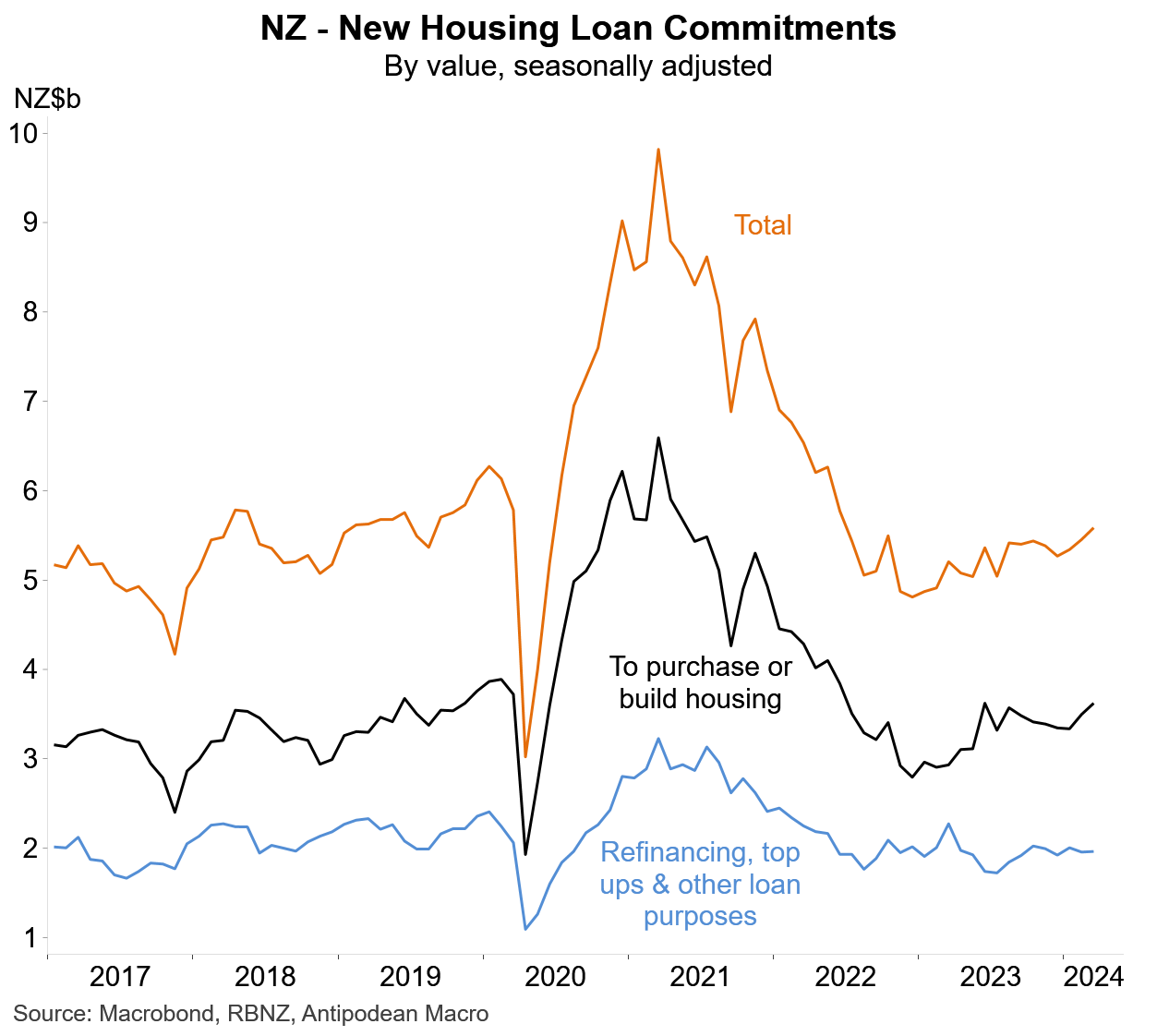

9. The value and number of new housing loan commitments (including refinancing) in New Zealand rose further in March.

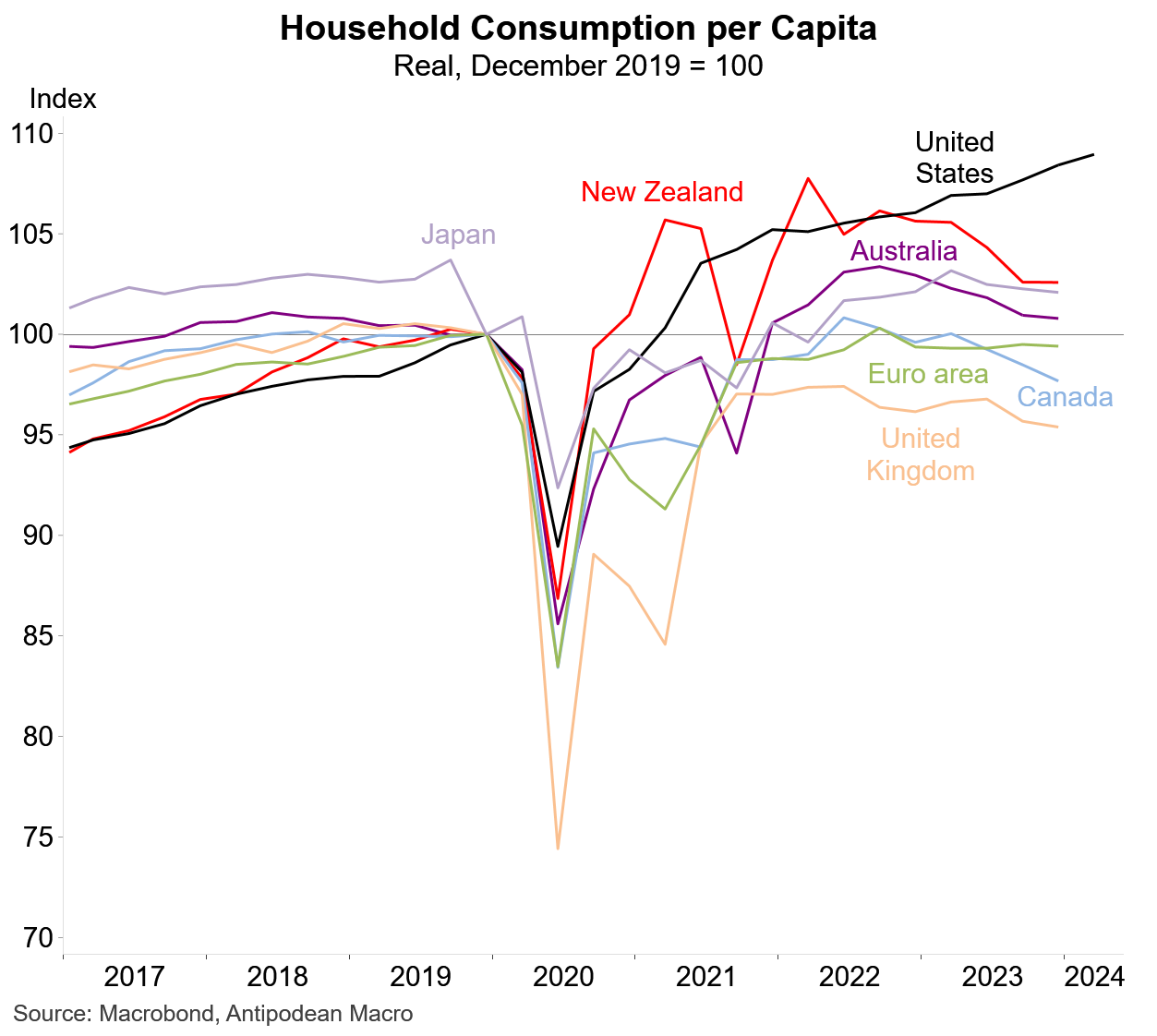

10. The US consumer continues to bound ahead on a global basis.

Discussion about this post

No posts