1. Core measures of monthly US CPI inflation dipped in February but the trend has been upwards for several months.

2. The share of the US CPI basket rising by more than 2.5% on an annualised monthly basis was well above average in January and February.

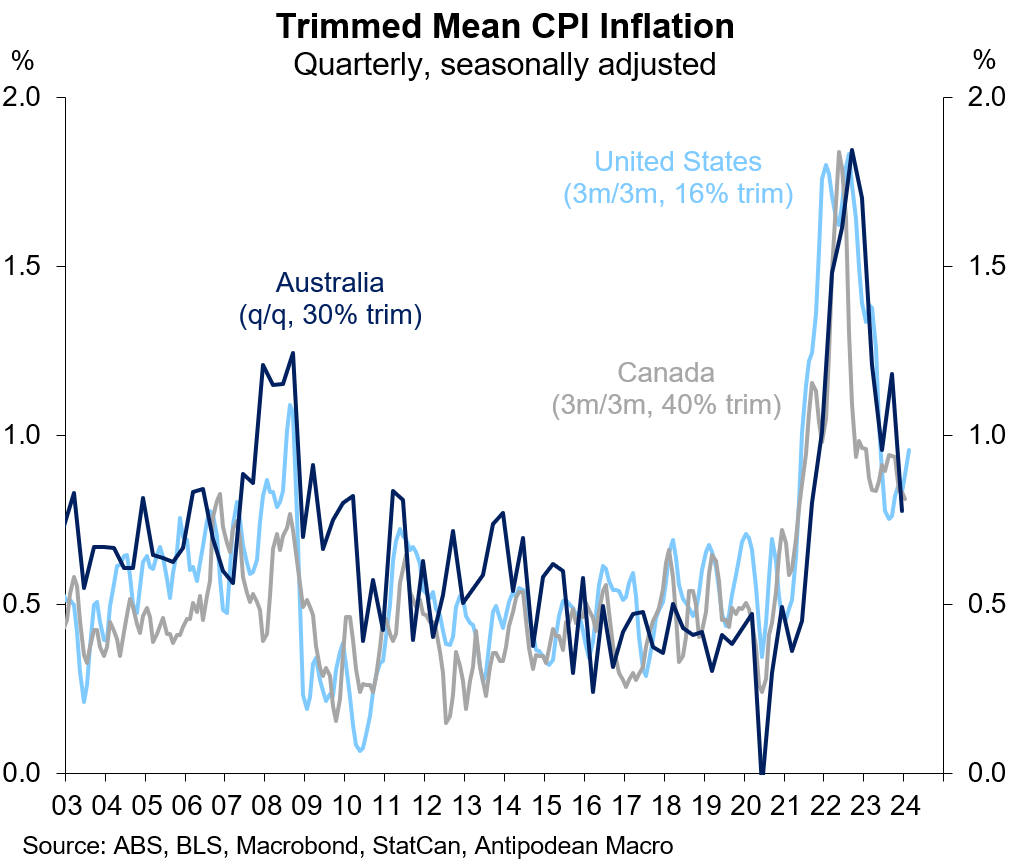

3. The takeaway for Australia, which has lagged developments in the US CPI, is to be wary of a re-broadening of (higher) inflation in the near-term.

4. US services CPI inflation - when measured similarly to how it’s done in Australia - has lifted meaningfully.

5. Despite relatively stronger productivity growth and slower growth in unit labour costs than other economies, services inflation in the US has reaccelerated noticeably since mid-2023 (after peaking the earliest).

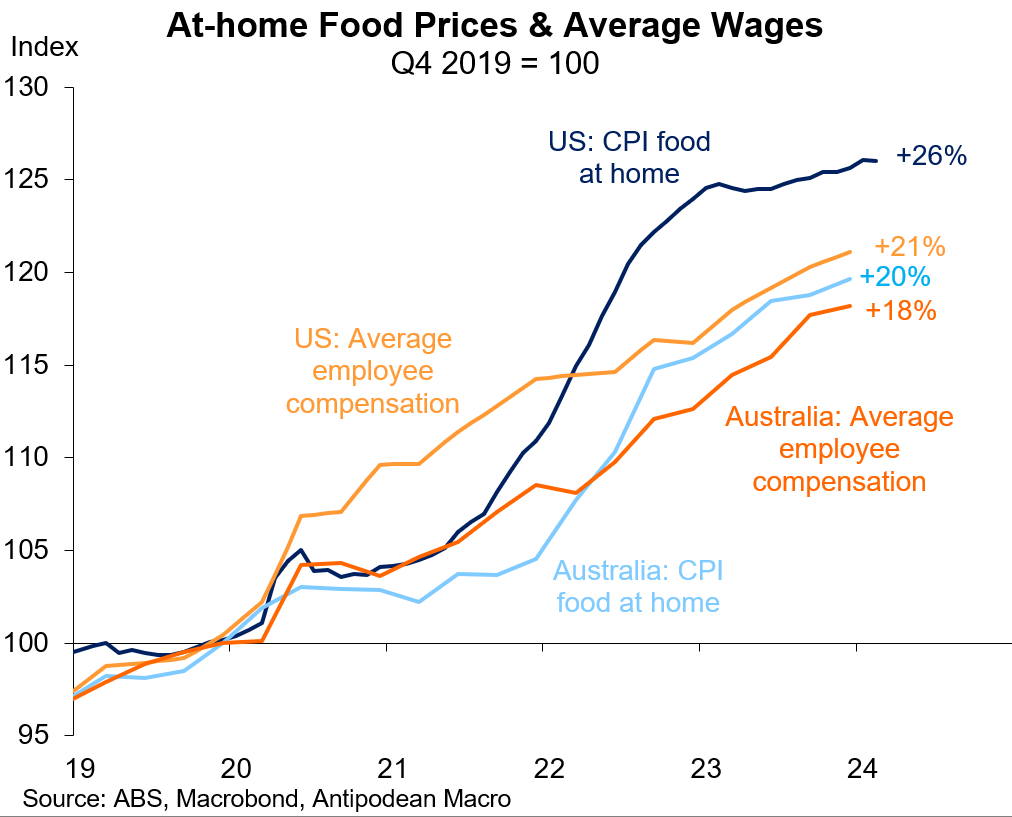

6. Since late 2019, food prices (ex eating out & takeaway) in the US have risen 26% compared with 20% in Australia. Average wages per worker have risen by a little more in the US than Australia (+21% vs +18%) over that period, but the food inflation difference is larger.

7. Food prices fell 0.6% m/m in New Zealand in February, with declines recorded for fresh and grocery items. On an annualised 3m/3m basis, total food inflation was just 0.3% in February. Within the total, eating out & takeaway prices were rising most strongly at a 3.5% annualised rate.

8. CBA’s Household Spending Indicator - based on their internal payments data - suggests that nominal consumption growth in Australia remained weak in February (note that this indicator significantly undershot the official consumption growth data in early 2023).

Discussion about this post

No posts