1. The value of new housing loan commitments (ex refinancing) in Australia continued to trend higher in March.

2. Most of the pick-up in the number of Aussie housing loan commitments has been for purchases of existing homes (for owner-occupiers and investors).

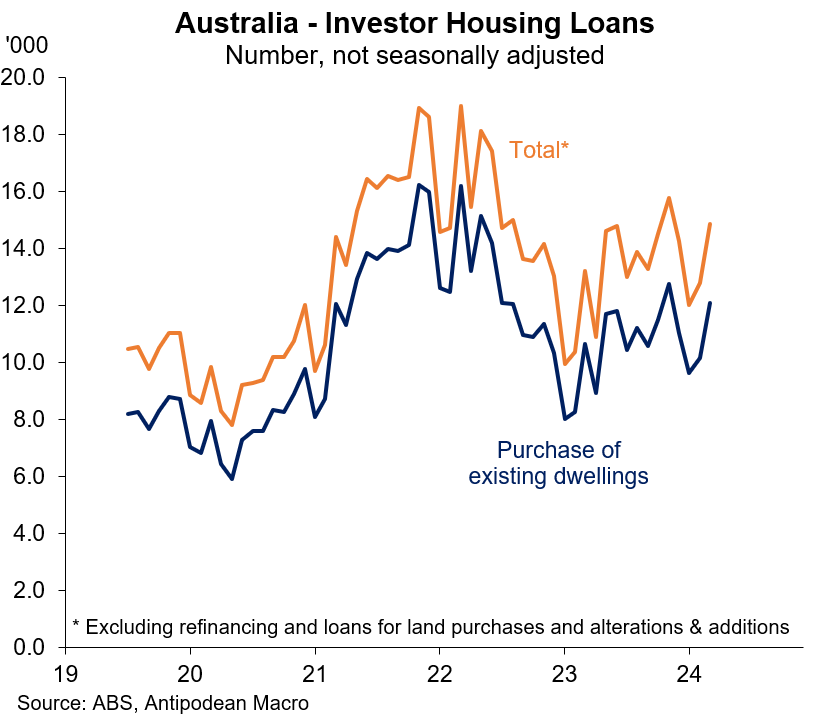

3. Investor housing finance is picking up in Australia with the usual lag to related Google search activity.

4. Very few Aussie housing loan borrowers are going fixed currently.

5. New motor vehicle registrations in Australia dipped a little in seasonally adjusted terms in April but remained at a high level.

6. The ABS’ monthly household spending indicator - which covers ~64% of total household consumption - rose 3.1% y/y in Q1.

If replicated in the national accounts, this would imply quarterly nominal growth of 1.3% q/q (in the consumption categories covered). Even allowing for inflation this would imply positive real growth in the quarter.

The monthly indicator, however, was boosted by the earlier timing of Easter this year. The national accounts consumption measure (and retail sales) adjusts for the timing of Easter in the seasonal adjustment process.

Moreover, the spending indicator data have not proved to be a reliable partial indicator for household consumption in the past.

7. Stronger spending on recreation & culture accounted for ALL of the net quarterly increase in the Australia household spending indicator in Q1. This is likely to partly reflect the “Taylor Swift” effect.

8. An underappreciated factor in Australia's productivity underperformance relative to the US over time is the massive terms of trade boom since the early 2000s.

Aussie businesses, in aggregate, haven't needed to try as hard for efficiency gains due to the "free" income kick.

Discussion about this post

No posts