ONLY CHARTS is only available to paid subscribers.

A 7-day free trial is available below. Group discounts are available here.

Antipodean Macro’s in-depth research is available here.

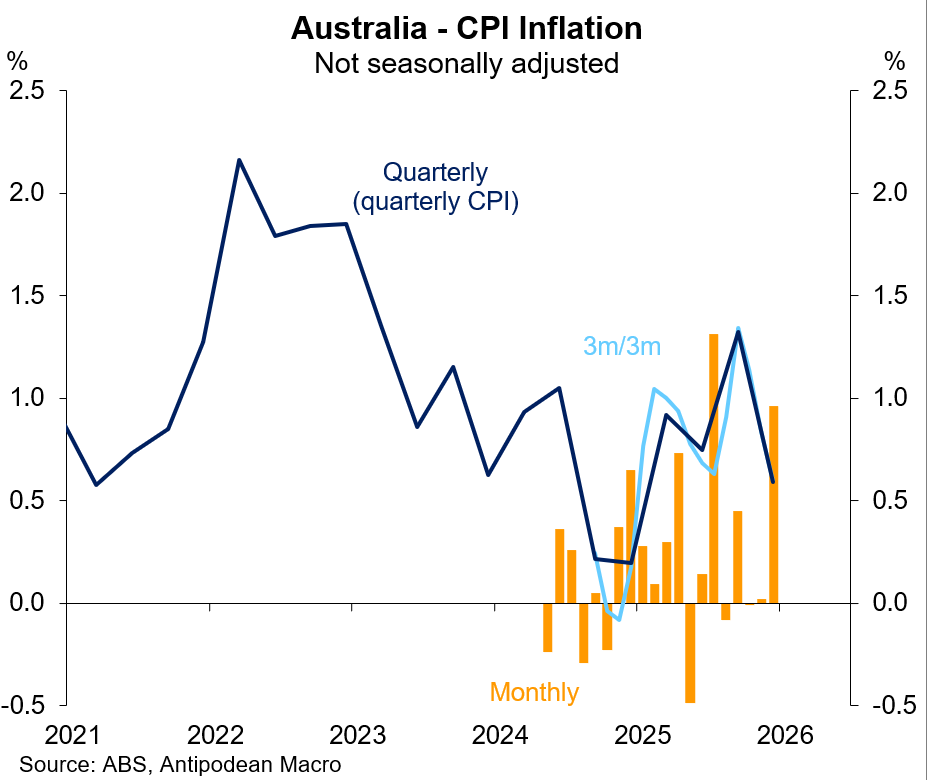

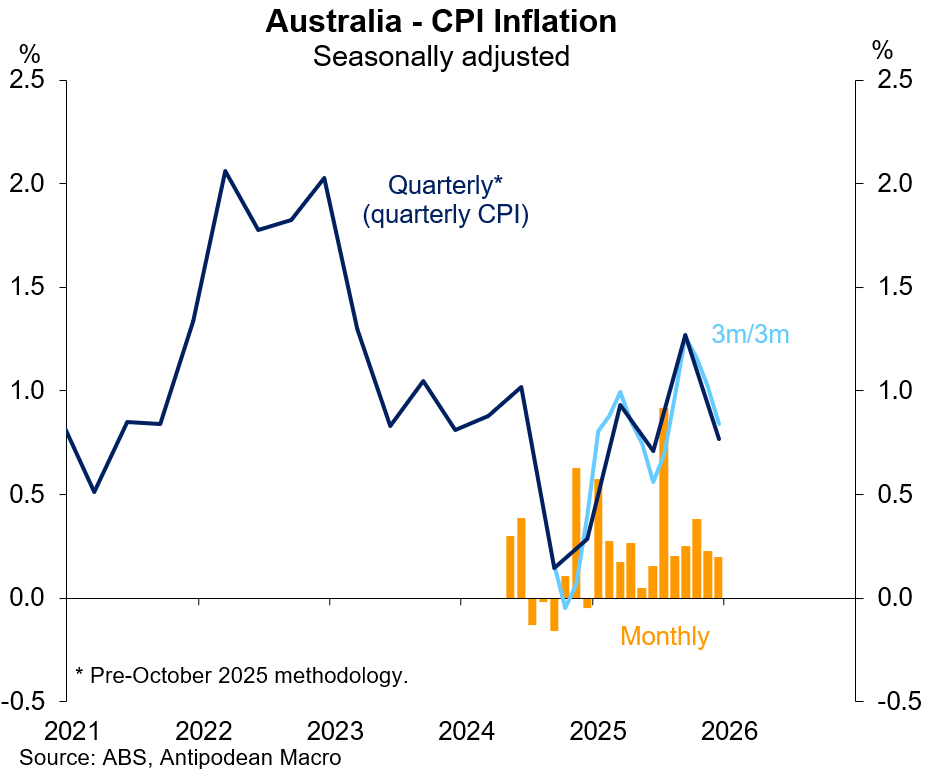

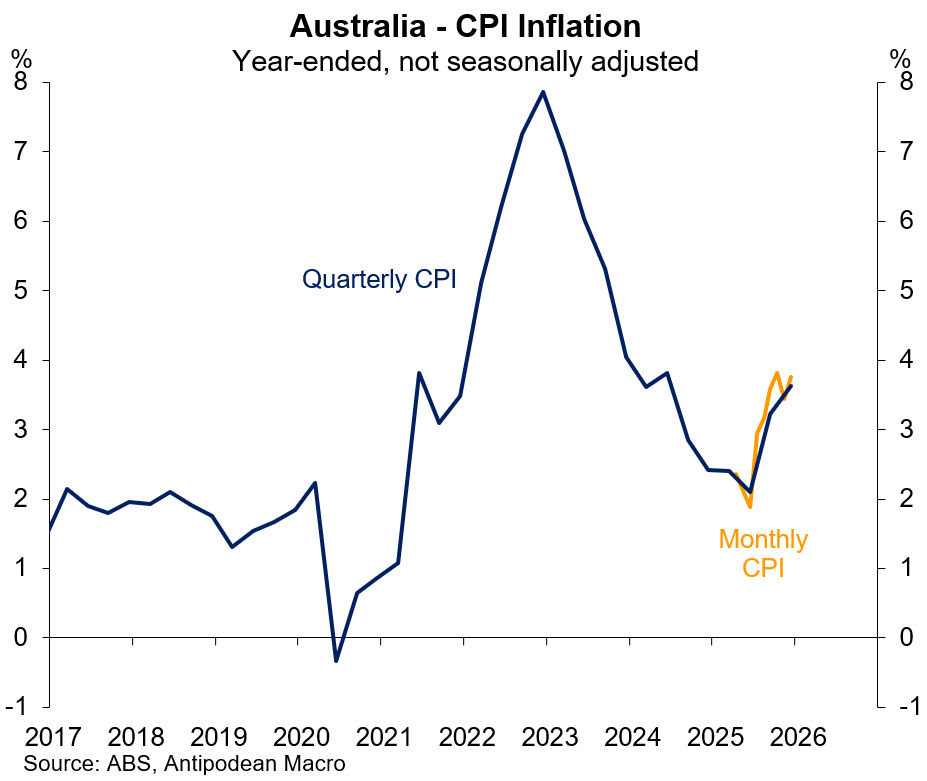

The key takeaway from today’s Aussie CPI data is that underlying inflation towards the end of 2025 was noticeably stronger than the Bank had anticipated in early November. It will take some creative communication to avoid a cash rate hike next week. Our view is a hike will happen but the Board will remain open-minded about the next steps for the cash rate.

1. Australia’s monthly CPI rose +1.0% m/m in December in original terms and rose +0.2% m/m after seasonal adjustment. Both were 0.1-0.2ppts higher than our nowcasts.

Year-ended CPI inflation was +3.8% y/y, up from +3.4% y/y in November.

The table below provides more detail on the CPI by key groupings, including on a 3m/3m basis.

Keep reading with a 7-day free trial

Subscribe to Antipodean Macro to keep reading this post and get 7 days of free access to the full post archives.