1. High-fives all around for the slightly softer-than-expected flash euro area CPI inflation for March. Services inflation, however, remained sticky.

2. Some better news on services inflation coming out of the US non-manufacturing ISM for March.

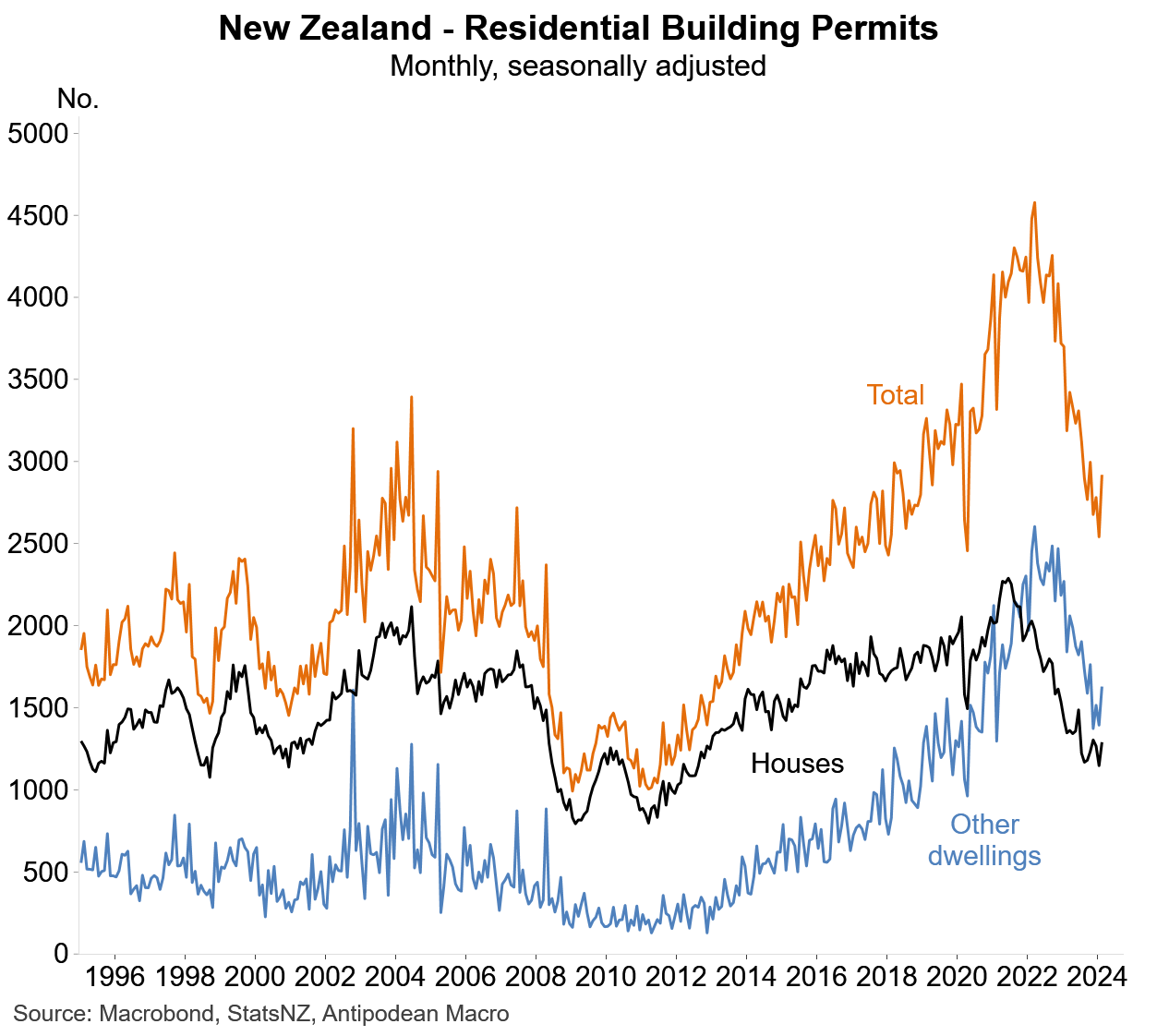

3. The number of residential building permits issued in New Zealand bounced back in February. Consents for houses remained around the lowest level in a decade.

4. The value of residential building in New Zealand is likely to decline further over 2024.

5. Non-residential building in New Zealand is holding up relatively well.

6. The number of home building approvals in Australia fell 1.9% m/m in February despite a bounce in detached house approvals (this also occurred in February in the prior 3 years so hints at changing seasonal patterns).

7. Weak sales of detached houses in Australia suggest that the statistical bounce in house building approvals is noise.

8. The value of home building approvals in Australia is below the long-run average but remains well above historical troughs.

9. The average value of home building approvals in Australia has increased by nearly 50% since early 2020 (houses +44%; apartments +61%).

10. The value of non-residential building approvals in Australia has fallen sharply amid weakness in public-sector project approvals.

11. The number of motor vehicle registrations in Australia bounced back in February/March, but declined in the March quarter as a whole.

12. Year-ended growth in nominal household consumption appears to have ticked higher again in February (but this is likely to at least partly reflect base effects).

Discussion about this post

No posts