ONLY CHARTS #463

Aus consumer spending, Aus trade, RBA pricing, Aus temporary visa holders, Aus motor vehicle sales, Aus wage share of income, NZ building

ONLY CHARTS is available to paid subscribers.

A 7-day free trial is available below. Group discounts are available here.

Antipodean Macro’s in-depth research is available here.

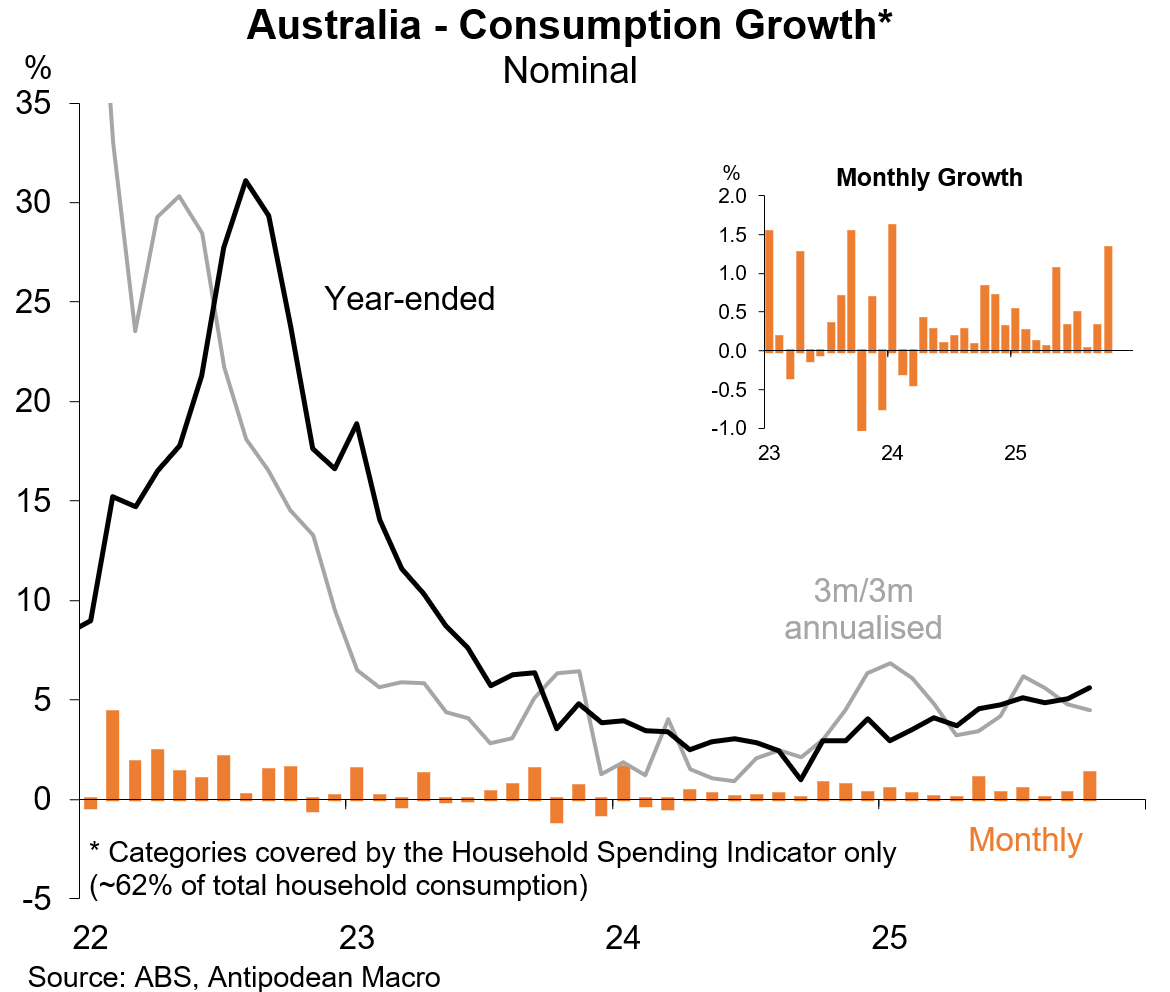

1. The ABS’ nominal household spending indicator rose a robust +1.3% m/m in October. This was the largest monthly increase since January 2024 and was led higher by discretionary spending (+1.7% m/m).

The ABS suggested that spending on goods (+1.7% m/m) was supported by “promotional events [which] saw households spend more on clothing, footwear, furnishings and electronics”.

A problem with that argument is that it is really supported supported by the ABS’ monthly CPI which showed solid price rises for clothing & footwear (+0.5% m/m), furniture (+2% m/m), household textiles (+1.7% m/m) and household appliances, utensils & tools (+1.1% m/m).

The ABS also noted that services spending (+0.8% m/m) was supported by “major concerts and cultural festivals [which] drove up demand for catering, hospitality and hotel stays”.

2. Australia’s merchandise trade surplus widened by nearly $700m in October to $4.4b. Nominal exports rose +3.4% m/m and imports grew +2% m/m. The A$ TWI was unchanged in October.

Keep reading with a 7-day free trial

Subscribe to Antipodean Macro to keep reading this post and get 7 days of free access to the full post archives.