ONLY CHARTS is only available to paid subscribers.

A 7-day free trial is available below. Group discounts are available here.

Antipodean Macro’s in-depth research is available here.

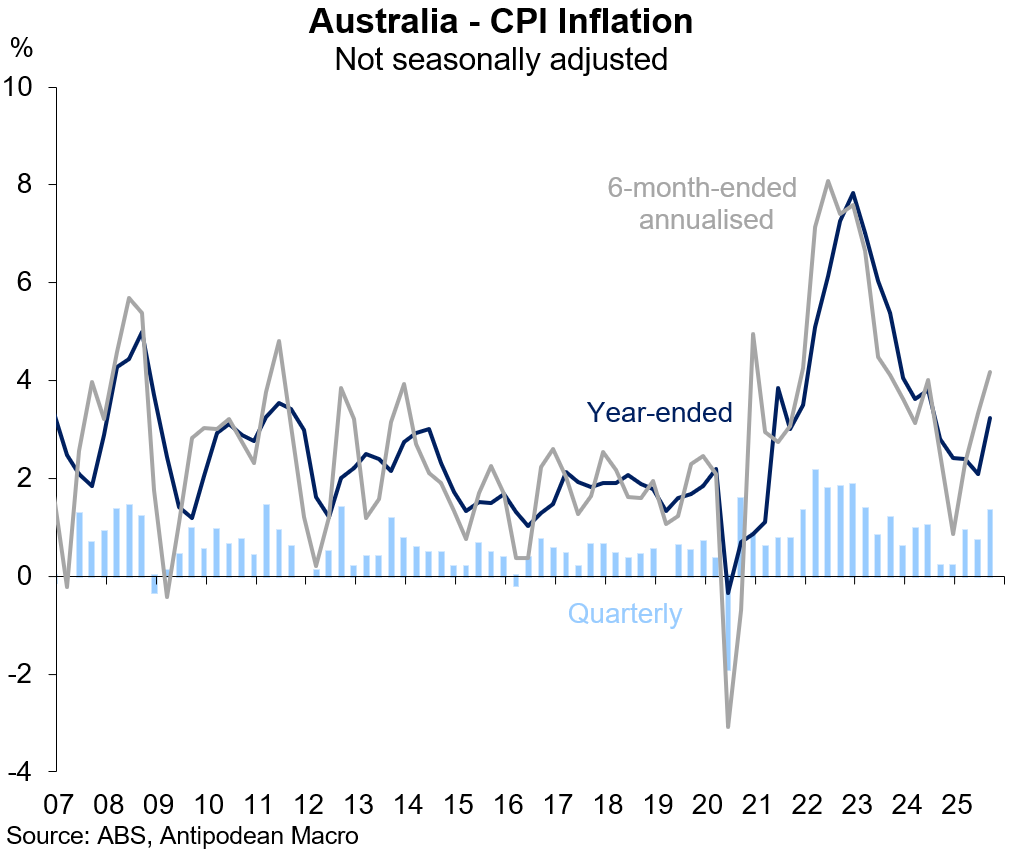

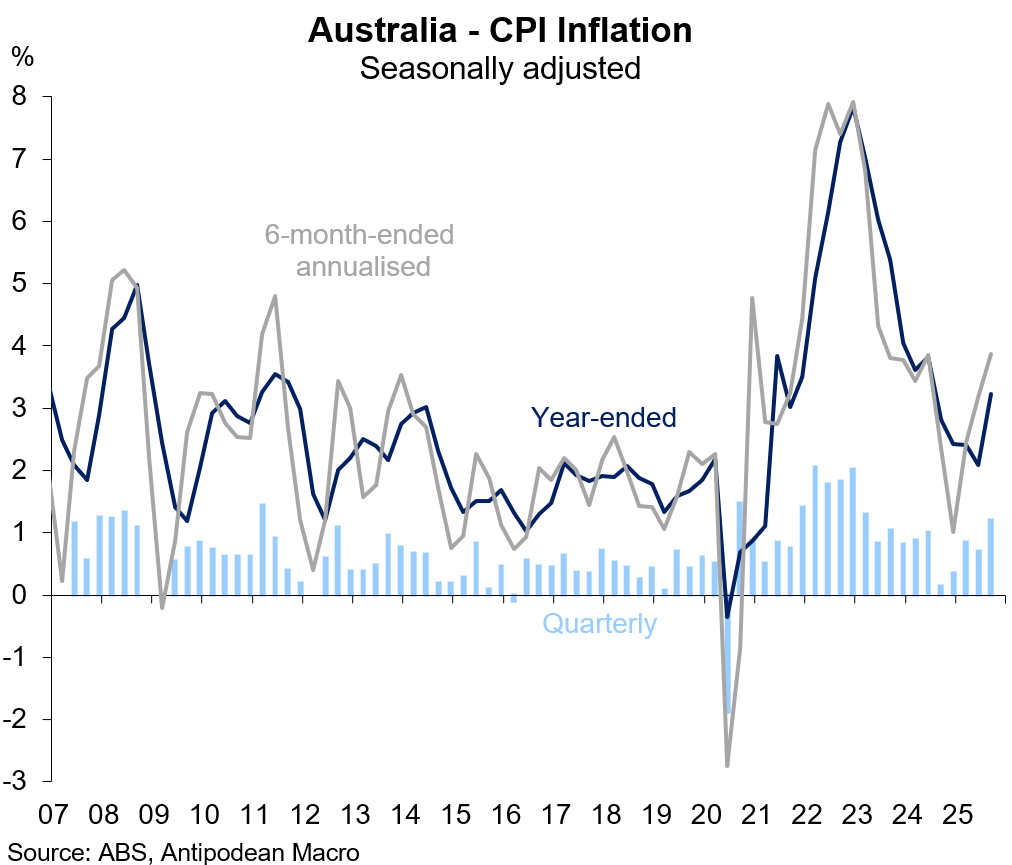

Australia’s Q3 CPI inflation all but confirms the RBA will be on hold next week and probably in December. It’s too early to call the policy easing cycle over, but the risks are rising of at least a long pause.

Trimmed mean inflation of +1% q/q was - to use Governor Bullock’s lexicon - “materially” above the RBA’s August SMP forecast.

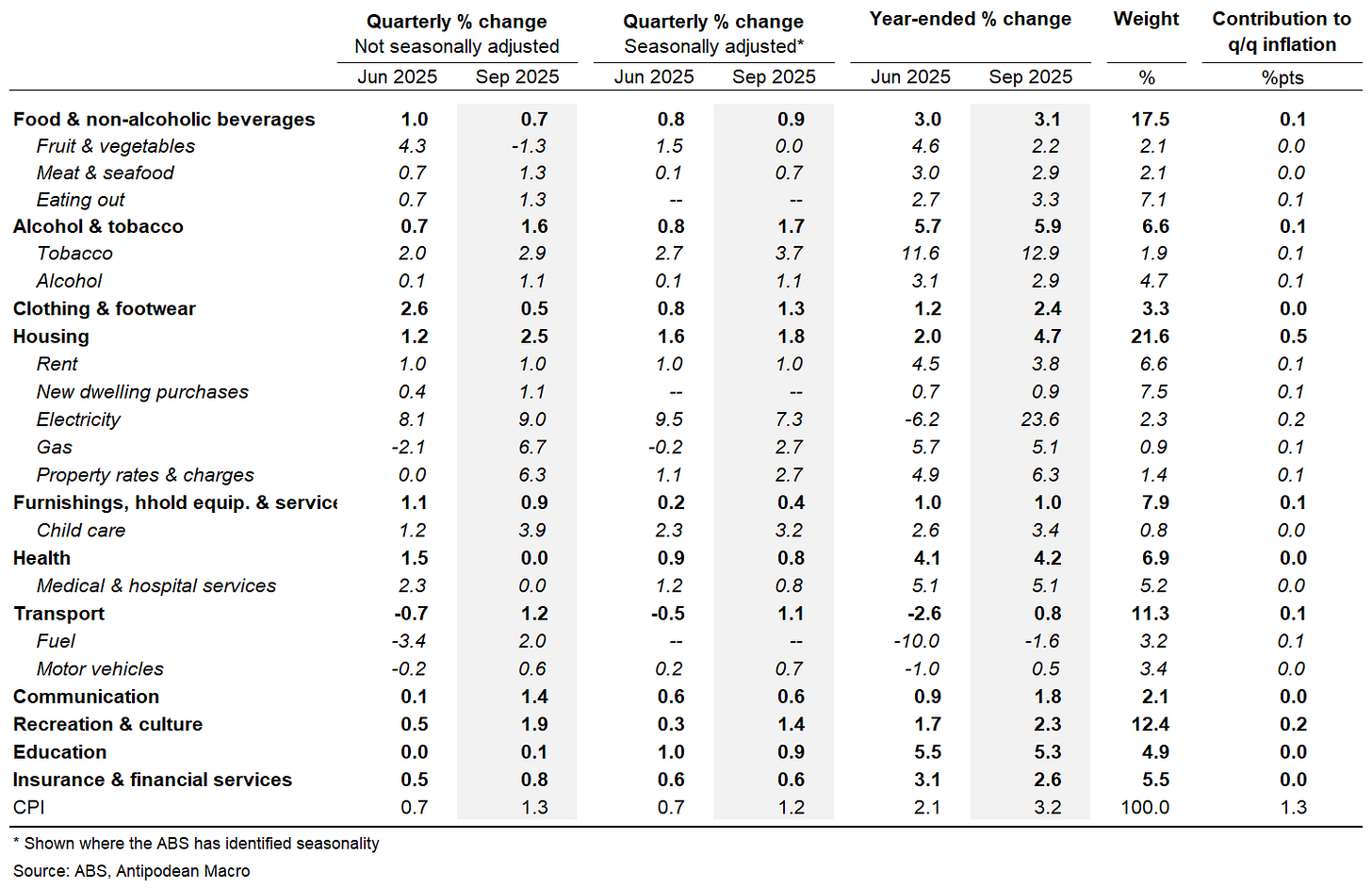

1. Australia’s Q3 headline CPI inflation of +1.3% q/q and +3.2% y/y was 0.2ppts above our expectation and consensus.

The seasonally adjusted CPI rose +1.2% q/q which was actually a touch LOWER than our nowcast of +1.3% q/q, suggesting that revisions to ABS seasonal factors played some role.

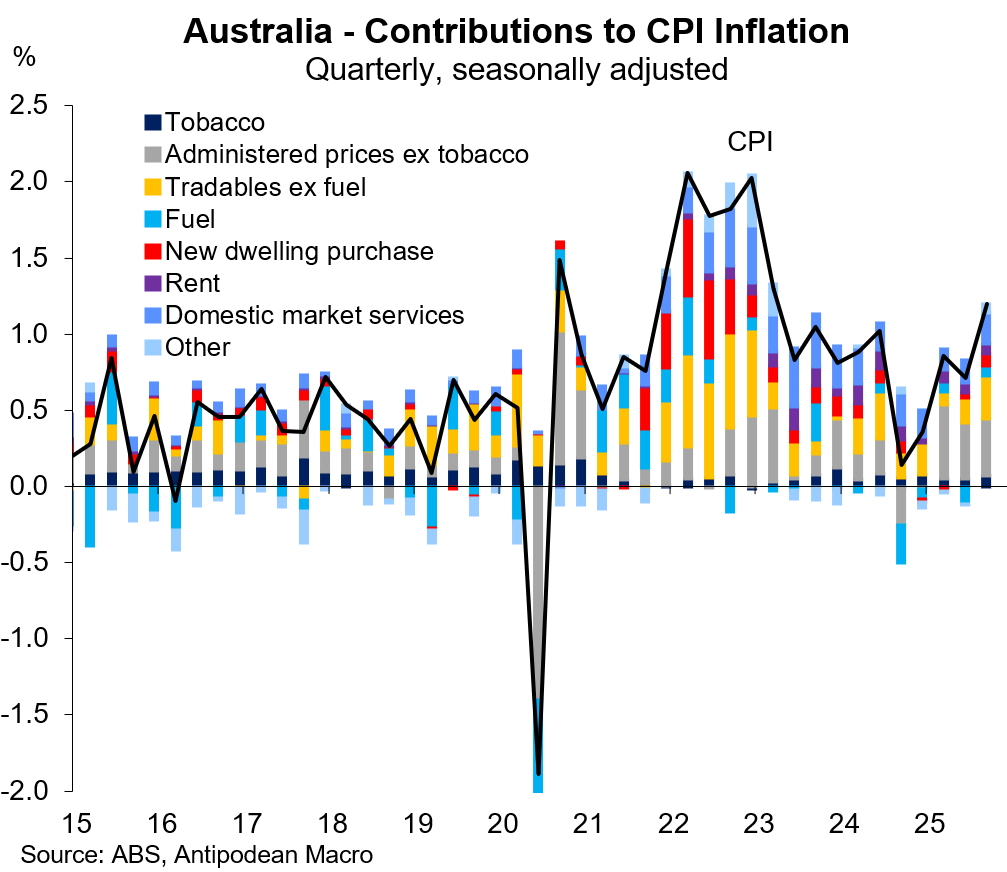

Stronger-than-expected administered and tradables price inflation accounted for most of our forecast error for headline inflation. This was largely because information contained in the monthly CPI indicator for the month of September printed above our estimates.

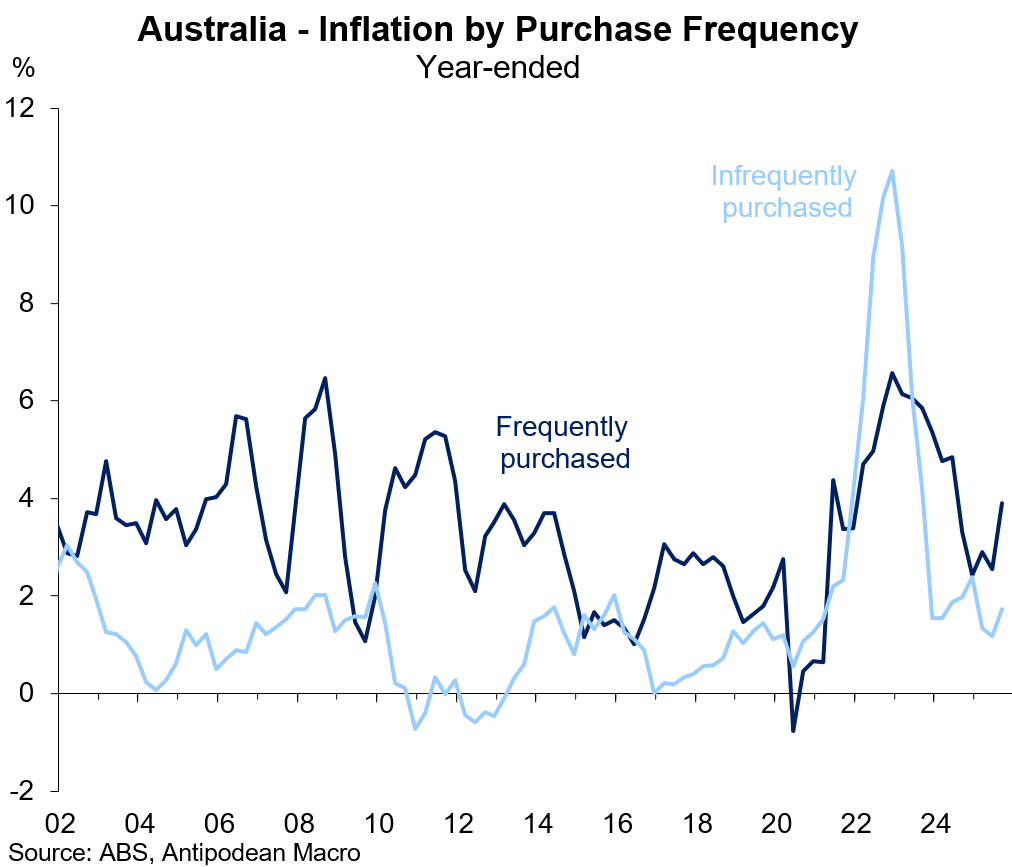

Inflation for frequently purchased goods and services picked up in Q3 and remained much stronger than for infrequently bought items. This may be feeding into the recent softening in consumer sentiment.

2. Trimmed mean CPI inflation was +1.0% q/q and +3.0% y/y.

This was much higher than consensus (+0.8% q/q) but only slightly higher than our final nowcast of +0.94% q/q (our preliminary nowcast was +1% q/q but we toned it down a bit).

Keep reading with a 7-day free trial

Subscribe to Antipodean Macro to keep reading this post and get 7 days of free access to the full post archives.