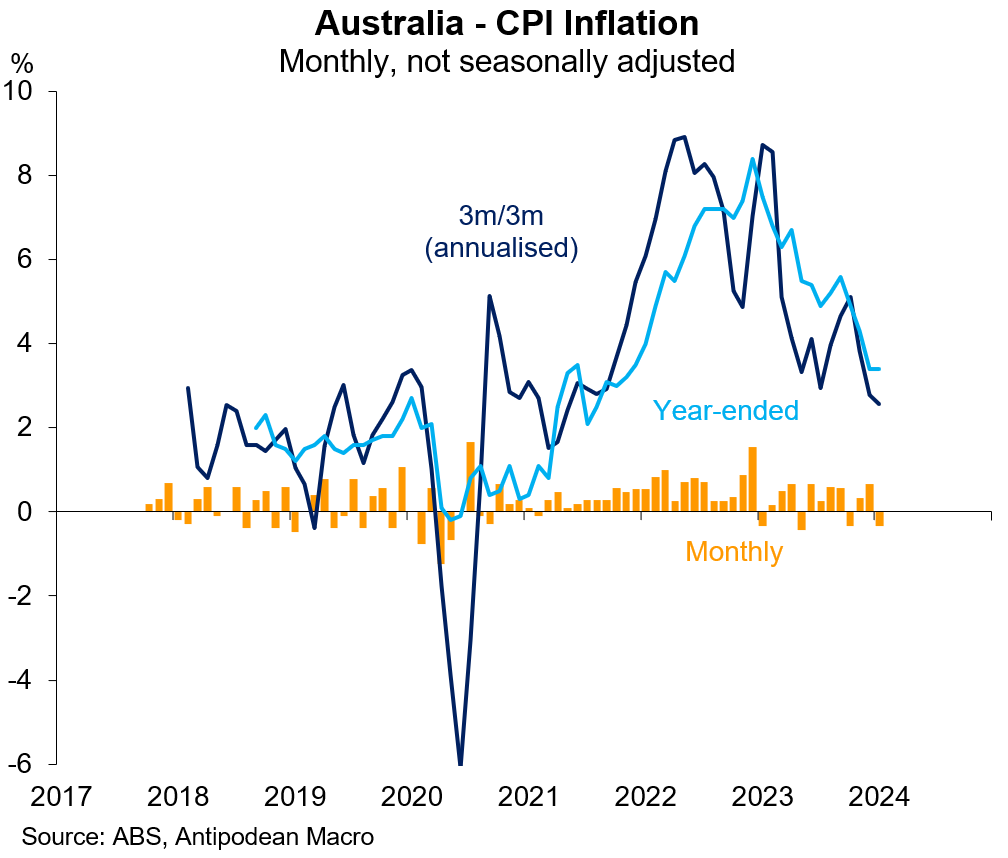

1. Australia’s monthly CPI fell 0.33% m/m in January and rose +3.4% y/y (mkt: +3.6% y/y). Our nowcast was for a fall of 0.2-0.3% m/m and a year-ended rise of +3.5%

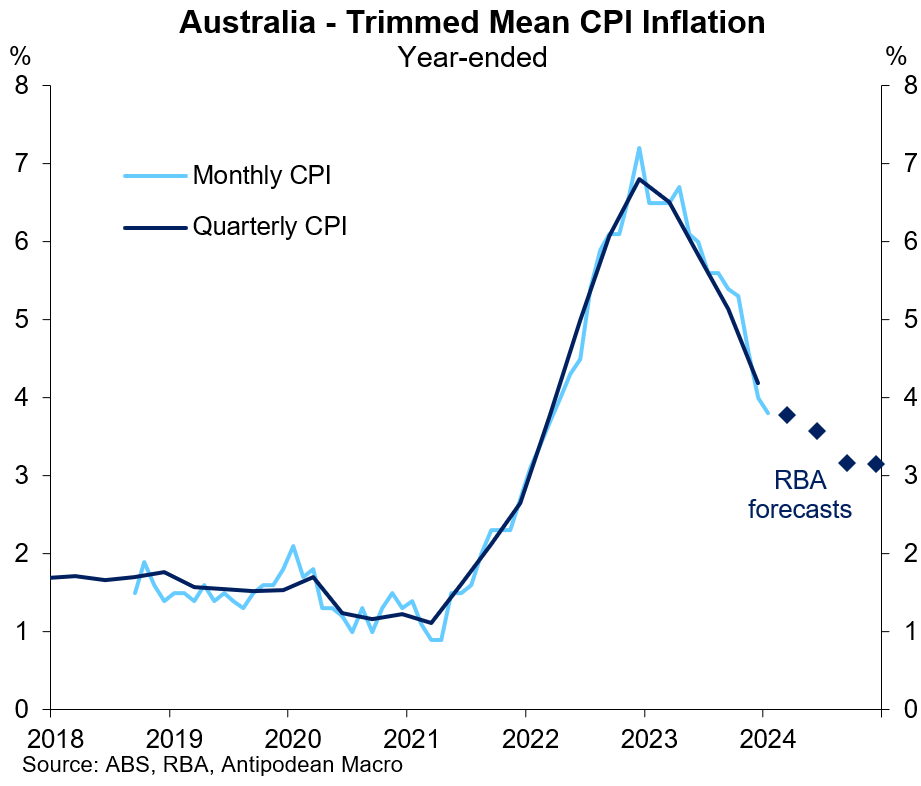

2. Year-ended trimmed mean inflation in Australia slowed to +3.8% y/y in January. This looks to be broadly on track, if not a bit lower, than the RBA’s forecast path

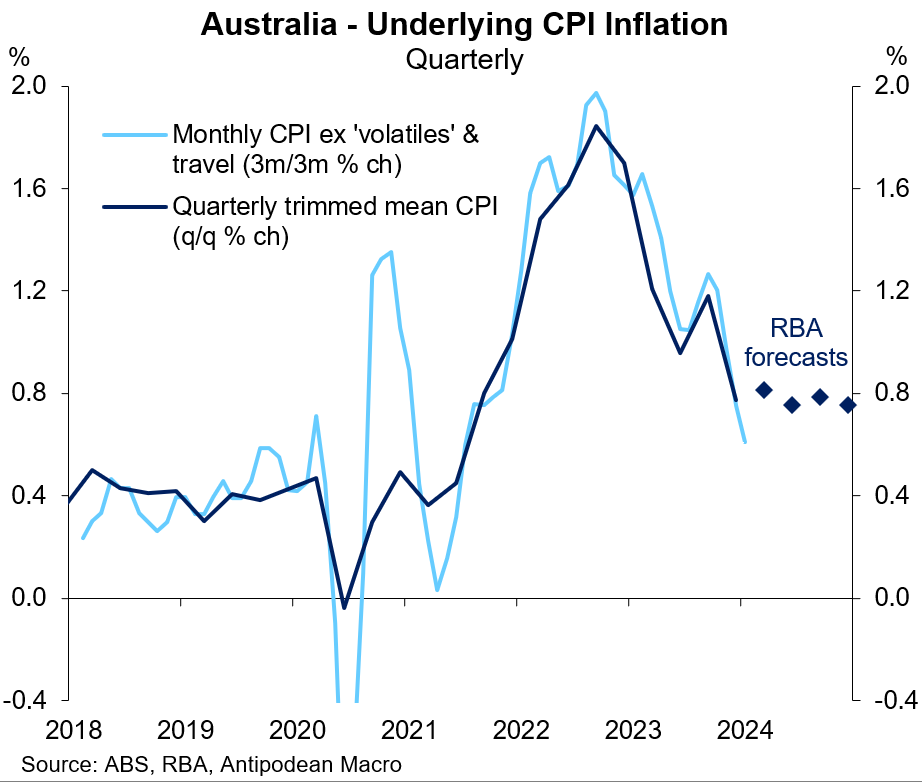

3. Excluding travel and ‘volatile’ items, the Aussie CPI rose just +0.2% m/m in seasonally adjusted terms in January and slowed further in 3m/3m terms (we had +0.3% m/m pencilled in)

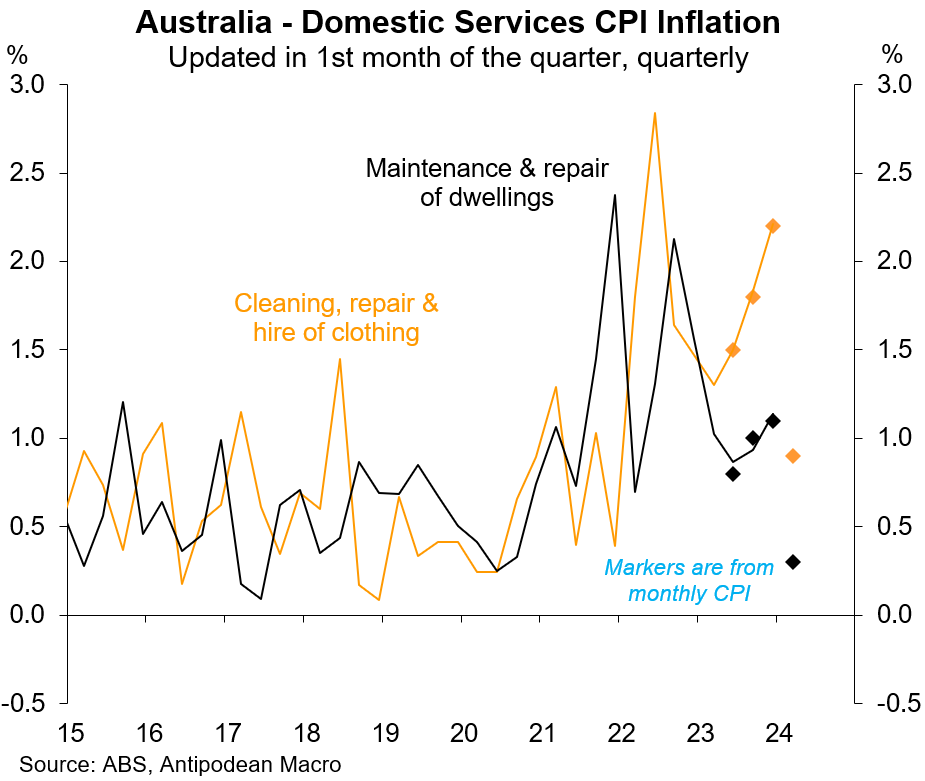

4. We recommended watching the two domestic services categories updated in the January Aussie CPI release. Both came in well under our expectations. While partly seasonal, the Bank will be encouraged by this - albeit partial - information on services disinflation

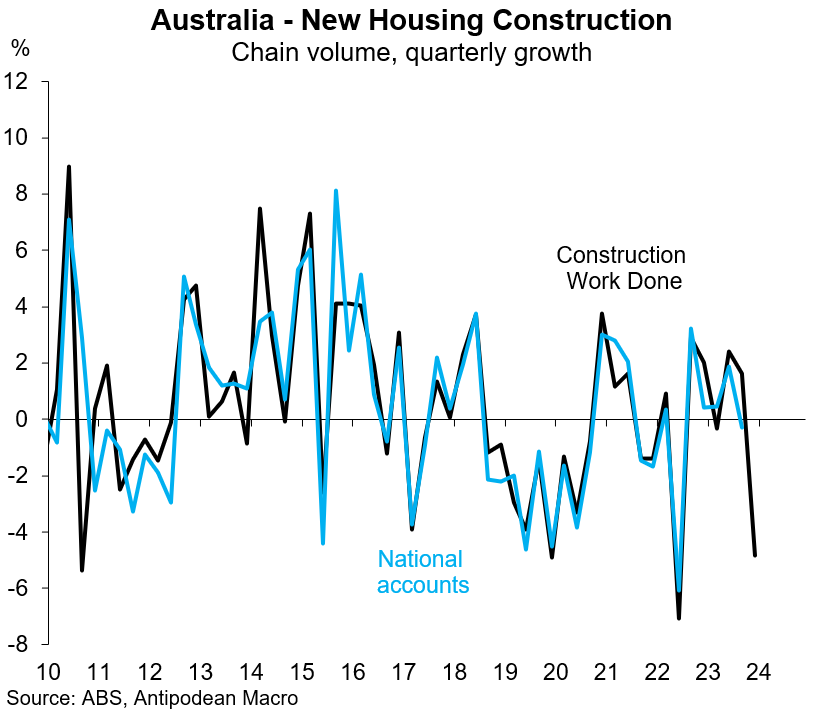

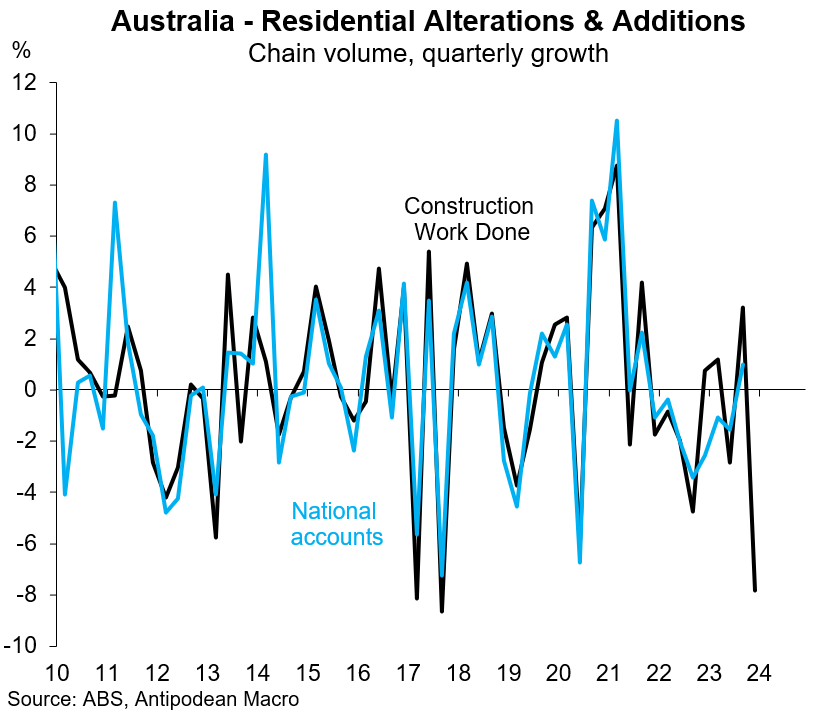

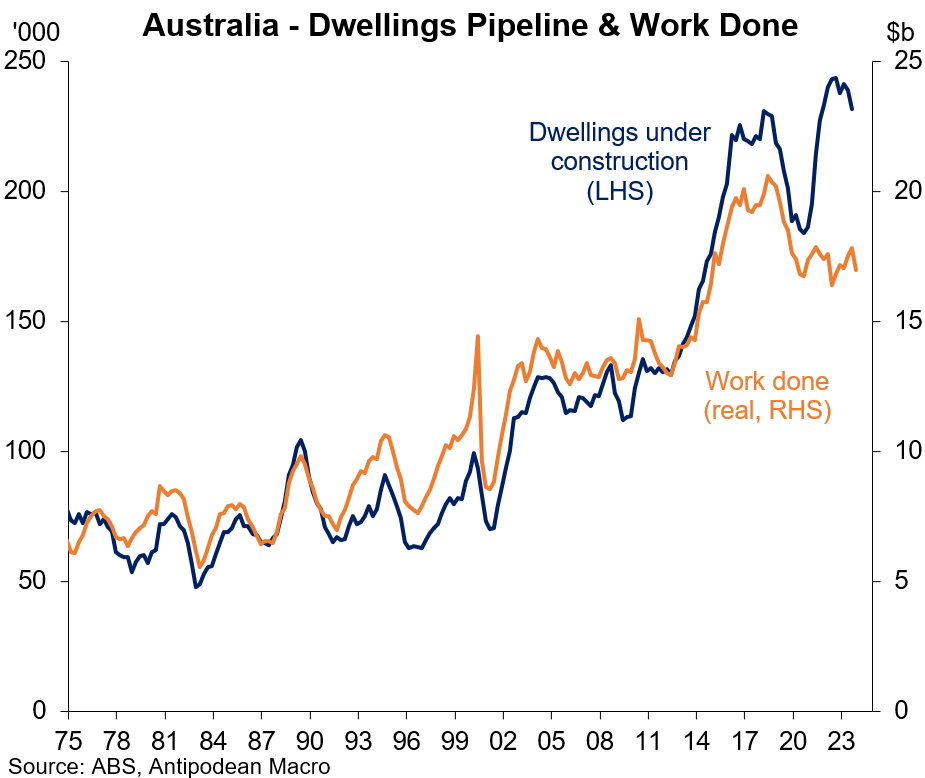

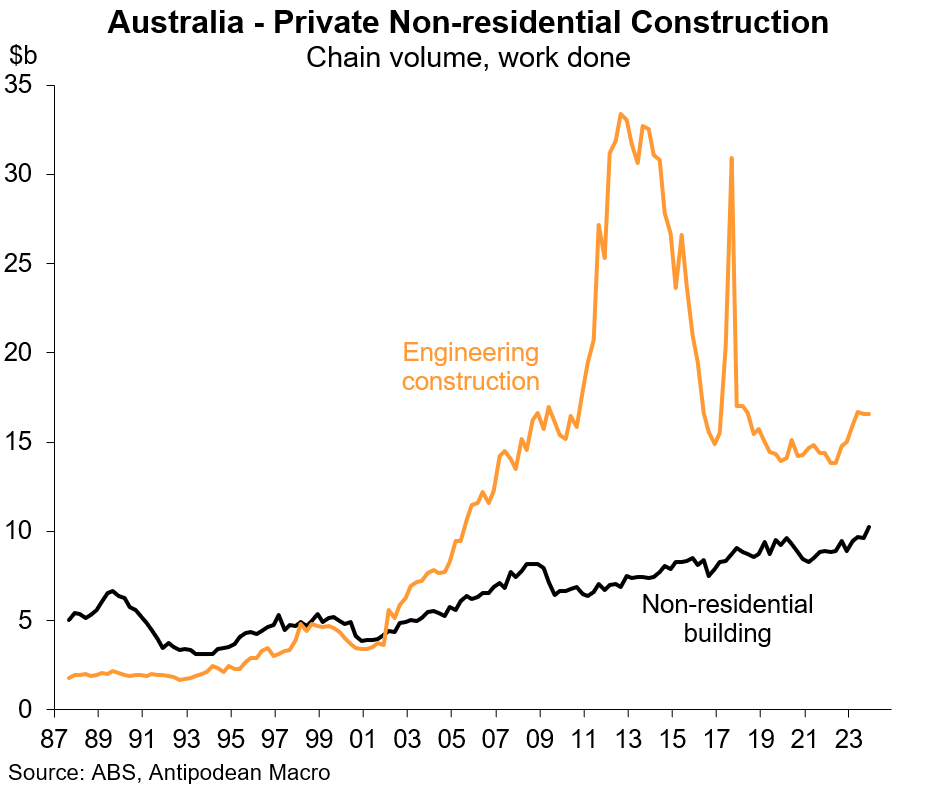

5. Q4 construction work done in Australia rose +0.7% q/q (mkt: +0.6% q/q). New housing construction and renovations activity fell sharply in the quarter as the pipeline of home building is falling from the peak

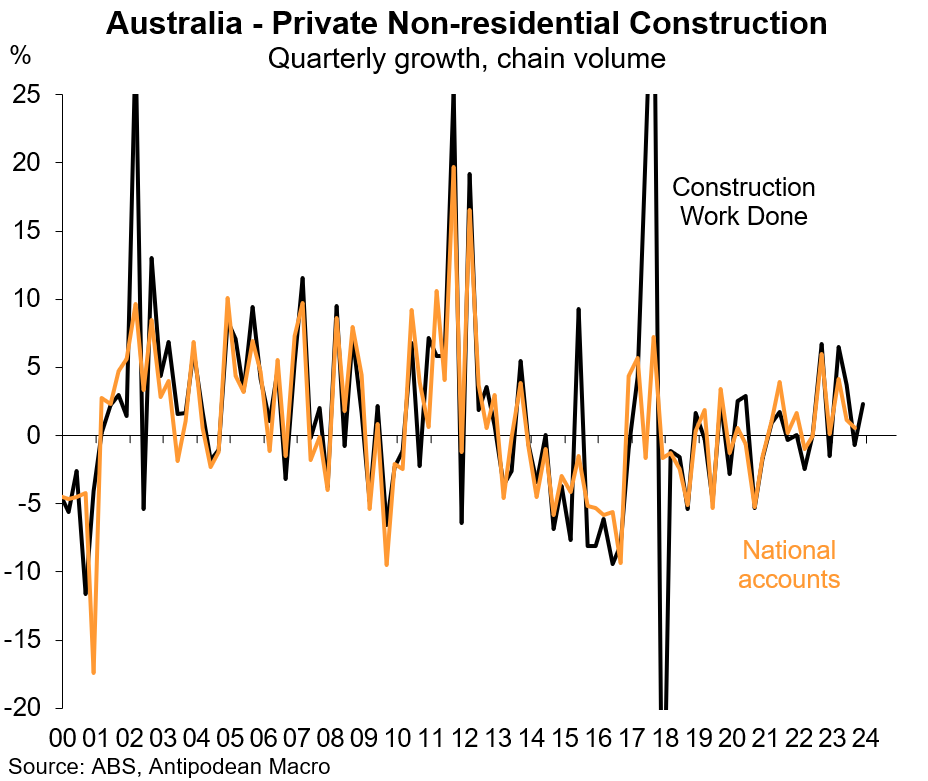

6. Private non-residential construction activity rose a solid +2.3% q/q in Q4 in Australia, led by a +6.5% q/q jump in non-residential building (engineering construction was broadly unchanged)

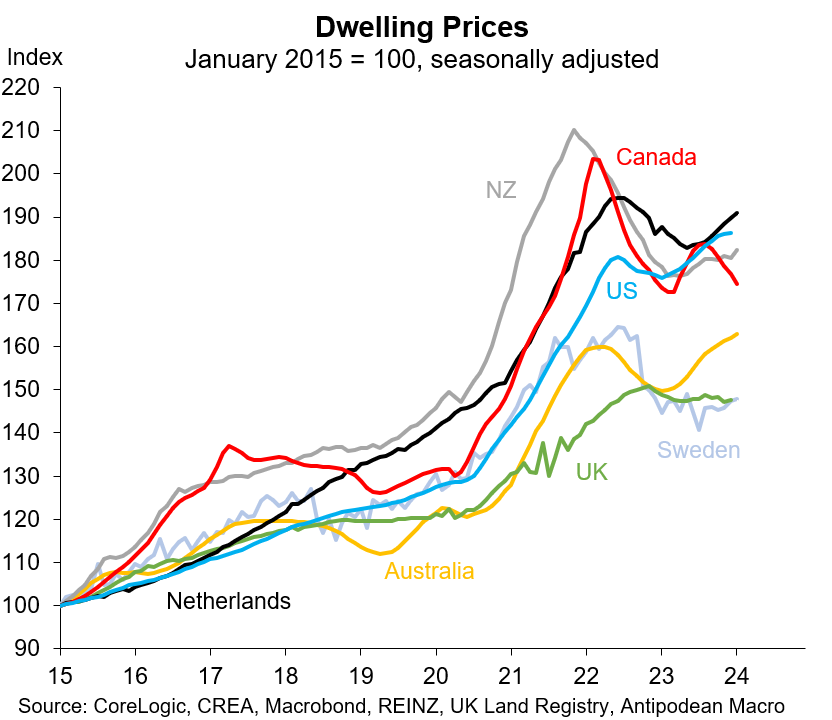

7. Canada has had a sharper pick-up in population growth than Australia and an enormous increase in ‘excess’ saving since the pandemic, yet dwelling prices have again turned lower

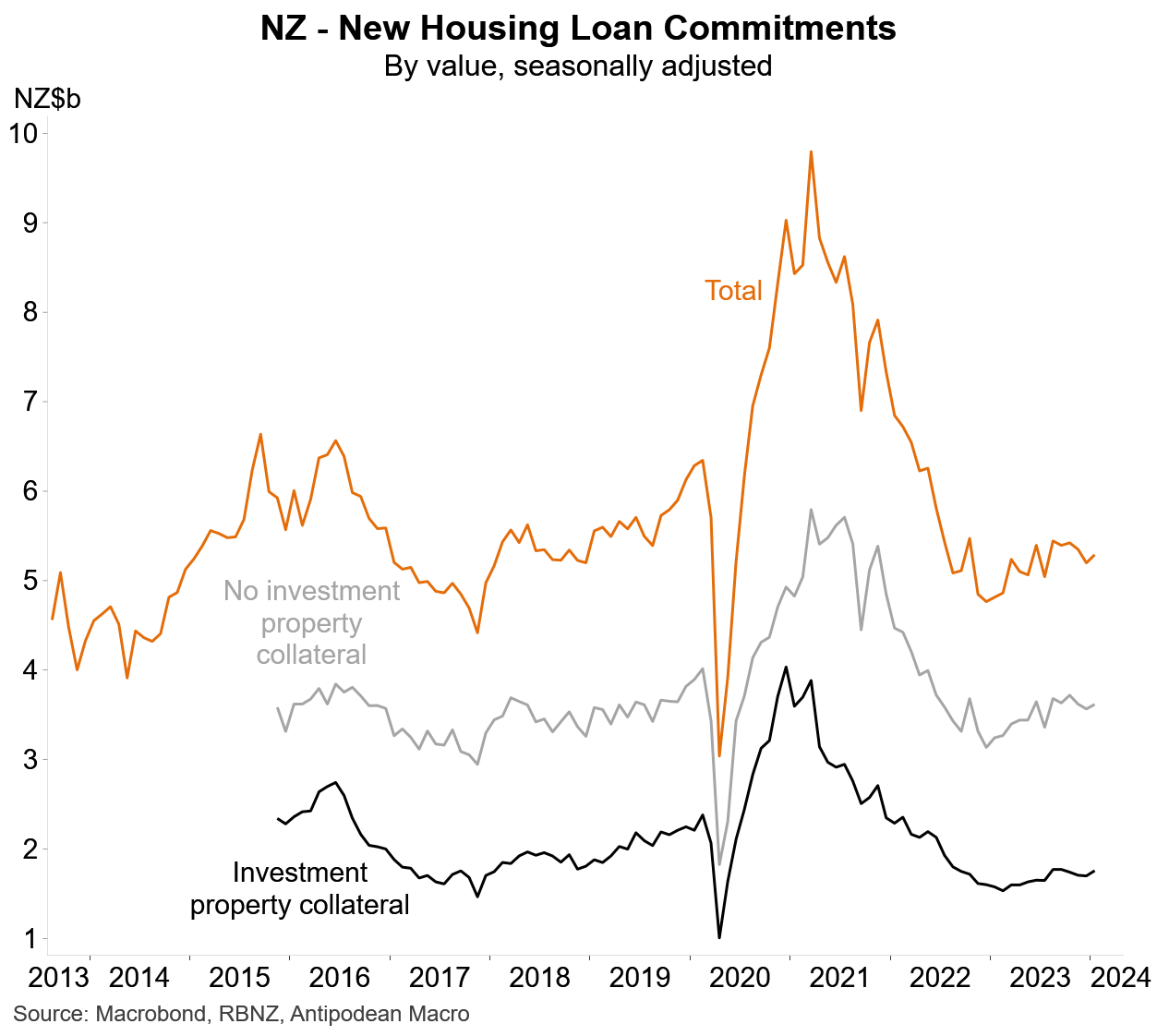

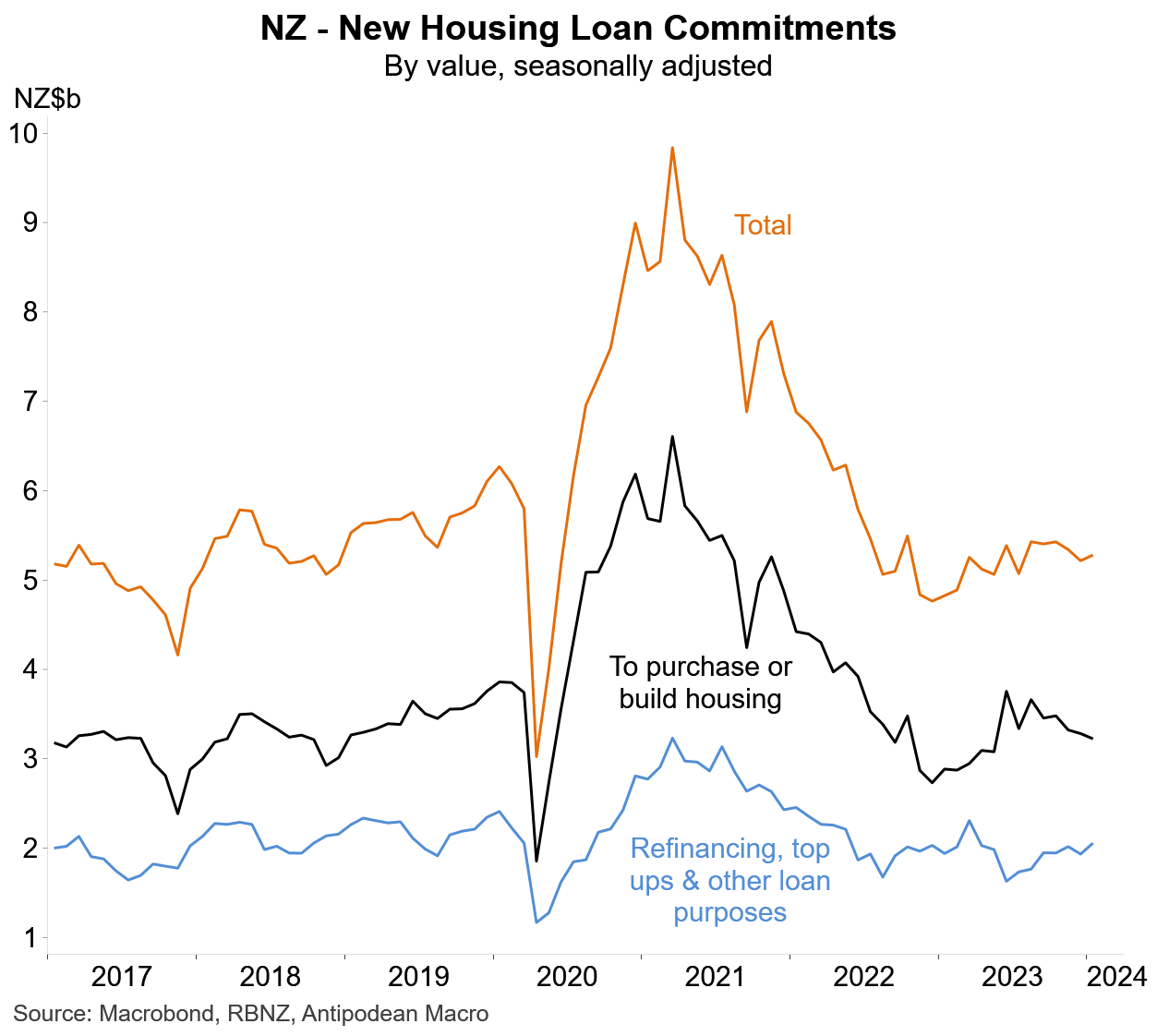

8. The value of new housing loan commitments in New Zealand rose modestly in January

9. …but the recent growth has been all in refinancing and top ups. Loan commitments to buy or build homes has been trending lower

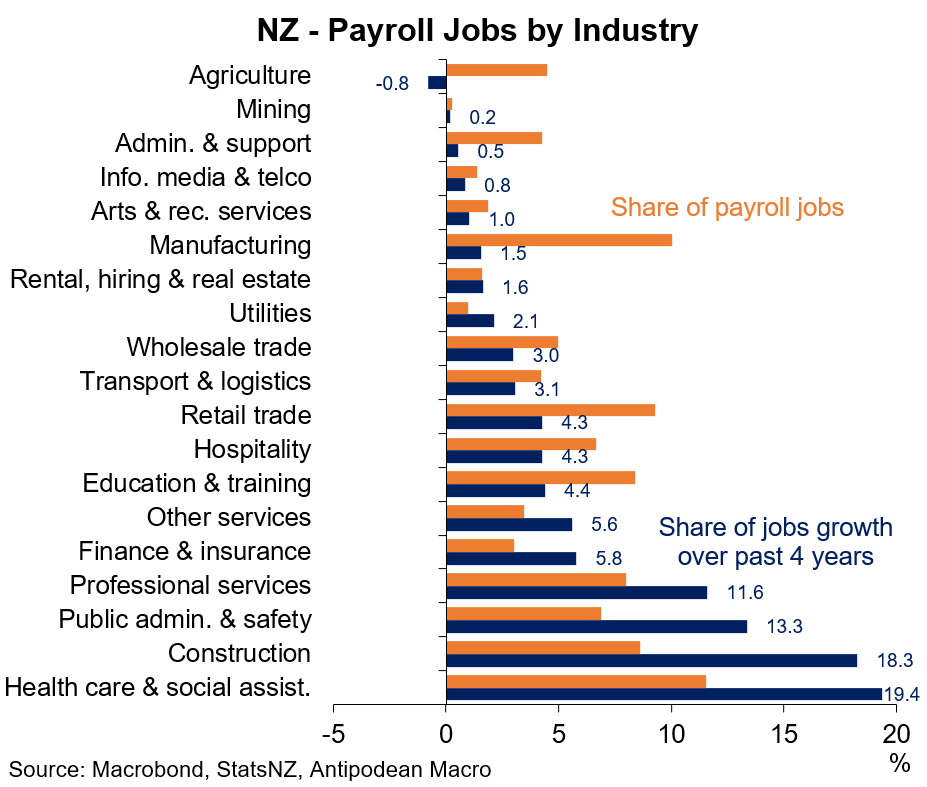

10. Four industries in New Zealand - health care & social assistance, public administration & safety, construction and professional services - accounted for 63% of payroll jobs growth over the 4 years to January. These industries account for 35% of jobs in New Zealand

Discussion about this post

No posts