1. We have shown that most of the easing in Australian labour market conditions has been for 15-24 year olds…

…which is quite normal during the early stages of an economic slowdown.

2. But what has been unclear is how much of a role has been played by the surge in potential labour supply of 15-24 year olds via stronger population growth.

3. Looking at New Zealand, we see a similar deterioration in the youth unemployment rate relative to that of 25+ year olds. The latter has also risen modestly, however, amid a weaker economy overall across the Tasman.

4. By historical standards, the increase in the kiwi youth unemployment rate has so far been relatively large…

…and it’s plausible that this is partly related to the fact that growth in the 15-24 year old population has recently been much stronger than during the few years prior to COVID (where it declined).

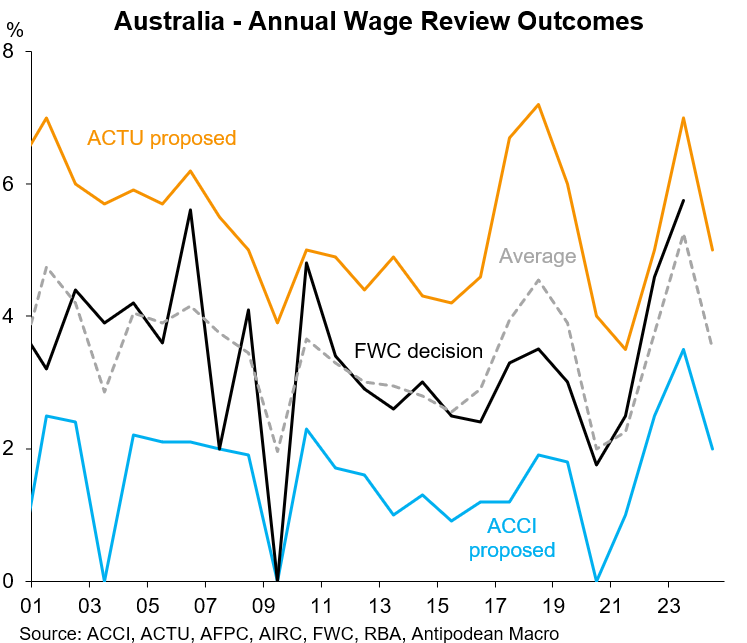

5. Both the ACTU (union) and ACCI (employer group) have recommended lower increases in Australia’s award wages and National Minimum Wage from 1 July. The average of the two submissions is 3.5%, though the Fair Work Commission has delivered higher outcomes than the average in recent years.

6. Proposed average annualised wage increases in enterprise bargaining agreements (EBAs) lodged with the Fair Work Commission in Australia have remained a bit below 4%.

Union agreements have continued to obtain much higher outcomes than non-union agreements.

7. The first April release for the slew of job ads series in Australia - the ANZ-Indeed measure - showed a solid rise in the number of jobs advertised in Australia in the month. This series has chopped around broadly the same level for the past 6-7 months.

8. Melbourne Institute’s headline and trimmed mean monthly inflation gauges for Australia declined in 3m/3m terms in April but haven’t recently provided a reliable read on the ABS data.

Discussion about this post

No posts