1. Australia’s monthly CPI rose +0.33% m/m and 4.3% y/y in November. This was close to our forecast for +4.4% y/y which we said had risks skewed to the downside.

2. We expected the reading for monthly year-ended trimmed mean CPI inflation to remain consistent with the RBA’s latest forecast and nothing has persuaded us from that view

3. The monthly underlying CPI inflation measure, which excludes fuel, fruit & veg, and travel prices, printed bang in line with our forecast of +0.25% m/m. Again, this is trending in line with the RBA’s Q4 trimmed mean inflation forecast

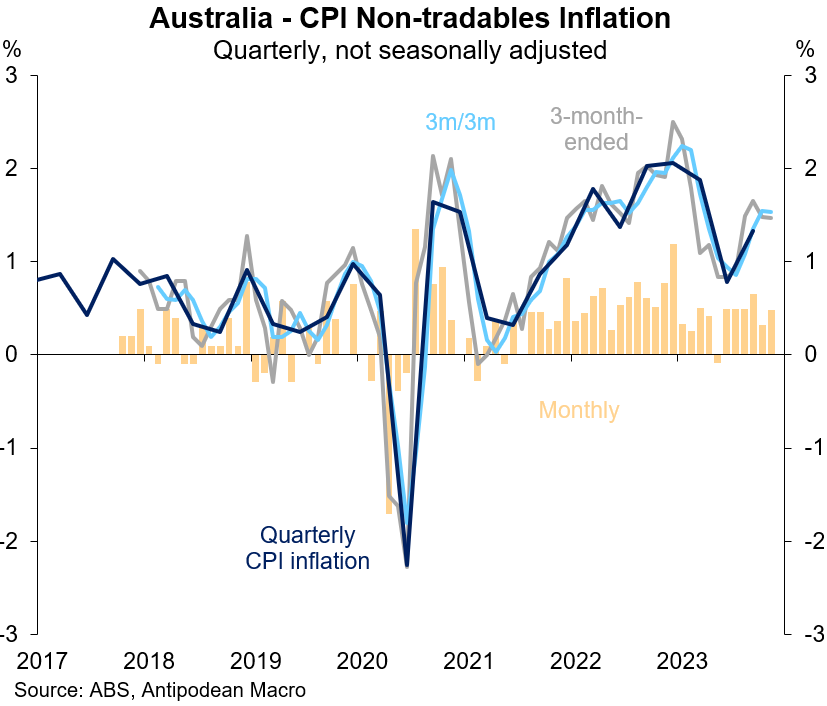

4. Unsurprisingly, most of the disinflation in Australia has been in the tradables component…

5. …with non-tradables inflation remaining elevated

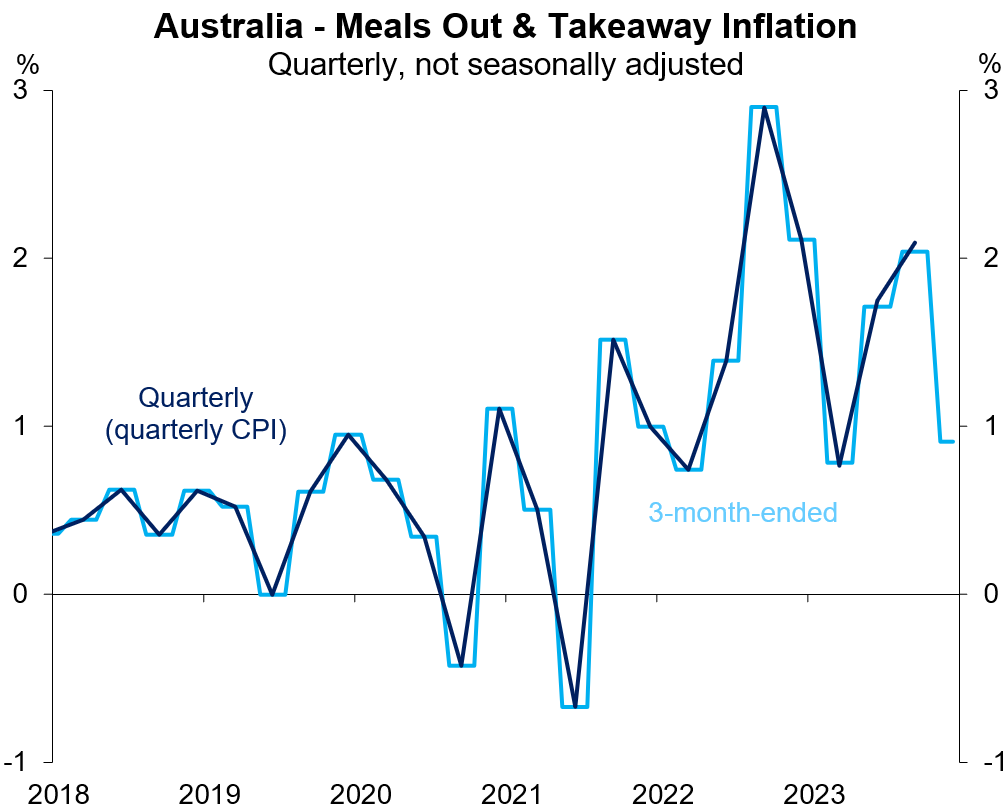

6. Updates on domestic market services inflation in Australia for Q4 were mixed, but overall it slowed in November because of slower price increases for eating out & takeaway

7. The ABS employer survey revealed just a 0.7% q/q decline in job vacancies in Australia over the 3 months to November. The job vacancy rate continued to fall…

8. …and we continue to slip back down the steepest part of the Beveridge Curve

9. Payroll jobs growth in New Zealand is running slower than growth in the working age population

Discussion about this post

No posts