1. Shout out to Gianna La Cava at e61 Institute for pointing this out.

The share of the Australian-born 15+ population in employment is lower than the peak prior to the GFC - in part this reflects aging of the population weighing on labour force participation.

Strikingly, however, migrants’ employment-to-population ratio in aggregate has risen significantly over time and since pre-COVID

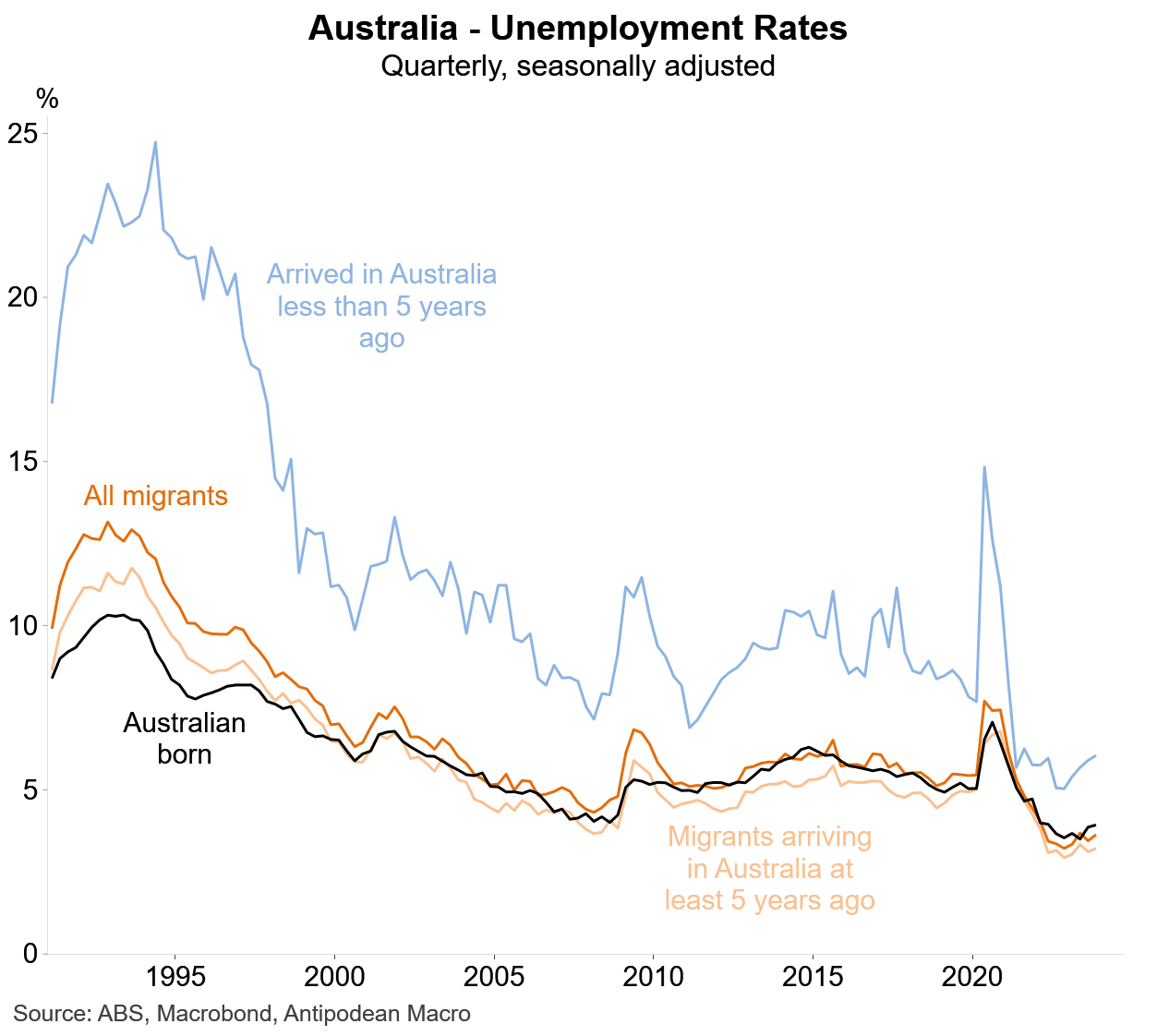

2. The unemployment rate for all migrants in Australia has remained below that of the Australian-born population for several quarters for the first time in more than 30 years

3. The volume of retail sales in Australia rose +0.3% q/q in Q4 2023 (mkt: +0.1% q/q). This was stronger than we had expected, reflecting that the retail deflator rose just +0.1% q/q, which was much lower than our CPI-based proxy for retail inflation. The Q3 outcome was revised down 0.3ppts to a fall of 0.1% q/q due to ABS seasonal re-analysis

4. Real household goods sales in Australia rose again in Q4, supported by discounting and the pick-up in housing turnover

5. Retailers never say no to stronger population growth

6. The share of retail sales in Australia conducted online continues to edge higher

7. New motor vehicle registrations in Australia fell again in January

8. Retail trade volumes in Australia and NZ have been much weaker than in the United States

9. The US ISM new orders indices improved in January but have been bouncing around similar levels for months

10. More importantly, and why we are flagging it here, is the pick up in US services firms’ reporting on supplier deliveries (slower) and prices paid (higher)

Discussion about this post

No posts