1. The number of job vacancies in Australia - as measured by the ABS employer survey - declined 6.1% over the three months to February for both the private- and public-sectors.

2. The Aussie labour market still sits relatively high on the Beveridge Curve.

3. Australia’s household debt-to-income ratio declined a little further in Q4 2023 but remained at a high level.

Relative to aggregate liquid assets, household debt is at a 22-year low.

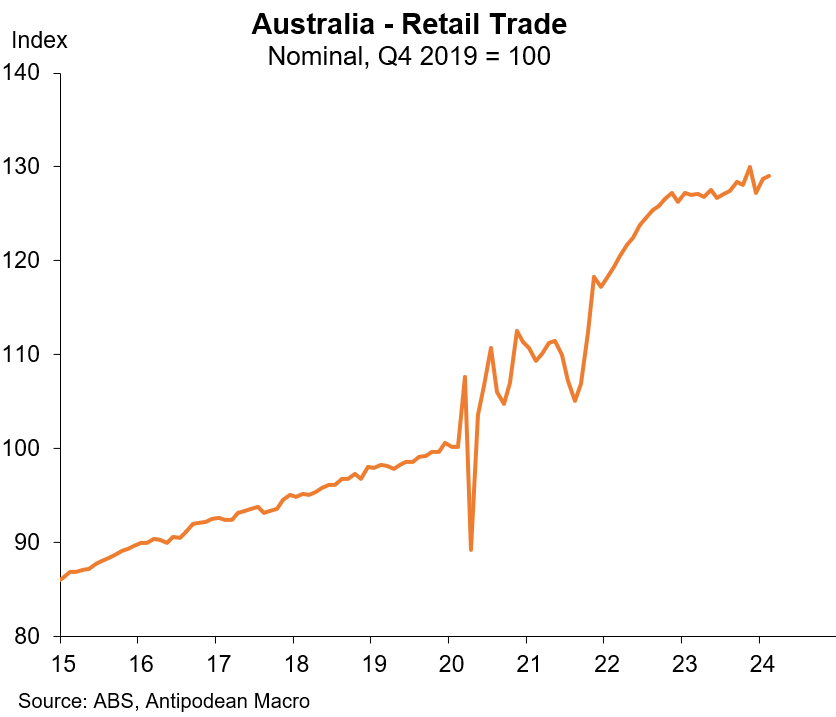

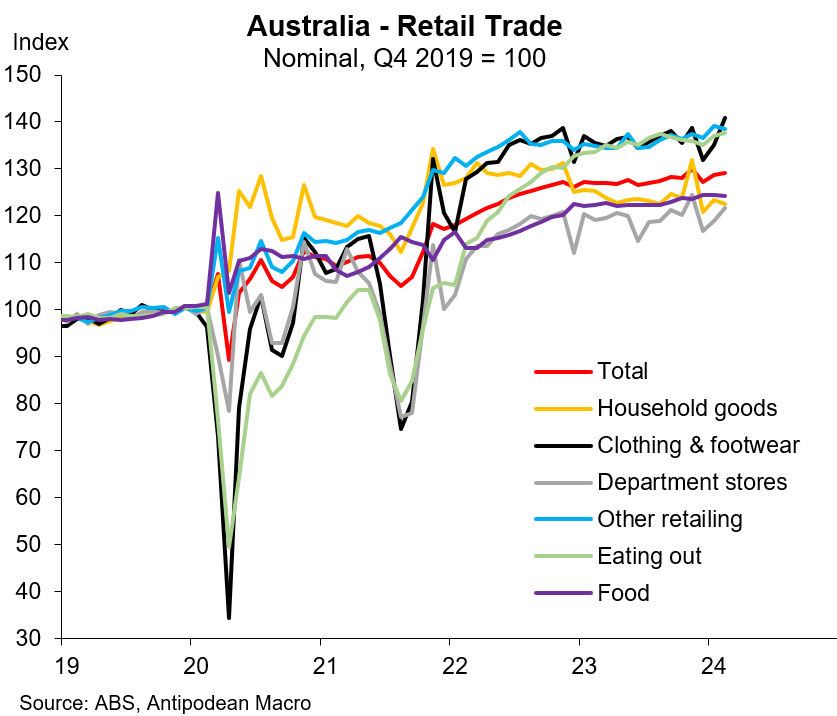

4. The value of retail trade in Australia rose +0.3% m/m in February (mkt: +0.4% m/m). The ABS noted that Taylor Swift concerts appeared to provide a temporary boost to parts of retail spending, particularly in NSW and Victoria (where the concerts were held).

5. Monthly housing credit growth in Australia remained at +0.4 m/m in February, with investor housing credit growth much weaker than the owner-occupier equivalent.

6. Growth in wages in job ads advertised on SEEK in Australia has moderated in recent months.

7. Another small dip in household inflation expectations in March suggests private-sector wages growth is likely to start to moderate.

8. Proposed average annualised wage increases in enterprise bargaining agreements lodged with Australia’s Fair Work Commission (to 23 Feb) also show some moderation.

9. ANZ’s business survey for March points to encouraging signs that kiwi firms’ pricing intentions, while still elevated, have moderated a little again in recent months.

10. The pipeline of public infrastructure work in Australia remains very large by historical standards.

Discussion about this post

No posts