ONLY CHARTS is only available to paid subscribers.

A 7-day free trial is available below. Group discounts are available here.

Antipodean Macro’s in-depth research is available here.

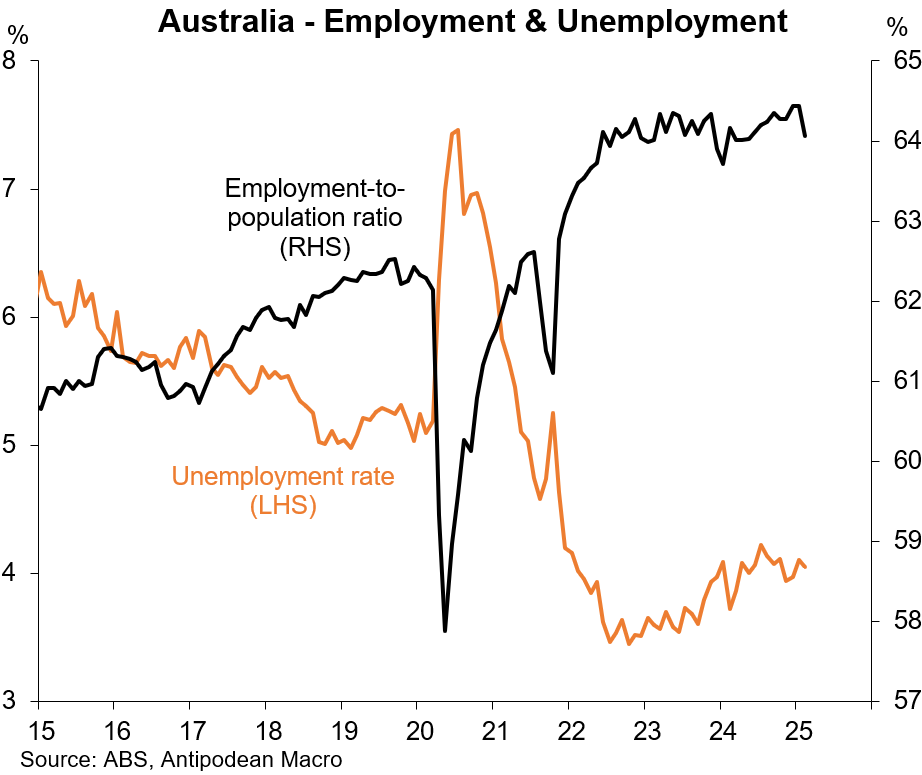

1. Australia’s unemployment rate remained at 4.1% in February (4.05% in unrounded terms).

Measured employment fell a sharp -52.8k m/m (-0.4% m/m), which was much weaker than consensus expected. This resulted in a 0.4ppt decline in the employment-to-population ratio to 64.1%.

The ABS noted that “[f]ewer older workers returning to work in February contributed to the fall in employment”. (More on this below.)

Many seasoned watchers of the labour force survey will be heard muttering that we were ‘due’ a weak employment print following a run of surprisingly strong outcomes.

The labour force participation rate declined 0.4ppts to 66.8% after reaching a record high in January.

Despite the noise in the employment data, the unemployment rate continues to track in line with the RBA’s latest forecasts.

Despite the 'surprising’ fall in measured employment in February, it’s not that unusual and the RBA won’t be jumping at shadows. The unemployment (and possibly underemployment) rates are the most important indicators from the labour force survey.

We continue to see a 25bp cut in May following the Q1 CPI.

2. Some economists were expecting a very large rise in measured employment in February given the ABS flagged last month that there had been “more people than usual with jobs in January who were waiting to start or return to work”.

Based on our analysis, however, we noted that “our own seasonal adjustment of the number of people waiting to start work but not employed suggests that this was not a huge issue in January”.

Keep reading with a 7-day free trial

Subscribe to Antipodean Macro to keep reading this post and get 7 days of free access to the full post archives.