ONLY CHARTS is only available to paid subscribers.

A 7-day free trial is available below. Group discounts are available here.

Antipodean Macro’s in-depth research is available here.

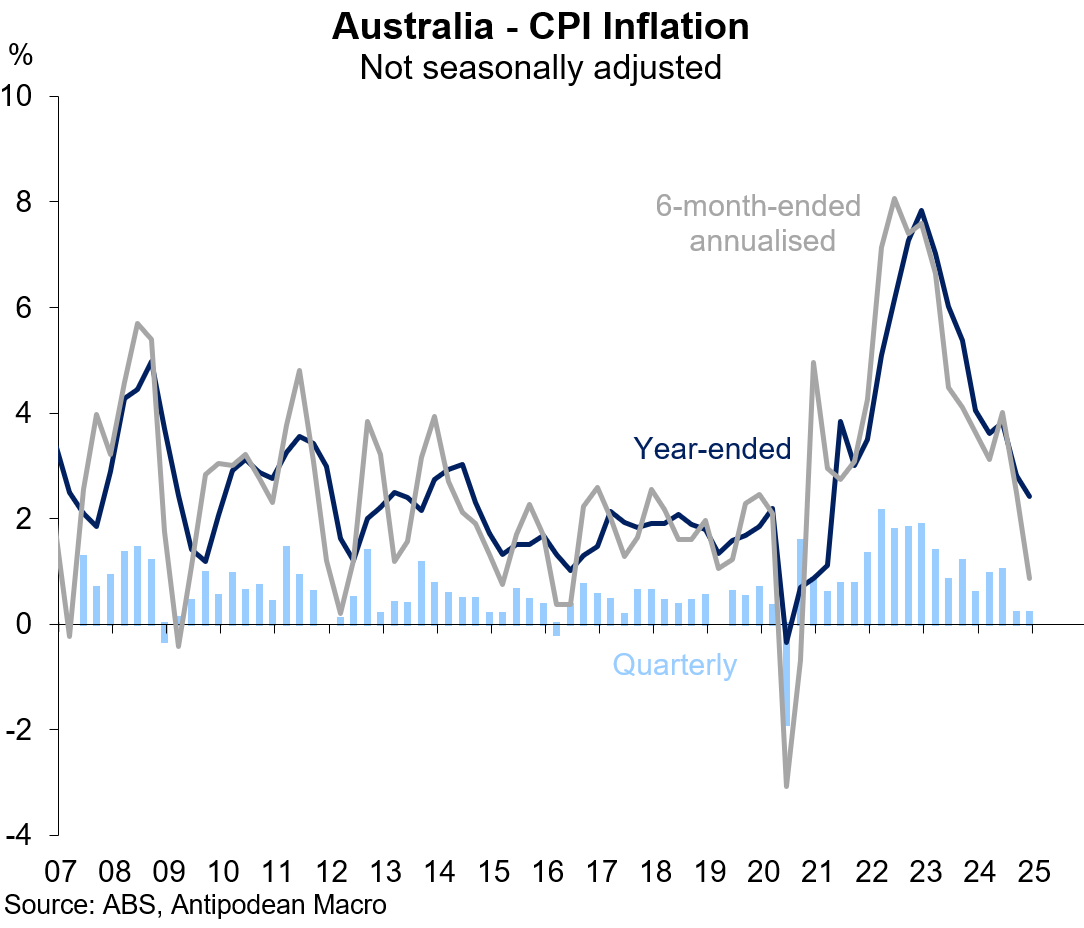

Australia’s Q4 CPI inflation was below market expectations but close to our forecasts. Trimmed mean inflation was 0.2ppts below the RBA’s November SMP forecast (though internal estimates will have been revised lower since then).

While government subsidies and the child care adjustment subtracted a bit more than 0.1ppts from trimmed mean inflation in Q4, we don’t think this changes the narrative.

That is, underlying inflation pressures have eased enough for the RBA Board to prod the cash rate lower on 18 February.

Our best guess remains that it can then watch the data (and politics) for a few months to gauge whether another rate cut is on for May (which we currently anticipate).

1. Australia’s Q4 headline CPI inflation was below market expectations at +0.2% q/q and +2.4% y/y but in line with our forecast.

The seasonally adjusted CPI rose 0.3% q/q.

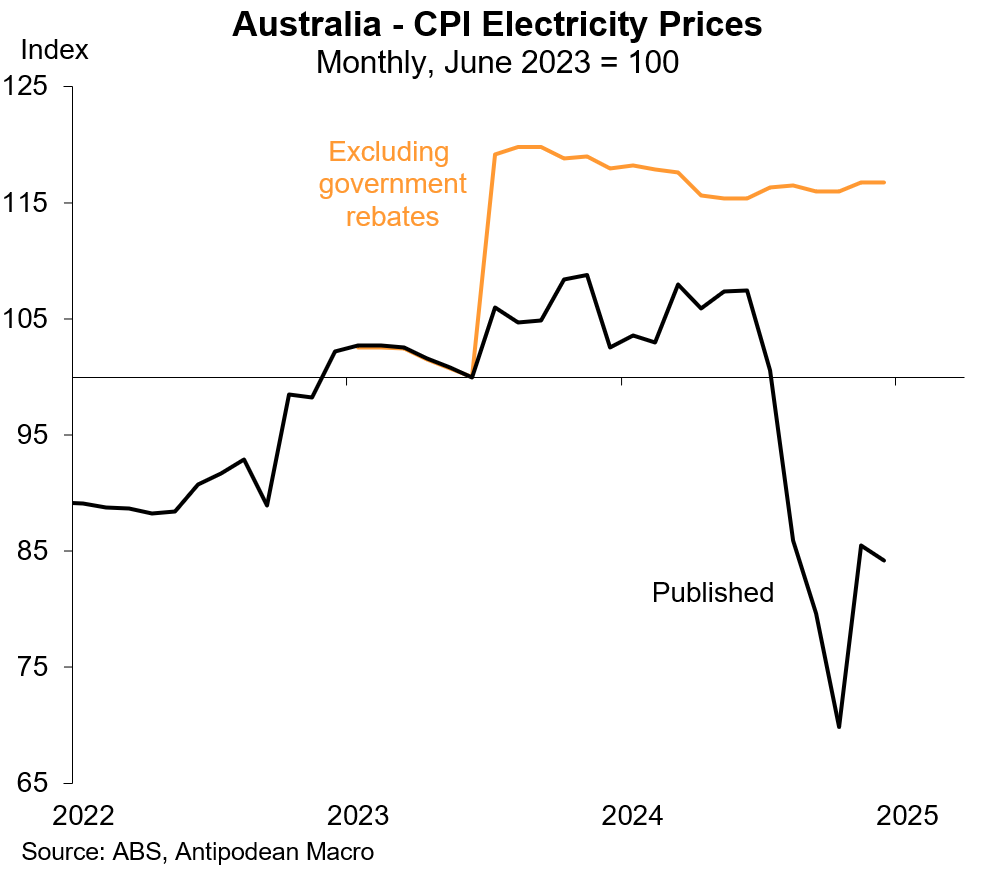

As expected, lower electricity prices (-9.9% q/q) subtracted 0.2ppts from quarterly inflation in Q4. Excluding government rebates, electricity prices would have risen +0.2% q/q.

Petrol prices also declined 2% q/q, subtracting a bit less than 0.1ppts from headline inflation.

The ABS’ downward correction to child care prices in the CPI (-5.8% q/q) and preschool and primary education prices (-0.4% q/q) subtracted 0.05ppts from quarterly headline inflation and 0.03ppts from quarterly trimmed mean inflation.

2. Trimmed mean inflation was +0.51% q/q and +3.2% y/y, which was below consensus expectations (+0.6% q/q) but close to our +0.54% q/q nowcast. It was 0.2 ppts lower than the RBA’s November SMP forecast.

Keep reading with a 7-day free trial

Subscribe to Antipodean Macro to keep reading this post and get 7 days of free access to the full post archives.