ONLY CHARTS #222

Aus stocks, wages & profits, Aus retail trade, Aus & NZ building approvals, Aus housing prices, Aus inflation, China PMIs

ONLY CHARTS is available to paid subscribers.

A 7-day free trial is available below. Group discounts are available here.

Antipodean Macro’s in-depth research is available here.

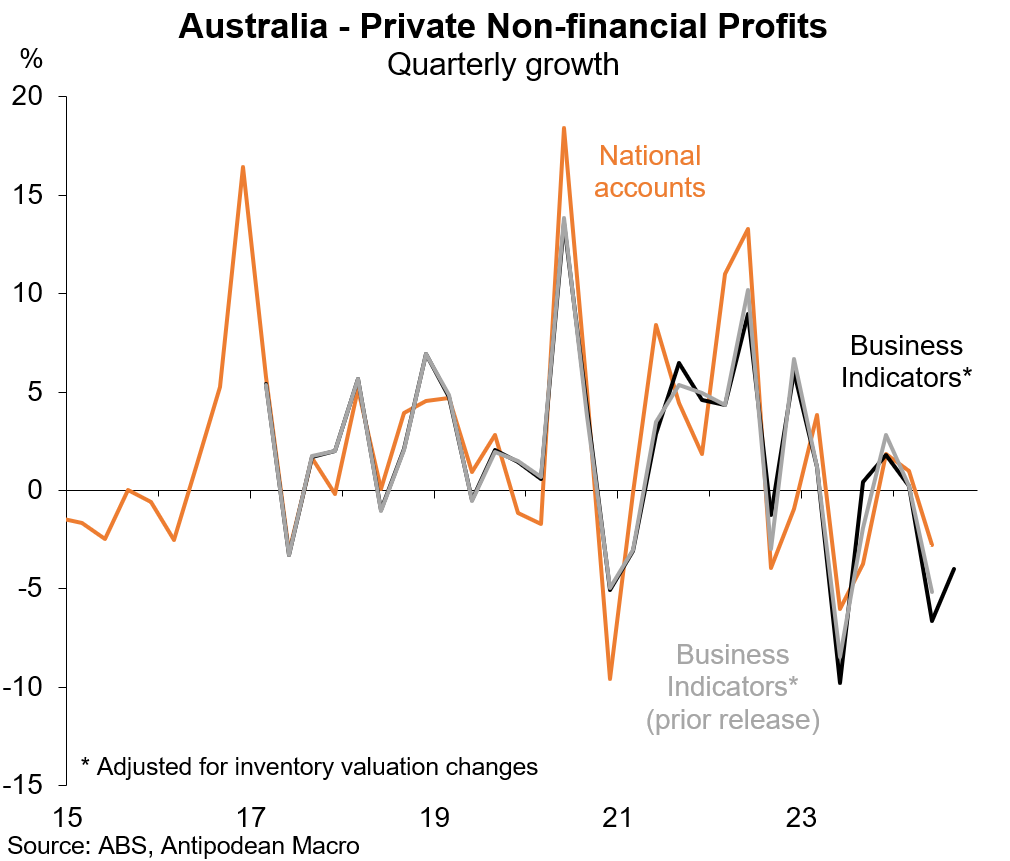

1. Q3 company profits in Australia declined 4.0% q/q and 8.5% y/y (after accounting for inventory valuation effects) following a downwardly revised 6.6% q/q fall in Q2.

Falling mining profits amid weaker prices for Australia’s commodity exports were again the main culprit.

We anticipate the national accounts measure of non-financial corporate profits (GOS) to be even weaker than today’s numbers suggest. Why? Because GOS has undershot the company profits print in Q3 in each of the past 3 years. (The opposite has been true for the different measures of wages growth.)

2. Australia’s private sector wages bill rose a solid+1.2% q/q and +4.0% y/y in Q3 following an upwardly revised +0.9% q/q Q2 outcome.

Keep reading with a 7-day free trial

Subscribe to Antipodean Macro to keep reading this post and get 7 days of free access to the full post archives.