ONLY CHARTS is available to paid subscribers.

A 7-day free trial is available below. Group discounts are available here.

Antipodean Macro’s in-depth research is available here.

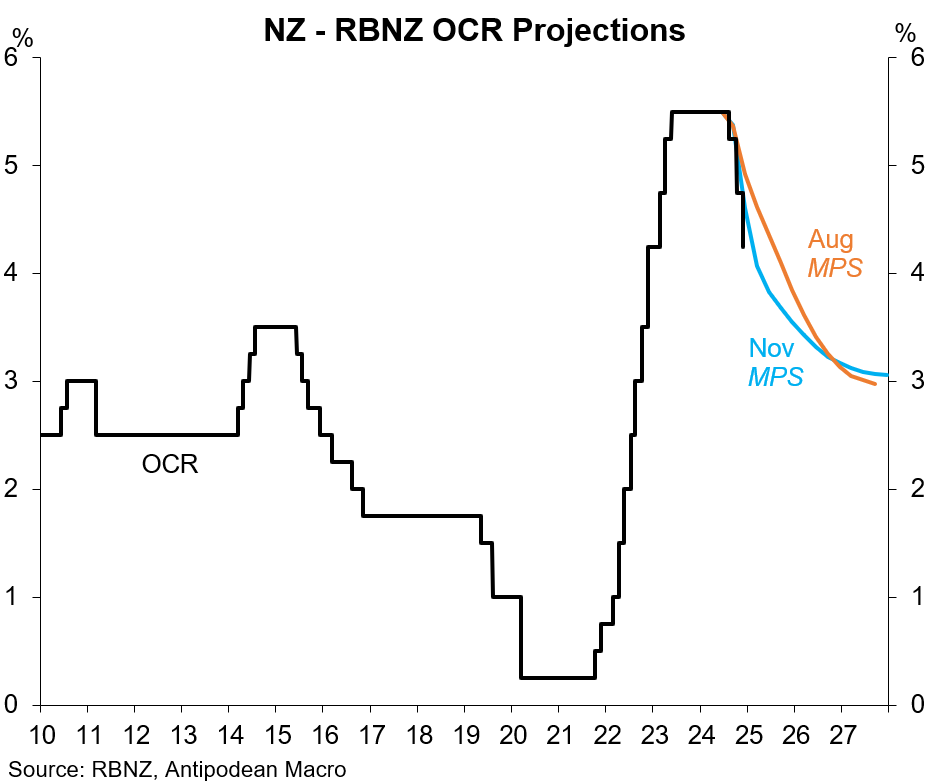

1. The RBNZ’s MPC cut the OCR by 50bps to 4.25% today. We thought a 75bps cut was an odds-on chance - in part due to the 3-month break to the February MPR - but noted that a 50bp cut would be dovish.

The MPC noted that if “economic conditions continue to evolve as projected, the Committee expects to be able to lower the OCR further early next year“. More easing coming.

Nonetheless, AUD/NZD fell 80pips had toyed with the possibility of a 75bp cut today.

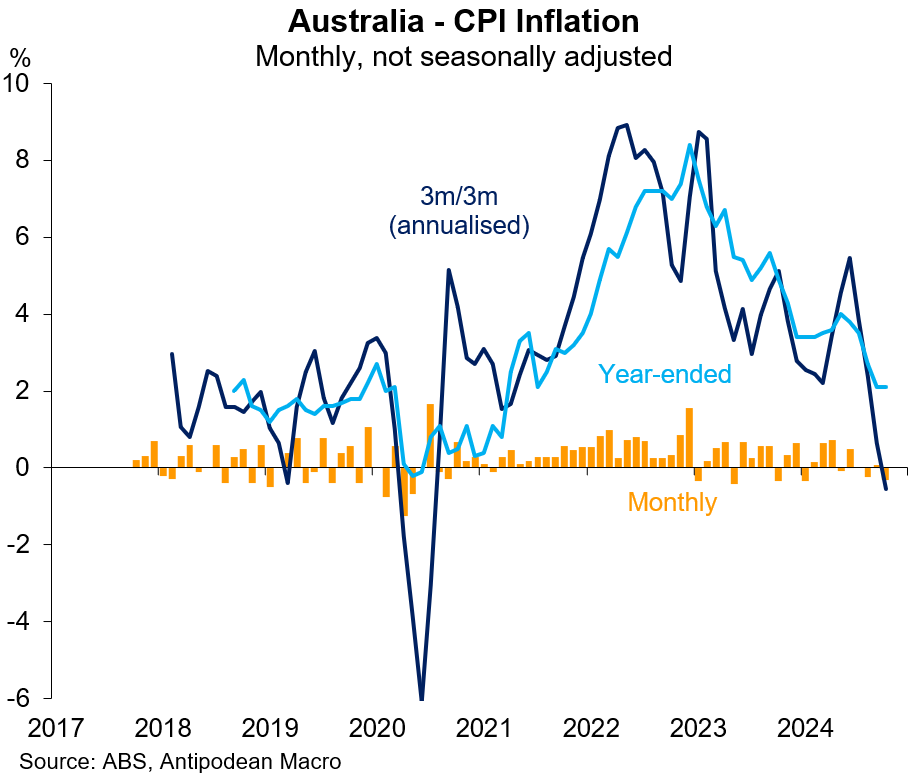

2. Australia’s monthly CPI declined 0.32% m/m in October and remained at +2.1% y/y. This was close to our -0.29% m/m forecast.

The slightly softer-than-expected outcome was partly accounted for by electricity prices falling 12.3% m/m versus our -7% m/m assumption.

As noted previously by the ABS and in our preview, 0.05ppts of the decline in the headline CPI in October was because of one-off downward corrections to child care and preschool & primary education.

Keep reading with a 7-day free trial

Subscribe to Antipodean Macro to keep reading this post and get 7 days of free access to the full post archives.