ONLY CHARTS #193

Aus public vs private / market vs non-market employment, Aus unemployment benefit recipients

ONLY CHARTS is only available to paid subscribers.

A 7-day free trial is available below. Group discounts are available here.

Antipodean Macro’s in-depth research is available here.

There has been a lot of commentary, confusion and borderline misinformation on the composition of employment growth in Australia, particularly the public/private split of jobs growth. This post aims to clear that up.

There are two sources of data on employment and hours worked in Australia: the monthly labour force survey (LFS) and the (newer) Labour Account. Industry and sector (i.e. private/public) employment is captured and published in the LFS for the mid-month of the quarter.

The Labour Account uses that information, combined with a range of other data sources to produce (better) data on industry and sector employment and filled jobs. A weakness of the Labour Account, however, is a publication delay. For example, we already have Q3 LFS employment data (i.e. August) but won’t get Q3 Labour Account data until end-November.

That delay has tempted some to make very strong statements about the composition of employment growth - particularly the private/public sector split - using LFS data which are known to be highly unreliable.

The ABS has been very clear that the Labour Account is the best source for employment and hours data by industry and sector. Measured employment and hours for some industries are very different between the two sources of data. For example, the chart below shows the differences for the wholesale trade industry.

Below we flesh out the data which are available.

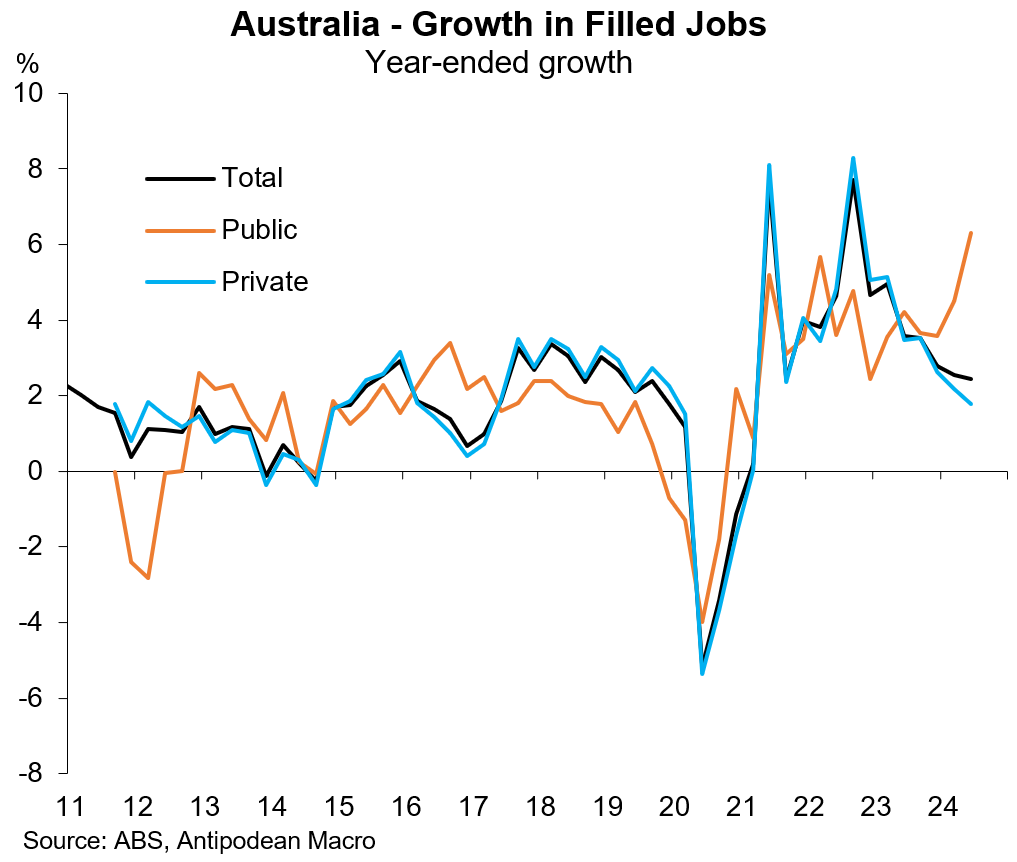

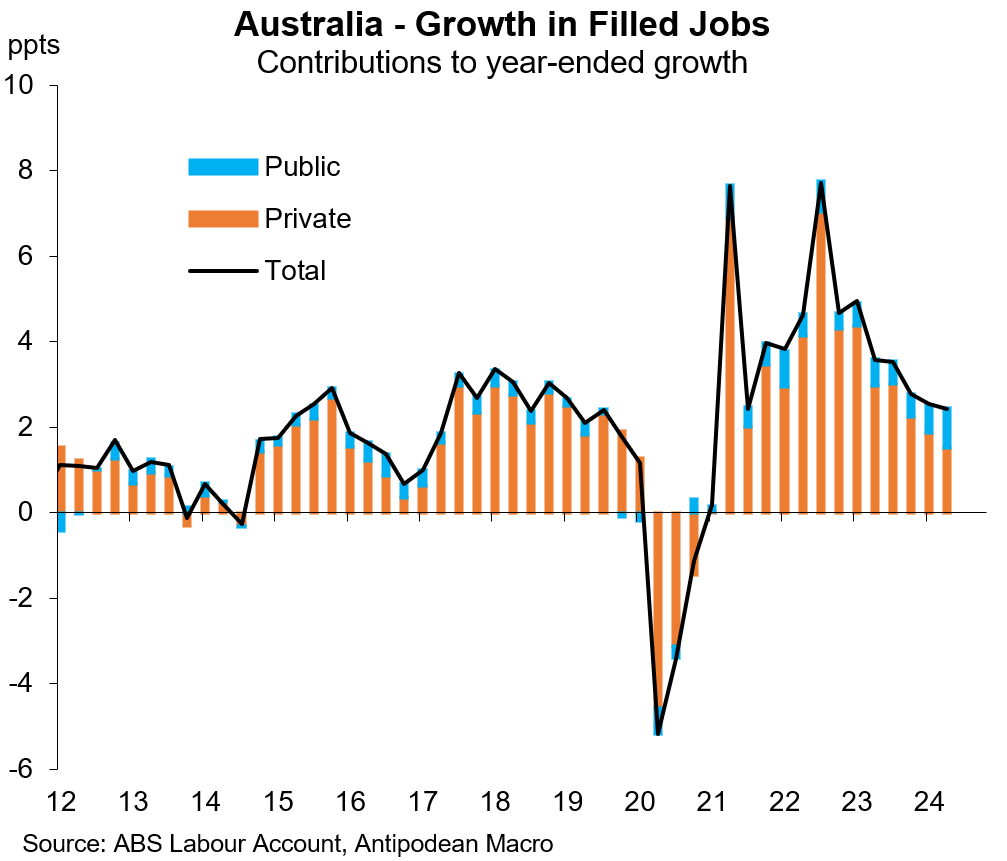

CONCLUSION: private-sector employment growth has slowed but remains solid, while public-sector employment growth has been very strong. From a different perspective, the majority of growth in jobs and hours worked over the past year has been in non-market industries which includes both private- and public-sector workers but has a strong influence from government funding.

1. Labour Account data to the June quarter show very strong growth in public-sector jobs and slowing growth in private-sector jobs. But private-sector jobs still rose 1.8% y/y.

Due to the much larger size of private-sector employment it still contributed MORE than the public sector to total jobs growth over the year to the June quarter.

2. What does the LFS say about the public/private employment split?

In short, nothing useful. The data are ropey and should be ignored.

Keep reading with a 7-day free trial

Subscribe to Antipodean Macro to keep reading this post and get 7 days of free access to the full post archives.