ONLY CHARTS is available to paid subscribers.

A 7-day free trial is available below. Group discounts are available here.

Antipodean Macro’s in-depth research is available here.

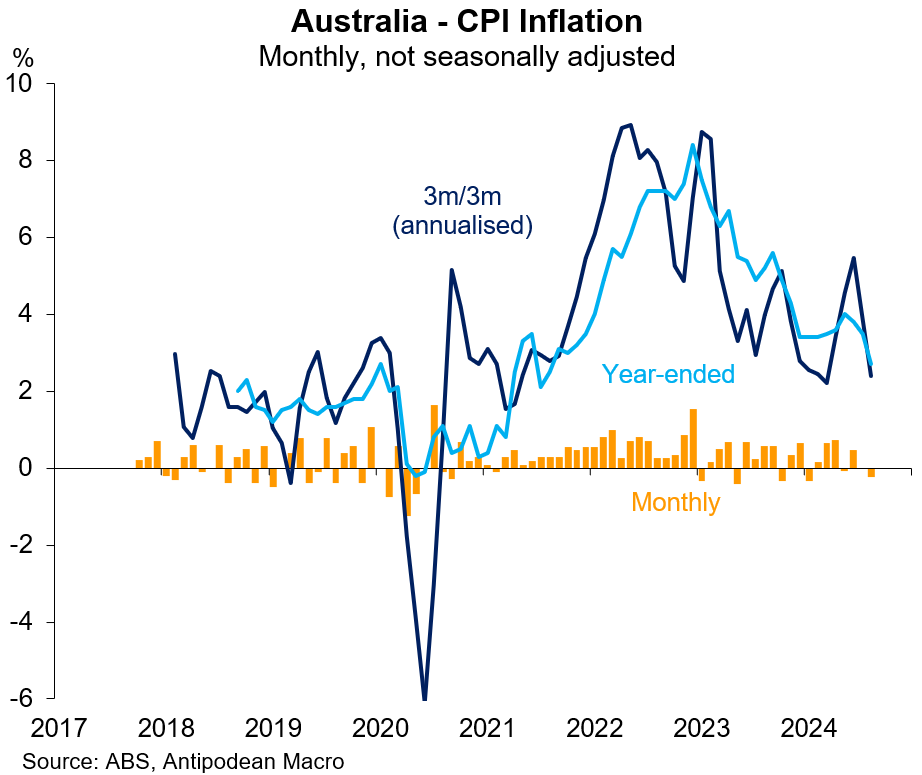

1. Australia’s monthly CPI declined 0.24% m/m in August and slowed to +2.7% y/y from +3.5% y/y in July. This was close to our forecast of +2.6% y/y.

Slower year-ended headline inflation reflected sharply lower out-of-pocket electricity prices (-14.6% m/m), weaker petrol prices (-3.1% m/m) and the dropping out of a +0.6% m/m increase in August 2023.

2. The RBA has clearly stated it is focused on underlying measures of inflation.

Monthly trimmed mean inflation slowed to 3.4% y/y in August from 3.8% y/y in July.

Excluding petrol, fruit & veg and travel, year-ended inflation declined to +3.0% y/y in August from +3.7% y/y in July.

We have augmented that underlying inflation measure by also excluding electricity prices (light blue series). This measure has been less volatile recently than both the monthly trimmed mean and measure excluding petrol, fruit & veg and travel.

It rose +3.5% y/y in August - down from +3.8% y/y in July - and bang in line with our nowcast.

Keep reading with a 7-day free trial

Subscribe to Antipodean Macro to keep reading this post and get 7 days of free access to the full post archives.