Today’s Q2 CPI data for Australia will be of HUGE relief to the RBA Board and Staff.

1. Australia’s Q2 headline CPI inflation was in line with market expectations at +1.0% q/q and +3.8% y/y.

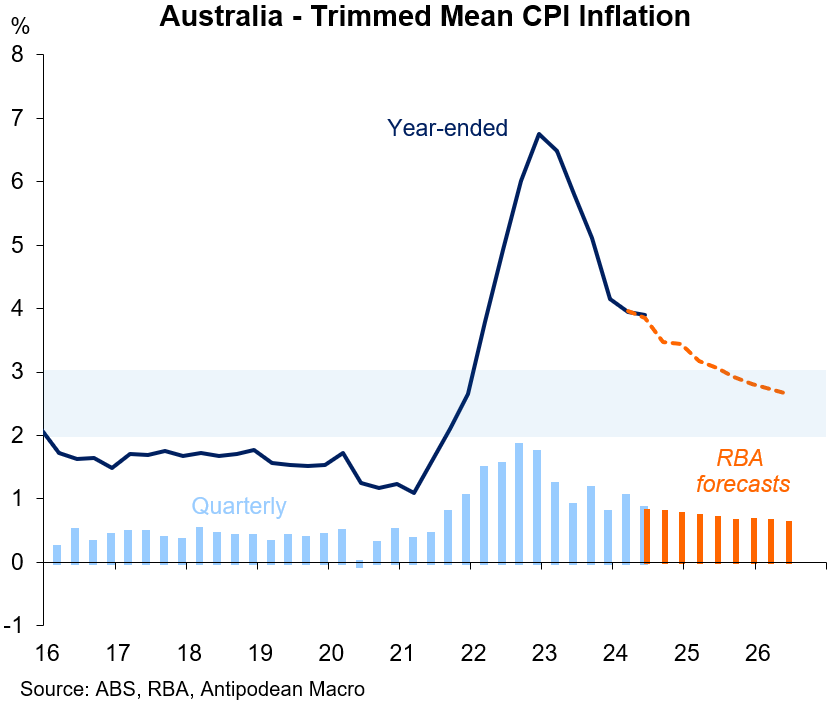

But the big surprise was trimmed mean inflation of ‘just’ +0.84% q/q, which was well below consensus for +1.0% q/q. That was also our expectation.

While trimmed mean inflation was in line with the RBA’s May SoMP forecast, we suspect that their internal Q2 nowcast was much higher. Huge relief for the Staff.

What accounted for the undershoot on quarterly trimmed mean inflation of ~0.15ppts on our numbers?

It mostly came down to softer-than-expected components where there was no/little partial information and the way the distribution of outcomes fell (i.e. what got trimmed).

At a high level, softer-than-expected non-tradables (and domestic services) inflation for Q2 accounted for a large part of the miss. Several of these components came in below our expectations in the monthly CPI for June (even though the monthly CPI was actually a touch higher than we anticipated: +0.49% m/m vs +0.43% m/m forecast).

Some big moves in markets post the release, including AUDNZD.

Key CPI breakdowns:

Keep reading with a 7-day free trial

Subscribe to Antipodean Macro to keep reading this post and get 7 days of free access to the full post archives.