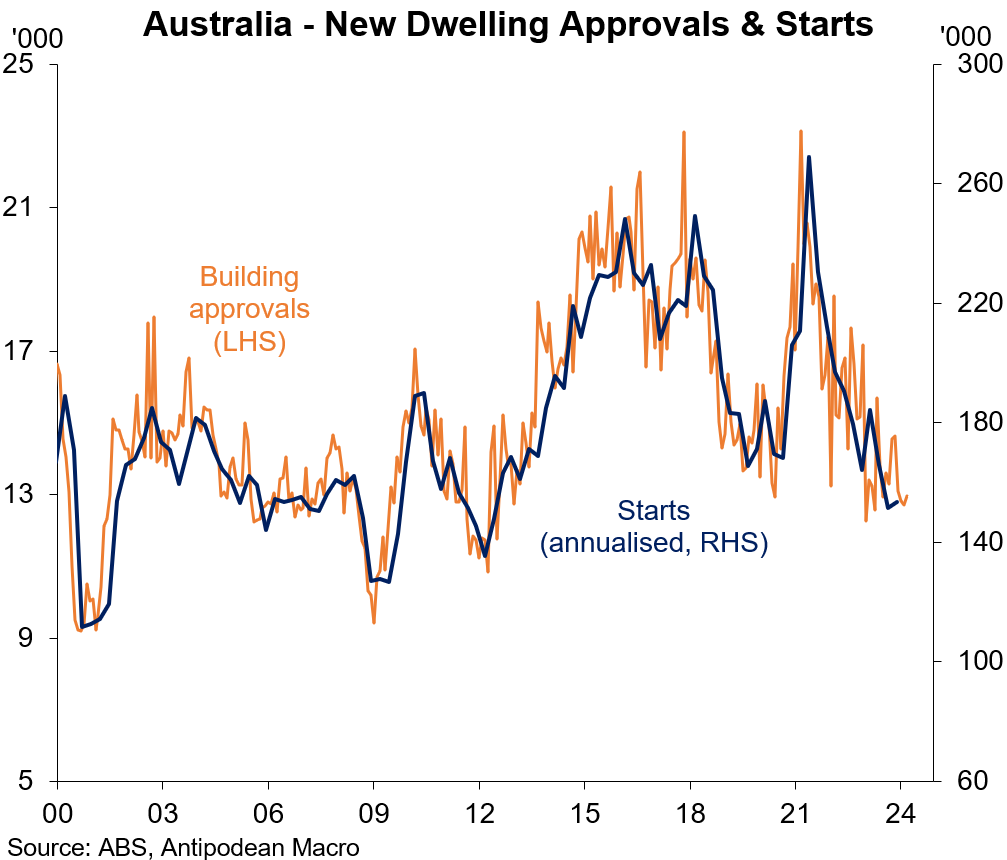

1. The number of residential building approvals in Australia rose nearly 2% m/m in March, driven by higher detached house approvals.

Approvals remain well short of what is currently needed.

2. Home building approvals have been picking up in Western Australia, possibly incentivised by higher prices (given Perth established housing price growth is running at ~2% m/m)

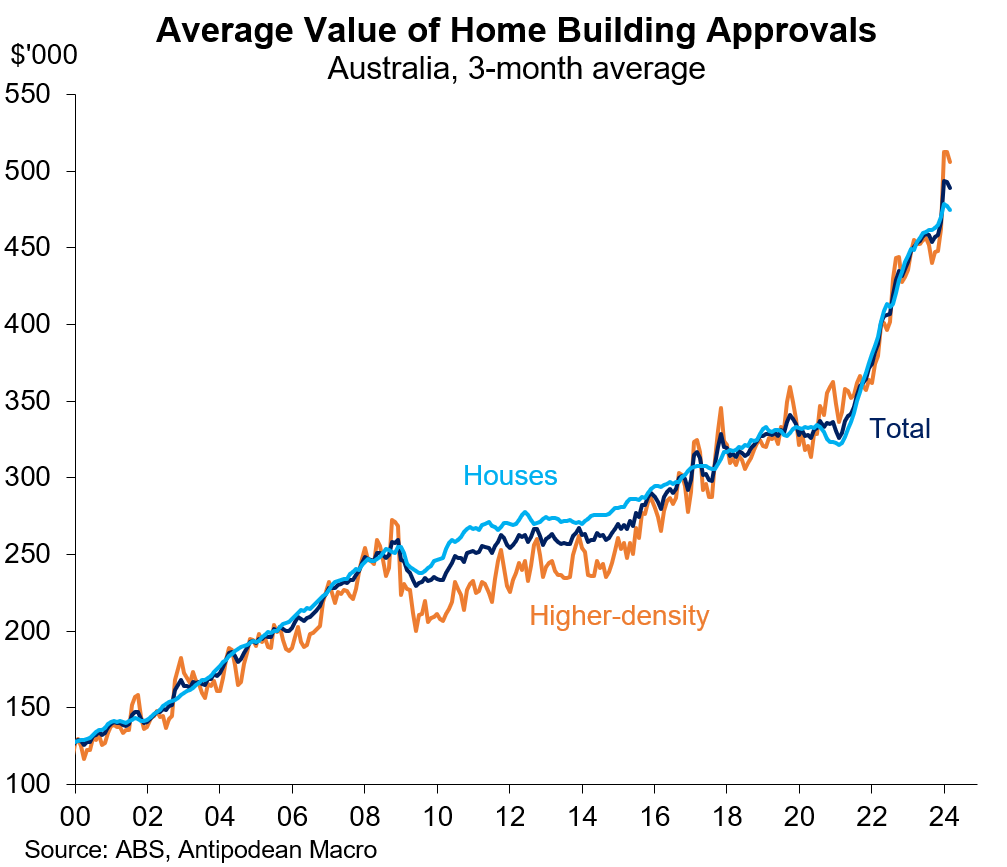

3. The average value of home building approvals in Australia has risen 50% over the past 4 years.

Is it any wonder than established housing prices have been rising against that backdrop?

4. The value of Australia’s goods imports rose through the March quarter after falling in late 2023.

5. Our estimates suggest that the volume of Australia’s goods imports rose very strongly in Q1…

6. …with strength evident in both consumer and capital goods import volumes.

Coupled with estimates showing little growth in goods exports volumes, net (goods) exports are likely to have weighed heavily Australia’s Q1 GDP growth, but inventory accumulation likely to prove at least a partial offset.

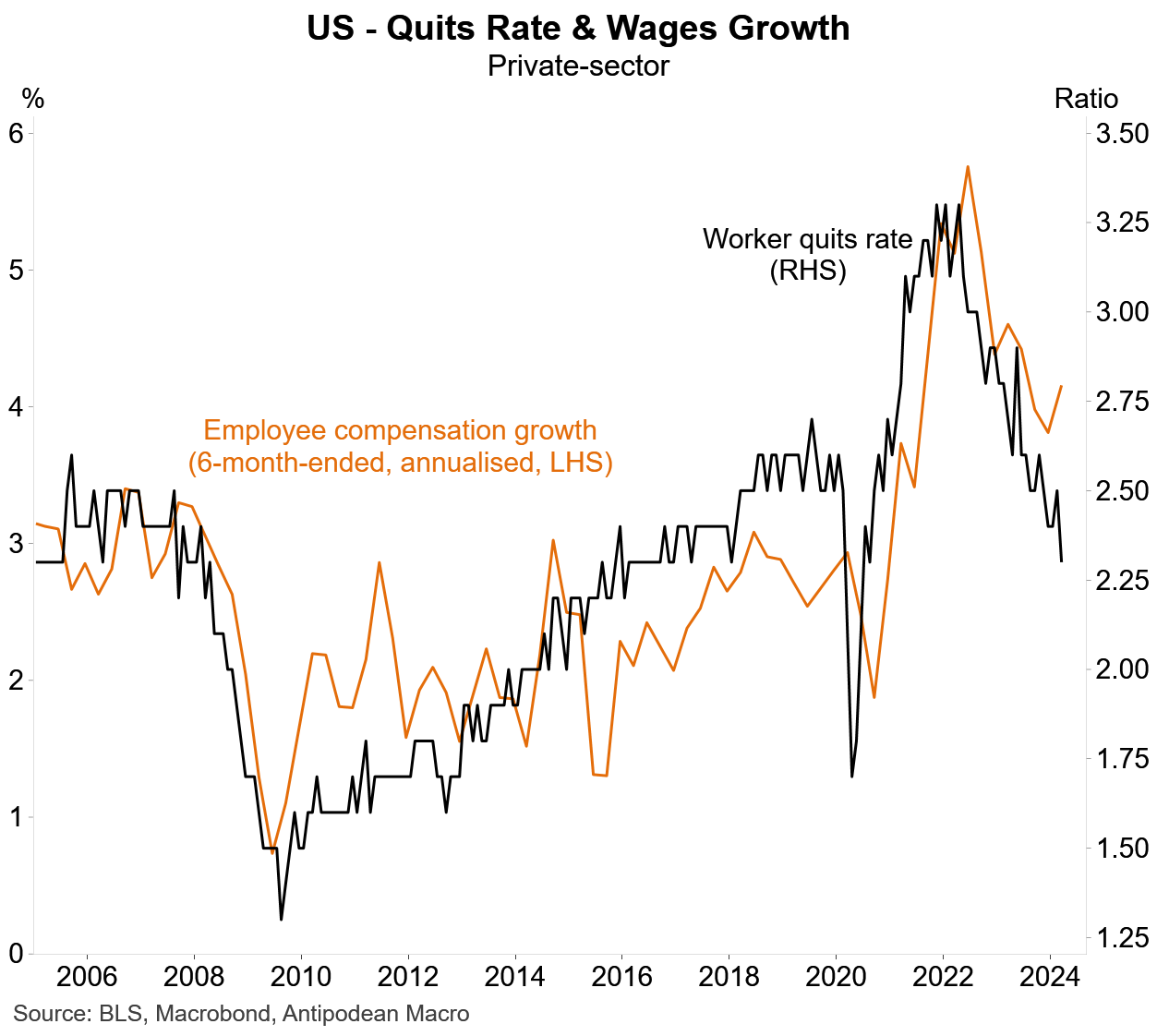

7. Food for thought given the solid US Q1 wages growth print this week…

8. Add this to the list of labour market conundrums. Google searches in Australia for “redundancy” have been rising steadily since early 2022 but actual redundancies have risen only modestly.

Discussion about this post

No posts

Great chart deck!